ASSETS VALUATION

METHODS OF ASSETS VALUATION:

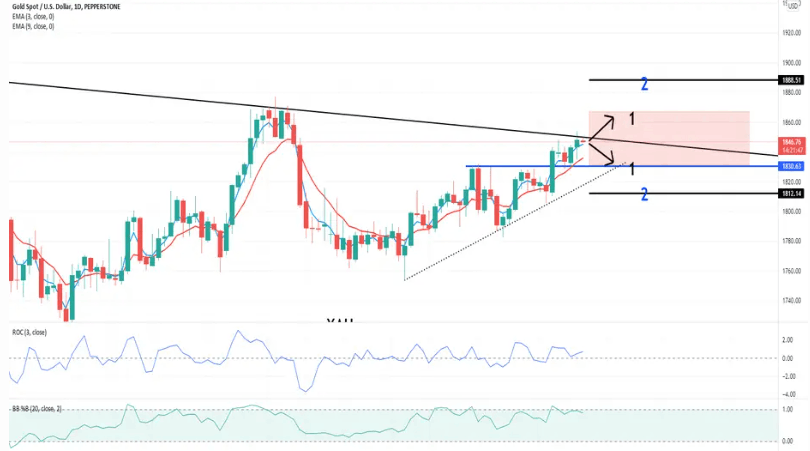

- MARKET APPROACH

This method involves determining the value of an asset based on the prices of similar assets that have recently sold in the market. This method is often used in the valuation of real estate and other tangible assets. For example, if a property is similar in size, location, and quality to other properties in the area that have recently sold for a certain price, then the market value of that property can be estimated based on those sales.

2. INCOME APPROACH

Another common method of asset valuation is the income approach, which involves determining the value of an asset based on its expected future earnings potential. This method is often used in the valuation of businesses and other intangible assets, such as patents or trademarks. The income approach involves estimating the future cash flows that the asset is expected to generate and then discounting those cash flows back to their present value using a discount rate that reflects the risk and opportunity cost of investing in the asset.

3. COST APPROACH

The cost approach is another method of asset valuation that involves determining the value of an asset based on the cost of replacing or reproducing it. This method is often used in the valuation of physical assets, such as buildings or machinery. The cost approach involves estimating the cost of replacing or reproducing the asset, taking into account factors such as depreciation, obsolescence, and other factors that may affect its value.

FACTORS AFFECING VALUE OF AN ASSET:

There are several factors that can affect the value of an asset, including supply and demand, market conditions, economic factors, and regulatory issues. For example, if there is a high demand for a particular asset, such as real estate in a desirable location, then its value is likely to be higher than similar assets in less desirable locations. Similarly, if there are regulatory changes or economic factors that affect the asset's earnings potential, such as changes in interest rates or tax laws, then its value may be affected as well.

IMPORTANCE OF ASSET VALUATION

1. It helps investors and companies make informed decisions about buying, selling, or holding assets.

2. The valuation of assets can be used to determine the fair value of an asset for accounting purposes,

3. To evaluate the performance of investment portfolios, or to assess the value of a business or other entity.

4. Risk Management: Different assets carry different levels of risk, which can affect their value and the discount rate used in the income approach.

IMPACT OF ASSETS VALUATION ON BUSINESS

Asset valuation has a significant impact on businesses. Below are some of the ways in which asset valuation can affect businesses:

- Investment decisions: Asset valuation plays a critical role in investment decisions made by businesses. By evaluating the potential returns and risks associated with different assets, businesses can make informed decisions about which assets to invest in and how much to invest. The valuation of assets can also help businesses determine whether an investment is worth pursuing or not.

- Financial reporting: Asset valuation is an important component of financial reporting, as it informs the value of assets reported on a company's balance sheet. Accurate asset valuation is critical for investors and other stakeholders in assessing a company's financial health and performance.

- Mergers and acquisitions: Asset valuation is also important in mergers and acquisitions, as it helps businesses determine the value of assets and liabilities that are being acquired. Accurate asset valuation can help businesses negotiate better terms for the acquisition and avoid overpaying for assets.

- Risk management: Asset valuation can also help businesses manage risks associated with their assets. By accurately valuing assets and assessing the risks associated with them, businesses can take steps to mitigate risks and ensure that they are adequately compensated for the risks they are taking.

- Capital allocation: Asset valuation can also inform decisions related to capital allocation, such as how much capital to allocate to different assets or investment opportunities. By accurately valuing assets, businesses can make informed decisions about how to allocate capital to maximize returns and minimize risks.

- Competitive advantage: Accurate asset valuation can also provide businesses with a competitive advantage by allowing them to make more informed decisions about investment opportunities and asset management. This can help businesses optimize their performance and improve their competitive position in the marketplace.

Overall, asset valuation has a significant impact on businesses, as it informs decisions related to investment, financial reporting, mergers and acquisitions, risk management, capital allocation, and competitive advantage. Accurate asset valuation is critical for businesses to make informed decisions that maximize returns and minimize risks.

Finally, asset valuation is a complex and multifaceted aspect of finance that involves determining the value of an asset based on a variety of factors, including market conditions, future earnings potential, and regulatory issues. The valuation of assets is an important aspect of financial management