Entrepreneurship! Starting Your Own Business to Create Wealth

Entrepreneurship is a powerful engine for wealth creation and personal fulfillment. It involves identifying a market need, creating a business plan, and executing it with determination and resilience.

Starting your own business can be one of the most rewarding ventures, providing the opportunity to innovate, grow financially, and contribute to the economy.

This article explores the key steps and considerations involved in starting your own business, offering insights and strategies to help you succeed in creating wealth.

Identifying Opportunities and Developing a Business Idea

Market Research and Analysis

The foundation of any successful business is a solid understanding of the market. Conduct thorough market research to identify gaps, needs, and opportunities within your chosen industry.

Analyze trends, customer behaviors, and competitor activities to gain insights that will inform your business idea.

Tools like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) can help you assess the viability of your concept.

Innovative Thinking

Innovation is at the heart of entrepreneurship. Whether you're improving an existing product, introducing a new service, or creating a completely unique offering, innovative thinking is essential.

Consider how you can solve a problem more effectively or offer something that competitors do not. Innovation doesn't always mean creating something entirely new; it can also mean enhancing what already exists.

Validating Your Idea

Before fully committing to your business idea, it's crucial to validate it. This involves testing your concept with potential customers to gather feedback and make necessary adjustments.

Create a minimum viable product (MVP) or prototype to demonstrate your idea and assess its feasibility. Crowdfunding platforms, focus groups, and surveys are effective ways to validate your idea and gauge market interest.

Creating a Business Plan

Executive Summary

An executive summary provides a snapshot of your business, outlining your vision, mission, and key objectives. It should succinctly convey the essence of your business and capture the interest of potential investors and stakeholders.

This section typically includes a brief description of your product or service, target market, and financial projections.

Detailed Business Description

Expand on your executive summary by providing a comprehensive description of your business. Detail your product or service, including its features, benefits, and unique selling points. Explain your business model, revenue streams, and pricing strategy. This section should clearly articulate how your business will operate and generate profit.

Market and Competitive Analysis

A thorough market analysis demonstrates your understanding of the industry landscape. Identify your target market, segment your customers, and outline their needs and preferences.

Conduct a competitive analysis to highlight your competitors' strengths and weaknesses. Define your competitive advantage and explain how you will differentiate your business from others in the market.

Marketing and Sales Strategy

Your marketing and sales strategy should outline how you plan to attract and retain customers. Detail your branding, positioning, and messaging. Describe the channels and tactics you will use to reach your target audience, such as social media, content marketing, or partnerships.

Include sales strategies, such as direct sales, e-commerce, or a sales team, and explain how you will convert leads into customers.

Financial Projections

Financial projections are critical for understanding the financial viability of your business. Include detailed forecasts of your income, expenses, and cash flow for the next three to five years.

Create a break-even analysis to determine when your business will start generating profit. These projections should be realistic and based on sound assumptions, demonstrating to investors that you have a clear path to profitability.

Securing Funding and Resources

Self-Funding and Bootstrapping

Many entrepreneurs start their businesses with personal savings or by bootstrapping, which involves using minimal external funding. This approach allows you to maintain control over your business and avoid debt.

However, it requires careful financial management and may limit the speed at which you can grow.

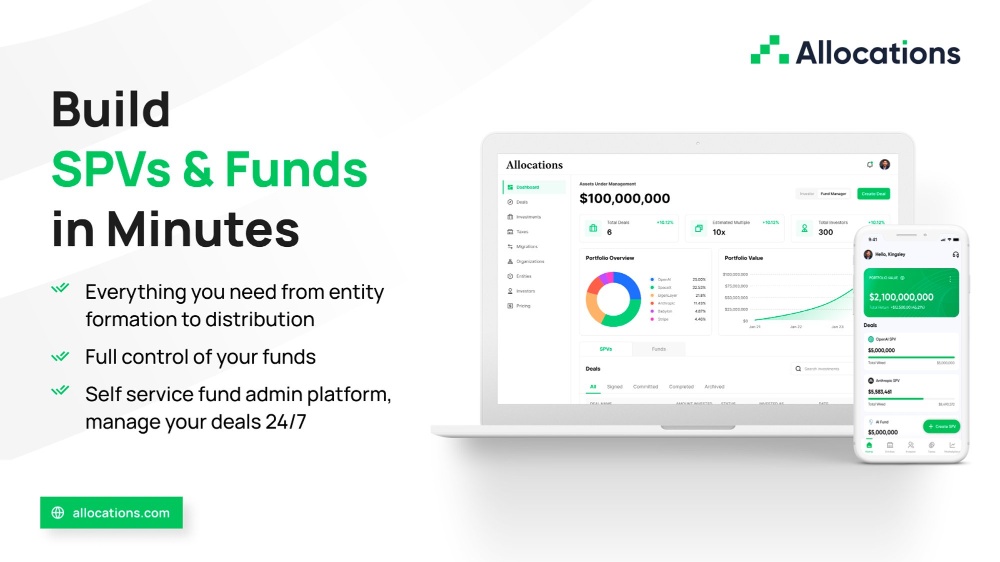

Angel Investors and Venture Capital

Angel investors and venture capitalists can provide significant funding in exchange for equity in your business. These investors bring not only capital but also valuable expertise and connections.

To attract such investors, you need a compelling pitch, a solid business plan, and evidence of market traction. Be prepared to give up a portion of ownership and share decision-making authority.

Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo allow you to raise funds from a large number of people, typically in exchange for early access to your product or other rewards.

This approach can validate your business idea and build a community of supporters. Successful crowdfunding campaigns require a strong marketing strategy and a compelling pitch to attract backers.

Small Business Loans and Grants

Traditional financing options, such as small business loans and grants, can provide the capital needed to start and grow your business. Research government programs, non-profit organizations, and financial institutions that offer loans and grants for small businesses.

Ensure you meet the eligibility criteria and prepare a detailed application to increase your chances of approval.

Launching and Growing Your Business

Building a Strong Team

A successful business relies on a capable and motivated team. Hire individuals who share your vision and bring complementary skills to the table. Foster a positive work culture that encourages collaboration, innovation, and continuous learning. Invest in training and development to ensure your team can adapt to changing business needs.

Effective Operations Management

Efficient operations are essential for delivering your product or service consistently and cost-effectively. Implement systems and processes to streamline workflows, manage inventory, and track performance.

Use technology to automate routine tasks and improve efficiency. Regularly review and optimize your operations to identify areas for improvement.

Customer Relationship Management

Building strong relationships with your customers is crucial for long-term success. Use customer relationship management (CRM) tools to track interactions, manage inquiries, and provide personalized service.

Solicit feedback to understand customer needs and preferences, and use this information to enhance your offerings. Loyal customers are more likely to provide repeat business and refer others to your company.

Scaling Your Business

Once your business is established, focus on scaling to increase revenue and market share. Explore new markets, expand your product or service line, and seek strategic partnerships. Invest in marketing and sales to drive growth.

Ensure your operations can support increased demand, and consider additional funding if needed to fuel expansion.

Adapting to Change

The business landscape is constantly evolving, and adaptability is key to long-term success. Stay informed about industry trends, technological advancements, and market shifts. Be willing to pivot your business model, strategies, or offerings in response to changes. Continuous innovation and agility will help you stay competitive and sustain growth.

Conclusion

Starting your own business to create wealth requires careful planning, resilience, and a willingness to learn and adapt. By identifying opportunities, developing a solid business plan, securing funding, and effectively managing and scaling your operations, you can turn your entrepreneurial vision into a reality. Embrace the challenges and rewards of entrepreneurship, and you will find not only financial success but also personal fulfillment and the satisfaction of contributing to the economy and society.

References

- The Essential Components of a Business Plan

- Use innovation to grow your business

- Crowdfunding Platforms: Kickstarter

- AngelList: Finding Angel Investors

- HubSpot: Customer Relationship Management