Bitcoin on-chain data shows movement of old coins, but they weren't transferred to exchanges.

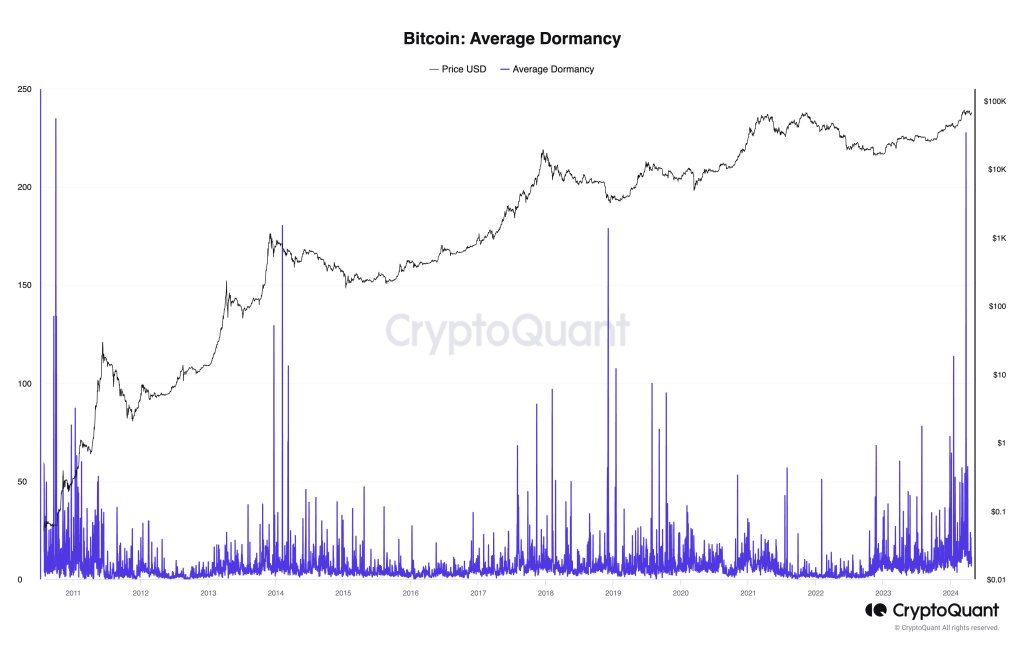

While Bitcoin struggles to extend gains, on-chain data shared by Ki Young Ju, the founder of CryptoQuant, on X shows increased movement of old coins. As the Bitcoin Average Dormancy chart shows, this trend recently hit a 13-year high.

More Old Whales Moving Coins

The Bitcoin Average Dormancy shows the average number of days each BTC has been dormant. On-chain data indicates that coins held for 3 to 5 years have changed hands and moved to new owners.  BTC dormancy chart | Source: CryptoQuant

BTC dormancy chart | Source: CryptoQuant

While there was movement, interestingly, data shows that they were not transferred to exchanges. Instead, it is highly likely that they were traded over the counter (OTC).

Usually, any transfer to centralized exchanges like Binance or Coinbase could suggest the intention of selling. The more coins hit these exchanges, especially from whales, the higher the chance of price dumping. However, if trades are made via OTC, the impact on spot rates is negligible, which is a positive for bulls.

Further analysis of these transfers using the Spent Output Profit Ratio (SOPR) indicator suggests that whales moving them made decent profits. Historically, whenever whales dump and register profits, prices tend to dip.

Will Bitcoin Prices Retest All-Time Highs

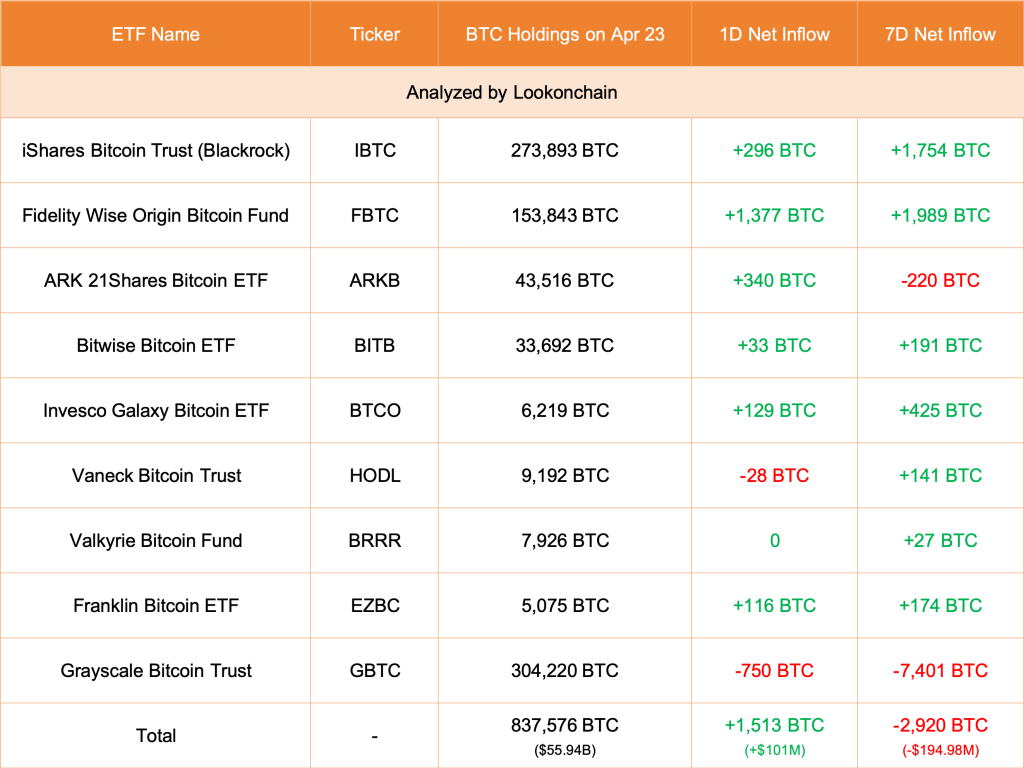

However, in a post on X, one analyst says prices will likely increase because of the impact of spot Bitcoin exchange-traded funds (ETFs). These derivatives are like a buffer against price drops, considering the pace of inflows in the past weeks.

Spot ETFs allow institutions to gain regulated exposure to BTC. Coupled with decreasing outflows from GBTC, the odds of prices rising remain elevated.

According to Lookonchain data, GBTC unloaded 750 BTC on April 23. However, Fidelity and other eight spot ETF issuers bought 1,513 BTC on behalf of their clients. Spot Bitcoin ETF issuers sell shares representing BTC holdings. These coins can be purchased from secondary markets like Binance, via OTC platforms, or directly from miners.  Spot Bitcoin ETF flow data | Source: Lookonchain

Spot Bitcoin ETF flow data | Source: Lookonchain

BTC prices remain muted and capped below $68,000, representing April 13 highs.

To define the uptrend, there must be a high volume expansion above this liquidation line, reversing recent losses. Bitcoin price trending downward on the daily chart | Source: BTCUSDT on Binance, TradingView

Even so, looking at the BTCUSDT candlestick arrangement in the daily chart, bulls must break above all-time highs for a clear trend continuation. Ideally, the uptick above $73,800 and the current range should be with expanding volumes, confirming the presence of buyers.

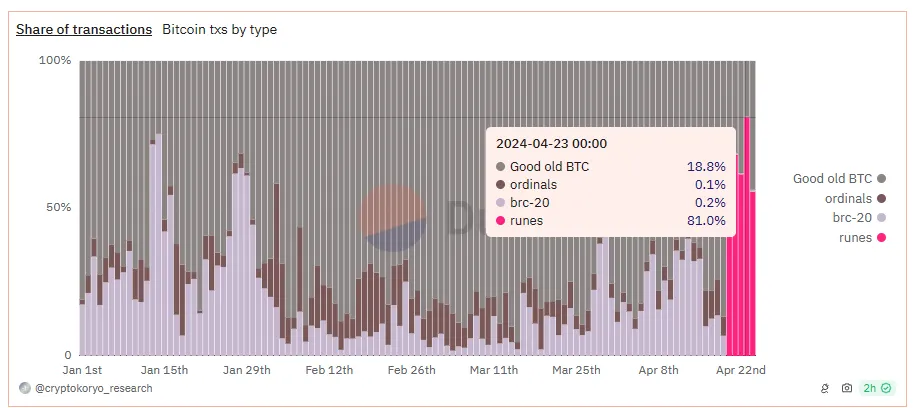

Bitcoin Runes are dominating Bitcoin blockchain activity, with over 81% of transactions on Tuesday being Rune etchings, according to a Dune report. Regular Bitcoin transactions represented 19% of the transactions, meanwhile, with BRC-20 tokens and Ordinals coming in a distance third and fourth at 0.2% and 0.1%, respectively.

According to the Dune dashboard, 750,428 Runes transactions accrued on Tuesday, followed by 174,475 “Good old BTC” transactions. 1,392 BRC-20 transactions took place, followed by 715 Ordinal transactions.

Runes also accounted for 64% of fees collected on Tuesday with 2,075 BTC, around $133 million in total fees.

The immense popularity of Bitcoin Ordinals and new meme coins minted on the world’s top blockchain has brought a coalition of Bitcoin developers together to cooperatively formalize the underlying BRC-20 fungible token standard. The coalition—the newly formed Layer 1 Foundation—announced its new governance body on Monday, focused on ensuring trust and transparency around the protocol and calling it crucial for future growth. “We invited all of the biggest BRC-20 indexers to become partners… and t...

Since the launch of the Runes protocol alongside the Bitcoin halving, 692,480 users have etched 7,995 Runes, the report notes, with a combined 3.1 million transactions related to Runes.

On Wednesday, for example, the Rune collection DOG•GO•TO•THE•MOON (DOG) airdropped 100 billion Runes to eligible wallets, amassing a $336 million market capitalization according to data from Bitcoin Runes marketplace Magic Eden.

While the novelty of Runes plays a factor in the surge in activity, also contributing was the race to be one of the first to etch the first batch of Runes, which are believed to be able to fetch a heftier price because of their rarity and age.

“For reference, an uncommon sat will go for $200 to $500 depending on market variations; rare sats we've seen go for up to three Bitcoin ($193,242),” Luxor mining pool CEO Nick Hansen previously told Decrypt. “But it is a logarithmic scale.

“We think most likely the epic [sat] is going to be to the tune of $4 to $6 million—[that's] probably the market value for that,” Hansen continued.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)