The Power of Compounding: Building Wealth Over Time

Introduction

Introduction

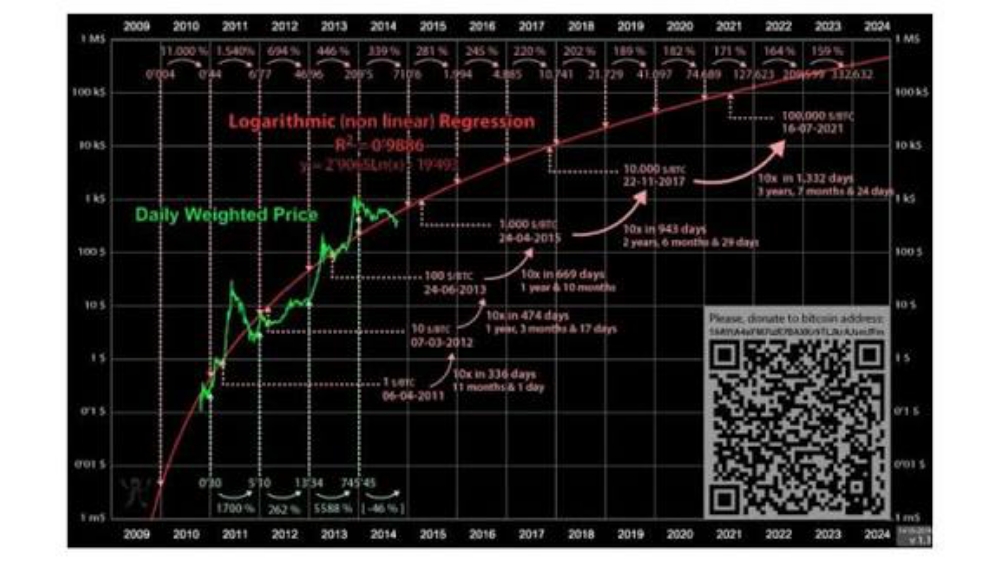

Compounding is a powerful concept in finance that allows your money to grow exponentially over time. It's the process of earning interest on both the initial principal and the accumulated interest, leading to accelerated growth. Understanding how compounding works is essential for building long-term wealth.

How Compounding Works

At its core, compounding is about earning interest on your interest. When you invest money, you earn a return on that investment. Over time, those returns also earn returns, leading to a snowball effect. The longer you let your money compound, the faster your wealth grows.

Compounding can be thought of as a snowball rolling down a hill. At first, it starts small, but as it rolls, it picks up more snow and gains momentum. Similarly, compounding starts with your initial investment, but as your investment grows, it earns more returns, which are then reinvested to generate even more returns.

The compounding effect is especially pronounced in investments that offer compound interest, where the interest is added to the principal, and future interest is calculated based on the updated principal. This compounding cycle can lead to exponential growth over time, turning small investments into substantial sums.

One of the key advantages of compounding is that it allows you to generate wealth with minimal effort once you've made your initial investment. Unlike active trading, which requires constant monitoring and decision-making, compounding lets you sit back and watch your money grow steadily over the long term.

The Impact of Time

Time is a critical factor in the power of compounding. The earlier you start investing, the more time your money has to grow. Even small contributions can turn into significant sums over decades, thanks to the magic of compounding.

For example, let's compare two investors: one who starts investing at age 25 and another who starts at age 35. Both invest $5,000 per year in a retirement account earning an average annual return of 7%. By age 65, the first investor would have contributed a total of $200,000 but would have a retirement fund worth approximately $614,000. In contrast, the second investor would have contributed $150,000 but would have a fund worth only about $303,000.

This example illustrates the significant impact that starting early can have on your wealth accumulation. By giving your investments more time to compound, you can potentially achieve greater financial security and retirement savings.

Time also plays a crucial role in mitigating the impact of market volatility. Over a long investment horizon, the ups and downs of the market tend to average out, smoothing the overall return. This is why experts often recommend a long-term investment strategy, as it allows you to ride out market fluctuations and benefit from the overall growth of the market.

In conclusion, the impact of time on compounding cannot be overstated. Starting early, even with small amounts, and staying invested for the long term are key strategies for maximizing the power of compounding and building wealth over time.

Example of Compounding

Let's delve deeper into the example of compounding to see how it works in practice. Suppose you invest $10,000 in a mutual fund that has an average annual return of 8%. In the first year, your investment would grow to $10,800 ($10,000 initial investment + $800 return).

In the second year, assuming the same 8% return, your investment would grow to $11,664 ($10,800 + $864 return). Notice that in the second year, you earned $864 on your initial investment of $10,000, as well as an additional $64 on the return from the first year.

If you continue this pattern over time, the growth of your investment accelerates. After 10 years, your initial $10,000 investment would have grown to approximately $21,589. After 20 years, it would be around $46,610. And after 30 years, it would be approximately $100,627.

This example illustrates the power of compounding over time. By reinvesting your returns and allowing your investment to grow, you can achieve significant wealth accumulation. The key is to start early, stay invested, and be patient, as the real benefits of compounding are often seen over the long term.

Harnessing Compounding for Wealth Building

Compounding is a powerful concept that can significantly impact your long-term financial growth. By understanding and utilizing compounding effectively, you can build wealth steadily over time.

At its core, compounding is the process where your money earns returns, and then those returns also earn returns, creating a snowball effect that accelerates your wealth growth. This concept is often summed up by the phrase "the earlier you start, the better," highlighting the importance of time in compounding.

One of the key strategies to harness compounding is to start investing early. The longer your money has to compound, the more significant the impact. Even small, regular investments can grow into substantial sums over time due to compounding.

Another important aspect of compounding is to reinvest your returns. Instead of withdrawing the earnings from your investments, leaving them to grow can significantly boost your wealth. This strategy is often used in dividend reinvestment plans (DRIPs) where dividends are automatically reinvested to purchase more shares, compounding your investment.

Compounding is not just about investing money. It can also be applied to debt repayment. By making regular payments towards your debt, you can reduce the principal amount faster, leading to lower interest payments over time. This concept is known as compounding in reverse, where your debt decreases exponentially.

In conclusion, harnessing the power of compounding requires discipline, patience, and a long-term perspective. By starting early, reinvesting your returns, and managing your debt effectively, you can leverage compounding to build wealth and secure your financial future.

The Role of Patience

Patience is a virtue often overlooked in today's fast-paced world, yet it plays a crucial role in wealth building. In the context of investing, patience refers to the ability to stay invested for the long term, even during periods of market volatility or uncertainty.

One of the key benefits of patience in wealth building is the ability to ride out market fluctuations. Markets are inherently volatile, and prices can fluctuate significantly in the short term. However, over the long term, markets tend to trend upwards, reflecting the overall growth of the economy. By staying patient and not reacting to short-term market movements, investors can benefit from this long-term growth.

Patience also allows for the power of compounding to fully take effect. As mentioned earlier, compounding relies on time to generate significant returns. By patiently staying invested and reinvesting returns, investors can maximize the compounding effect, leading to substantial wealth growth over time.

Moreover, patience can help investors avoid making impulsive decisions that could harm their long-term financial goals. Emotions such as fear and greed can lead to irrational decisions, such as selling investments during market downturns or chasing after hot investment trends. By exercising patience and sticking to a well-thought-out investment plan, investors can avoid these pitfalls and stay on course towards their financial objectives.

Patience is a crucial ingredient in wealth building. By staying invested for the long term, riding out market fluctuations, and avoiding impulsive decisions, investors can benefit from the power of compounding and achieve their financial goals.

Conclusion

Compounding is a simple yet powerful concept that can help you build wealth over time. By understanding how it works and harnessing its power through long-term investing, you can set yourself on the path to financial independence and security. Start early, be consistent, and let time work its magic.