Crypto Market vs Stock Market

This article provides a detailed comparison between the crypto market and the stock market, focusing on regulation, market hours, volatility, market participants, and associated risks.

Regulation

Crypto Market

Advantages:

- Innovation and Freedom: The lower level of regulation fosters innovation and allows for the development of new financial products and services without the constraints of traditional financial oversight.

- Accessibility: The minimal regulatory barriers make it easier for individuals worldwide to participate in the market, promoting financial inclusion.

Disadvantages:

- Fraud and Scams: The lack of stringent regulation has led to numerous instances of fraud, scams, and market manipulation, posing significant risks to investors.

- Uncertainty: Regulatory uncertainty can impact market stability, with potential changes in legislation or enforcement actions causing significant price fluctuations.

Stock Market

The stock market is heavily regulated by government agencies such as the Securities and Exchange Commission (SEC) in the United States. These regulations are designed to protect investors, ensure fair trading practices, and maintain market integrity.

Advantages:

- Investor Protection: Robust regulatory frameworks help protect investors from fraud, insider trading, and other malpractices.

- Market Stability: Regulations ensure transparency and accountability, contributing to overall market stability and investor confidence.

Disadvantages:

- Limited Innovation: Extensive regulations can stifle innovation and delay the introduction of new financial instruments and services.

- Accessibility Barriers: Regulatory requirements can create barriers to entry for smaller investors and new market participants, potentially limiting market access.

Market Hours

Crypto Market

The cryptocurrency market operates 24/7, without any closure or breaks. This continuous operation is enabled by the decentralized nature of blockchain technology, which does not rely on centralized exchanges that operate within specific hours.

Advantages:

- Flexibility: Investors can trade at any time, providing flexibility to manage investments based on their schedules and market conditions.

- Immediate Response: The market’s continuous operation allows for immediate responses to global events and news, offering timely investment opportunities.

Disadvantages:

- Increased Stress: The perpetual nature of the market can lead to increased stress and pressure for traders who feel the need to monitor the market constantly.

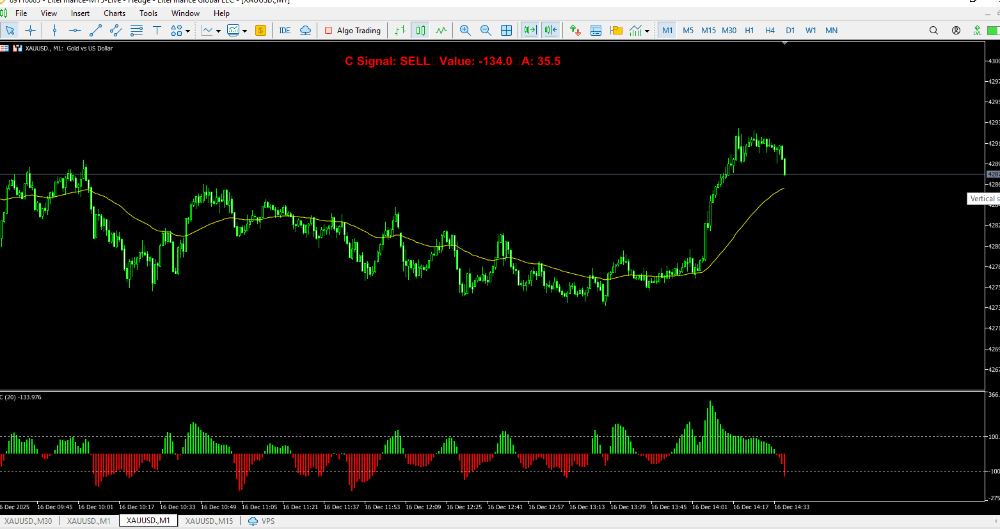

- Volatility: The lack of market closure can contribute to heightened volatility, as prices react immediately to any news or events.

Stock Market

Advantages:

- Predictability: Fixed trading hours provide a predictable schedule for market participants, facilitating planning and analysis.

- Reduced Stress: Limited trading hours allow traders to take breaks and avoid the constant pressure of monitoring the market around the clock.

Disadvantages:

- Limited Access: Investors have limited opportunities to react to after-hours news and events, potentially missing out on timely investment decisions.

- Gaps in Trading: The closure of markets can lead to gaps in trading, where significant price changes occur between the close of one trading day and the opening of the next.

Volatility

Crypto Market

Cryptocurrencies are known for their high volatility, with prices often experiencing significant fluctuations within short periods. This volatility is driven by factors such as market sentiment, regulatory news, technological developments, and macroeconomic trends.

Advantages:

- High Returns: The high volatility of cryptocurrencies presents opportunities for substantial returns, particularly for traders who can accurately predict market movements.

- Dynamic Market: The frequent price movements create a dynamic market environment, attracting traders and speculators looking for quick profits.

Disadvantages:

- High Risk: The same volatility that offers high returns also poses significant risks, with the potential for substantial losses in short periods.

- Uncertainty: The unpredictable nature of the market can make long-term investment planning challenging and increase the risk of holding assets.

Stock Market

The stock market generally exhibits lower volatility compared to the crypto market. While stocks can experience significant price movements, especially during earnings reports or economic announcements, the overall volatility is more moderated.

Advantages:

- Stability: Lower volatility provides a more stable investment environment, suitable for long-term investors looking for steady growth.

- Predictability: The relative stability of the stock market allows for more predictable investment planning and risk management.

Disadvantages:

- Lower Returns: The reduced volatility can limit the potential for high returns, particularly for traders seeking short-term gains.

- Market Manipulation: Despite lower volatility, the stock market is still susceptible to manipulation and sudden price changes due to external factors.

Market Participants

Crypto Market

The cryptocurrency market attracts a diverse range of participants, with a higher proportion of retail investors and individuals compared to the stock market. This demographic is driven by the accessibility and decentralized nature of cryptocurrencies.

Advantages:

- Diverse Participation: The broad participation base contributes to a dynamic and inclusive market environment.

- Retail Influence: Retail investors can have a significant impact on the market, driving trends and price movements.

Disadvantages:

- Market Manipulation: The high proportion of retail investors can make the market more susceptible to manipulation by large holders (whales).

- Speculative Nature: The influence of retail investors can contribute to speculative trading and increased volatility.

Stock Market

The stock market involves a mix of institutional investors, such as mutual funds, pension funds, and hedge funds, along with retail investors. Institutional investors often play a dominant role in the market.

Advantages:

- Professional Management: The presence of institutional investors ensures a level of professional management and analysis, contributing to market stability.

- Liquidity: The involvement of large institutional investors provides liquidity, making it easier to buy and sell assets without significant price impact.

Disadvantages:

- Institutional Dominance: The dominance of institutional investors can marginalize retail investors and influence market movements based on large trades.

- Barrier to Entry: The significant capital required to influence the market can be a barrier for smaller investors, limiting their impact.

Risks

Crypto Market

The cryptocurrency market is associated with higher risks, particularly in terms of security and regulatory challenges. The decentralized nature of cryptocurrencies and the nascent regulatory environment contribute to these risks.

Advantages:

- Potential for High Returns: The high-risk environment can lead to substantial returns for investors who can navigate the market effectively.

- Innovation and Growth: The riskier environment fosters innovation and the development of new financial products and services.

Disadvantages:

- Security Risks: The crypto market is prone to hacking, theft, and fraud, posing significant risks to investors.

- Regulatory Uncertainty: The lack of clear regulatory frameworks can lead to sudden legal changes and enforcement actions, impacting market stability.

Stock Market

The stock market, being heavily regulated, is generally perceived as having lower risks compared to the crypto market. The established regulatory frameworks provide a degree of security and stability.

Advantages:

- Security and Protection: Regulatory measures protect investors from fraud, insider trading, and other malpractices.

- Stable Environment: The lower risk environment contributes to market stability and long-term investment planning.

Disadvantages:

- Lower Returns: The lower risk environment can limit the potential for high returns, particularly for speculative investors.

- Regulatory Compliance: The extensive regulations can create compliance challenges and costs for market participants.

Conclusion

Both the crypto market and the stock market offer unique opportunities and challenges for investors. The crypto market, characterized by its high volatility, lower regulation, and accessibility, appeals to risk-tolerant investors seeking high returns and innovation. In contrast, the stock market, with its stability, regulatory oversight, and professional management, provides a more secure environment for long-term investment.

Understanding the differences between these markets is crucial for investors to make informed decisions based on their risk tolerance, investment goals, and market knowledge. Whether one chooses to invest in cryptocurrencies, stocks, or both, it is essential to stay informed, diversify investments, and develop a robust risk management strategy to navigate the dynamic financial landscape effectively.