SEC Suing Robinhood

The Security and Exchange Commission is really going after Cryptocurrency exchanges and it's hauling Robinhood Markets Inc. to court, Robinhood is also into cryptocurrency trading and its chief legal officer says it “firmly believe that the assets listed on our platform are not securities” and "good faith attempts to work with the SEC for regulatory clarity" ended last year without resolution. The SEC has brought cases against other high-profile crypto brokerages and trading platforms, including Coinbase Global Inc., XRP, Ethereum Blockchain etc. The SEC relies on a test laid out in a 1946 Supreme Court case. Crypto advocates say many digital assets don’t meet that standard and that the SEC should provide revised rules to take into account the unique characteristics of the asset class, meaning it should lay down a regulatory clarity on the issue of cryptocurrency not on an outmoded and antique ruling put out when computers are just a pigment of imagination of humanity. According to Dan Gallagher-Robinhood's chief legal officer during his 2023 testimony in the US congress "The most fundamental problem in digital asset markets is that there is no clear guidance on which digital assets the SEC and Commodity Futures Trading Commission deem to be securities and commodities, respectively, and how cryptocurrency platforms and digital asset securities can be appropriately registered under federal law".

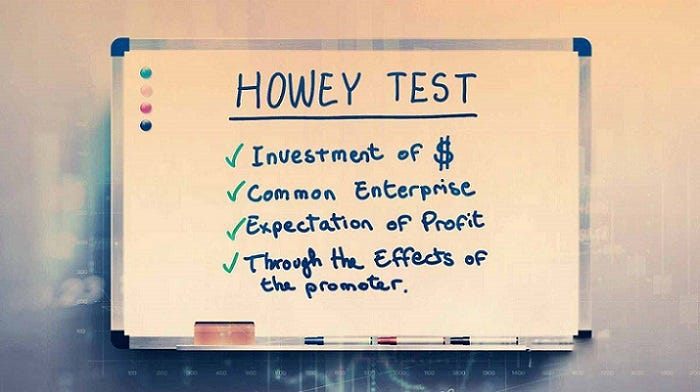

SEC Chairman Gary Gensler emphasized that certain prominent cryptocurrency exchanges are probably dealing in securities, necessitating registration with the SEC. Gensler underscored that with the advent of new technologies, existing regulations remain relevant. Additionally, he advocated for increased enforcement regarding Stablecoins and other types of cryptocurrency tokens. Cryptocurrencies fall within the regulatory purview of the SEC if they satisfy the criteria outlined in the Howey test. This benchmark, originating from a 1946 Supreme Court case concerning orange groves, has been instrumental in distinguishing securities transactions from other forms of transactions. According to the court's ruling, a transaction falls under the SEC's jurisdiction if an individual invests capital in a collective venture and anticipates profits primarily from the efforts of the promoter or a third party.

Regulators aim to enhance investor safeguards, ensure market stability, and foster greater transparency within the swiftly evolving digital realm. Below is an analysis of why the SEC is intensifying its enforcement efforts concerning cryptocurrency-related cases:

Investor Protection

- Fraud prevention: Cryptocurrency markets are still relatively new and have been associated with many frauds and scams, SEC enforcement could deter fraud and protect investors from bad actors.

- Disclosure standards: By regulating crypto markets under securities laws, the SEC is hoping to make these enterprises provide more accurate and thorough information to the public, enabling investors to make more informed decisions.

Market Integrity

- Price manipulation: The anonymity and lack of regulation in cryptocurrency markets make them susceptible to manipulative practices. SEC oversight could help curb such practices to secure fair prices.

- Market surveillance: Monitoring the crypto markets for unusual activities could help maintain market integrity and investor trust.

Legitimacy and Adoption

- Legal framework: Falling under the SEC's regulations could legitimize cryptocurrency enterprises and attract more traditional investors and institutions, potentially leading to broader adoption.

- Innovation and competition: By creating a level playing field, SEC enforcement could encourage innovation and competition, which are essential for the crypto sector's long-term sustainability and growth.

- Money laundering and terrorism financing: By enforcing anti-money laundering (AML) and counterterrorism financing (CTF) regulations, the SEC and other agencies could address two major public concerns about cryptocurrencies.

Regulatory Clarity

- Defining boundaries: The SEC's involvement could help determine the boundaries between traditional securities and crypto assets, providing much-needed clarity for entrepreneurs and investors.

- Compliance standards: Establishing compliance standards can help crypto enterprises follow widely known regulations and cut legal uncertainties.

- Cross-border collaboration: Cryptocurrencies are without borders, so international cooperation and enforcement could help address challenges common to regulators worldwide.

The Howey Test

- Money is invested: Something of value is put at stake.

- There is a common enterprise: The investment must be in a common enterprise, although courts have had varied interpretations of what that means.

- Those involved hope to profit: At least one of the parties must anticipate potential profits from the investment. This is typically where the efforts of a third party—the promoter or a third party affiliated with the promoter—significantly affect the value of the investment.

- The profits come from the work of another: Essentially, investors are reliant on the actions of others to generate a return on the value they put in.

What is the Howey Test? Originating from the 1946 U.S. Supreme Court case SEC v. W.J. Howey Co., the test lays out the parameters. The Howey test has risen to prominence within the financial domain, particularly within the rapidly expanding cryptocurrency realm, as it determines the regulatory framework applicable to particular entities. The Howey test serves as a fundamental legal doctrine in the United States for assessing whether a financial agreement constitutes an investment contract and is thus subject to regulatory obligations. Over time, the Howey test has emerged as a pivotal tool in the SEC's evaluation of a wide array of financial products and arrangements, encompassing cryptocurrencies and initial coin offerings (ICOs). This is how it goes: You decide to invest in a real estate investment trust (REIT), a vehicle that pools funds to purchase, oversee, and divest real estate assets. The management of the REIT, composed of real estate experts, represents the third party as per the Howey test. This team makes decisions regarding property acquisition, management strategies, and sales timing. Your anticipation of returns heavily relies on the expertise and endeavors of this management team. The REIT satisfies the Howey test criteria because:

1) you invested funds

2) your investment is part of a collective venture (the REIT)

3) you anticipate profits

4) the third party handles operational tasks

Consequently, once the SEC determines that a cryptocurrency or token qualifies as a security and falls within its regulatory jurisdiction, this decision carries significant ramifications. The issuer becomes subject to SEC regulations entailing comprehensive reporting obligations and transparency mandates. Is this clear enough regulation to safeguard crypto investor and buyer? I'm sure SEC is not yet over in suing crypto exchanges and businesses and this will not be the last time they will invoke the Howey test.

Conclusion

Blockchain and Cryptocurrency is moving fast, lighting fast in innovation that everybody is getting caught flatfooted and waking up next day finding there's a new crypto in the market or there's a new exchange offering more secure and fast transactions that regulation is falling way way behind in how to regulate or reign in the innovation that the tool they are using to investigate cryptocurrency and blockchain was developed in the 1940's, a era were even the concept of computer was not even imagined. Cryptocurrency and blockchain developer will have to work it out with the government, the SEC in particular, to cut out a crystal clear regulation regarding cryptocurrency and blockchain business. Using an antiquated tool, and whatever tools they can lay their hands on as they go after crypto business is not gonna cut it.

Source

https://www.spokesman.com/stories/2024/may/06/sec-warns-robinhood-that-its-crypto-business-faces/

https://arstechnica.com/tech-policy/2024/05/sec-crypto-crackdown-continues-with-robinhood-as-lawsuit-looms/

https://www.investopedia.com/news/how-sec-regs-will-change-cryptocurrency-markets/

Image

https://media.licdn.com/

https://encrypted-tbn0.gstatic.com/https://miro.medium.com/