Mt.Gox trustee started repaying users, issues reported; outstanding BTC payments remain, potential i

Bitcoin exchange Mt. Gox has reportedly begun repaying its users, providing a glimmer of hope for those affected by the exchange’s infamous hack over a decade ago.

The trustee of Mt. Gox confirmed the verification process for eligible repayment clients three months ago, and now users are seeing actual payments being made. However, the repayment process raises concerns about the potential impact on the Bitcoin market.

Mt. Gox Users Receive Payments, But Challenges Persist

Users of the social media site Reddit have reported receiving payments from Mt. Gox, as the trustee added specific amounts and completion dates to their claim accounts.

While some users expressed satisfaction with the repayment process and the absence of fees, others faced challenges such as failed transfers and extended deadlines.

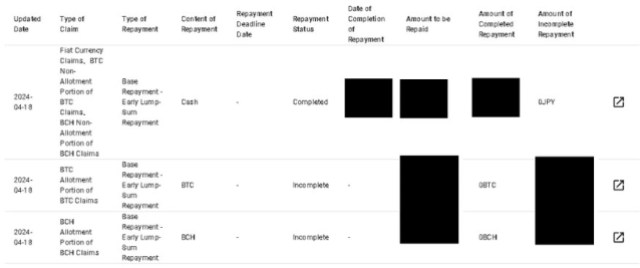

As seen in the image below, the trustee has been regularly updating the redemption tables to provide transparency on progress. However, users and customers of the defunct exchange remain concerned about the fees incurred during the redemption process. Mt. Gox’s repayment table updates. Source: Reddit

Mt. Gox’s repayment table updates. Source: Reddit

As noted in the image, the payments made so far have been cash redemptions, leaving BTC and Bitcoin Cash payments pending. If users decide to sell the tokens they received, this is expected to impact the prices of both cryptocurrencies further.

200,000 BTC To Be Release And Bitcoin Price Outlook

With over 10 years passing since the hack that resulted in the loss of 809,000 BTC, the release of 200,000 BTC to users could potentially impact the cryptocurrency’s price.

Additionally, Mt. Gox still holds 143,000 BCH and 69 billion Japanese yen, adding further complexity to the situation. The potential selling of the received BTC by users waiting for their funds for years might dampen Bitcoin’s bullish sentiment and the ongoing price recovery.

While the amount of cash refunded has not been disclosed, it has come to light that users are being paid in Circle’s USDC stablecoin. This leaves Mt. Gox users who requested to be paid in BTC or Bitcoin Cash as key players in the market, as they could play a significant role in the current market conditions.

The timing of the repayment and the users’ strategy toward holding or selling their BTC and Bitcoin Cash are critical factors determining the long-term effects on Bitcoin’s price.The daily chart shows BTC’s price trending upwards. Source: BTCUSD on TradingView.com

Currently, BTC is trading at $65,900, showcasing a 1.9% surge within the last 24 hours. The $60,000 mark has emerged as a crucial threshold for BTC bulls striving to establish a strong consolidation above this level.

On the other hand, Bitcoin Cash (BCH) is trading at $510, reflecting a 2.1% increase over the past 24 hours and an impressive 8.5% growth over the past month.

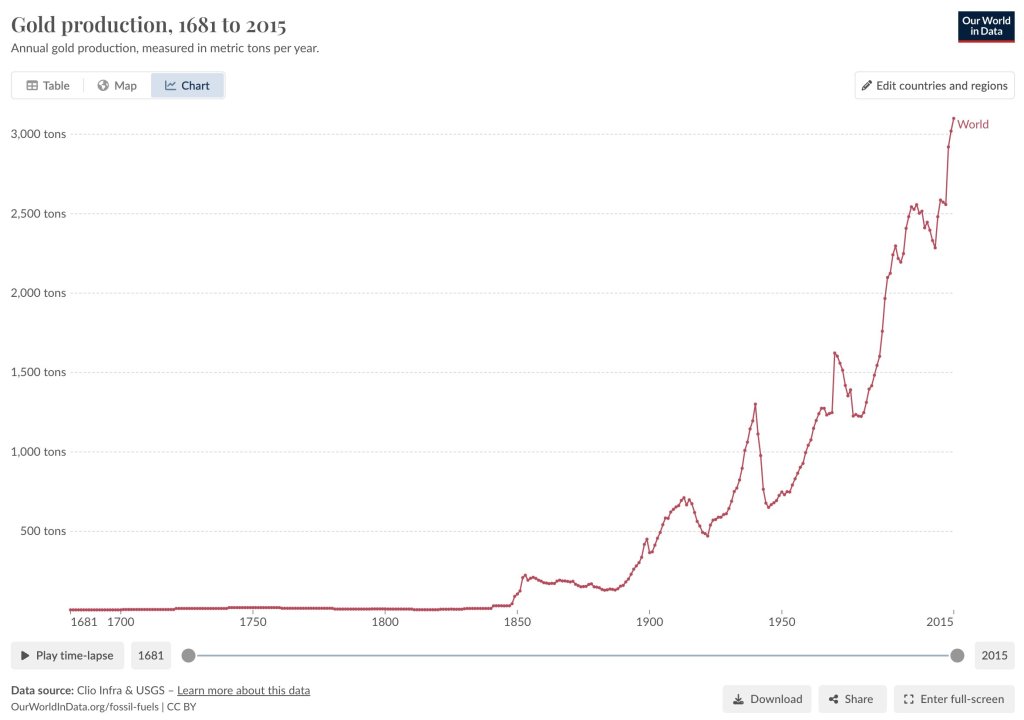

Taking to X on April 22, Willy Woo, an on-chain analyst, notes that the tides are turning in the age-old battle between gold and Bitcoin. While gold has enjoyed a 6,000-year reign as a scarce asset, advancements in mining technology have eroded its scarcity narrative, going by the accelerated production rate in the past few decades.  Gold production | Source: Analyst on X

Gold production | Source: Analyst on X

Gold Versus Bitcoin: Which Is A Better Store Of Value?

Meanwhile, Bitcoin’s supply is decreasing as gold risks an oversupply in the next few years. With the Halving event on April 20, the BTC’s scarcity is only set to become even more pronounced in the years to come.

Since launching, the Bitcoin network has reduced daily issuance to miners through Halving. In the fifth epoch, the network rewards 3.125 BTC to every successful miner or mining pool every 10 minutes. This rate is down 50% from epoch four when rewards stood at 6.25 BTC per block.

Overall, Gold and Bitcoin are considered safe-haven assets. However, over the past centuries, the scarcity of gold has made it the preferred store of value assets for banks and countries. Nearly all central banks in the world hold gold in their reserves.

However, due to technological advancements increased production rate, Woo now thinks gold holders will face rough times in the coming years as new supply floods the market.

Woo backs Bitcoin, a digital asset considered digital gold due to its predetermined and transparent issuance schedule. Traditional gold investors have failed to recognize that the yellow metal is a “slow-moving rug pull” playing out over the next decade, Woo says.

Is BTC Preparing For A Sharp Rally?

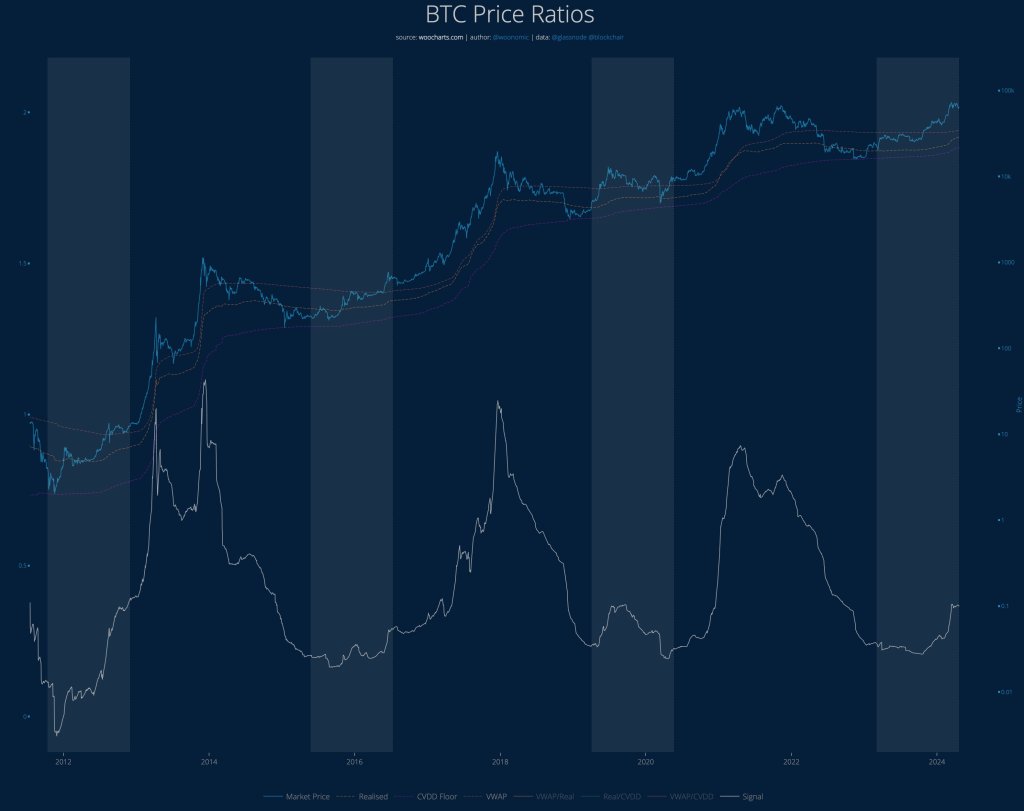

In another post on X, Woo argues that the Bitcoin Price ratio suggests that the coin is gearing for a mega run upward. The rally, the analyst continues, has not even started despite Bitcoin surging to as high as $73,800 in March 2024.  Bitcoin price ratios | Source: Analyst on X

Bitcoin price ratios | Source: Analyst on X

The spike in the coin’s valuation above the previous all-time high of $70,000 was a deviation from historical performance.

Even so, if history guides and prices surge even higher in the current epoch, a new all-time high will be recorded in alignment with Woo’s projections.Bitcoin price trending upward on the daily chart | Source: BTCUSDT on Binance, TradingView

By analyzing how the Bitcoin Price ratio behaved relative to previous Halving events, Woo now thinks the current leg up will be a unique blend of solid market demand and dominance.

![[LIVE] Engage2Earn: Sam Rae for Hawke boost](https://cdn.bulbapp.io/frontend/images/6b43c624-bd70-48c8-b0bc-7bc27c86e0ee/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)