Coins vs. Fiat: The Battle for Dominance in the Financial Landscape

Introduction

In the ever-evolving landscape of global finance, a profound clash has emerged between the age-old traditional fiat currencies and the innovative rise of digital coins. As we navigate the intricate web of economic transactions and financial systems, the dichotomy between these two forms of currency becomes increasingly evident. Traditional fiat, backed by governments and established financial institutions, has long been the cornerstone of global economies. However, the advent of digital coins, fueled by blockchain technology and decentralized principles, poses a formidable challenge to the longstanding dominance of fiat currencies. This clash, at the intersection of technology and finance, prompts us to explore the advantages, disadvantages, and potential ramifications of this ongoing battle for supremacy. Join us on a journey into the heart of the financial revolution as we delve into the Clash of Digital Coins and Traditional Fiat.

The Rise of Digital Coins: A Threat to Fiat Supremacy?

In recent years, the financial world has witnessed an unprecedented surge in the popularity and influence of digital coins, challenging the traditional hegemony of fiat currencies. The rise of cryptocurrencies such as Bitcoin, Ethereum, and a myriad of altcoins has sparked debates and discussions about the potential threat they pose to the supremacy of fiat currencies. Unlike fiat, which is centrally regulated by governments and financial institutions, digital coins operate on decentralized blockchain technology, offering a level of transparency, security, and autonomy that was previously unimaginable. As digital coins gain widespread acceptance and recognition, concerns about their impact on fiat currencies have intensified. The decentralization ethos, coupled with the appeal of borderless and permissionless transactions, has led some to question whether digital coins could dethrone fiat currencies as the primary medium of exchange. This paradigm shift prompts us to critically examine the fundamental attributes of both digital coins and fiat currencies, exploring the challenges and opportunities that arise as we navigate this transformative phase in the evolution of global finance.

Advantages and Disadvantages: Evaluating the Pros and Cons of Coins and Fiat

The ongoing clash between digital coins and traditional fiat currencies prompts a thorough examination of their respective advantages and disadvantages. On the side of digital coins, the most compelling advantage lies in the decentralized nature facilitated by blockchain technology. This decentralization not only provides a transparent and tamper-resistant ledger but also empowers users with greater control over their financial transactions, eliminating the need for intermediaries. Additionally, the borderless nature of digital coins facilitates global transactions without the constraints of traditional banking hours or cross-border restrictions. However, this newfound autonomy comes with its own set of challenges, including heightened volatility, regulatory uncertainties, and the potential for misuse in illicit activities.

On the other hand, fiat currencies, backed by governments and central banks, offer a level of stability and widespread acceptance that digital coins are still striving to achieve. The established infrastructure of fiat allows for quick and reliable transactions, supported by a well-established regulatory framework. However, the centralized control of fiat currencies raises concerns about transparency, susceptibility to inflation, and dependence on the stability of the issuing government.As we navigate this landscape, it becomes essential to weigh these advantages and disadvantages carefully. The evolution of the financial ecosystem depends not only on understanding the merits of each form of currency but also on finding a harmonious balance that can harness the strengths of both digital coins and fiat currencies.

Cryptocurrency Volatility vs. Fiat Stability: Analyzing the Risk Factor

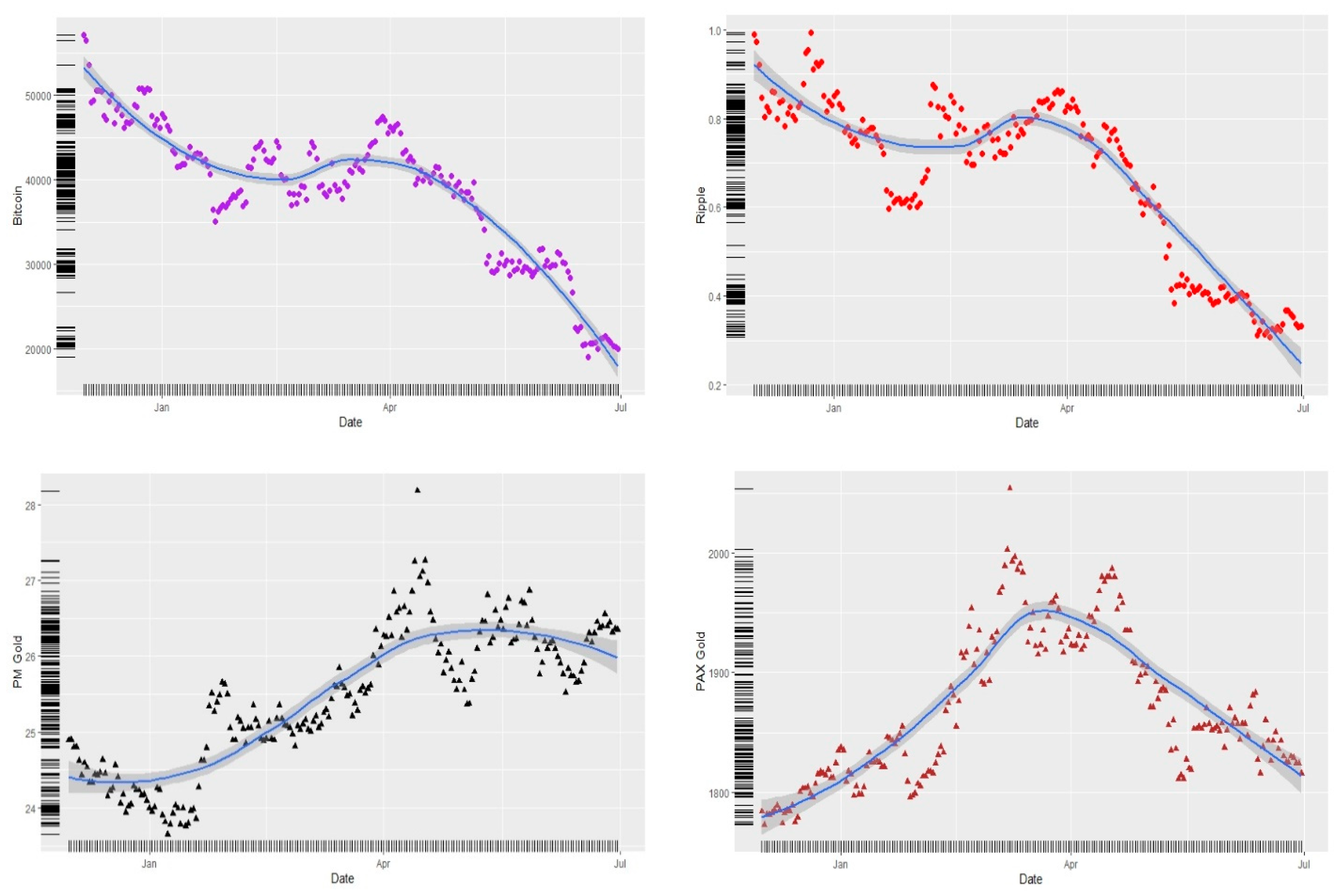

One of the most pronounced distinctions between cryptocurrencies and fiat currencies lies in their respective levels of volatility and stability. Cryptocurrencies, known for their price fluctuations, can experience significant value swings within short time frames. This volatility can be attributed to factors such as market sentiment, regulatory developments, and technological advancements. While the dynamic nature of cryptocurrency markets presents opportunities for substantial gains, it also introduces a heightened risk factor for investors and users.

In contrast, fiat currencies are traditionally characterized by a more stable valuation, largely owing to the centralized control and regulation imposed by governments and central banks. The stability of fiat currencies provides a sense of security for individuals and businesses engaged in everyday transactions. However, this stability is not without its own risks, as factors like inflation and economic uncertainties can erode the purchasing power of fiat currencies over time. Analyzing the risk factor becomes a pivotal aspect of the ongoing debate between cryptocurrency volatility and fiat stability. Investors must carefully consider their risk tolerance and investment goals when choosing between these two forms of currency. While the potential for higher returns exists in the volatile world of cryptocurrencies, it comes hand-in-hand with an elevated level of risk. Fiat currencies, on the other hand, offer a more predictable environment but may lack the potential for rapid capital appreciation.

Analyzing the risk factor becomes a pivotal aspect of the ongoing debate between cryptocurrency volatility and fiat stability. Investors must carefully consider their risk tolerance and investment goals when choosing between these two forms of currency. While the potential for higher returns exists in the volatile world of cryptocurrencies, it comes hand-in-hand with an elevated level of risk. Fiat currencies, on the other hand, offer a more predictable environment but may lack the potential for rapid capital appreciation.

As the financial landscape continues to evolve, understanding and navigating the risk factors associated with cryptocurrency and fiat currency become integral components in shaping informed investment and financial decisions.

Adoption and Acceptance: The Growing Influence of Coins in Everyday Transactions

In recent years, a notable shift has occurred in the landscape of everyday transactions, as digital coins gain increasing acceptance and influence. Cryptocurrencies, once considered niche or speculative assets, are now progressively infiltrating mainstream commerce, reshaping the way individuals and businesses engage in financial transactions. The growing adoption of digital coins is propelled by several factors, including the desire for financial autonomy, the appeal of decentralized technologies, and the increasing recognition of cryptocurrencies as legitimate mediums of exchange.

One key driver of this trend is the rise of digital payment platforms that seamlessly integrate cryptocurrencies into their services. Major companies and online retailers now accept digital coins as a valid form of payment, expanding the range of goods and services that can be acquired using cryptocurrencies. Moreover, the accessibility and ease of use associated with digital coins contribute to their adoption, enabling quick and secure transactions across borders without the need for traditional banking infrastructure. The acceptance of digital coins is not limited to online transactions; brick-and-mortar businesses are also adapting to this evolving financial landscape. Cryptocurrency ATMs are becoming more commonplace, allowing users to easily convert digital coins into traditional fiat or vice versa. Additionally, the integration of cryptocurrency payment systems in point-of-sale solutions is enhancing the practicality of using digital coins for everyday purchases.

The acceptance of digital coins is not limited to online transactions; brick-and-mortar businesses are also adapting to this evolving financial landscape. Cryptocurrency ATMs are becoming more commonplace, allowing users to easily convert digital coins into traditional fiat or vice versa. Additionally, the integration of cryptocurrency payment systems in point-of-sale solutions is enhancing the practicality of using digital coins for everyday purchases.

While challenges such as regulatory uncertainties and price volatility persist, the growing acceptance of digital coins in everyday transactions underscores a fundamental shift in how individuals and businesses perceive and utilize currency. As the adoption rate continues to rise, digital coins may increasingly become an integral part of our daily financial interactions, challenging the long-established dominance of traditional fiat currencies.

Regulatory Challenges: How Governments Are Responding to the Coin Revolution

The rapid rise and widespread adoption of digital coins have posed significant regulatory challenges for governments worldwide. The decentralized and pseudonymous nature of many cryptocurrencies has raised concerns among regulatory bodies regarding issues such as financial transparency, tax evasion, and the potential facilitation of illicit activities. As a response to the coin revolution, governments are navigating the complex task of striking a balance between fostering innovation and protecting the integrity of financial systems.

One prevalent challenge is the lack of a standardized global regulatory framework for cryptocurrencies. Different countries have adopted diverse approaches, ranging from embracing and regulating the technology to outright bans. Some nations are working towards comprehensive regulations to provide legal clarity for market participants, while others are taking a more cautious stance, citing concerns about consumer protection and market stability. Governments are also grappling with the classification of digital coins. The question of whether they should be considered commodities, currencies, securities, or a unique asset class adds a layer of complexity to regulatory efforts. The varying classifications impact taxation, licensing, and compliance requirements, further highlighting the need for coordinated and consistent international regulatory standards.

Governments are also grappling with the classification of digital coins. The question of whether they should be considered commodities, currencies, securities, or a unique asset class adds a layer of complexity to regulatory efforts. The varying classifications impact taxation, licensing, and compliance requirements, further highlighting the need for coordinated and consistent international regulatory standards.

Despite the challenges, some forward-thinking governments are exploring the integration of blockchain technology into their own infrastructure. Central bank digital currencies (CBDCs) are gaining attention as governments consider issuing their own digital currencies, which would be under their control and subject to existing regulatory frameworks. This approach aims to harness the benefits of digital currencies while maintaining regulatory oversight.

In conclusion, the regulatory landscape surrounding digital coins is dynamic and evolving. Governments are faced with the task of crafting effective and adaptive regulations to harness the potential benefits of this financial innovation while mitigating associated risks. The coming years will likely see continued developments in regulatory approaches as authorities worldwide respond to the challenges posed by the coin revolution.

Security Matters: Exploring the Safety of Coins vs. Fiat Transactions

As the financial landscape undergoes a transformative shift with the rise of digital coins, the question of security becomes paramount. The decentralized and cryptographic nature of blockchain technology, upon which many cryptocurrencies are built, has often been touted as a secure alternative to traditional fiat transactions. The fundamental principle of blockchain, with its decentralized and distributed ledger, makes it resistant to tampering and fraud. Cryptographic algorithms used in digital coins enhance the security of transactions, providing a level of anonymity and protection against unauthorized access.

However, this heightened security is not without its nuances. The pseudonymous nature of cryptocurrency transactions, while offering privacy, has also raised concerns about potential illicit use and money laundering. Additionally, the prevalence of hacking incidents on cryptocurrency exchanges has underscored the importance of securing digital wallets and platforms. Users must remain vigilant in safeguarding their private keys, as the loss of access can result in irreversible financial consequences. On the other hand, traditional fiat transactions are often facilitated by well-established banking systems with stringent security measures. Banks employ sophisticated encryption technologies, multi-factor authentication, and regulatory compliance frameworks to ensure the security of financial transactions. The centralized nature of fiat transactions allows for greater oversight and control by regulatory bodies, aiding in the prevention of fraudulent activities.

On the other hand, traditional fiat transactions are often facilitated by well-established banking systems with stringent security measures. Banks employ sophisticated encryption technologies, multi-factor authentication, and regulatory compliance frameworks to ensure the security of financial transactions. The centralized nature of fiat transactions allows for greater oversight and control by regulatory bodies, aiding in the prevention of fraudulent activities.

In the ongoing debate over the safety of coins versus fiat transactions, striking a balance between privacy and security remains a challenge. Cryptocurrency enthusiasts argue that the decentralized and cryptographic features provide a robust defense against fraud, while skeptics express concerns about the potential misuse and lack of regulatory oversight. As the financial ecosystem continues to evolve, the emphasis on security will play a crucial role in shaping the widespread acceptance and adoption of digital coins in everyday transactions.

Investment Strategies: Diversifying Portfolios with Coins or Sticking to Fiat?

In the realm of investment, the choice between diversifying portfolios with digital coins or adhering to traditional fiat assets has become a pivotal decision for investors seeking to optimize returns and manage risk. Diversification, a well-established strategy in traditional finance, involves spreading investments across various asset classes to mitigate risk and enhance overall portfolio resilience.

Proponents of diversifying with digital coins argue that cryptocurrencies offer a unique set of characteristics that can complement traditional investment portfolios. The potential for high returns, especially during periods of significant market volatility, has attracted the attention of investors looking to capitalize on the dynamic nature of the cryptocurrency market. Additionally, digital coins operate independently of traditional financial markets, providing a potential hedge against economic downturns and inflation. However, the undeniable volatility and regulatory uncertainties associated with digital coins pose challenges for those considering diversification. The rapid price fluctuations characteristic of cryptocurrencies can lead to substantial gains, but they also expose investors to heightened risk. Moreover, the lack of a standardized regulatory framework adds an additional layer of uncertainty, making it crucial for investors to carefully navigate the evolving landscape.

However, the undeniable volatility and regulatory uncertainties associated with digital coins pose challenges for those considering diversification. The rapid price fluctuations characteristic of cryptocurrencies can lead to substantial gains, but they also expose investors to heightened risk. Moreover, the lack of a standardized regulatory framework adds an additional layer of uncertainty, making it crucial for investors to carefully navigate the evolving landscape.

Conversely, adhering to fiat investments offers a sense of stability and predictability, traits that traditional financial markets have long been associated with. Government-backed securities, bonds, and other fiat instruments provide a level of security and regulatory oversight that digital coins may still be striving to achieve. Investors prioritizing capital preservation and a more conservative approach may find comfort in the familiarity of traditional fiat assets.

Ultimately, the decision to diversify portfolios with digital coins or stick to fiat assets hinges on an investor's risk tolerance, financial goals, and belief in the potential of cryptocurrencies as a long-term asset class. Striking the right balance between these contrasting elements is key, as the investment landscape continues to evolve, offering new opportunities and challenges for those navigating the intersection of traditional and digital finance.

The Future Landscape: Predictions for the Dominance of Coins and Fiat Currency

As we peer into the future of the financial landscape, predictions for the dominance of digital coins versus fiat currency remain a subject of intense speculation and debate. The rapid evolution of technology, coupled with the increasing acceptance of digital coins, suggests that cryptocurrencies will continue to play a more prominent role in shaping the future of finance. Proponents argue that the decentralized and borderless nature of digital coins aligns with the growing demand for financial autonomy and inclusion, potentially positioning them as formidable contenders for dominance.

However, challenges such as regulatory uncertainties, security concerns, and the intrinsic volatility of digital coins cannot be ignored. Governments and regulatory bodies are likely to play a crucial role in determining the future landscape, with some embracing and regulating digital currencies while others exercise caution or implement restrictions. The development of central bank digital currencies (CBDCs) is a testament to the effort to strike a balance between innovation and regulatory oversight. Fiat currencies, with their long-established history and stability, are not expected to vanish from the financial stage. The extensive infrastructure supporting traditional financial systems, combined with the backing of governments and central banks, provides a level of trust and confidence that digital coins may need more time to establish. Fiat currencies will likely undergo transformations, leveraging advancements in financial technology to enhance efficiency and inclusivity.

Fiat currencies, with their long-established history and stability, are not expected to vanish from the financial stage. The extensive infrastructure supporting traditional financial systems, combined with the backing of governments and central banks, provides a level of trust and confidence that digital coins may need more time to establish. Fiat currencies will likely undergo transformations, leveraging advancements in financial technology to enhance efficiency and inclusivity.

Predicting the dominance of one over the other may oversimplify the intricate dynamics at play. The future financial landscape may witness a coexistence, where digital coins and fiat currency serve distinct purposes within a diversified ecosystem. The success of this coexistence may hinge on finding synergies that combine the strengths of both, offering users a comprehensive and adaptable array of financial instruments. As we move forward, the trajectory of dominance will likely be influenced by technological advancements, regulatory frameworks, and societal attitudes, making it a compelling area to watch as the financial narrative unfolds.

My Other Articles:

- AVAX: From High-Performance Cryptocurrency Beyond Blockchain to Digital Financial Revolution

- The Revolution of NFTs in the Art World: The Rise of Crypto Art

- Cryptocurrencies: A Revolutionary Financial Trend

- The World of Crypto Airdrops: Strategies, Advantages, and Future Outlook

- Bitcoin ETF Approval: Shaping the Future of Cryptocurrency Markets

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)