Bitcoin Dips Below $26K in Crypto Market Whirlwind; $1 Billion Liquidated Amid Top Coins' Tumble

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

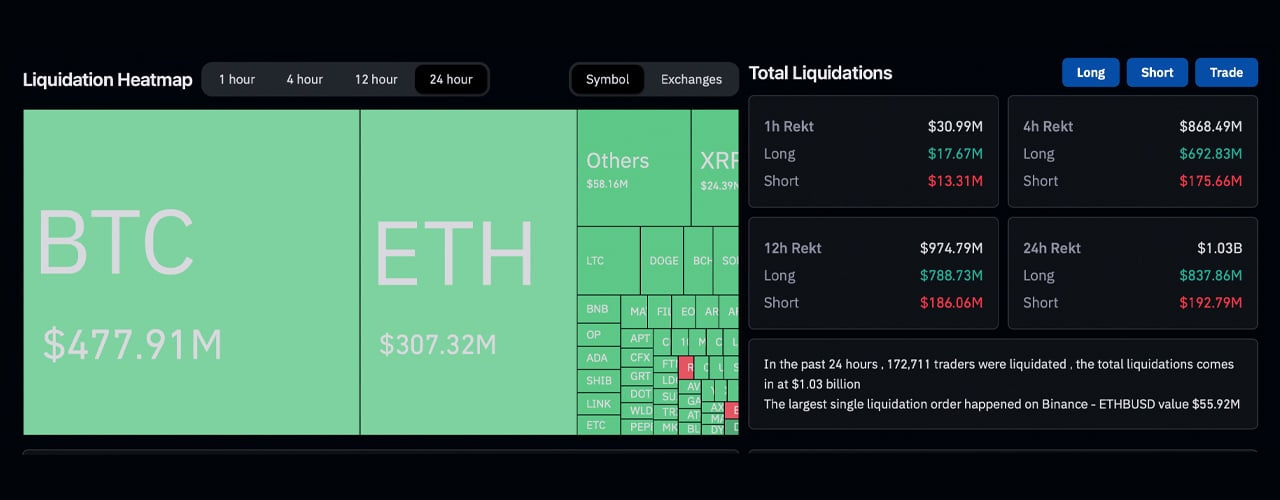

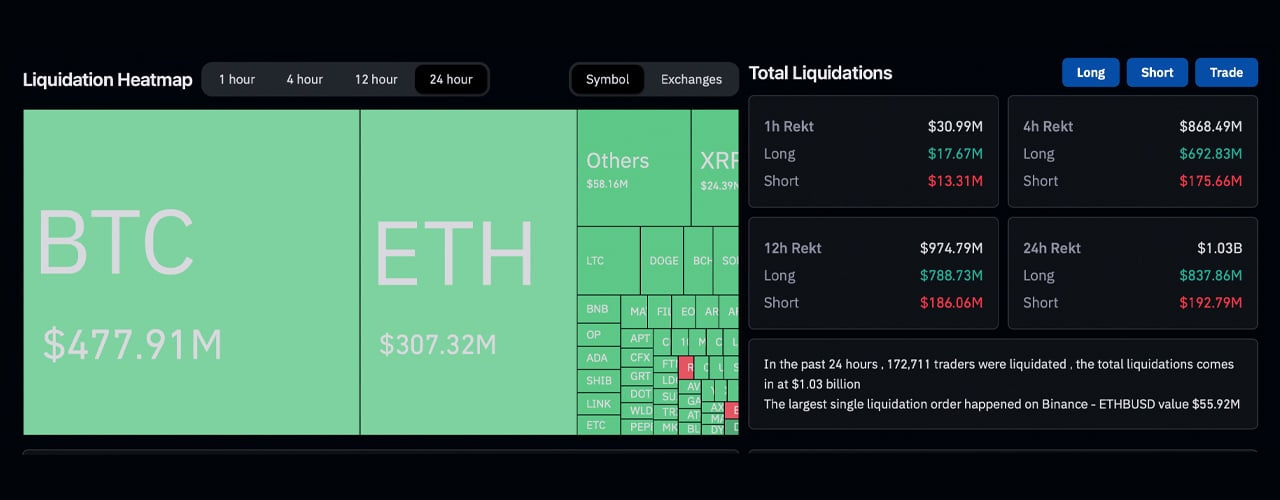

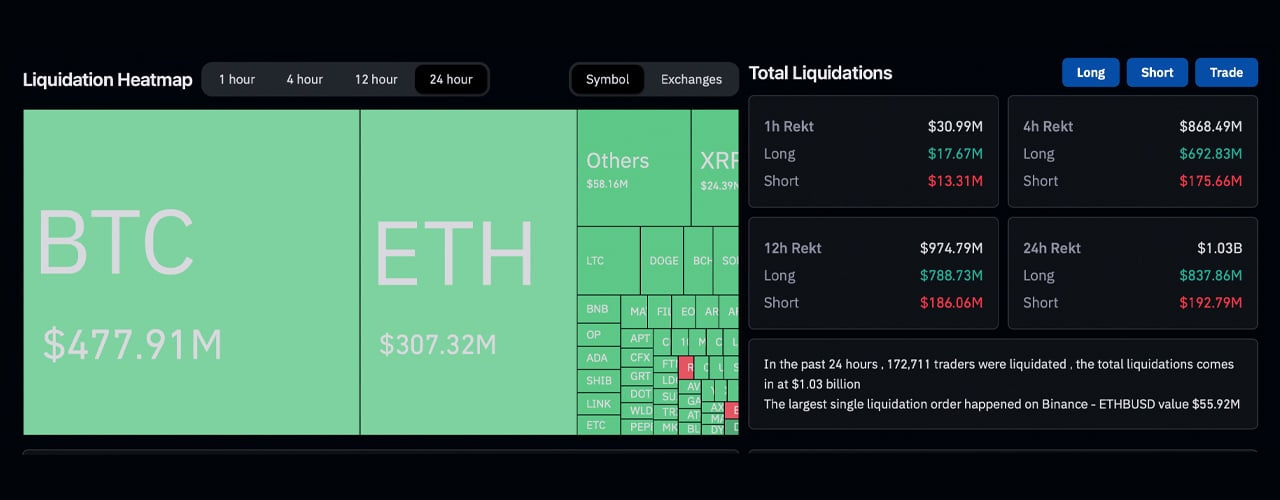

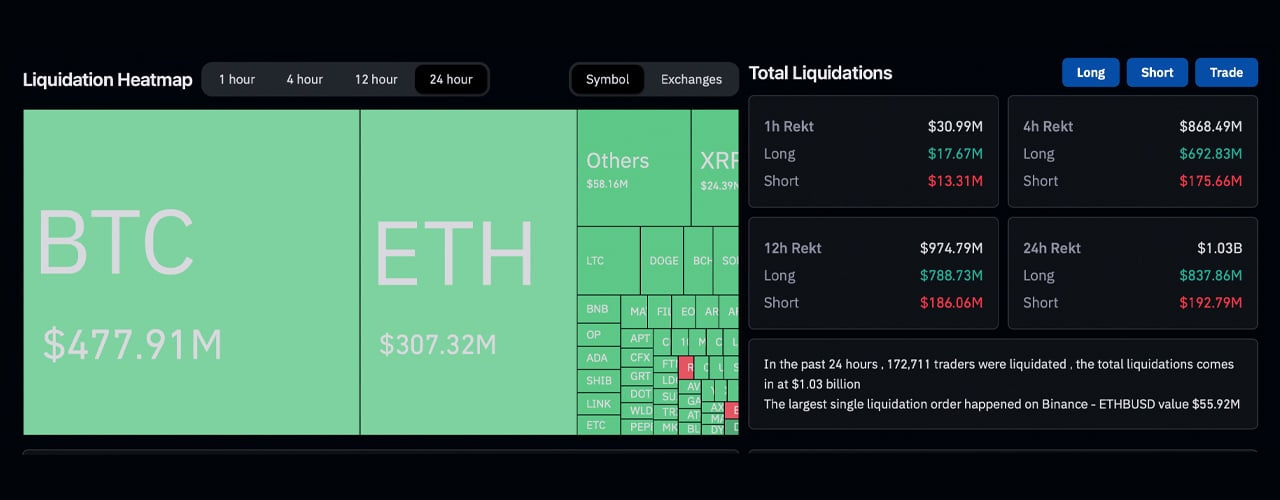

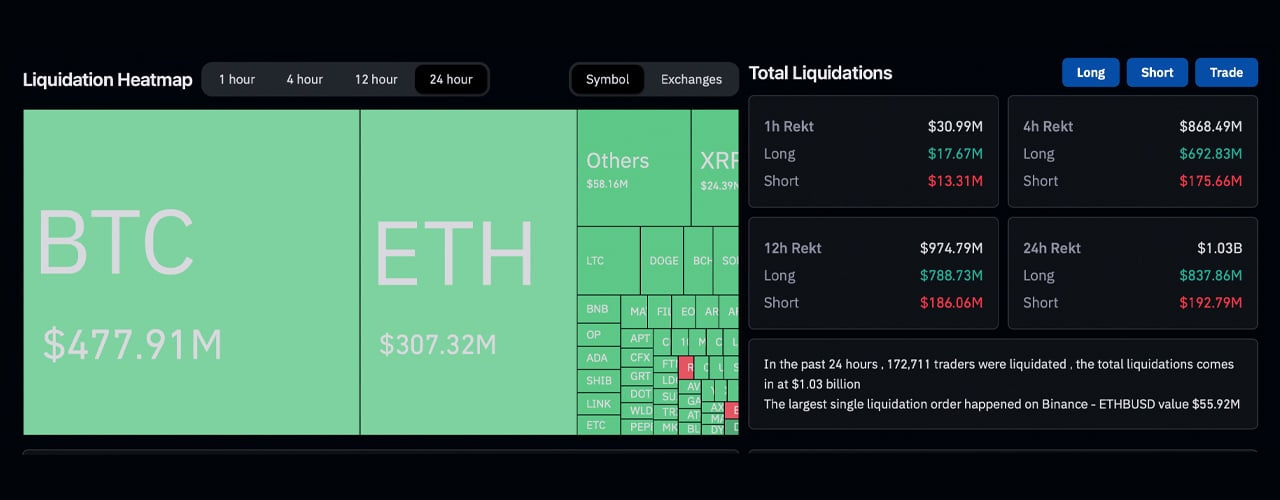

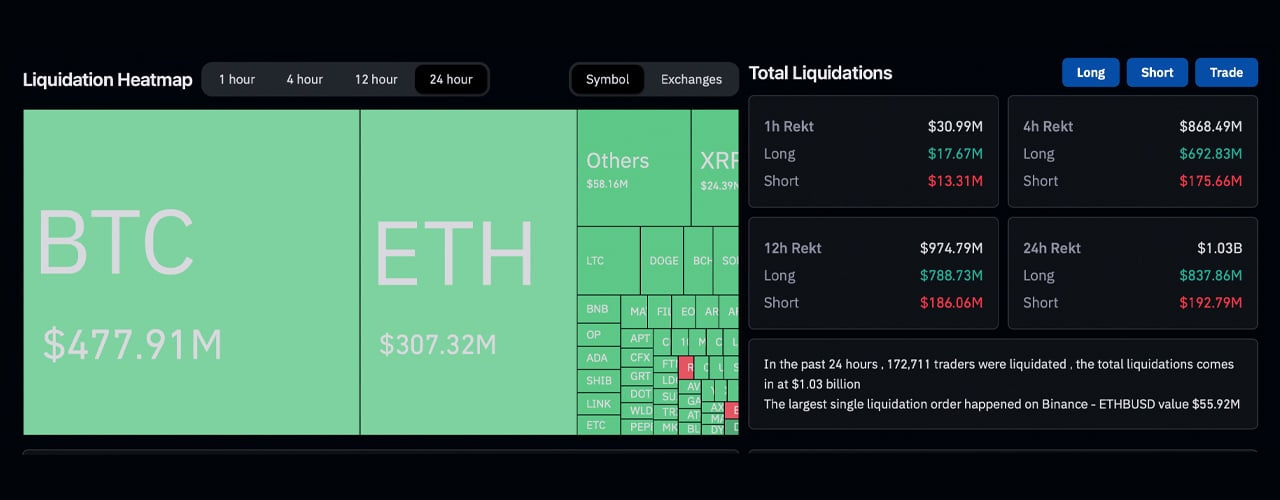

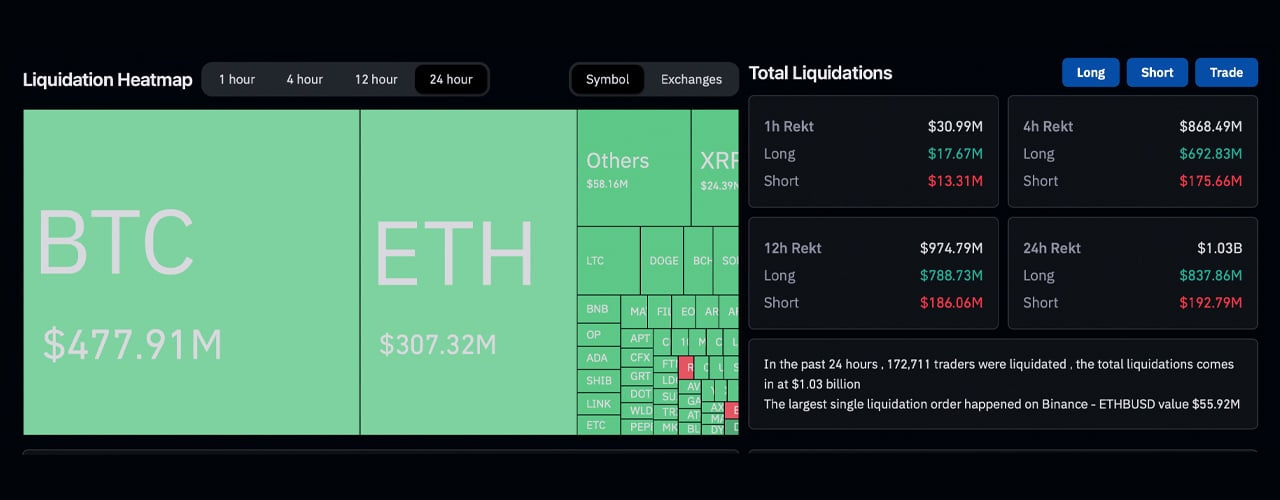

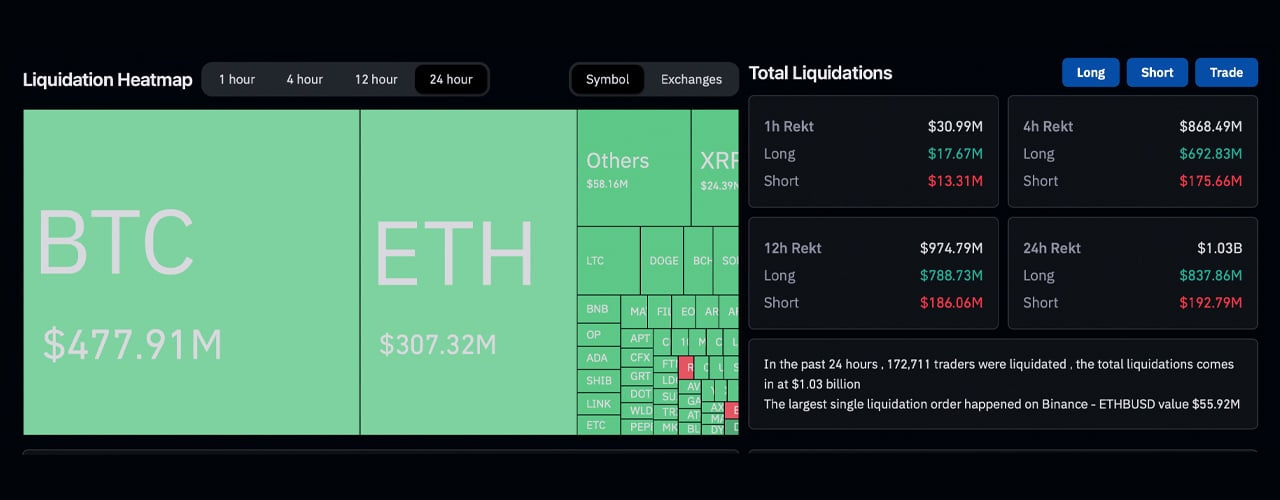

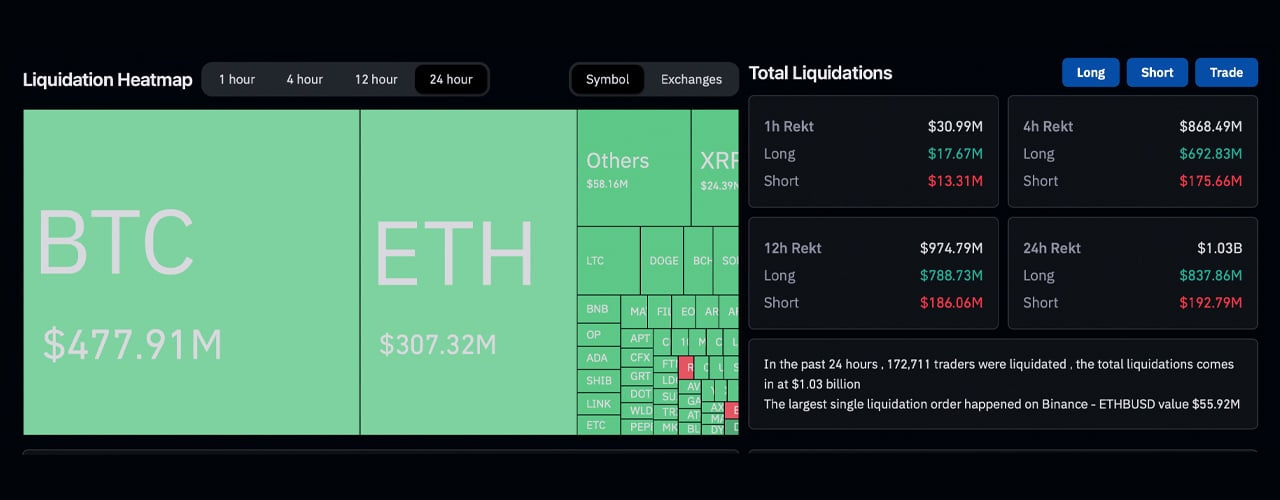

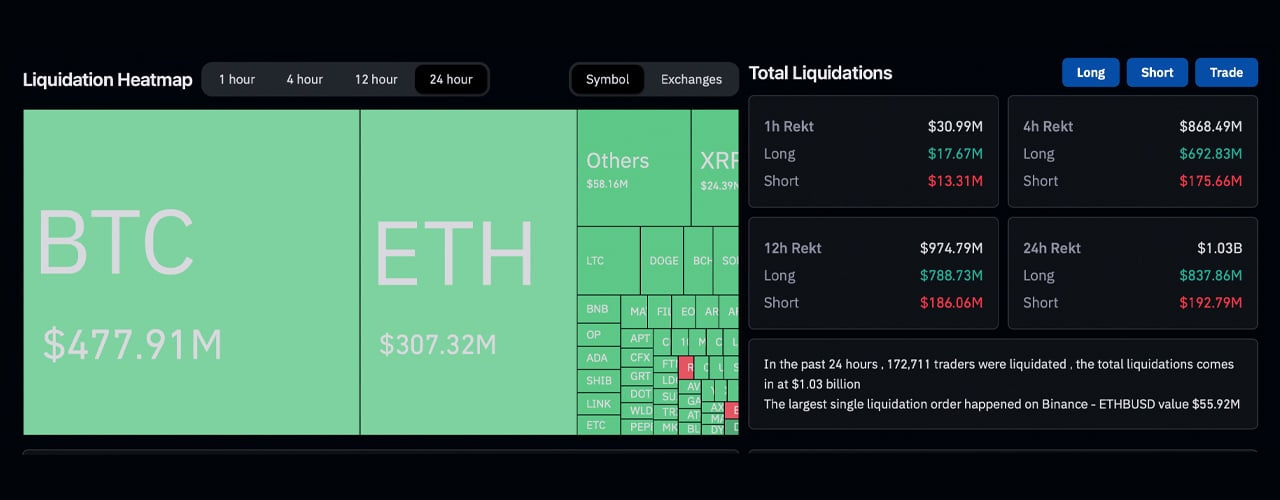

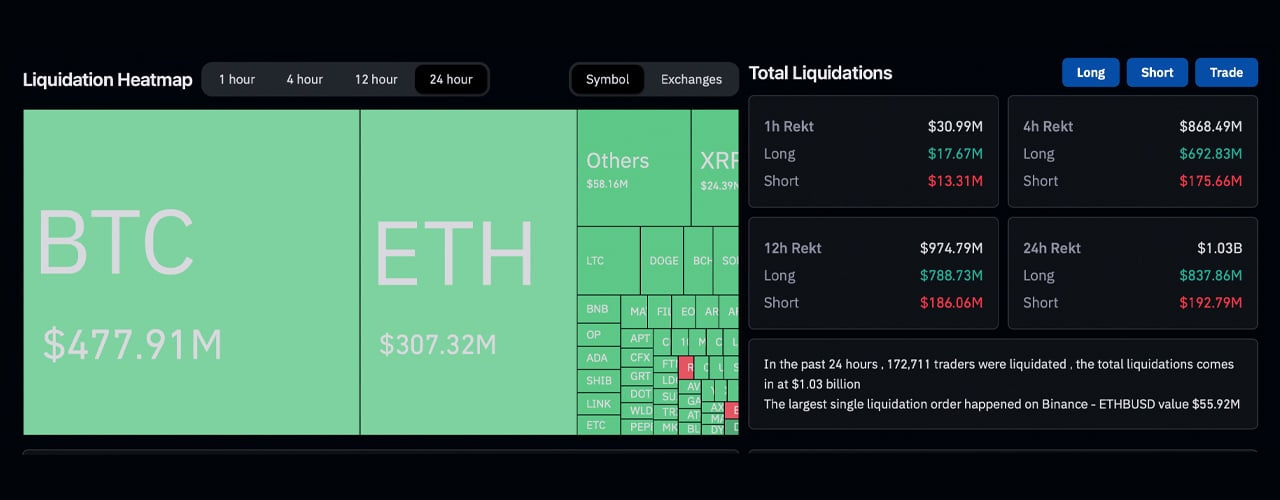

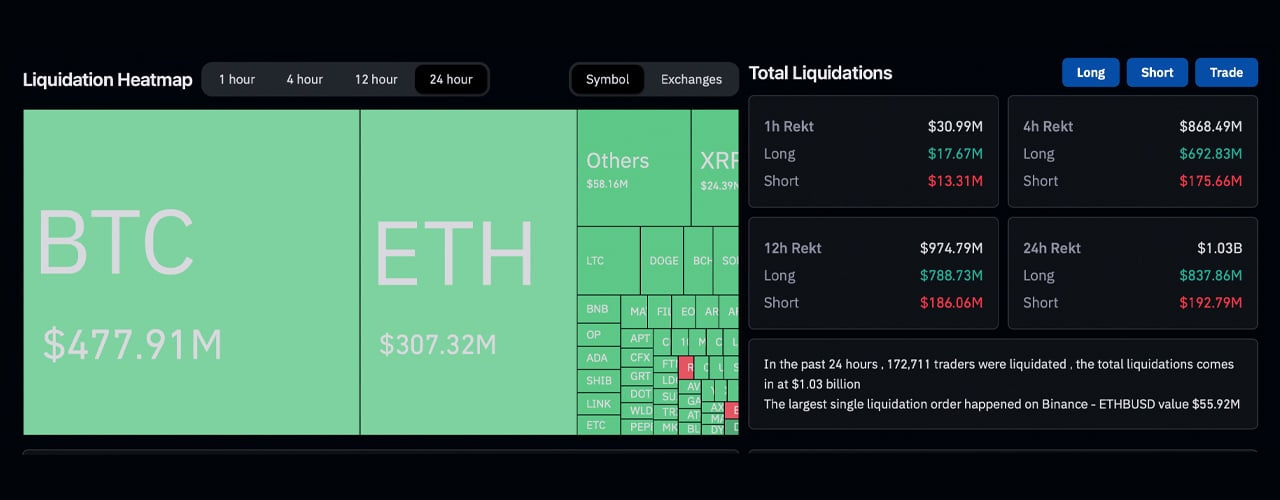

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly. About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours. Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)