Bybit Copy Trading Review 2024: Maximize Your Crypto Trading

🚀 Ready to embark on your crypto trading journey but feeling overwhelmed by the complexities of the market?

😟 Worried about making mistakes or missing out on lucrative trading opportunities?

Say goodbye to uncertainty and hello to copy trading — your ticket to stress-free crypto trading. This trading strategy has changed the way traders approach the market, offering a simple solution for those lacking experience or confidence.

💡Stop worrying about countless hours of analyzing charts or second-guessing your decisions — just choose a skilled trader to emulate.

🤝Where you ask? On Bybit, of course!

What is Bybit?

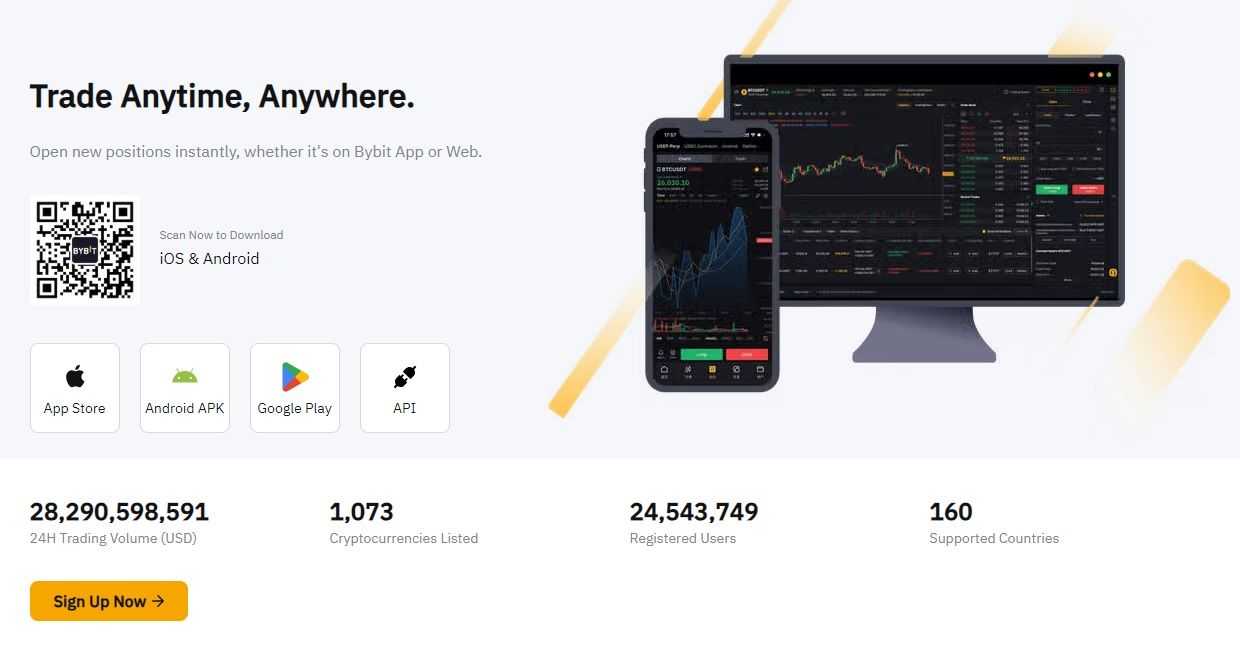

Bybit is a cryptocurrency and derivatives trading platform headquartered in Dubai. It offers several services such as trading bots, lending, institutional services, referral and affiliate programs, the Bybit debit card, P2P market and copy trading, which is the focus of this article.

One of the exchange's notable features is its provision of leverage of up to 100x on certain assets, a strategy known for its high risk. To mitigate this risk, Bybit implements various safeguards such as an insurance fund, auto deleveraging, and both cross and isolated margin accounts. These measures aim to limit the potential downside of trades for users.

Bybit boasts a selection of over 1,000 cryptocurrencies. Its user base exceeds 24 million individuals, and the exchange serves clients in 160 countries worldwide.

What is Copy Trading?

Copy trading means mimicking the trades of experienced investors automatically. This trading strategy gained mainstream traction in the traditional finance space but has now become a staple in crypto trading as well.

Imagine you have a friend who is a great chef. Every time they whip up something tasty, you ask them for the recipe and follow it step by step to make the same dish. Copy trading works in the same manner: you find a skilled trader whose investment strategies you admire. Instead of making your own investment decisions, you simply replicate the trades made by the trader.

For example, suppose a Bybit trader you're copying executes a sell order for Bitcoin with a specified risk-to-reward ratio and exit point. In this case, the copy trading software will mimic this trade in your account according to your chosen risk parameters.

Alternatively, traders can join social trading groups on platforms like Facebook or Telegram to receive advice and trade signals from other traders. However, it's important to recognize the inherent risks involved in trading and the challenges of mastering the volatile cryptocurrency market. Many novice traders struggle to succeed and may incur significant losses before gaining experience.

Copy trading differs from social trading, where seasoned traders provide recommendations on which assets to buy or sell manually. While social trading fosters community engagement and learning opportunities, it may also introduce potential errors and reduce the likelihood of success compared to automated copy trading.

Be warned though: just like following a recipe doesn't guarantee a perfect meal every time due to variations in ingredients or cooking techniques, copy trading doesn't ensure identical results to the original trader's performance. However, it benefits you from the expertise of more advanced traders without needing to possess the same level of skill or knowledge.

What is Bybit Copy Trading?

Copy trading is a feature in the Bybit trading platform that serves as a tool for managing portfolios by mirroring the actions of skilled crypto traders.

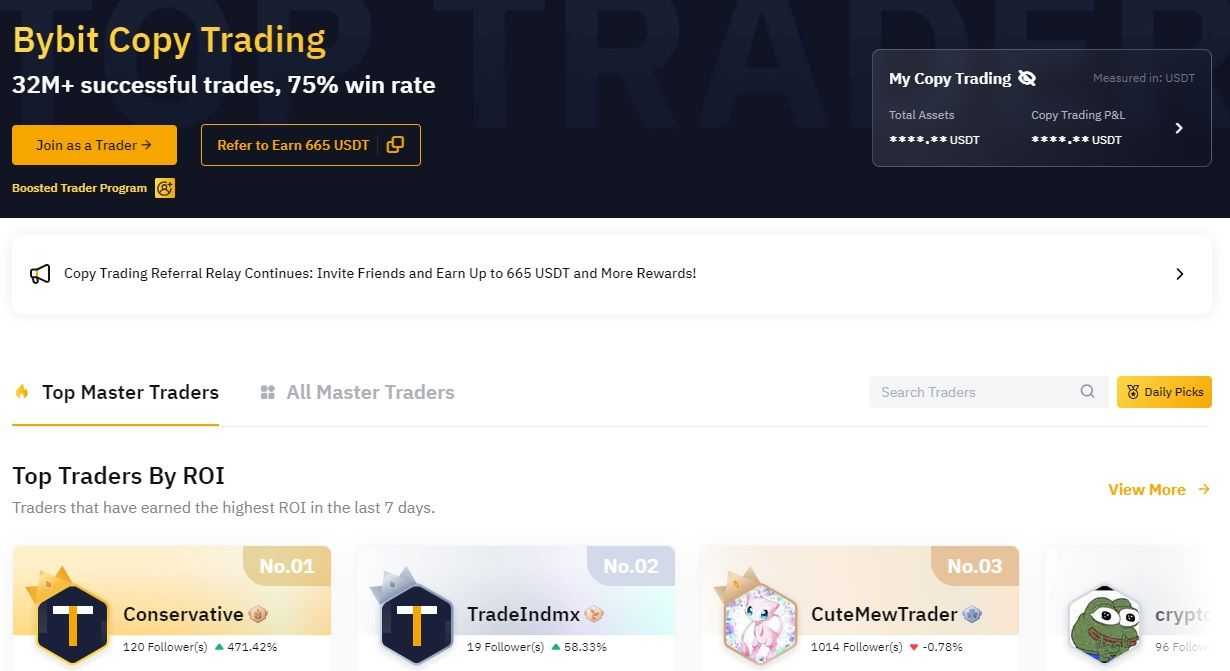

Bybit categorizes copy traders into two buckets:

- Followers, who replicate the trading strategies of experienced investors. Followers entrust their trading decisions to the expertise and track record of experienced traders.

- Master traders are seasoned investors who have demonstrated proficiency in trading and have fetched followers interested in replicating their strategies.

Master traders can showcase their trading strategies to attract new followers. These master traders have the opportunity to earn a percentage of the profits generated by each follower who copies their trades. The amount they receive is determined by their level as a master trader on the platform. This system allows master traders to leverage their expertise to build a following, while also providing them with a potential source of additional income based on the success of their followers.

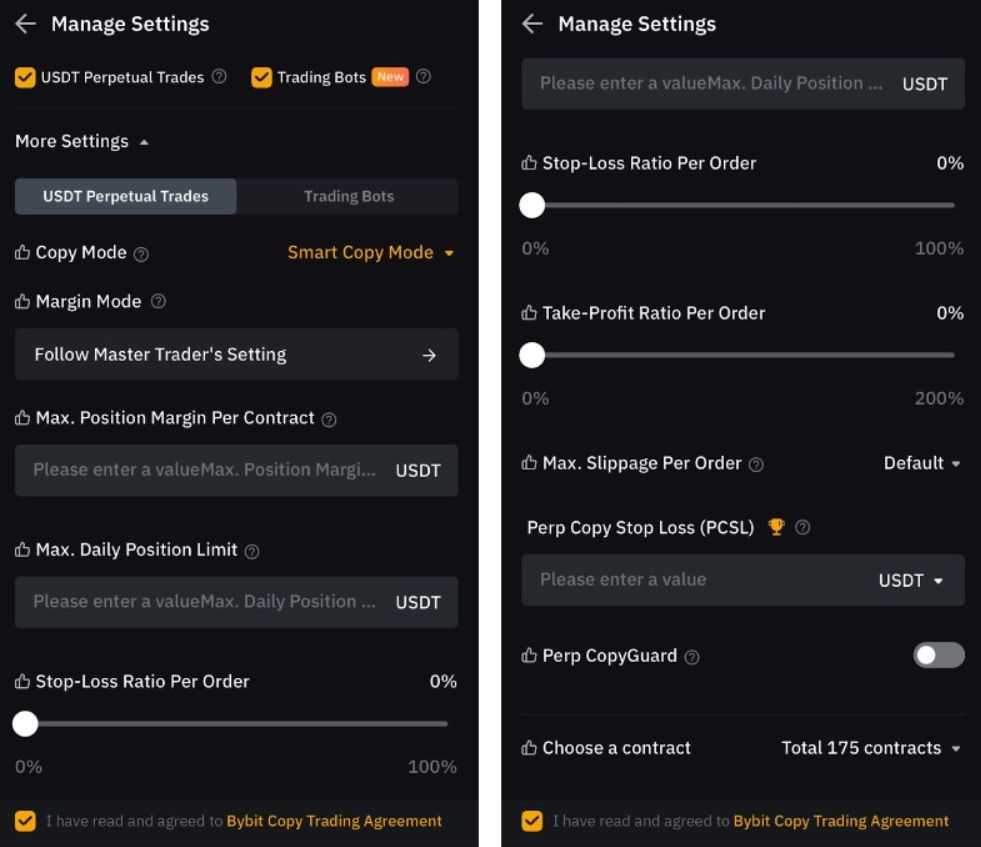

Followers can choose either USDT perpetual trades or trading bots for copy trading. The minimum investment amount is 50 USDT. However, Bybit has given master traders considerable leeway and they can set their own minimums. In any case, the minimum investment requirement will be front and centre on the master trader's profile.

How to Start Copy Trading on Bybit

Before we start this section of the guide, it's important to note that as a centralized exchange, Bybit must adhere to Know Your Customer (KYC) standards, or identity verification in plain English, which are designed to stem the illicit flow of money. This process is required for users to access all Bybit products and services.

With that out of the way, here's how you can start following your favourite master traders on Bybit.

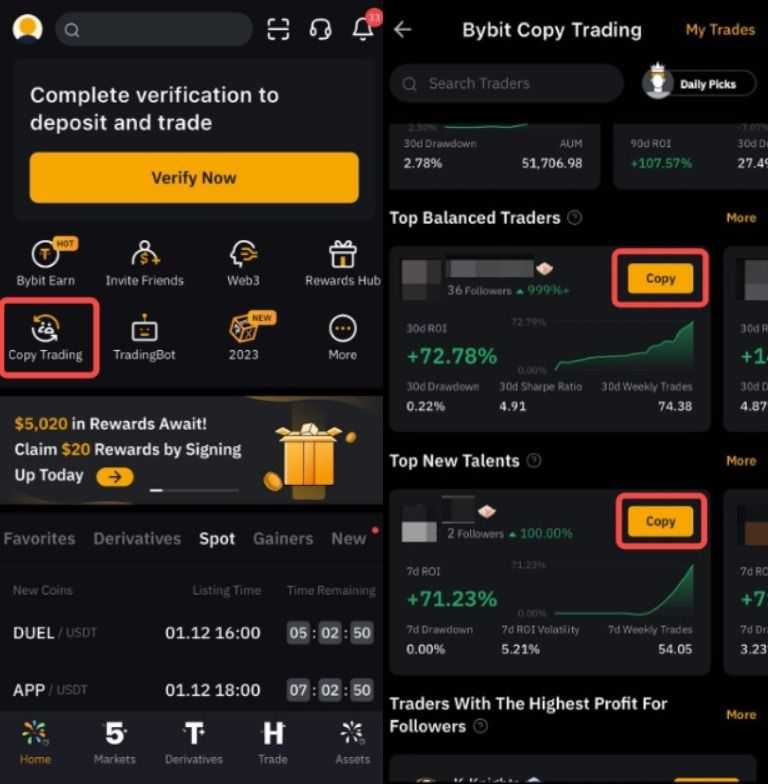

STEP 1: Navigate to the Copy Trading section on the app's home page.

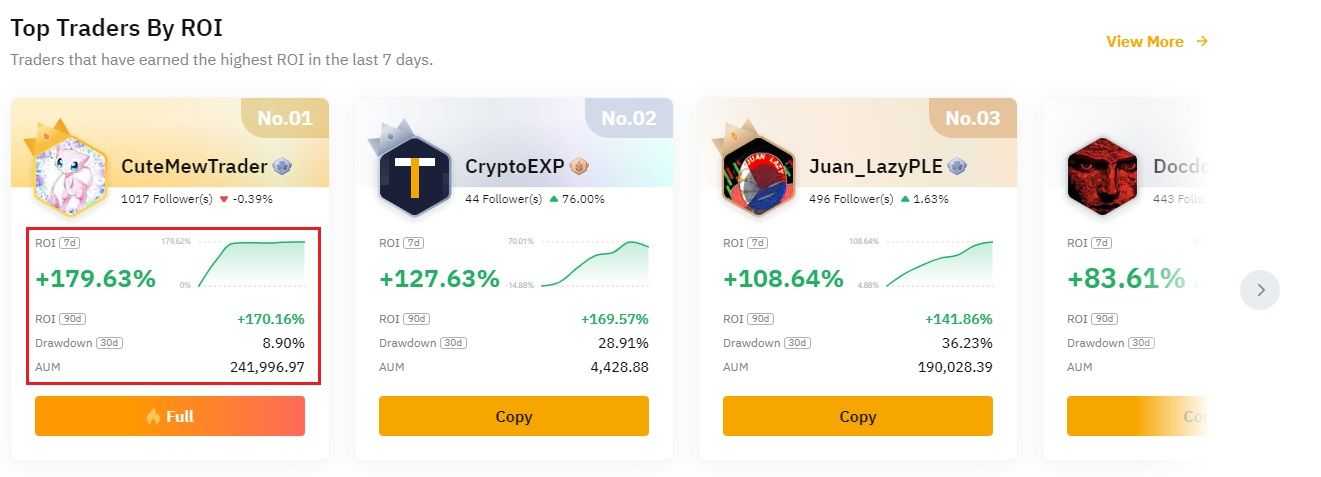

STEP 2: Browse through the top Master Traders, pick the ones you'd like to follow and tap Copy. You can follow up to 10 master traders at the same time.

STEP 3: Here, you'll have to set the investment amount and decide whether you'd like to copy trade USDT perpetual trades or trading bots. As a reminder, the minimum investment amount is 50 USDT.

STEP 4: You can select “More Settings” to get access to additional parameters for your copy trades like stop-loss ratio and take-profit ratio per order, among many other things.

STEP 5: Once the settings are confirmed, you can simply acknowledge the copy trading agreement and tap “Copy Now." Viola, you're done!

Bybit Copy Trading Fees

You will be charged the same trading and funding fees that traders incur on Bybit's derivatives platform. As a reminder, Bybit charges maker/taker fees of 0.02%/0.055%. Bybit's perpetual and futures contract fees can be read in their full glory on the dedicated fees page.

The funding fee has a lot of moving parts, however. Bybit uses funding as a mechanism to ensure that its last traded price remains aligned with the global spot price, akin to the interest cost of holding a position in spot margin trading. Here's a quick rundown:

- Funding occurs every 8 hours at specific times

- Traders pay or receive a funding fee based on their positions

- Fees are deducted from available balances or position margins

- Bybit adjusts funding intervals based on market conditions

- This mechanism promotes price stability in perpetual contract trading

Benefits of Copy Trading

There are several benefits to be had with copy trading.

Access to Expertise

Picture yourself navigating a dense jungle filled with financial mysteries and market madness. As a beginner trader, you might feel like you're armed with only a compass that doesn't work and a map written in an incomprehensible language. Copy trading is like a seasoned jungle guide who knows all the secret shortcuts, hidden dangers and where to find the treasure.

Copy trading offers the opportunity to gain real-time insights into the investment decisions of skilled professionals. Instead of relying solely on theoretical knowledge or delayed market analysis, traders can witness how master traders react to live market events and adjust their strategies accordingly. This real-time observation allows for a deeper understanding of market behaviour and helps traders adapt to changing conditions more effectively.

Seasoned traders are adept at managing risk effectively, employing techniques such as position sizing, stop-loss orders and portfolio diversification to protect their capital and minimize losses. By copying the trades of master traders, novice investors can benefit from the same level of professional risk management, reducing the likelihood of significant drawdowns and preserving their trading capital over the long term.

Reduced Emotional Bias

No more sweaty palms or racing heartbeats when the market falls to dizzying lows! Cryptocurrencies are a volatile asset class that one up one minute and down the next. With copy trading, you can sit back, relax, and enjoy the ride knowing your trades are in capable hands.

When you're making trading decisions on your own, emotions can cloud your judgment. Fear, greed, and FOMO (fear of missing out) can all conspire to sabotage your carefully laid trading plans, leading to impulsive decisions and regrettable trades.

Copy trading guides you through the turbulent waters of market volatility with calm and clarity like a Zen master. By automating trades based on the actions of master traders, you remove the emotional guesswork from the equation, allowing you to make rational decisions based on proven strategies and data-driven analysis.

Learning Opportunity

Copy trading presents an invaluable opportunity for traders, particularly the inexperienced ones, to gain access to the knowledge and expertise of seasoned investors. By observing and replicating the trades of master traders, novice investors can glean insights into market dynamics, trading techniques, risk management strategies and decision-making processes.

Copy trading shouldn't just be about blindly following the herd, but a learning experience that empowers followers to become more informed and self-reliant. Think of it as a trading masterclass where each trade serves as a valuable lesson in strategy and execution.

Copy trading also provides followers the opportunity to experiment and refine their skills over time. As you gain experience and confidence, you can gradually transition from being a passive follower to an active participant in the trading process, incorporating lessons learned from master traders into your own trading approach.

Diversification

Anyone who's ever invested in TradFi or crypto has heard of the importance of diversification, a cornerstone principle of successful investing. Diversification acts as a safety net, spreading risk across different assets and strategies to limit your downside.

Copy trading can be a potent tool to achieve diversification. The strategy allows traders to diversify their portfolios by following multiple master traders with distinct trading styles and approaches. Each master trader brings their unique perspective, expertise, and strategies to the table, offering traders a broad flavour of investment opportunities.

One master trader may specialize in day trading, executing rapid-fire trades based on short-term price movements, while another may focus on long-term investing, patiently holding positions for extended periods to capitalize on macroeconomic trends. This diversification not only spreads risk but also enhances the potential for returns.

Different trading strategies may perform better in different market conditions, and by diversifying across multiple strategies, traders can increase the likelihood of capturing profitable opportunities.

Drawbacks of Copy Trading

While copy trading offers numerous benefits, there are also a few drawbacks to consider.

Dependency on Master Traders

One of the primary drawbacks of copy trading is being too dependent on master traders, which means you lose autonomy in trading decisions.

Traders may become accustomed to following master traders without conducting their own analysis or research. This dependency can lead to a lack of critical thinking and decision-making skills, which can act as roadblocks to their own journey of navigating the crypto markets independently.

Dependency on master traders may create a false sense of security among traders, leading to complacency and a lack of diligence in monitoring their investment portfolios. Traders may also falsely assume that master traders will always make profitable decisions without recognizing the inherent risks and uncertainties of the crypto markets.

Limited Control

While copy trading offers convenience and the potential to benefit from the expertise of others, it also entails relinquishing a degree of autonomy over your investment decisions.

- Inability to Customize Strategies: One of the primary drawbacks of copy trading is the inability to tailor trading strategies to individual preferences or market conditions. When following master traders, traders must adhere to their predefined strategies and trading styles, which may not always align with their own objectives or risk tolerance.

- Delayed Reaction to Market Changes: Copy trading relies on the actions of master traders to execute trades, meaning that traders may experience delays in responding to rapidly changing market conditions. In fast-moving crypto markets, this delay could result in missed opportunities or increased exposure to market volatility.

- Overexposure to Popular Traders: Popular master traders may attract a large number of followers, resulting in overexposure to their trading strategies and potentially increasing risk. If a significant number of traders are following the same master trader, it can lead to overcrowding of trades and reduced effectiveness of their strategies.

Risk of Overreliance

Copy trading may lure you with easy access to successful trading strategies, but it also carries the danger of becoming overly dependent on the actions and decisions of others.

Relying solely on master traders for investment decisions can lead to a lack of independent thinking and decision-making. Traders may become complacent, deferring to the strategies of others without conducting their own analysis or research. There's also the risk of herd mentality where traders may be tempted to blindly follow the crowd, mimicking the actions of popular master traders without fully understanding the rationale behind their trades.

Good times don't last forever and master traders may experience fluctuations in their performance over time. Traders who over-rely on specific master traders may find themselves exposed to the risks associated with these fluctuations. In addition, overreliance on copy trading can hinder traders' personal development and growth as investors.

Questions to Ask Yourself Before Copy Trading

Before you begin your copy-trading journey, you must ask yourself a few questions to help align your decision with your investment goals, risk tolerance and trading preferences.

- What Are My Investment Goals?: Reflect on your investment objectives and determine whether copy trading aligns with your long-term financial goals. Are you looking to grow your investment portfolio or gain exposure to specific market sectors? Understanding your goals will help you evaluate whether copy trading is the right strategy for achieving them.

- What Is My Risk Tolerance?: Assess your risk tolerance and comfort level with market volatility. Crypto copy trading involves inherent risks, including the potential for losses, so it's crucial to determine how much risk you are willing to accept.

- Do I Understand the Master Trader's Strategy?: Take the time to research and understand the trading strategy employed by the master trader you are considering following. What is their approach to market analysis, risk management, and trade execution? Does their strategy align with your own trading style and preferences?

- What Is the Track Record of the Master Trader?: Evaluate the performance history and track record of the master trader over time. Review metrics such as their win rate, average return, maximum drawdown, and consistency of performance. This information is front and centre on Bybit.

- What Are the Costs and Fees?: Review the costs and fees associated with copy trading on the platform. Understand how these costs may impact your overall returns and factor them into your decision-making process.

- Am I Diversifying Sufficiently?: Assess whether following the master trader will contribute to diversifying your investment portfolio. Consider factors such as the number of master traders you are following, the diversity of their trading strategies, and the allocation of your investment capital across different asset classes and market sectors.

- Can I Afford to Lose?: Finally, consider whether you can afford to lose the capital allocated to copy trading. While copy trading offers the potential for profits, there is also the risk of losses, so it's essential to only invest funds you can afford to lose without jeopardizing your financial well-being.

Is Copy Trading Only for Beginners?

Copy trading is a versatile tool that caters to traders of varying experience levels. While beginners lacking experience or confidence may benefit the most, copy trading can also be utilized by traders of all skill levels.

- Diversification Strategy: Copy trading enables traders, regardless of their experience level, to diversify their investment portfolios. By following multiple master traders with different trading styles, strategies and market focuses, users can spread their risk across various assets and trading approaches.

- Learning Opportunity for Beginners: For novice traders, copy trading offers an invaluable learning opportunity. By following and replicating the trades of experienced investors, beginners can gain insight into effective trading strategies, risk management techniques and market dynamics.

- Efficiency and Convenience: Copy trading offers a convenient and time-efficient way for traders to participate in the crypto market. Instead of pouring hours upon hours into conducting research, analyzing market trends and executing trades, investors can simply choose to replicate the trades of master traders.

- Potential for Collaboration and Community: Copy trading platforms often foster a sense of community and collaboration among traders. Users can interact with each other, share insights and experiences, and discuss trading strategies and market developments.

- Continuous Improvement for Seasoned Traders: Even experienced traders can benefit from copy trading by gaining exposure to new ideas, perspectives and trading strategies. By observing the approaches of other successful investors, seasoned traders can identify areas for improvement in their own trading practices, refine their strategies, and adapt to changing market conditions.

Closing Thoughts

Bybit's copy trading feature allows crypto newbies to tap into the knowledge and strategies of experienced investors, providing insights into market dynamics and trading techniques. Novice traders, in particular, benefit from this approach, gaining practical experience and refining their skills through observation and replication.

Despite its numerous benefits, copy trading does pose certain challenges, including the risk of overreliance on master traders and limited control over trading decisions. Traders must carefully assess their investment goals, risk tolerance, and preferences before engaging in copy trading to ensure it aligns with their overall strategy.

While it's essential to remain mindful of the potential drawbacks, copy trading remains a valuable tool for traders seeking to achieve investment success in the cryptoverse.

![[LIVE] Engage2Earn: Veterans Affairs Labor repairs](https://cdn.bulbapp.io/frontend/images/1cbacfad-83d7-45aa-8b66-bde121dd44af/1)