CRYPTO TAX SEASON UPDATE: GUIDANCE FOR AMERICANS ON FILING TAXES

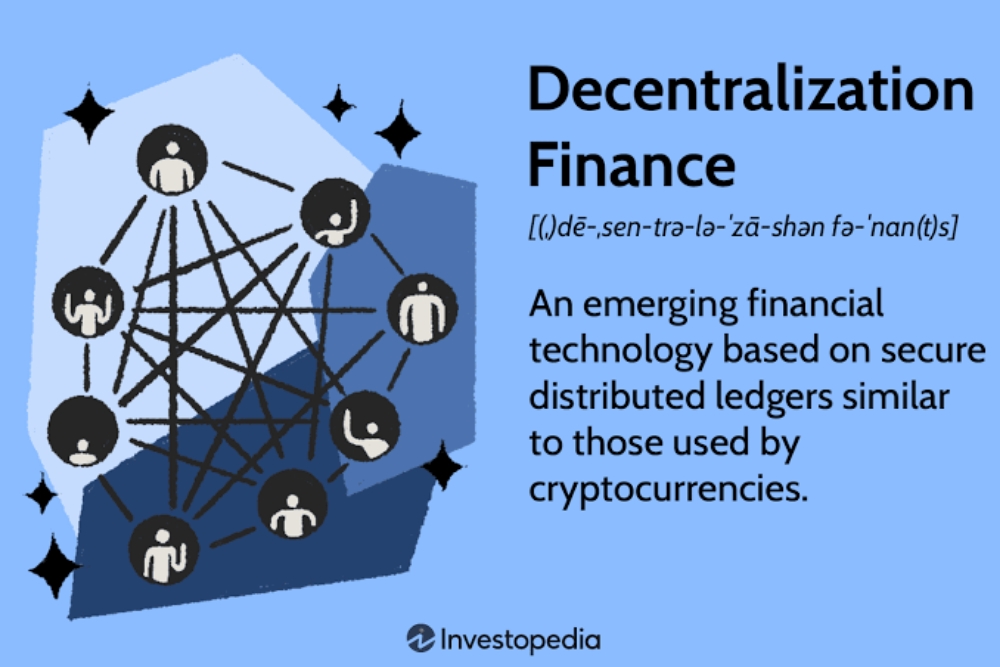

The IRS is shining a spotlight on cryptocurrency enthusiasts and occasional dippers alike this tax season. Gone are the days when you could vaguely mention your digital endeavors; now, the taxman demands clarity. The Form 1040—your golden ticket to tax compliance—kicks things off with a nosy inquiry about your dealings in digital assets, signaling a shift from the somewhat quaint term “virtual currencies” to the all-encompassing “digital assets.” This umbrella term captures everything from your garden-variety cryptocurrencies to stablecoins and those elusive non-fungible tokens.

This year, answering “no” might be the easiest decision for those untouched by the digital gold rush. However, for the crypto connoisseurs, the path is fraught with checkboxes that demand a “yes.” According to Shehan Chandrasekera of CoinTracker, this isn’t the time for wishful thinking or memory lapses. The broad phrasing of the IRS’s question is a dragnet for any and all digital transactions.

Knowing When to Say “Yes”

Navigating the labyrinth of crypto transactions requires a keen eye for detail. If you’ve cashed out on your digital investments for cold hard cash, the IRS expects a slice of the pie. And don’t think swapping digital currencies escapes notice; trading Bitcoin for Ethereum is as reportable as any stock exchange.

Then there’s the income side of things. Earning crypto isn’t just about mining. It encompasses receiving digital currencies as payment for services or goods, not to mention staking rewards. And yes, even that pizza you bought with Bitcoin counts. The IRS’s gaze extends to more esoteric activities like receiving crypto from airdrops or hard forks—events unique to the crypto world that result in new coins landing in your digital wallet.

When You Can Breathe Easy

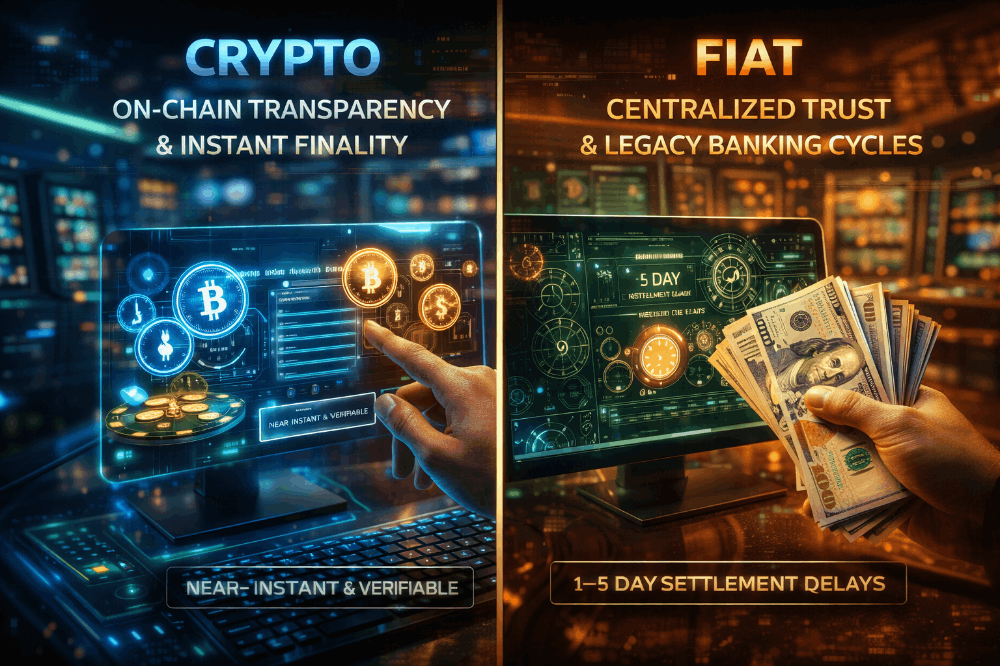

However, not all crypto interactions trigger a tax event. Buying crypto with fiat and simply holding onto it offers a temporary reprieve from the taxman’s scrutiny. Similarly, moving your digital stash between wallets you own isn’t a taxable event. Yet, it’s wise to keep a tax professional in your corner to navigate these waters correctly.

The illusion of anonymity in crypto transactions is just that—an illusion. The IRS has its ways, and playing hide and seek with your digital dealings is a game you’re unlikely to win. With penalties ranging from audits to criminal charges, transparency is your best policy.

The digital frontier is ever-evolving, and with it, the tax implications of engaging with cryptocurrencies and other digital assets. The IRS’s definition casts a wide net, encompassing everything from the cryptocurrencies we’ve come to know and love (or loathe) to the more niche corners of the digital asset world, like stablecoins and non-fungible tokens (NFTs). This expansion in terminology reflects the growing complexity and diversity of the digital asset ecosystem.

Navigating this complex landscape requires diligence and a thorough understanding of what constitutes a taxable event. Whether it’s cashing out cryptocurrencies, trading between different types of digital coins, earning digital assets through various means, or using cryptocurrencies for purchases, each action has implications for your tax obligations.

Moreover, the article emphasizes the importance of being proactive and transparent in reporting these transactions. The IRS’s question on Form 1040 is a clear indication that the government is paying close attention to the crypto space. Ignorance or omission can lead to significant penalties, underscoring the need for crypto investors to keep detailed records of their transactions.

The IRS is shining a spotlight on cryptocurrency enthusiasts and occasional dippers alike this tax season. Gone are the days when you could vaguely mention your digital endeavors; now, the taxman demands clarity. The Form 1040—your golden ticket to tax compliance—kicks things off with a nosy inquiry about your dealings in digital assets, signaling a shift from the somewhat quaint term “virtual currencies” to the all-encompassing “digital assets.” This umbrella term captures everything from your garden-variety cryptocurrencies to stablecoins and those elusive non-fungible tokens.

This year, answering “no” might be the easiest decision for those untouched by the digital gold rush. However, for the crypto connoisseurs, the path is fraught with checkboxes that demand a “yes.” According to Shehan Chandrasekera of CoinTracker, this isn’t the time for wishful thinking or memory lapses. The broad phrasing of the IRS’s question is a dragnet for any and all digital transactions.

Knowing When to Say “Yes”

Navigating the labyrinth of crypto transactions requires a keen eye for detail. If you’ve cashed out on your digital investments for cold hard cash, the IRS expects a slice of the pie. And don’t think swapping digital currencies escapes notice; trading Bitcoin for Ethereum is as reportable as any stock exchange.

Then there’s the income side of things. Earning crypto isn’t just about mining. It encompasses receiving digital currencies as payment for services or goods, not to mention staking rewards. And yes, even that pizza you bought with Bitcoin counts. The IRS’s gaze extends to more esoteric activities like receiving crypto from airdrops or hard forks—events unique to the crypto world that result in new coins landing in your digital wallet.

When You Can Breathe Easy

However, not all crypto interactions trigger a tax event. Buying crypto with fiat and simply holding onto it offers a temporary reprieve from the taxman’s scrutiny. Similarly, moving your digital stash between wallets you own isn’t a taxable event. Yet, it’s wise to keep a tax professional in your corner to navigate these waters correctly.

The illusion of anonymity in crypto transactions is just that—an illusion. The IRS has its ways, and playing hide and seek with your digital dealings is a game you’re unlikely to win. With penalties ranging from audits to criminal charges, transparency is your best policy.

The digital frontier is ever-evolving, and with it, the tax implications of engaging with cryptocurrencies and other digital assets. The IRS’s definition casts a wide net, encompassing everything from the cryptocurrencies we’ve come to know and love (or loathe) to the more niche corners of the digital asset world, like stablecoins and non-fungible tokens (NFTs). This expansion in terminology reflects the growing complexity and diversity of the digital asset ecosystem.

Navigating this complex landscape requires diligence and a thorough understanding of wThe IRS is shining a spotlight on cryptocurrency enthusiasts and occasional dippers alike this tax season. Gone are the days when you could vaguely mention your digital endeavors; now, the taxman demands clarity. The Form 1040—your golden ticket to tax compliance—kicks things off with a nosy inquiry about your dealings in digital assets, signaling a shift from the somewhat quaint term “virtual currencies” to the all-encompassing “digital assets.” This umbrella term captures everything from your garden-variety cryptocurrencies to stablecoins and those elusive non-fungible tokens.

This year, answering “no” might be the easiest decision for those untouched by the digital gold rush. However, for the crypto connoisseurs, the path is fraught with checkboxes that demand a “yes.” According to Shehan Chandrasekera of CoinTracker, this isn’t the time for wishful thinking or memory lapses. The broad phrasing of the IRS’s question is a dragnet for any and all digital transactions.

Knowing When to Say “Yes”

Navigating the labyrinth of crypto transactions requires a keen eye for detail. If you’ve cashed out on your digital investments for cold hard cash, the IRS expects a slice of the pie. And don’t think swapping digital currencies escapes notice; trading Bitcoin for Ethereum is as reportable as any stock exchange.

Then there’s the income side of things. Earning crypto isn’t just about mining. It encompasses receiving digital currencies as payment for services or goods, not to mention staking rewards. And yes, even that pizza you bought with Bitcoin counts. The IRS’s gaze extends to more esoteric activities like receiving crypto from airdrops or hard forks—events unique to the crypto world that result in new coins landing in your digital wallet.

When You Can Breathe Easy

However, not all crypto interactions trigger a tax event. Buying crypto with fiat and simply holding onto it offers a temporary reprieve from the taxman’s scrutiny. Similarly, moving your digital stash between wallets you own isn’t a taxable event. Yet, it’s wise to keep a tax professional in your corner to navigate these waters correctly.

The illusion of anonymity in crypto transactions is just that—an illusion. The IRS has its ways, and playing hide and seek with your digital dealings is a game you’re unlikely to win. With penalties ranging from audits to criminal charges, transparency is your best policy.

The digital frontier is ever-evolving, and with it, the tax implications of engaging with cryptocurrencies and other digital assets. The IRS’s definition casts a wide net, encompassing everything from the cryptocurrencies we’ve come to know and love (or loathe) to the more niche corners of the digital asset world, like stablecoins and non-fungible tokens (NFTs). This expansion in terminology reflects the growing complexity and diversity of the digital asset ecosystem.

Navigating this complex landscape requires diligence and a thorough understanding of what constitutes a taxable event. Whether it’s cashing out cryptocurrencies, trading between different types of digital coins, earning digital assets through various means, or using cryptocurrencies for purchases, each action has implications for your tax obligations.

Moreover, the article emphasizes the importance of being proactive and transparent in reporting these transactions. The IRS’s question on Form 1040 is a clear indication that the government is paying close attention to the crypto space. Ignorance or omission can lead to significant penalties, underscoring the need for crypto investors to keep detailed records of their transactions.hat constitutes a taxable event. Whether it’s cashing out cryptocurrencies, trading between different types of digital coins, earning digital assets through various means, or using cryptocurrencies for purchases, each action has implications for your tax obligations.

Moreover, the article emphasizes the importance of being proactive and transparent in reporting these transactions. The IRThe IRS is shining a spotlight on cryptocurrency enthusiasts and occasional dippers alike this tax season. Gone are the days when you could vaguely mention your digital endeavors; now, the taxman demands clarity. The Form 1040—your golden ticket to tax compliance—kicks things off with a nosy inquiry about your dealings in digital assets, signaling a shift from the somewhat quaint term “virtual currencies” to the all-encompassing “digital assets.” This umbrella term captures everything from your garden-variety cryptocurrencies to stablecoins and those elusive non-fungible tokens.

This year, answering “no” might be the easiest decision for those untouched by the digital gold rush. However, for the crypto connoisseurs, the path is fraught with checkboxes that demand a “yes.” According to Shehan Chandrasekera of CoinTracker, this isn’t the time for wishful thinking or memory lapses. The broad phrasing of the IRS’s question is a dragnet for any and all digital transactions.

Knowing When to Say “Yes”

Navigating the labyrinth of crypto transactions requires a keen eye for detail. If you’ve cashed out on your digital investments for cold hard cash, the IRS expects a slice of the pie. And don’t think swapping digital currencies escapes notice; trading Bitcoin for Ethereum is as reportable as any stock exchange.

Then there’s the income side of things. Earning crypto isn’t just about mining. It encompasses receiving digital currencies as payment for services or goods, not to mention staking rewards. And yes, even that pizza you bought with Bitcoin counts. The IRS’s gaze extends to more esoteric activities like receiving crypto from airdrops or hard forks—events unique to the crypto world that result in new coins landing in your digital wallet.

When You Can Breathe Easy

However, not all crypto interactions trigger a tax event. Buying crypto with fiat and simply holding onto it offers a temporary reprieve from the taxman’s scrutiny. Similarly, moving your digital stash between wallets you own isn’t a taxable event. Yet, it’s wise to keep a tax professional in your corner to navigate these waters correctly.

The illusion of anonymity in crypto transactions is just that—an illusion. The IRS has its ways, and playing hide and seek with your digital dealings is a game you’re unlikely to win. With penalties ranging from audits to criminal charges, transparency is your best policy.

The digital frontier is ever-evolving, and with it, the tax implications of engaging with cryptocurrencies and other digital assets. The IRS’s definition casts a wide net, encompassing everything from the cryptocurrencies we’ve come to know and love (or loathe) to the more niche corners of the digital asset world, like stablecoins and non-fungible tokens (NFTs). This expansion in terminology reflects the growing complexity and diversity of the digital asset ecosystem.

Navigating this complex landscape requires diligence and a thorough understanding of what constitutes a taxable event. Whether it’s cashing out cryptocurrencies, trading between different types of digital coins, earning digital assets through various means, or using cryptocurrencies for purchases, each action has implications for your tax obligations.

Moreover, the article emphasizes the importance of being proactive and transparent in reporting these transactions. The IRS’s question on Form 1040 is a clear indication that the government is paying close attention to the crypto space. Ignorance or omission can lead to significant penalties, underscoring the need for crypto investors to keep detailed records of their transactions.S’s question on Form 1040 is a clear indication that the government is paying close attention to the crypto space. Ignorance or omission can lead to significant penalties, underscoring the need for crypto investors to keep detailed records of their transactions.

The IRS is shining a spotlight on cryptocurrency enthusiasts and occasional dippers alike this tax season. Gone are the days when you could vaguely mention your digital endeavors; now, the taxman demands clarity. The Form 1040—your golden ticket to tax compliance—kicks things off with a nosy inquiry about your dealings in digital assets, signaling a shift from the somewhat quaint term “virtual currencies” to the all-encompassing “digital assets.” This umbrella term captures everything from your garden-variety cryptocurrencies to stablecoins and those elusive non-fungible tokens.

This year, answering “no” might be the easiest decision for those untouched by the digital gold rush. However, for the crypto connoisseurs, the path is fraught with checkboxes that demand a “yes.” According to Shehan Chandrasekera of CoinTracker, this isn’t the time for wishful thinking or memory lapses. The broad phrasing of the IRS’s question is a dragnet for any and all digital transactions.

Knowing When to Say “Yes”

Navigating the labyrinth of crypto transactions requires a keen eye for detail. If you’ve cashed out on your digital investments for cold hard cash, the IRS expects a slice of the pie. And don’t think swapping digital currencies escapes notice; trading Bitcoin for Ethereum is as reportable as any stock exchange.

Then there’s the income side of things. Earning crypto isn’t just about mining. It encompasses receiving digital currencies as payment for services or goods, not to mention staking rewards. And yes, even that pizza you bought with Bitcoin counts. The IRS’s gaze extends to more esoteric activities like receiving crypto from airdrops or hard forks—events unique to the crypto world that result in new coins landing in your digital wallet.

When You Can Breathe Easy

However, not all crypto interactions trigger a tax event. Buying crypto with fiat and simply holding onto it offers a temporary reprieve from the taxman’s scrutiny. Similarly, moving your digital stash between wallets you own isn’t a taxable event. Yet, it’s wise to keep a tax professional in your corner to navigate these waters correctly.

The illusion of anonymity in crypto transactions is just that—an illusion. The IRS has its ways, and playing hide and seek with your digital dealings is a game you’re unlikely to win. With penalties ranging from audits to criminal charges, transparency is your best policy.

The digital frontier is ever-evolving, and with it, the tax implications of engaging with cryptocurrencies and other digital assets. The IRS’s definition casts a wide net, encompassing everything from the cryptocurrencies we’ve come to know and love (or loathe) to the more niche corners of the digital asset world, like stablecoins and non-fungible tokens (NFTs). This expansion in terminology reflects the growing complexity and diversity of the digital asset ecosystem.

Navigating this complex landscape requires diligence and a thorough understanding of what constitutes a taxable event. Whether it’s cashing out cryptocurrencies, trading between different types of digital coins, earning digital assets through various means, or using cryptocurrencies for purchases, each action has implications for your tax obligations.

Moreover, the article emphasizes the importance of being proactive and transparent in reporting these transactions. The IRS’s question on Form 1040 is a clear indication that the government is paying close attention to the crypto space. Ignorance or omission can lead to significant penalties, underscoring the need for crypto investors to keep detailed records of their transactions.

The IRS is shining a spotlight on cryptocurrency enthusiasts and occasional dippers alike this tax season. Gone are the days when you could vaguely mention your digital endeavors; now, the taxman demands clarity. The Form 1040—your golden ticket to tax compliance—kicks things off with a nosy inquiry about your dealings in digital assets, signaling a shift from the somewhat quaint term “virtual currencies” to the all-encompassing “digital assets.” This umbrella term captures everything from your garden-variety cryptocurrencies to stablecoins and those elusive non-fungible tokens.

This year, answering “no” might be the easiest decision for those untouched by the digital gold rush. However, for the crypto connoisseurs, the path is fraught with checkboxes that demand a “yes.” According to Shehan Chandrasekera of CoinTracker, this isn’t the time for wishful thinking or memory lapses. The broad phrasing of the IRS’s question is a dragnet for any and all digital transactions.

Knowing When to Say “Yes”

Navigating the labyrinth of crypto transactions requires a keen eye for detail. If you’ve cashed out on your digital investments for cold hard cash, the IRS expects a slice of the pie. And don’t think swapping digital currencies escapes notice; trading Bitcoin for Ethereum is as reportable as any stock exchange.

Then there’s the income side of things. Earning crypto isn’t just about mining. It encompasses receiving digital currencies as payment for services or goods, not to mention staking rewards. And yes, even that pizza you bought with Bitcoin counts. The IRS’s gaze extends to more esoteric activities like receiving crypto from airdrops or hard forks—events unique to the crypto world that result in new coins landing in your digital wallet.

When You Can Breathe Easy

However, not all crypto interactions trigger a tax event. Buying crypto with fiat and simply holding onto it offers a temporary reprieve from the taxman’s scrutiny. Similarly, moving your digital stash between wallets you own isn’t a taxable event. Yet, it’s wise to keep a tax professional in your corner to navigate these waters correctly.

The illusion of anonymity in crypto transactions is just that—an illusion. The IRS has its ways, and playing hide and seek with your digital dealings is a game you’re unlikely to win. With penalties ranging from audits to criminal charges, transparency is your best policy.

The digital frontier is ever-evolving, and with it, the tax implications of engaging with cryptocurrencies and other digital assets. The IRS’s definition casts a wide net, encompassing everything from the cryptocurrencies we’ve come to know and love (or loathe) to the more niche corners of the digital asset world, like stablecoins and non-fungible tokens (NFTs). This expansion in terminology reflects the growing complexity and diversity of the digital asset ecosystem.

Navigating this complex landscape requires diligence and a thorough understanding of what constitutes a taxable event. Whether it’s cashing out cryptocurrencies, trading between different types of digital coins, earning digital assets through various means, or using cryptocurrencies for purchases, each action has implications for your tax obligations.

Moreover, the article emphasizes the importance of being proactive and transparent in reporting these transactions. The IRS’s question on Form 1040 is a clear indication that the government is paying close attention to the crypto space. Ignorance or omission can lead to significant penalties, underscoring the need for crypto investors to keep detailed records of their transactions.

The IRS is shining a spotlight on cryptocurrency enthusiasts and occasional dippers alike this tax season. Gone are the days when you could vaguely mention your digital endeavors; now, the taxman demands clarity. The Form 1040—your golden ticket to tax compliance—kicks things off with a nosy inquiry about your dealings in digital assets, signaling a shift from the somewhat quaint term “virtual currencies” to the all-encompassing “digital assets.” This umbrella term captures everything from your garden-variety cryptocurrencies to stablecoins and those elusive non-fungible tokens.

This year, answering “no” might be the easiest decision for those untouched by the digital gold rush. However, for the crypto connoisseurs, the path is fraught with checkboxes that demand a “yes.” According to Shehan Chandrasekera of CoinTracker, this isn’t the time for wishful thinking or memory lapses. The broad phrasing of the IRS’s question is a dragnet for any and all digital transactions.

Knowing When to Say “Yes”

Navigating the labyrinth of crypto transactions requires a keen eye for detail. If you’ve cashed out on your digital investments for cold hard cash, the IRS expects a slice of the pie. And don’t think swapping digital currencies escapes notice; trading Bitcoin for Ethereum is as reportable as any stock exchange.

Then there’s the income side of things. Earning crypto isn’t just about mining. It encompasses receiving digital currencies as payment for services or goods, not to mention staking rewards. And yes, even that pizza you bought with Bitcoin counts. The IRS’s gaze extends to more esoteric activities like receiving crypto from airdrops or hard forks—events unique to the crypto world that result in new coins landing in your digital wallet.

When You Can Breathe Easy

However, not all crypto interactions trigger a tax event. Buying crypto with fiat and simply holding onto it offers a temporary reprieve from the taxman’s scrutiny. Similarly, moving your digital stash between wallets you own isn’t a taxable event. Yet, it’s wise to keep a tax professional in your corner to navigate these waters correctly.

The illusion of anonymity in crypto transactions is just that—an illusion. The IRS has its ways, and playing hide and seek with your digital dealings is a game you’re unlikely to win. With penalties ranging from audits to criminal charges, transparency is your best policy.

The digital frontier is ever-evolving, and with it, the tax implications of engaging with cryptocurrencies and other digital assets. The IRS’s definition casts a wide net, encompassing everything from the cryptocurrencies we’ve come to know and love (or loathe) to the more niche corners of the digital asset world, like stablecoins and non-fungible tokens (NFTs). This expansion in terminology reflects the growing complexity and diversity of the digital asset ecosystem.

Navigating this complex landscape requires diligence and a thorough understanding of what constitutes a taxable event. Whether it’s cashing out cryptocurrencies, trading between different types of digital coins, earning digital assets through various means, or using cryptocurrencies for purchases, each action has implications for your tax obligations.

Moreover, the article emphasizes the importance of being proactive and transparent in reporting these transactions. The IRS’s question on Form 1040 is a clear indication that the government is paying close attention to the crypto space. Ignorance or omission can lead to significant penalties, underscoring the need for crypto investors to keep detailed records of their transactions.

The IRS is shining a spotlight on cryptocurrency enthusiasts and occasional dippers alike this tax season. Gone are the days when you could vaguely mention your digital endeavors; now, the taxman demands clarity. The Form 1040—your golden ticket to tax compliance—kicks things off with a nosy inquiry about your dealings in digital assets, signaling a shift from the somewhat quaint term “virtual currencies” to the all-encompassing “digital assets.” This umbrella term captures everything from your garden-variety cryptocurrencies to stablecoins and those elusive non-fungible tokens.

This year, answering “no” might be the easiest decision for those untouched by the digital gold rush. However, for the crypto connoisseurs, the path is fraught with checkboxes that demand a “yes.” According to Shehan Chandrasekera of CoinTracker, this isn’t the time for wishful thinking or memory lapses. The broad phrasing of the IRS’s question is a dragnet for any and all digital transactions.

Knowing When to Say “Yes”

Navigating the labyrinth of crypto transactions requires a keen eye for detail. If you’ve cashed out on your digital investments for cold hard cash, the IRS expects a slice of the pie. And don’t think swapping digital currencies escapes notice; trading Bitcoin for Ethereum is as reportable as any stock exchange.

Then there’s the income side of things. Earning crypto isn’t just about mining. It encompasses receiving digital currencies as payment for services or goods, not to mention staking rewards. And yes, even that pizza you bought with Bitcoin counts. The IRS’s gaze extends to more esoteric activities like receiving crypto from airdrops or hard forks—events unique to the crypto world that result in new coins landing in your digital wallet.

When You Can Breathe Easy

However, not all crypto interactions trigger a tax event. Buying crypto with fiat and simply holding onto it offers a temporary reprieve from the taxman’s scrutiny. Similarly, moving your digital stash between wallets you own isn’t a taxable event. Yet, it’s wise to keep a tax professional in your corner to navigate these waters correctly.

The illusion of anonymity in crypto transactions is just that—an illusion. The IRS has its ways, and playing hide and seek with your digital dealings is a game you’re unlikely to win. With penalties ranging from audits to criminal charges, transparency is your best policy.

The digital frontier is ever-evolving, and with it, the tax implications of engaging with cryptocurrencies and other digital assets. The IRS’s definition casts a wide net, encompassing everything from the cryptocurrencies we’ve come to know and love (or loathe) to the more niche corners of the digital asset world, like stablecoins and non-fungible tokens (NFTs). This expansion in terminology reflects the growing complexity and diversity of the digital asset ecosystem.

Navigating this complex landscape requires diligence and a thorough understanding of what constitutes a taxable event. Whether it’s cashing out cryptocurrencies, trading between different types of digital coins, earning digital assets through various means, or using cryptocurrencies for purchases, each action has implications for your tax obligations.

Moreover, the article emphasizes the importance of being proactive and transparent in reporting these transactions. The IRS’s question on Form 1040 is a clear indication that the government is paying close attention to the crypto space. Ignorance or omission can lead to significant penalties, underscoring the need for crypto investors to keep detailed records of their transactions.

![𝐐𝐮𝐢𝐜𝐤 𝐚𝐥𝐩𝐡𝐚: [𝑝𝑜𝑡𝑒𝑛𝑡𝑖𝑎𝑙 𝑠𝑡𝑖𝑚𝑚𝑦 𝑎𝑡 𝑇𝐺𝐸] – 𝐉𝐔𝐒𝐓 𝐃𝐎 𝐈𝐓 𝐍𝐎𝐖!!!!](https://cdn.bulbapp.io/frontend/images/30a2649d-ce6e-4d5d-8666-7a0e754fc4e6/1)