Liquidity Distribution in Forex

Role and Principles of Liquidity Distribution in Forex

Liquidity distribution is paramount for the effective operation of finance markets. It permits people to engage in commerce without creating substantial fluctuations in the value of currency.

Liquidity significantly influences various elements of FX trading, such as the disparity in buying and selling rates and the speed of trade completion. Brokerage professionals must have access to liquidity to fulfil their clients’ needs.

As technology advances, the digital finance industry evolves, creating opportunities for innovative liquidity providers. As traders invest in various markets, reliable liquidity services with adequate risk management are essential for success. With numerous options, including trading venues and payment services, it’s essential to choose an experienced partner.

In this article, we will discuss how FX liquidity works and liquidity distribution in FX, as well as find out how to choose a reliable supplier of liquidity.

Key Takeaways

- Trading in the FX market heavily hinges on liquidity.

- There are various types of liquidity: for example, market or intrabank liquidity.

- To pick a dependable provider, pay attention to pricing, reputation, and trading instruments offering.

- A liquidity zone is a price range with a high active and pending order density, influencing price direction.

Explaining Liquidity Distribution

Forex trading relies heavily on liquidity, which applies to the easiness with which a currency can be bought or sold without notable price movements.

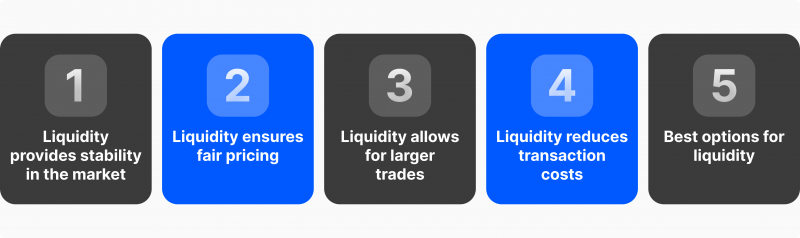

Liquidity in the FX market is crucial for retaining price steadiness, efficient execution, and risk management. High liquidity allows for gradual and predictable price movements, while low liquidity can lead to sharp swings. High liquidity also allows traders to enter quickly and exit positions at desired prices, reducing slippage risk. Additionally, it provides for the effective use of stop-loss orders in volatile markets, minimising potential losses.

High liquidity refers to buying and selling currencies with no significant impact on the currency pair’s value in foreign exchange trading. It involves easy trading activity and a broad liquidity pool.

Market liquidity affects bid-ask spread, transaction execution speed, and position opening and closing speed.  The liquidity distribution of a currency pair in Forex refers to its ability to purchase and sell without affecting its exchange rate. It allows for easy transactions and substantial trading volumes. This distribution determines the success of trade and prompt fulfilment of open positions. A liquidity pair is considered liquid if it can be rapidly purchased or sold and has high trading activity.

The liquidity distribution of a currency pair in Forex refers to its ability to purchase and sell without affecting its exchange rate. It allows for easy transactions and substantial trading volumes. This distribution determines the success of trade and prompt fulfilment of open positions. A liquidity pair is considered liquid if it can be rapidly purchased or sold and has high trading activity.

Brokers must access the largest liquidity pool to meet customer needs and offer liquidity to multiple tokens on a single platform. This multi-asset liquidity allows investors to optimise earnings by utilising market changes and abundant trading views.

Maintaining liquidity is crucial for smooth trade, as it affects bid-offer spreads and individual trades. Brokerage companies acquire their liquidity from various sources.

The FX market is the world’s largest and most liquid market, with a daily trading volume of over $7.5 trillion. It is primarily dominated by the U.S. dollar.

Fast Fact

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)