Understanding Swaps in Crypto: Token Swapping, Importance, and Considerations

The cryptocurrency space is dynamic and filled with various terms and concepts. One such term, "swap," plays a crucial role in decentralized finance (DeFi) and crypto trading. In this blog post, we will explore what swaps are, delve into the significance of token swapping in the crypto market, and discuss key considerations for users engaging in swaps.

Defining Swaps:

- Overview:

A swap, in the context of cryptocurrencies, refers to the exchange of one token for another, typically facilitated by decentralized exchanges (DEXs). It enables users to trade different tokens directly from their wallets without the need for an intermediary.:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

- Types of Swaps:

There are two primary types of swaps:

- Simple Swaps: Direct exchange between two tokens.

- Complex Swaps: Involve multiple tokens or steps, often used in liquidity provision and yield farming.

Token Swapping and Its Significance in the Crypto Market:

- Decentralization and User Empowerment:

Token swapping aligns with the principles of decentralization, allowing users to trade directly from their wallets. This empowers users by providing control over their assets without relying on centralized exchanges.

- Liquidity Provision:

Swapping plays a vital role in providing liquidity to decentralized exchanges. Liquidity pools, where users contribute tokens to facilitate swaps, enhance the overall efficiency and functionality of decentralized trading platforms.

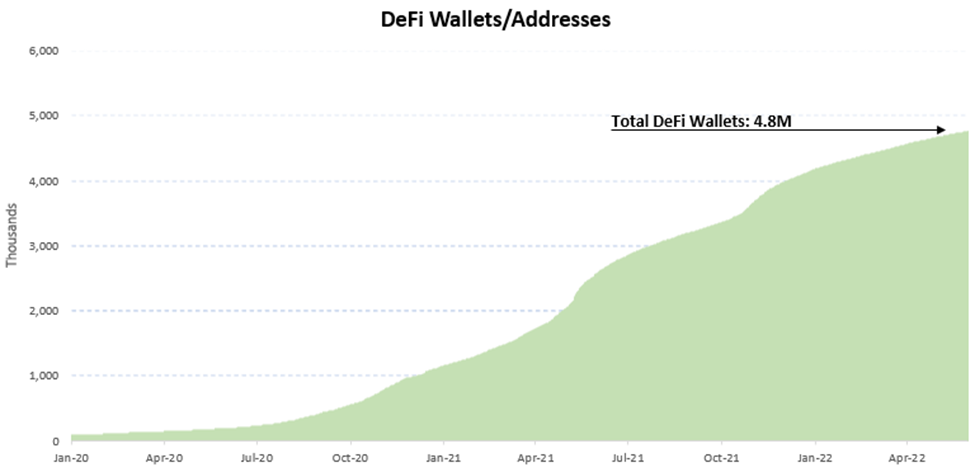

- DeFi Ecosystem Growth:

The rise of decentralized finance has been closely associated with the prevalence of token swapping. DeFi projects often leverage swaps to enable users to lend, borrow, and earn interest on their assets in a decentralized manner.

Considerations for Swapping Tokens:

- Smart Contract Audits:

Before engaging in any token swap, users should verify the security of the smart contracts governing the swap. Smart contract audits help ensure the safety and integrity of the swapping process.

- Token Liquidity:

Consider the liquidity of the tokens involved in the swap. Tokens with higher liquidity are generally easier to trade without significant slippage, providing a better user experience.

- Gas Fees:

Gas fees, the costs associated with blockchain transactions, can vary based on network congestion. Users should be mindful of gas fees, especially during peak times, as they can impact the overall cost of the swap.

- Project Reputation:

Assess the reputation and credibility of the projects involved in the swap. Consider the history, community feedback, and overall standing of the tokens and platforms facilitating the exchange.

Conclusion:

In the ever-evolving landscape of cryptocurrency, swaps play a pivotal role in enabling decentralized and efficient trading. Whether for empowering users, providing liquidity, or contributing to the growth of the DeFi ecosystem, token swapping has become a cornerstone of crypto market activity. As users navigate the world of swaps, being mindful of security, liquidity, gas fees, and project reputation is crucial for a safe and seamless swapping experience.