MACD (Moving Average Convergence Divergence) [ENG]

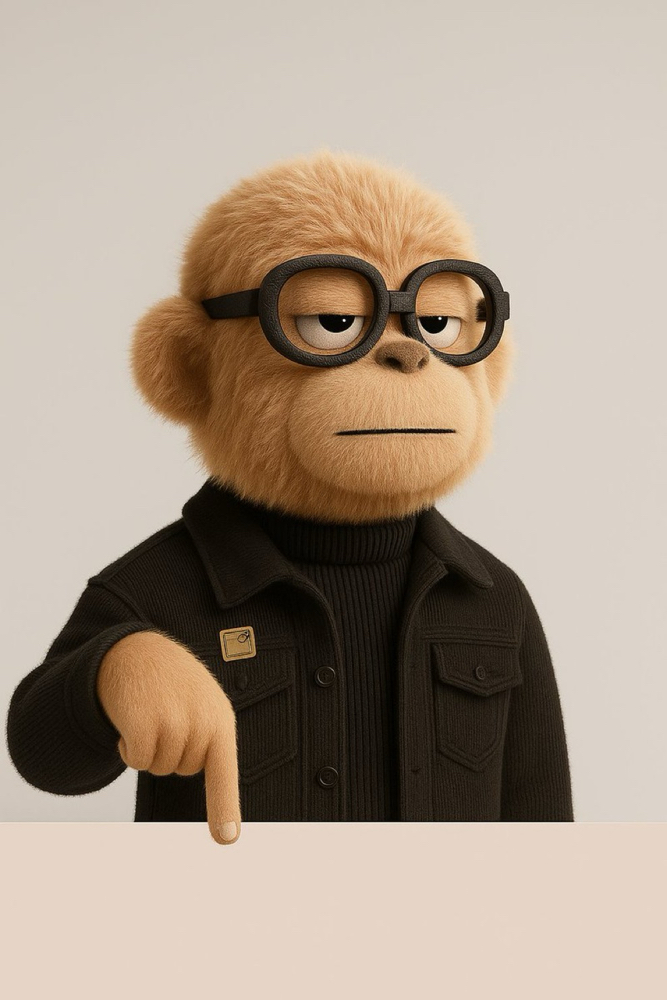

MACD (Moving Average Convergence Divergence) is a technical analysis tool used to measure the short-term momentum of price movements. MACD represents the difference between two moving averages. It typically consists of the difference between a 12-day Exponential Moving Average (EMA) and a 26-day EMA.

The basic formula for MACD is as follows:

MACD = 12-day EMA - 26-day EMA

This formula calculates the difference between short-term (12-day) and long-term (26-day) moving averages. This difference provides information about the direction and momentum of price movements.

However, the standard form of the MACD indicator includes two components: the Signal Line and the Histogram:

- Signal Line: It is typically derived by applying a 9-day EMA to the MACD. This makes the MACD line a smoother and less noisy indicator.

- Histogram: It represents the difference between the MACD line and the Signal line. The histogram shows the speed of momentum. When the histogram takes positive values, it is considered that prices are in an increasing trend; when it takes negative values, it is considered that prices are in a decreasing trend.

One of the primary uses of MACD is to consider the crossing of the MACD line with the Signal line from above or below as a trading signal. For example, when the MACD line crosses below the Signal line, it can be interpreted as a sell signal. Conversely, when the MACD line crosses above the Signal line, it can be interpreted as a buy signal.

However, instead of using MACD alone, it is recommended to use it in conjunction with other indicators and analysis tools to obtain more accurate signals. Additionally, using other technical analysis tools alongside MACD can help confirm signals and reduce false alarms.