Real World Assets

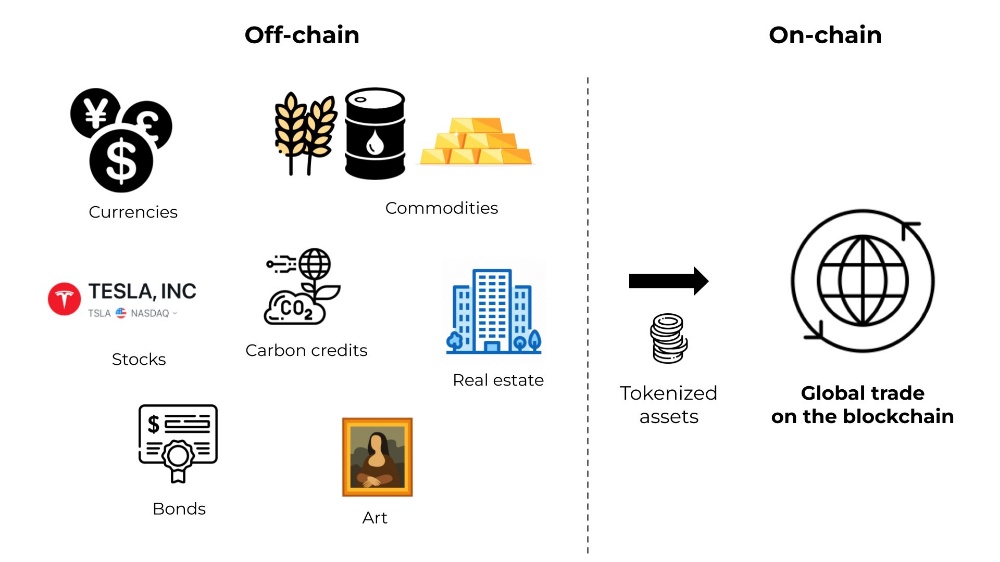

Real-international assets, or RWAs, refer extensively to any property—whether physical, digital, or statistics-based—that derive their cost from their life outdoor of the blockchain. By tokenizing RWAs, you’re essentially growing a virtual twin that exists on a blockchain. Stablecoins are the OG of real-international belongings. Pegged to a fiat currency just like the US dollar or euro, stablecoins offer a solid and liquid alternative to fiat foreign money. Beyond traditional forex, it’s possible to tokenize different financial assets, consisting of insurance, shares, securities, treasuries, equities, and indices. Tangible belongings that can be added on-chain are fairly limitless. Precious metals, uncooked substances, agricultural products, real property, artwork, and track licensing can all benefit from tokenization.

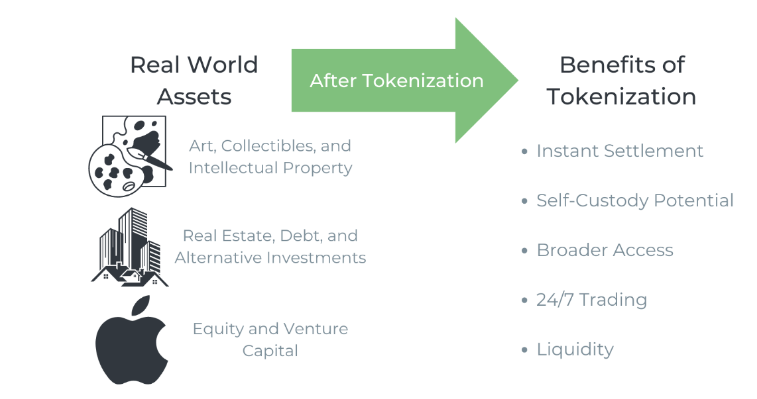

Benefits of actual-world assets

- Efficiency: Tokenizing real-global belongings lets in fractions of high-price assets to be traded effectively 24/7 on virtual exchanges, bypassing brokers and facilitating speedy, worldwide transactions at scale. This streamlines processes like pass-border deals and automated redistribution of earnings/earnings.

- Trust: A key advantage of tokenization is that it allows atomic agreement of actual-global assets (traded against tokenized fiat) with out requiring a trusted 1/3 party to act as a clearing agent, as traditional clearinghouses and CSDs do today. Blockchain protocols facilitate who goes first in an change thru intrinsic consensus mechanisms, increasing accept as true with and performance in transactions.

- Transparency: A public, immutable report at the blockchain offers full visibility into asset ownership and transaction interest. This establishes clear name and provenance even as preventing fraud thru open tracking of transfers, liens and other information.

- Compliance: Smart contracts can automate regulatory necessities and KYC/AML assessments for compliance. Digital tokens can also make it simpler to adhere to tax reporting responsibilities through incorporated equipment and public ledgers.

- Cost: Cutting out middlemen reduces traditional transaction prices and documentation charges. Ongoing token management through blockchain consensus can deliver down renovation prices compared to physical property and legacy document preserving.

- Liquidity: Fractionalizing RWAs property allows extra liquidity. The tokens that represent RWAs can be with no trouble traded at any time. This steady tradeability paperwork a new secondary marketplace for real-international investments that turned into now not previously viable.

How To Tokenize Real-World Assets

The excessive-stage technique of tokenizing a actual-international-asset involves several steps.

- Asset selection: Determining the real-world asset to be tokenized. Token specifications: Determining the kind of token (fungible or non-fungible), the token fashionable for use (like ERC20 or ERC721), and other fundamental components of the token.

- Blockchain choice: Choosing the general public or private blockchain community on which to difficulty the tokens.

- Integrating Chainlink Cross-Chain Interoperability Protocol (CCIP) allows make the tokenized RWA to be had on any blockchain.

- Offchain connection: Most tokenized assets require super offchain statistics from stable and dependable Chainlink oracles. Using a verification carrier, such as the industry-preferred Chainlink Proof of Reserve (PoR), to verify the belongings backing the RWA tokens is vital for keeping transparency for customers.

- Issuance: Deploying the smart contracts on the chosen community, minting the tokens, and making them available for usage.

Types of actual-world belongings

Stablecoins

Stablecoins are designed to preserve rate stability relative to specific belongings, like currencies or commodities. In real-world instances, stablecoins are used for pass-border bills and feature as banking infrastructure for the ones with out access and are more and more growing in popularity international. Examples of stablecoins on Algorand are: Circle’s USDC and Tether’s USDT.

Real estate

Tokenizing residences allows human beings to invest in real estate globally through fractional ownership of belongings like housing devices or business homes. Smart contracts are capable of manage tenant payments and belongings charges, and distribute proceeds to token holders. Lofty tokenizes residential real estate, which includes houses and condos, and SliceSpace, business homes, such as offices and co-work spaces.

Commodities and precious metals

Tokenizing commodities allows new modes of making an investment in raw materials or precious metals. Meld permits gold and other treasured metals to be tokenized on blockchain, so customers can very own physical gold in virtual form. Projects like Agrotoken permit farmers to tokenize their grains, reworking them into virtual assets that they can exchange, exchange for elements and services, and use as collateral for loans. Any product can be tokenized and traced through the supply chain the use of a platform like Origino.

Art and collectibles

Blockchain helps the creation, possession, and switch of non-fungible tokens representing one-of-a-type artistic endeavors, collectibles, and antiques that still exist within the bodily international. This grants digital provenance and preserves shortage. Artory is a assignment that brings art and collectibles on-chain. Tokenizing artwork additionally lets in divisions of possession; excessive-cost artwork can be broken down into fractions, making the cost of investment much decrease and more reachable.

Books and tune

Cultural works like books, song, and films represent a massive market for tokenization as virtual documents on blockchain. Projects like Book.Io are pioneering the issuance of e-book and audiobook RWAs that represent genuine ownership of the content material. Music platforms, which include Opulous, are minting digital music RWAs that allow actual possession of track for creators and fanatics. The tokenization of cultural property offers enormous capacity to revolutionize commercial enterprise models for creators and reshape media consumption globally.

Intellectual assets

Artists, writers, and inventors can difficulty digital tokens representing stocks in future sales generated from their works. Smart contracts can allocate tokens and habitual shares of licensing charges or sales to early supporters. For example, on ANote Music, investors can bid on shares of the royalties of music catalogs. Dequency permits musicians to promote the rights to apply their work quickly and successfully, with all transaction facts recorded on-chain.

Vehicles

By tokenizing cars, boats, and planes, blockchain can handle seamless transitions of custody for vehicles and track their provenance as they change palms. Tokenization also can facilitate fractional ownership of luxury automobiles, yachts, and personal jets, with their expenses, utilization schedules, and earnings being cut up proportionately consistent with smart contracts.

Salaries and invoices

Blockchain programs are being evolved to tokenize payroll and invoicing. This lets in self-hired individuals and small groups to apply destiny profits streams as collateral for loans or sell quantities on secondary markets. For instance, personnel could access earned but unpaid wages, or freelancers could cut price invoices in alternate for fast coins. Such structures introduce welcome flexibility and liberate capital that may otherwise be inaccessible for months.

Consumer goods

Tokenizing excessive-cost client products like electronics and luxury gadgets permits fractional possession and a resale marketplace. This should take numerous forms: consumers may also earn tokens for device utilization over the years, change partial ownership fractions, or auction pre-owned goods. Brands benefit from additional approaches to foster consumer loyalty applications and preserve asset price cycles inside their ecosystems.

![[LIVE] Engage2Earn: Veterans Affairs Labor repairs](https://cdn.bulbapp.io/frontend/images/1cbacfad-83d7-45aa-8b66-bde121dd44af/1)