Understanding Spot ETFs and Their Potential Impact on Bitcoin

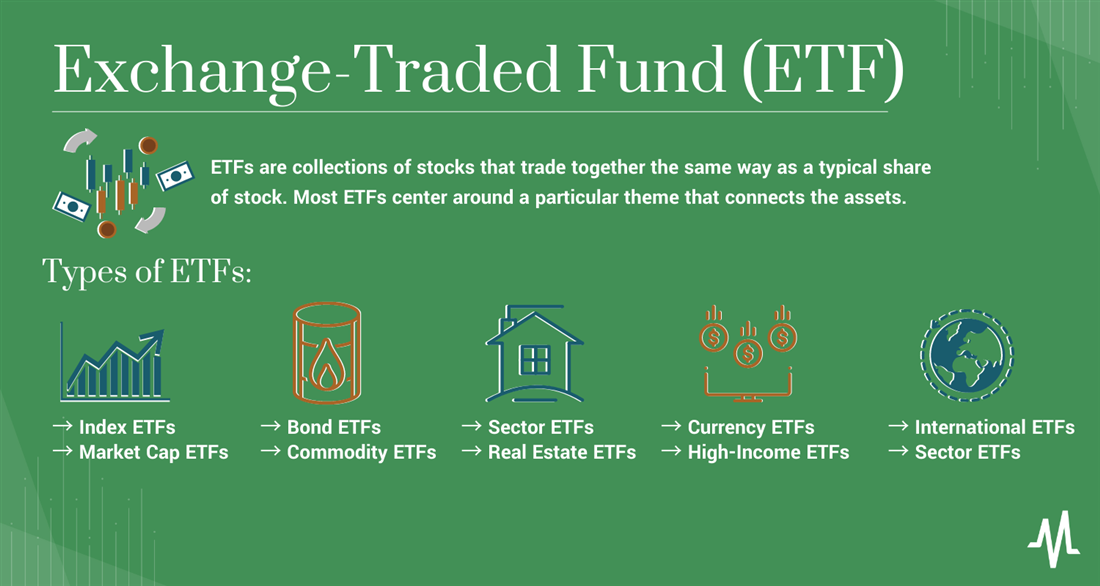

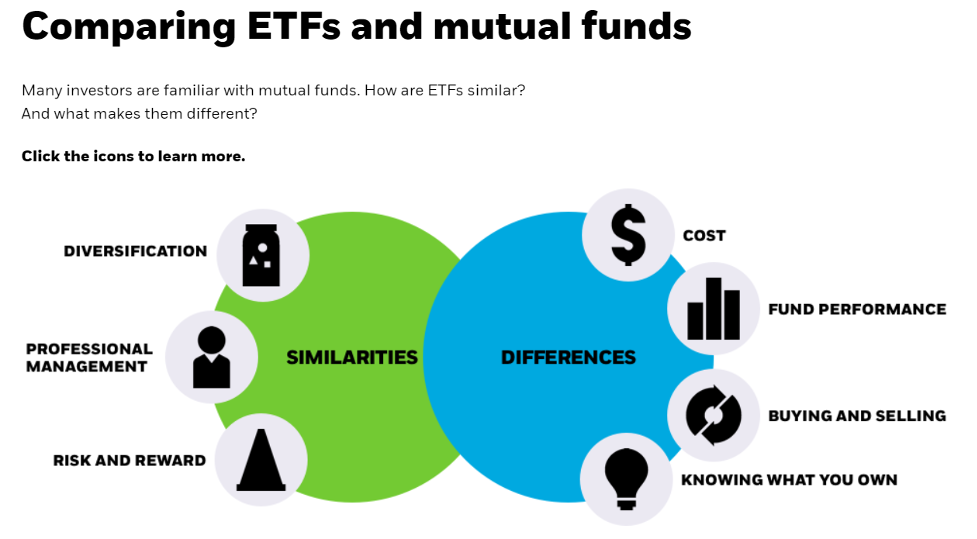

Exchange-Traded Funds (ETFs) have become a popular investment vehicle, providing investors with exposure to various assets. One notable development in the cryptocurrency space is the discussion around Spot ETFs, especially concerning Bitcoin. In this blog post, we will delve into what Spot ETFs are and explore their potential implications for the world's leading cryptocurrency.

Spot ETFs: A Brief Overview

Spot ETFs, or Exchange-Traded Funds, represent a form of investment fund that holds the underlying asset directly, rather than using derivative instruments. In the context of Bitcoin, a Spot ETF would own and store the actual cryptocurrency itself, as opposed to futures or other financial instruments linked to its price.

Importance of Spot ETFs:

- Market Access and Liquidity:

Spot ETFs offer a convenient way for traditional investors to gain exposure to Bitcoin without needing to directly hold or manage the cryptocurrency. This accessibility can potentially increase liquidity in the market.

- Regulatory Approval and Mainstream Adoption:

The approval of Spot ETFs by regulatory authorities signals a level of acceptance and maturity for Bitcoin in the financial markets. This could lead to increased participation from institutional investors and further mainstream adoption.

- Price Discovery and Stability:

With Spot ETFs directly tied to the underlying asset, they may contribute to more accurate price discovery and potentially reduce volatility in the Bitcoin market, making it a more attractive investment for risk-averse investors.

Potential Impact on Bitcoin:

- Positive Price Momentum:

The approval of Spot ETFs could trigger positive sentiment and attract new capital into the Bitcoin market. This influx of institutional funds may lead to an upward price trend.

- Increased Liquidity:

Spot ETFs typically involve large trading volumes, contributing to increased liquidity in the Bitcoin market. Higher liquidity often results in more stable prices and reduced bid-ask spreads.

- Broader Acceptance:

Institutional investors, pension funds, and other traditional financial entities often have regulatory constraints that limit direct investments in cryptocurrencies. Spot ETFs provide a regulated vehicle for these entities to gain exposure to Bitcoin, potentially broadening its acceptance.

Conclusion:

The approval of Spot ETFs for Bitcoin represents a significant milestone in the integration of cryptocurrency into traditional financial markets. While the potential benefits are substantial, it's important to note that regulatory decisions, market dynamics, and broader economic factors can influence the actual impact on Bitcoin's price and market dynamics. As the conversation around Spot ETFs continues, investors and enthusiasts alike will closely monitor developments and their implications for the broader cryptocurrency ecosystem.