The Empire Strikes Back: Inside America’s Real Motives Against Binance

Creator: QuoteInspector.com | Credit: QuoteInspector.com

Creator: QuoteInspector.com | Credit: QuoteInspector.com

The explosive rise of Binance from its 2017 launch to the world’s largest cryptocurrency exchange seemingly happened overnight. But so did its sudden downfall.

Binance’s recent legal troubles in the U.S. culminating in federal criminal charges and a guilty plea from its legendary founder Changpeng Zhao has become the biggest news in crypto.

A conventional narrative argues that lax compliance with banking laws allowed unlawful transactions through Binance, hence justified enforcement action to protect consumers and national interests.

But an alternative thesis proposed by some industry experts spotlights different machinations at play beneath the hood — that American governmental and commercial drivers deliberately orchestrated Binance and CZ’s downfall to reestablish control over the runaway crypto economy.

This theory warrants deeper scrutiny given cryptocurrency and blockchain technology’s disruptive potential first harnessed by America now appear increasingly decentralized overseas. Let’s analyze the contexts and incentives that make Binance a unique threat in the American psyche:

The Unprecedented Rise of an Outsider

Launched via an audacious 2017 ICO from China later relocated to crypto-friendly islands, Binance captured lightning in a bottle.

Leveraging blockchain’s inherent borderless nature, Binance swiftly became the world’s largest and most profitable crypto trading venue in just four years.

By generating $20 billion revenue in 2021, Binance beat even tech titans like Airbnb or Uber in profits. Binance accounts for over half of all crypto trading volumes globally.

Its vertical ascent was virtually unprecedented in corporate history. But America soon had reasons to worry.

Ways Binance Uniquely Threatens America

Unlike other breakout unicorns before it, Binance specifically threatened U.S. governmental and commercial interests by:

1. Dominating an emerging sector completely outside America — Unlike big tech disruptors like Google or Amazon which rode U.S. innovation to the top, Binance claimed leadership over Web3 from Asia. Its offshore ascent underscored crypto’s decentralization rendering US influence over the industry weaker. Regulatory arbitrage also turbocharged Binance through jurisdictional flexibility.

2. Beating Wall Street at their own game — America prides itself as the global financial epicenter with Wall Street as its crown jewel. Binance adopting the same playbook of generating transaction fees, but just on a new tradable asset class was galling, more so when crypto trading volumes started rivaling traditional stock exchanges.

3. Supplanting expectations of U.S. crypto leadership — As America dominates global tech, even spawning crypto itself, policymakers saw U.S. entities eventually steering the crypto economy. Binance shattered that assumption and the leverage that provided.

In many ways, Binance’s rise marked the first truly formidable Web3 project to develop fully outside American systemic advantages. Little wonder then it provoked a response. Photo by Jonathan Borba

Photo by Jonathan Borba

Cracking Down on the Outlier Threat

Part of said response is now crystallizing through the Department of Justice’s (DOJ’s) legal assault on Binance and CZ’s plea deal.

Yet contextual clues suggest greater machinations at play orchestrating America’s counterattack:

1. Suspiciously selective targeting — Though Binance is just one among hundreds of crypto firms, the specificity of its targeting seems disproportionate and deliberate, as if making an example.

2. Well-timed strike — The investigation pouncing on Binance happened just when crypto markets cratered, maximizing the business damage when exchanges were already struggling.

3. Opaque plea deal and settlement — For purported justice against the largest rogue crypto player, Binance’s instant settlement and CZ’s guilty plea avoid adversarial court transparency that could surface inconsistencies.

4. Potentially disproportionate penalties — Relative to inadequate transaction monitoring controls, the massive $4 billion penalty and restrictions imposed seem extreme attempts to significantly debilitate Binance.

5. Convenient rise of big finance players — Alongside Binance’s legal woes, major financial incumbents like BlackRock suddenly launched crypto offerings. Their convenient timing lets them fill any vacuum created.

Taken together, these coinciding events make a circumstantial yet compelling case for powerful institutional forces choreographing Binance’s fall from grace after concluding it gained too much sway.

America’s Crypto Catch-22: Control Without Breaking It

U.S. authorities now find themselves stuck between a rock and a hard place.

Crypto’s borderless access model that enhances freedom through decentralization seems inherently adversarial to any large government’s urge to consolidate control.

Squaring that circle demands enlightened statecraft. On one hand, decentralized systems remain practically uncontrollable by design and therefore must be shepherded through public faith rather than force.

On the other hand, runaway success stories like Binance point to gaps in existing regulations if projects globally subvert compliance related to securities law or banking standards.

But aggressively targeting specific players or symbols of the industry can be counterproductive by exacerbating public distrust rather than safeguarding adoption.

The Conceptual Flaw in Heavy-Handed Enforcement

America’s deftness for tactical maneuvers that subordinate hostile actors often outshines recognition of the barometer for long-term strategic victory: Who ultimately wins people’s hearts, minds and participation?

Cast against this, we must evaluate whether technical legal actions to make examples out of non-compliant innovators builds essential public trust.

Especially for an industry premised on disrupting traditional hierarchies through peer-to-peer decentralization.

All indications suggest this style of “shock and awe” only nourishes fears that the system eventually plans to co-opt crypto — a view the most strident decentralization die-hards already held.

It risks permanently alienating talent and communities drawn to uplift underdog stories.

And it may only accelerate activity moving to anonymized DeFi protocols completely outside legal purview.

Essentially, even if takedowns like Binance’s debilitate their targets as intended, will it truly further strategic outcomes America cares about like:

- General public embracing crypto more rather than less?

- Faith in governments positively steering crypto?

- Next-gen Web3 talent and capital circling American shores?

Photo by Karolina Grabowska:

Photo by Karolina Grabowska:

The Empire’s Enduring Crypto Conundrum

According to legend, silk was first smuggled from imperial China to nomadic tribes sparking beginnings of the storied Silk Road trading channel.

But silk’s magical properties soon meant demand outpaced supply. China issued death penalties around preserving production secrets while Roman emperors vainly restricted wearing silk to nobility only.

In both instances, silk’s irresistible attributes had unleashed a pan-human yearning no empire could bottleneck for long.

In similar veins, America birthed blockchain and crypto, perhaps modernity’s apex evolutions for borderless exchange. But their access model amplifying freedom by removing gatekeepers makes decentralization almost inherently adversarial to sovereignty’s consolidation instincts.

It recalls the iconic Apple 1984 commercial where the rebel woman warrior throws a sledgehammer at Big Brother’s screen projecting empire power to liberate minds from manipulation.

Substitute the sledgehammer with bitcoin sparking a financial insurgency powered by blockchain. One that likewise overcomes fears centralized authorities invariably exploit.

This presents the crypto conundrum America must reconcile within its statecraft — either through prohibitionist China-style bans or by adopting enlightened guidance recognizing decentralization’s virtues.

The Binance offensive’s efficacy remains uncertain on that count. Projecting power can be pyrrhic without earning public trust.

And if the void left by humbling its biggest player only breeds more impenetrable and anonymous protocols beyond all regulatory reach, was it worth wounding at all?

Squaring the ‘Land of Free Markets’ with ‘Don’t Bet Against the U.S.’

Great power rivals like China can ban crypto outright utilizing their authoritarian toolkit as a worst-case scenario.

But America’s innate affinity for free enterprise innovation means that honoring ideological principles matters equally alongside protecting national interests.

Walking that tightrope demands policies that don’t unnecessarily throttle initially non-compliant entrepreneurs operating on the frontiers.

Overreacting risks rupturing faith in the aspirational values America represents to the world beyond just force and coercion — values like free thinking, bold creativity and inclusive opportunity.

Those ultimately determine if United States stays the crypto industry leader as its forebears envisioned. Or loses pole position by ceding moral high ground to more crypto-progressive regimes.

The unfolding Binance saga and uncertain wider crypto regulations remain a litmus test for reconciling America’s global ‘first principles’ with the temptations to control global capital flows projected onto the digital asset arena.

One thing’s guaranteed though. Much like Imperial China discovered about silk spawning the Silk Road outbreak and Rome found from vain prohibitions, no empire can long contain a decentralized invention whose time has come.

Not without breaking faith between state and citizen. And public trust matters most of all to ensure America retains crypto leadership instead of forcing innovation overseas.

The crypto empire now strikes back at its progeny. But as legacy wars against disruptive outbreaks go, decentralized forces tend to win — by opting out rather than fighting within rigged games.

Disclaimer: The arguments made in this article represent the personal opinions of the author. They do not constitute financial or investing advice. The author does not provide any guarantees of accuracy in the statements expressed herein.

20

Blockchain

Bitcoin

Technology

Investing

Cryptocurrency

20

Follow

Follow

Written by Crypto Overload

42 Followers

·

Writer for

Coinmonks

Crypto and Blockchain Enthusiast

More from Crypto Overload and Coinmonks

Crypto Overload

Crypto Overload

in

Coinmonks

Qubic: The Quantum Leap for AI and Blockchain

In the ever-evolving landscape of blockchain technology and artificial intelligence (AI), a quiet revolution is brewing that combines these…

5 min read

·

Dec 13, 2023

6

1

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

607

2

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

31K

827

Crypto Overload

Crypto Overload

in

Coinmonks

Inside the Shady World of Crypto Market Manipulation

The crypto markets are rife with manipulation. Savvy whales deliberately distort prices to profit from unsuspecting retail traders. Strange…

6 min read

·

Oct 6, 2023

10

Recommended from Medium

Scott Galloway

Scott Galloway

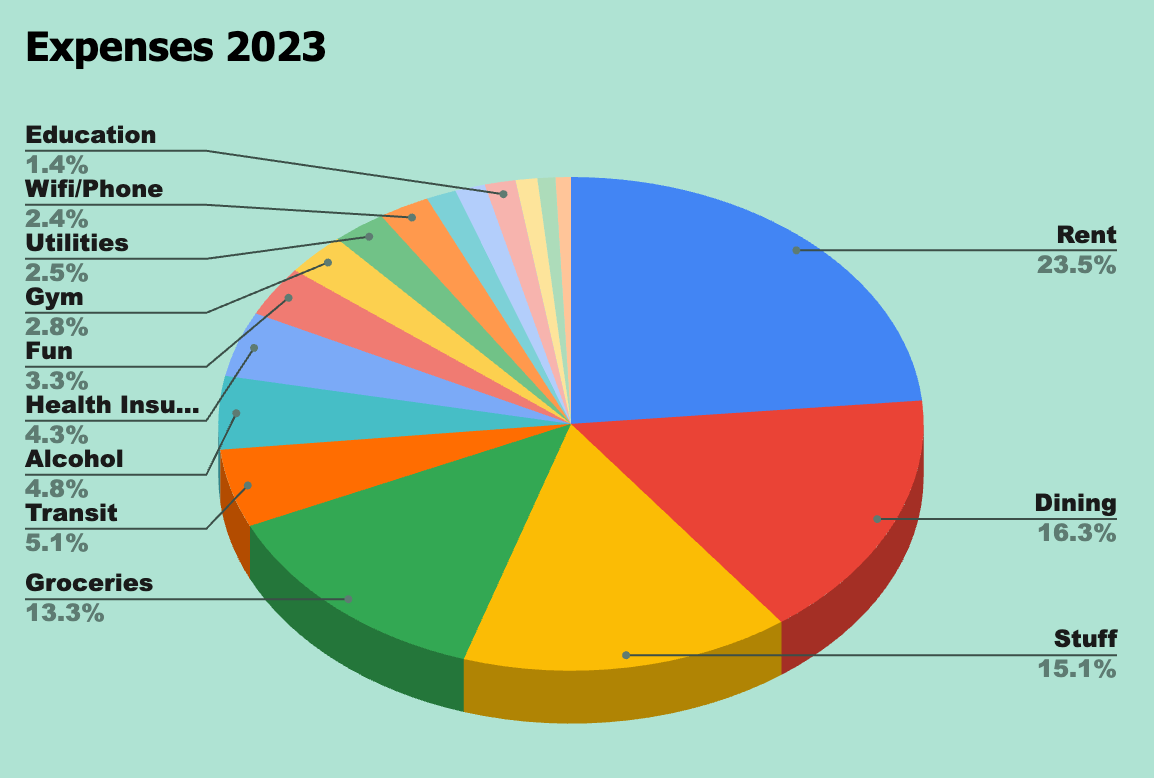

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

7.9K

107

Shawn Forno

Shawn Forno

in

The Startup

Here’s Exactly How Much it Costs to Live in Spain for One Year

An honest look at our average monthly expenses in Galicia, Spain

·

12 min read

·

Jan 6

2.4K

49

Lists

AI Regulation6 stories

AI Regulation6 stories

·

276

saves

ChatGPT prompts34 stories

ChatGPT prompts34 stories

·

971

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

617

saves

ChatGPT23 stories

ChatGPT23 stories

·

392

saves Aaron Dinin, PhD

Aaron Dinin, PhD

in

Entrepreneurship Handbook

I’ll Never Forget the Conversation That Destroyed My $10 Million Startup

A single conversation can inspire entrepreneurs to build amazing things or trick the into making huge mistakes.

·

5 min read

·

Jan 8

1.9K

27

B Kean

B Kean

Moscow’s Naked Party Reveals So Much More Than Body Parts

Three years ago, this party would have been an Instagram sensation, but it now confirms how far-gone Russia is

·

6 min read

·

Jan 8

2.7K

23

Adrien Book

Adrien Book

in

Predict

The Dumbest Project happening in the Tech World right now

The Pendant will make your life worse if you buy it

·

6 min read

·

Jan 4

1.8K

51 Ignacio de Gregorio

Ignacio de Gregorio

in

Towards AI

Apple Outclasses ChatGPT with Ferret

Listen up, Microsoft, You Might have a New Rival

·

7 min read

·

Jan 5

3.7K

48

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)