ARB (arbitrum)

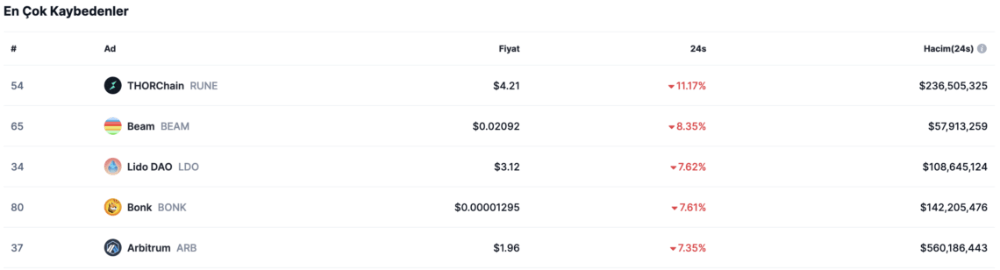

Arbitrum (ARB), which has come to the fore with the ETF developments in Ethereum (ETH), has caused concern with the stagnation in the last week. Arbitrum (ARB), which has come to the fore with the ETF developments in Ethereum (ETH), has caused concern with its decline in the last week. After the approval of the Spot BTC ETF, all eyes turned to Ethereum. With this development, Lido DAO and Layer-2s, especially Ethereum, exploded. In particular, ARB's breathless rise has attracted great attention both in the Turkish crypto ecosystem and globally. However, the reversal in BTC brought selling pressure on the popular coin, leading to a 20 percent decline in the last week. In addition, ARB, which fell 7.35 percent in the last 24 hours, ranked fifth on the "Top Losers" list.

n just one week, is traded at $ 1.9658 as of the writing of the news. The course of BTC and the developments in ETH will be of critical importance in order for the ARB craze to return. In a scenario where things go positive, the levels of 2.0149 – 2.1171 – 2.2732 and 2.4264 dollars, respectively, can be targeted for ARB. Factors such as decreased interest in Tier-2s, a negative attitude towards ETH ETFs or the downward movement of BTC will continue to push the ARB price to lower levels. In such a scenario, the prices that can be considered as demand points are 1.8389 - 1.65 - 1.45 and 1.20 dollars, respectively. The $1.65 and $1.45 levels will be decisive for the short/medium term price structure.Arbitrum (ARB), one of the most popular altcoins of recent times, demonstrated its power by increasing 50 percent in just two days. Arbitrum, which has an incredible investor base not only in Turkey but also globally, continues to shake the market. The popular coin, which has experienced an almost uninterrupted rise since one dollar, renewed its ATH again. ARB, which was pumped up with the arrival of Spot BTC ETF approvals, ranked third in the "Top Risers" list with its sharp increase in the last 24 hours.He is seen as one of the star candidates of 2024! Arbitrum, one of the leading names in Layer-2, has increased its expectations for 2024. The popular coin, which is very positive not only in terms of technical but also social metrics, is increasing the number of investors every day. ARB is one of the most popular altcoins at the moment, quickly recovering from intermediate corrections and continuing its upward course. The dynamism that came to the market with the development of ETFs at night gave ARB a new ATH. Layer-2 coin, which reached $ 2.42, is currently selling at $ 2.2350. Various indicators such as Fibonacci can be used to monitor the next resistance levels. The regions that can be considered for the purchase level are 2.11 - 2.01 - 1.83 - 1.65 and 1.45 dollars, respectively. Daily closes above $2.11 will continue to keep the bull scenario strong.XAI, located in the Arbitrum ecosystem and supported by Offchain Labs, has risen 60 percent since yesterday evening. Cryptocurrencies have been trending upwards since yesterday evening. In particular, the approval of spot Bitcoin ETFs was an important factor in the rise of cryptocurrencies. The SEC's approval of ETFs, which has been awaited for months, has increased the appetite of crypto investors. Investors showed more interest in Ethereum (ETH) and Arbitrum (ARB) than BTC. With ARB exceeding $2.20, the Arbitrum ecosystem also revived. Xai Games (XAI), the newest member of the Arbitrum ecosystem and attracting attention, has risen 60 percent since last night.Xai Games (XAI) meets expectations After its launch and completion of airdrop distribution, Xai Games (XAI) started to rise, taking advantage of the positive crypto market. XAI, which is on the Arbitrum network and backed by Arbitrum developer Offchain Labs, rose from $0.4517 to $0.7332. Facing selling pressure at $0.7332, XAI retreated to $0.68.XAI has declined since its launch, mainly due to selling pressure created by airdrop distribution. XAI, which retreated to $ 0.4517 the other day, encountered investors' buying appetite. Purchases from this region pushed the XAI price up. XAI soon tested and managed to break through the resistance point at $0.5483. Staying above $0.5483, XAI set its sights on the resistance at $0.6215. The impact of the spot Bitcoin ETF approval helped XAI break the $0.6215 resistance. XAI tested the $0.7118 resistance during the day and retreated from this area. The peak of XAI was $ 0.7332. This daily movement in the popular cryptocurrency brought Celestia (TIA) to mind. Many investors expect XAI to experience further rises. If XAI breaks the $0.7118 resistance and stays above it, it can set its sights on the $0.76 resistance. Breaking this resistance will push XAI to $0.80 in a short time. XAI may have to take strength from the $0.80 resistance on its journey to its ultimate goal of $1. On the other hand, XAI may retreat to $0.6215 if it experiences a pullback. If it loses the $0.6215 support, XAI could decline to the $0.5483 support. XAI is known as the native token of the Xai Games project, which is the apple of the eye of the Arbitrum ecosystem. Xai Games attracted attention with its layer-3 gaming blockchain. XAI has managed to build a strong community, especially by airdropping it before launch.XAI has declined since its launch, mainly due to selling pressure created by airdrop distribution. XAI, which retreated to $ 0.4517 the other day, encountered investors' buying appetite. Purchases from this region pushed the XAI price up. XAI soon tested and managed to break through the resistance point at $0.5483. Staying above $0.5483, XAI set its sights on the resistance at $0.6215. The impact of the spot Bitcoin ETF approval helped XAI break the $0.6215 resistance. XAI tested the $0.7118 resistance during the day and retreated from this area. The peak of XAI was $0.7332. This daily movement in the popular cryptocurrency brought Celestia (TIA) to mind. Many investors expect XAI to experience further rises. If XAI breaks the $0.7118 resistance and stays above it, it can set its sights on the $0.76 resistance. Breaking this resistance will push XAI to $0.80 in a short time. XAI may have to take strength from the $0.80 resistance on its journey to its ultimate goal of $1. On the other hand, XAI may retreat to $0.6215 if it experiences a pullback. If it loses the $0.6215 support, XAI could decline to the $0.5483 support. XAI is known as the native token of the Xai Games project, which is the apple of the eye of the Arbitrum ecosystem. Xai Games attracted attention with its layer-3 gaming blockchain. XAI has managed to build a strong community, especially by airdropping it before launch.Binance announced Xai Games (XAI), supported by Offchain Labs and located on the Arbitrum network, as the 43rd Launchpool. Binance's Launchpool announcement attracted great attention in a short time. Announcing the 43rd Launchpool project, Binance chose Xai Games, which is in the Arbitrum network and supported by Offchain Labs, the team behind Arbitrum. Binance's new Launchpool, Xai Games (XAI), will be opened for trading on the stock exchange on January 9. Users will be able to join Launchpool on January 5. Binance users who want to earn XAI will stake BNB, TUSD and FDUSD. Cryptocurrency on the Arbitrum network is listed on Binance! Xai Games (XAI), created on the Arbitrum network as the first layer-3 project, became Binance's 43rd Launchpool. Binance will launch the XAI-yielding staking system on January 5 and list XAI on January 9. You may be interested in: Tension is increasing in Solana (SOL): Breakout is near! XAI attracted all the attention when it was included in the Arbitrum network as the first layer-3 project and entered Binance. Xai Games, a gaming blockchain, aims to revitalize the Arbitrum ecosystem. Apart from the fact that XAI will be listed on Binance, there is another important detail. Offchain Labs, the team behind Arbitrum, partnered in the development of Xai Games. Created on the Arbitrum network and backed by the support of Arbitrum developers, Xai Games managed to attract the attention of crypto investors with its Binance agenda.Bitcoin's (BTC) bull season-like rise led to the liquidation of a total of $2.6 billion in short positions in crypto stocks. The bull market created by the Bitcoin spot ETF news flow upset investors who predicted that the share prices of companies in the cryptocurrency sector would fall. According to a new report from data company S3 Partners, during the three-month period when Bitcoin experienced aggressive growth, $2.6 billion in short positions in the shares of crypto companies were liquidated. Bitcoin (BTC) is in flight, companies are following! Bitcoin (BTC) has risen from $25,152 to $44,500 since September 11. The rise of BTC brought about remarkable bull runs in altcoins. AVAX, LINK, TIA, ORDI and many altcoins had their own bull run. You may be interested: A whale sold the ETH and BTCs he collected from the bottom: Big profit! The BTC rise also brought a spring mood to crypto companies. Coinbase shares have surged 51 percent in the past month alone, reaching over $140. On the other hand, the shares of MicroStrategy, which holds $6.6 billion worth of BTC, have witnessed an 82 percent increase since October.Huge increases in the share prices of crypto companies have left stock short investors in a difficult situation. Investors who opened short positions in the shares of crypto companies such as Coinbase and MicroStrategy lost $2.656 billion in three months. While Coinbase stock accounted for 50 percent of the losses, MicroStrategy accounted for 25 percent. According to data source S3, on Tuesday alone, $387 million in shorts in crypto companies' stocks were liquidated.Arbitrum (ARB), which has been around 1 dollar for a long time, approached the potential breakout with a 7 percent increase in the last two days. The crypto market continues its bullish progress. BTC's rise to the 39 thousand dollar band put altcoins on the attack again. BTC followed an up-and-down chart last week. For this reason, retreats were seen in altcoins. Especially major coins followed a calm price chart with BTC factor. ARB, one of these majors, has been around $1 for a long time. ARB, which draws attention with its calmness in the 1 dollar region, rose by 7 percent in two days and is on the verge of a significant breakout. ARB could rise to $1.20 if market conditions remain positive. Could Arbitrum (ARB) rise? Popular tier-2 project Arbitrum (ARB) is preparing to debut after remaining calm in the $1 region for a long time. ARB is up 7 percent in the last two days. You may be interested: A whale sold the ETH and BTCs he collected from the bottom: Big profit! ARB failed to accompany the positive crypto market in November. The popular cryptocurrency started its decline at $1.22 on November 8 and completed it at $0.95 on November 22. ARB, which regained $ 1 towards the end of November, exhibited calm price movement in the $ 1 region. ARB, which could not take off despite all expectations, started December strong. ARB experienced a 7 percent increase throughout December. The popular cryptocurrency rose from $1 to $1.0790. The Layer-2 project experienced a 12 percent volume increase in the last 24 hours. ARB volume reached $219 million in the last 24 hours.The popular cryptocurrency is on the rise with a 7 percent rise. ARB could continue its rise if it can sustain above $1.05. The $1.0871 region stands out as a critical resistance point in front of ARB. If this point is exceeded, the $ 1,146 to $ 1,166 region, which is also seen as a sales zone, may come to the fore. If this box can survive the selling pressure, it could trigger a potential breakout and the ARB price could rise again to $1.20.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)