How to Identify Fake ICOs and Token Sales

In recent years, the popularity of Initial Coin Offerings (ICOs) and token sales has surged, attracting both legitimate projects and opportunistic scammers. ICOs provide a means for blockchain startups to raise capital by issuing digital tokens to investors.

However, with the rapid growth of this industry, the risk of encountering fake ICOs and fraudulent token sales has also increased. To safeguard your investments and avoid falling victim to scams, it's crucial to know how to identify and steer clear of fake ICOs. Here are some key strategies and tips:

1. Research the Team Behind the Project

One of the first steps in evaluating an ICO or token sale is to thoroughly research the team driving the project. Look into the background and experience of the project's founders, developers, and advisors.

Verify their identities and check if they have a reputable track record in the blockchain and cryptocurrency space. Genuine projects usually have transparent team information readily available on their website and social media profiles.

2. Scrutinize the Whitepaper

A comprehensive and well-written whitepaper is a hallmark of a legitimate ICO. The whitepaper should clearly outline the project's goals, technological aspects, use cases for the token, and a detailed roadmap for development.

Be wary of projects with vague or overly ambitious whitepapers that lack technical depth or specifics. Additionally, watch out for plagiarism-scammers often copy whitepapers from other projects to deceive investors.

3. Check the Project's Community and Social Media Presence

Engage with the project's community on social media platforms, forums, and channels like Twitter, Telegram, or Discord. Legitimate projects typically have an active and responsive community.

Look for red flags such as overly aggressive marketing tactics, fake followers, or orchestrated hype campaigns. Evaluate the quality and authenticity of discussions within the community.

4. Assess the Viability of the Project

Evaluate whether the project has a clear value proposition and a realistic plan for implementation.

Assess the market need for the project's solution and whether blockchain technology is genuinely required to solve the problem at hand. Be cautious of projects that promise unrealistic returns or lack a viable business model beyond the ICO stage.

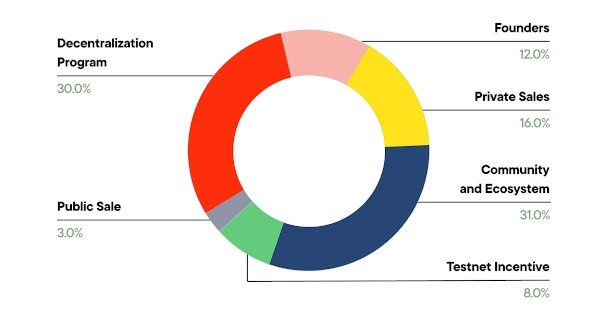

5. Review Tokenomics and Distribution

Examine the tokenomics of the project, including details about token distribution, allocation of funds raised, and lock-up periods for team tokens.

6. Look for Legal Compliance

Check if the ICO is compliant with relevant regulations and has legal counsel. Genuine projects usually disclose legal information and terms of the token sale to ensure compliance with securities laws and investor protection measures. Consult legal experts if needed, especially if the project's jurisdiction is unclear.

7. Conduct Due Diligence on Partnerships and Backers

Verify any claimed partnerships or endorsements by conducting independent research. Scammers often fabricate partnerships or exaggerate affiliations with reputable entities to gain credibility. Contact the supposed partners directly to confirm their involvement with the project.

8. Watch Out for Warning Signs

Be cautious of common warning signs of fraudulent ICOs, such as:

- Lack of transparency about the project's development or team.

- Unrealistic promises of high returns with minimal risk.

- Pressure to invest quickly due to limited availability of tokens.

- Inconsistencies or discrepancies in information provided by the project.

Conclusion

Navigating the landscape of ICOs and token sales requires vigilance and careful consideration. While legitimate ICOs can offer promising investment opportunities, fake ICOs pose significant risks to unsuspecting investors.

By following these guidelines and conducting thorough due diligence, you can minimize the likelihood of falling victim to fraudulent schemes and make informed investment decisions in the blockchain space.

Remember, if an ICO or token sale seems too good to be true, it probably is. Stay informed, ask questions, and seek advice from trusted sources before committing your funds to any project.

By prioritizing security and conducting thorough research, you can protect yourself from fake ICOs and contribute to the growth of a more trustworthy and transparent blockchain ecosystem.

Frequently asked questions (FAQs) about identifying fake ICOs and token sales

1. What is an ICO?

- An Initial Coin Offering (ICO) is a fundraising method used by blockchain startups to raise capital by issuing digital tokens to investors. These tokens typically represent a stake in the project or access to its products and services.

2. How can I identify a fake ICO or token sale?

- To identify a fake ICO, you should conduct thorough research on the project team, scrutinize the project's whitepaper and roadmap, assess the viability of the project's goals, evaluate the tokenomics and distribution, and check for legal compliance and transparency.

3. Why are fake ICOs a problem?

- Fake ICOs can be problematic because they deceive investors into putting their money into non-existent or fraudulent projects, leading to financial losses and undermining trust in the broader cryptocurrency and blockchain industry.

4. What are some red flags to watch out for in ICOs?

- Red flags in ICOs include anonymous or unverified team members, unrealistic promises of high returns with low risk, plagiarized or vague whitepapers, lack of community engagement, and suspicious marketing tactics such as aggressive promotions or false partnerships.

5. How can I research the team behind an ICO?

- Research the team by checking their LinkedIn profiles, reviewing their previous work experience in blockchain and related industries, verifying their identities through social media, and assessing their reputation within the crypto community.

6. Should I invest in an ICO solely based on potential returns?

- No, you should never invest in an ICO solely based on potential returns. It's essential to evaluate the project's fundamentals, team expertise, technological innovation, market need, and long-term viability before making any investment decisions.

7. What should I do if I suspect an ICO is fake?

- If you suspect an ICO is fake or fraudulent, avoid investing in it and report your concerns to relevant authorities or regulatory bodies. Warn others in the crypto community to prevent further potential victims.

8. How can I protect myself from ICO scams?

- Protect yourself from ICO scams by staying informed, conducting thorough due diligence before investing, seeking advice from trusted sources, avoiding investments that seem too good to be true, and following best practices for securing your cryptocurrency holdings.

9. Are all ICOs scams?

- No, not all ICOs are scams. Many legitimate blockchain projects have successfully raised funds through ICOs to develop innovative technologies and solutions. However, the risk of encountering scams highlights the importance of conducting proper research and due diligence.

10. Where can I find reliable information about ICOs?

- Reliable information about ICOs can be found on reputable cryptocurrency news websites, blockchain forums like Bitcointalk, official project websites and social media channels, and through discussions with experienced investors and advisors in the crypto community.

These FAQs provide a basic understanding of the risks associated with ICOs and how to navigate the landscape of token sales in the blockchain industry. Always prioritize caution, research, and due diligence to protect yourself from potential investment scams.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)