Introducing Parcl: Solana Real Estate Investment Protocol for All

Parcl is the first-ever synthetic real estate perpetual market on the blockchain…

What is Parcl?

Parcl is a decentralized real estate trading protocol built on the Solana blockchain.

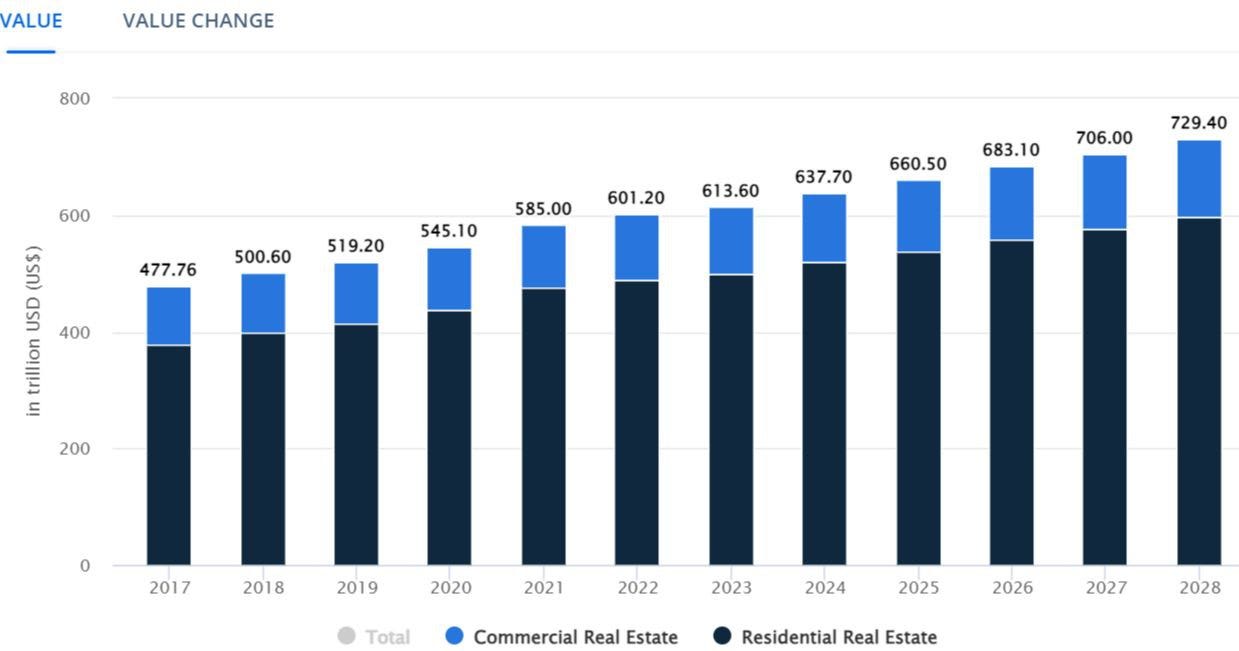

The Parcl team raised $4.1 million in seed investment in March 2022, receiving funding from entities such as Archetype, Dragonfly Capital, Solana Ventures, and Coinbase Ventures, among others. Since then, they have embarked on a mission to make the multi-trillion dollar real estate market accessible to everyday people. Data showing the projection of the real estate market between 2017 and 2028 by Statista

Data showing the projection of the real estate market between 2017 and 2028 by Statista

With every iteration of the protocol, Parcl seems to be drawing closer to its goal. For instance, the protocol’s decentralized nature means that the unbanked can access real estate investments. Also, as of today, for as low as $1, a trader may long (buy) or short (sell) a position in the real estate market via Parcl.

How it works

Parcl allows traders to speculate on the value of real estate through city indexes rather than investing in individual properties.

City indexes aggregate the value of real estate in a specific city.

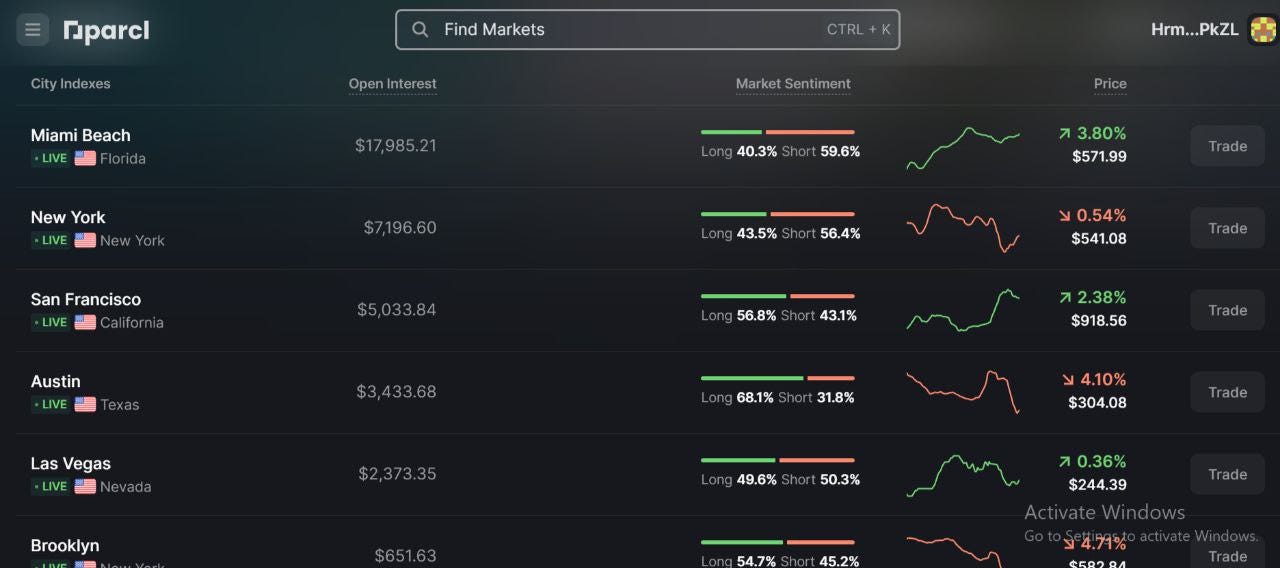

As a trader on Parcl, your goal is to predict whether real estate values within a location will increase or decrease, allowing you to trade real estate across various cities worldwide. Parcl UX

Parcl UX

For instance, if you anticipate that real estate in Miami Beach will appreciate in value, you only need to enter a long (buy) position on the Miami Beach index. Parcl allows you to enter with up to 10x margin, meaning a $100 trade can open a $1,000 position for you. If real estate prices in Miami Beach were to rise while your trade remains open, you’d accumulate profits from the trade.

Parcl supports trading perps, so your position will remain open as long as your trade does not trigger a margin call.

Who can use Parcl?

The major stakeholders in Parcl include:

Traders: Individuals who speculate on rising and falling real estate markets, seeking to profit from them. In Parcl’s V3 iteration, traders are permitted to use up to 10x leverage for real estate trading.

Liquidity Providers (LP): Individuals who facilitate trading on Parcl. They deposit USDC on the protocol to provide counterparties to match traders’ long and short positions at all times.

Price Oracle: The market prices for city indexes traded on Parcl are based on price feeds developed by Parcl Labs. This team then relies on Pyth, a decentralized blockchain oracle, to put these prices on-chain, further establishing the decentralized nature of Parcl.

Parcl v1

Parcl v1 represents the initial version of the Parcl protocol, establishing itself as the first-ever real estate derivative exchange protocol. The protocol recorded $240,000 in traded volume in USDC, with over 5,000 wallet connections, 1,200 swaps, and visitors from more than 157 countries worldwide.

Parcl v2

On December 8, 2022, the Parcl team published an article announcing the launch of Parcl v2. This version marked a significant upgrade and improvement over Parcl v1. Notable figures from Parcl v2 include over 3,500 unique wallets connected to the Parcl protocol, more than 800 unique traders, and over $3.5 million in notional value traded.

Parcl V3

Parcl V3 is the latest iteration of the Parcl protocol, introducing new and improved features that outperform previous iterations and enhance the user experience for both traders and liquidity providers.

Parcl’s V3 incorporates changes in architecture and governance, enhancing risk management and resulting in an overall improvement in the protocol’s user experience.

The Parcl team announced the Parcl V3 upgrade on November 14, 2023.

Notable changes to Parcl V3 include:

- Single LP Pools

Every exchange featured on Parcl V3 will have a single liquidity pool. This consolidation of liquidity into one place facilitates a robust counterparty to match traders’ long and short positions at all times, leading to a more efficient trading experience.

- Cross Margin System

In Parcl V3, traders can use the profit from one open position to keep other running positions active. This improves the trading experience, as traders are less likely to be abruptly closed out of a trade if they have other positions active in the green.

This feature reduces the risk of sudden closures, providing traders with more flexibility and stability in managing their trades. It also introduces the opportunity to profit from a trade that would have otherwise been closed due to margin calls.

- Delta Neutral LP Experience

The Parcl V3 upgrade reduces the risk exposure for LPs, and one of the ways it achieves this is by using a model that rewards traders for consistently maintaining a fair and balanced market. This way, LPs have great experience with the protocol.

- Flexible Governance

The ‘exchange settings’ & ‘market settings’ on Parcl V3 are adjustable to fit the best-case scenario for both traders and LPs. This feature can also be migrated into a DAO, where Parcl users can objectively decide how settings are adjusted.

Want a more extensive overview of the Parcl V3 upgrade?

Parcl V3 doc: https://docs.parcl.co/

How to be a part of the Parcl Ecosystem

The obvious way to be a part of the Parcl ecosystem is to use the Parcl protocol. You can use Parcl as a trader to find good buys and sells in the real estate market, or as a liquidity provider that generates income from trading fees paid by traders on the protocol.

You can also find ongoing trading contests via the Parcl protocol and through Parcl’s social media channels to join the ecosystem and stand a chance to win exciting rewards, from cash prizes to NFTs, exclusive merch, and more.

You can show your participation in the ecosystem by staying active on Parcl’s Discord and Twitter.

Start trading via: https://app.parcl.co/

Code: nadenoil (get 5% boost your points)

Stay up to date with the latest developments via Parcl’s official Twitter

Please note that this post is for educational purposes only and should not be taken as financial advice.

Good Luck!