Journey Through Warren Buffett's Life and Portfolio

Warren Buffett, the name synonymous with astute investing and unparalleled success, needs no introduction. His life, an intricate tapestry woven with business acumen, calculated risks, and an unwavering moral compass, offers valuable lessons for aspiring investors and curious minds alike. Let's embark on a chronological journey through Buffett's remarkable story, exploring his formative years, investment strategies, and the ever-evolving portfolio that cemented his legendary status.

Early Days: A Spark of Brilliance Ignites (1930-1951)

Young Buffet Born in Omaha, Nebraska, in 1930, young Warren displayed an innate fascination with business and money. At just 11, he made his first stock purchase – six shares of Cities Service preferred – sparking a lifelong passion for investing. He devoured books on finance, honing his skills and laying the foundation for his future endeavors.

Born in Omaha, Nebraska, in 1930, young Warren displayed an innate fascination with business and money. At just 11, he made his first stock purchase – six shares of Cities Service preferred – sparking a lifelong passion for investing. He devoured books on finance, honing his skills and laying the foundation for his future endeavors.

Buffett's academic journey mirrored his financial pragmatism. He bypassed Ivy League institutions, opting for the University of Nebraska and later Columbia Business School, graduating with his Master's in 1951. Notably, Harvard Business School rejected him, a decision they likely regret to this day.

Building the Foundation: The Partnership Years (1951-1969)

Graham:max_bytes(150000):strip_icc()/bengraham.asp-ADD-V1-85a6ac15b8bd4be7af14e7037f1c2443.jpg) Armed with knowledge and ambition, Buffett began his professional career working under Benjamin Graham, the "father of value investing," at Graham-Newman Corp. He absorbed Graham's philosophy of "intrinsic value" - investing in undervalued companies with strong fundamentals - a principle that would guide his decisions throughout his career.

Armed with knowledge and ambition, Buffett began his professional career working under Benjamin Graham, the "father of value investing," at Graham-Newman Corp. He absorbed Graham's philosophy of "intrinsic value" - investing in undervalued companies with strong fundamentals - a principle that would guide his decisions throughout his career.

In 1956, Buffett formed his own investment partnership, attracting clients with his impressive track record. He meticulously researched companies, identifying hidden gems with long-term potential. Over the next 13 years, his partnership achieved an astounding 31.7% annual compound return, far exceeding market averages.

Berkshire Hathaway: From Textile Mill to Investment Powerhouse (1962-Present)

1962 marked a pivotal moment when Buffett acquired control of Berkshire Hathaway, a struggling textile company. He saw its potential as a holding company, allowing him to invest in diverse businesses beyond textiles. This marked the beginning of the Berkshire Hathaway we know today, a conglomerate encompassing energy, insurance, railroads, retail, and more.

Throughout his tenure, Buffett remained true to his value investing principles. He acquired iconic companies like Coca-Cola, Geico, and Apple, holding them for the long term and reaping the rewards of their consistent growth. His focus on intrinsic value, patient investing, and ethical conduct earned him the moniker "The Oracle of Omaha."

Berkshire:max_bytes(150000):strip_icc()/buffetts-road-to-riches-503bf79a9c444047840ea156fd648143.png)

Portfolio Evolution: Reflecting a Visionary's Strategy

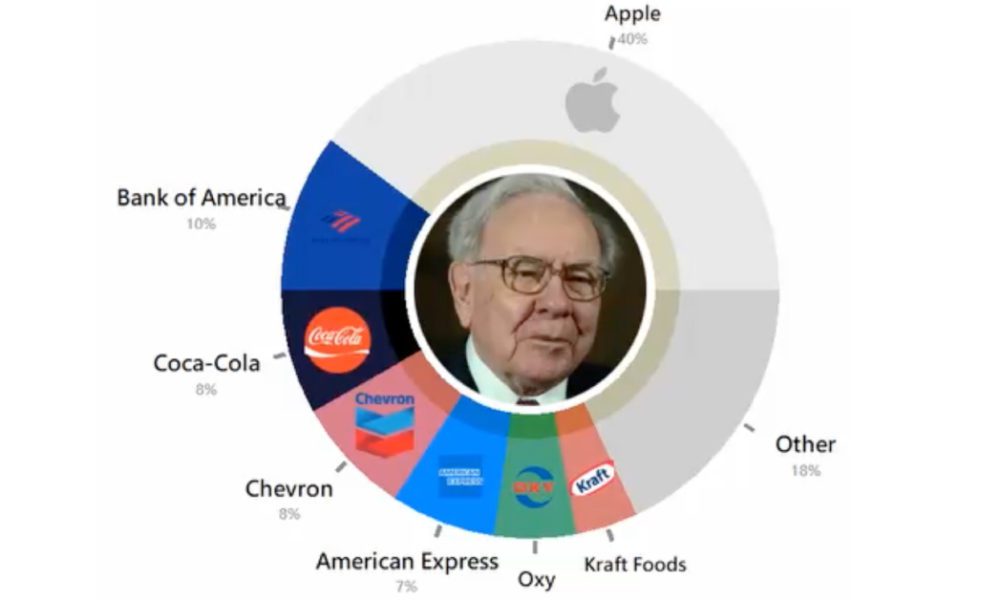

Port Buffett's portfolio isn't static; it adapts to changing market conditions and reflects his evolving investment philosophy. While still anchored in value investing, he has shown flexibility, allocating more capital to technology companies like Apple and Amazon in recent years.

Buffett's portfolio isn't static; it adapts to changing market conditions and reflects his evolving investment philosophy. While still anchored in value investing, he has shown flexibility, allocating more capital to technology companies like Apple and Amazon in recent years.

Interestingly, Berkshire Hathaway doesn't pay dividends, reinvesting profits back into the company. This aligns with Buffett's long-term perspective, prioritizing capital appreciation over short-term gains.

Beyond Business: A Legacy of Philanthropy and Wisdom

Buffett isn't just a financial maestro; he's a dedicated philanthropist. In 2006, he pledged to donate over 99% of his wealth to charity, inspiring the Giving Pledge campaign that encourages other wealthy individuals to do the same.

His annual letters to Berkshire shareholders are revered for their wisdom, combining financial insights with reflections on life, business, and ethics. These letters offer valuable lessons for individuals navigating the complexities of life and investment.

Closing Thoughts: The Enduring Relevance of Warren Buffett

Warren Buffett's story is a testament to the power of knowledge, discipline, and ethical principles in achieving success. His journey, from a young boy fascinated by stocks to the "Oracle of Omaha," offers valuable lessons for aspiring investors and individuals alike. Even at 93, Buffett remains actively involved in Berkshire Hathaway, his legacy continuing to inspire future generations.

By understanding his past, analyzing his current strategies, and appreciating his philanthropic endeavors, we gain a deeper understanding of what makes Warren Buffett a truly remarkable figure, whose impact on the world of finance and beyond will continue to resonate for years to come.