Bitcoin Tumbles on Hot CPI Data, But This Analyst Stays Ultra Bullish: Here’s Why

The better-than-expected United States Consumer Price Index (CPI) released on April 10 is already sending shock waves through the financial market. Bitcoin and most crypto assets are trading lower, extending losses recorded on April 9, weighing negatively against optimists.

United States CPI Data Came In Hot

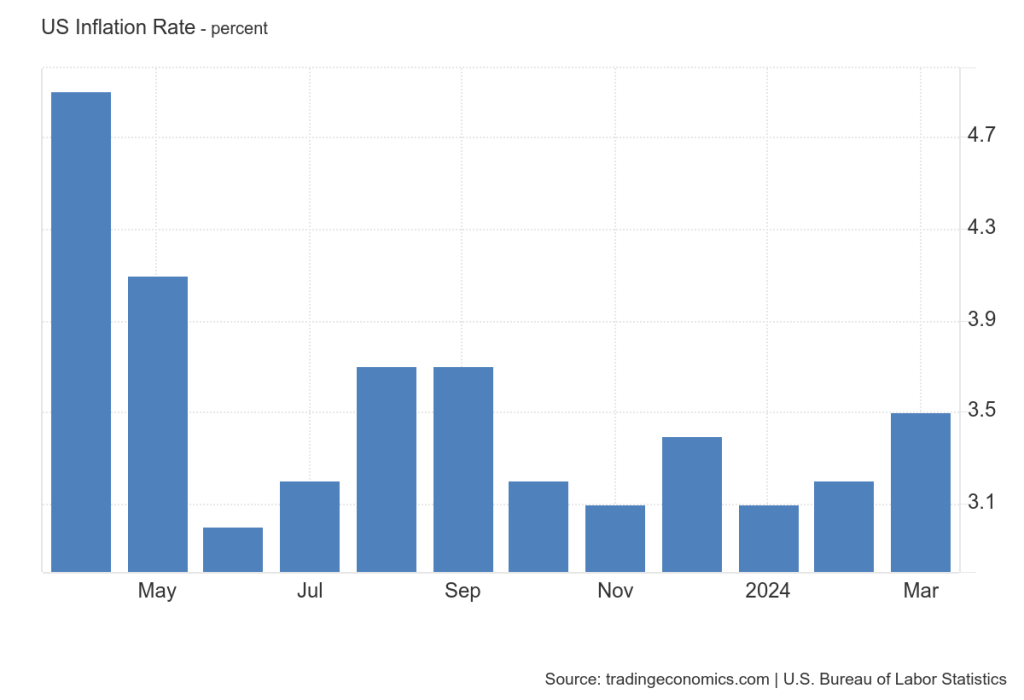

According to Trading Economics data on April 10, CPI, a key economic metric for gauging inflation, rose 0.4% in March, pushing the annual inflation rate to 3.5%. Notably, this surpassed economist predictions and, most importantly, dashed hopes for the United States Federal Reserve (Fed) to slash rates aggressively this year. United States CPI data | Source: Trading Economics

United States CPI data | Source: Trading Economics

However, amidst the market jitters, Matt Hougan, the CIO of Bitwise Asset Management, offered a contrarian perspective as fear permeated the Bitcoin and crypto market. In a post on X, Hougan downplayed the influence of the CPI data on Bitcoin’s long-term trajectory.

Related Reading: XRP Heading To $100-$500? Analyst Provides Speculated Timeframes

The executive argues that investors and traders should track other market factors like spot Bitcoin exchange-traded fund (ETF) inflows and rising government deficits. In Hougan’s assessment, these can strongly influence price, even lifting Bitcoin higher since they are currently aligned.

Time To Buy The Bitcoin Dip?

As such, even with the fall in BTC, the drop could offer potential buying opportunities for long-term holders. Some supporters believe the “hot” CPI data only exposes the vulnerabilities of fiat currencies. This would potentially drive investors to use Bitcoin as a hedge.

Moreover, this upbeat sentiment is backed by solid demand for gold, a store of value asset preferred by traditional finance investors. Analysts anticipate Bitcoin will follow a similar path as investors seek to protect value amid rising inflation.

570% up to 12 BTC + 300 Free Spins for new players & 1 BTC in bonuses every day, only at Wild.io. Play Now!Further bolstering the bullish sentiment is the possibility of a spot Bitcoin ETF launch in Hong Kong before the end of April.

The Hong Kong Securities and Futures Commission (SFC) has been assessing various applications. Leading Chinese asset managers have submitted some. If the product is approved, it could further channel more capital to BTC, boosting inflows from the United States.Bitcoin price trending sideways on the daily chart | Source: BTCUSDT on Binance, TradingView

When writing, BTC is steady but under pressure. April 9’s losses have been confirmed. The coin might track lower if bulls fail to push prices above all-time highs of around $74,000.

BitStarz Player Lands $2,459,124 Record Win! Could you be next big winner?

Related Reading: Analyst Says Bitcoin Halving Influence Is No Longer Driving Price, Here’s What Is

Bitcoin remains in a broader bullish formation, technically moving inside a rising wedge. This bullish outlook will only be invalidated if prices tank below $61,500 in the sessions ahead.

Feature image from DALLE, chart from TradingView

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)