Bitcoin Halvings: Do Reward Cuts Help or Hurt Miners?

T

T

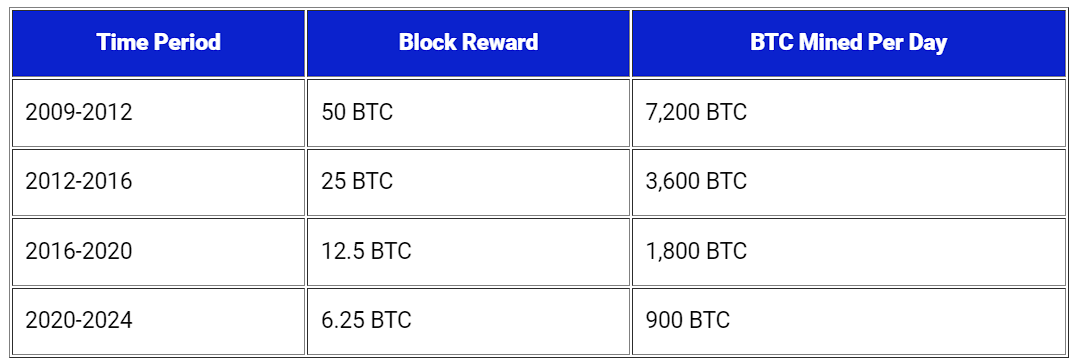

he Bitcoin halving refers to a programmed event that occurs roughly every 4 years and slashes the block reward miners receive for processing transactions on the network by 50%. For example, the current block reward of 6.25 bitcoins will drop to 3.125 bitcoins per block sometime in 2024 after the next halving.

This steep drop in revenue earned by miners naturally has significant impacts on the profitability and sustainability of Bitcoin mining operations. However, halving is also a crucial mechanism that controls the supply and issuance rate of new bitcoins, making it essential to maintaining scarcity and value within the Bitcoin ecosystem.

So ultimately, is bitcoin halving good for miners or bad? As with most things in investing, there are valid arguments on both sides. Let’s dive deeper into the key considerations.

New to bitcoin mining? Learn the fundamentals of crypto mining here.

Key Takeaways

- The Bitcoin halving cuts the block reward miners receive in half every 4 years, reducing mining profitability

- With the reward reduced, miners relying on older equipment will likely shut down until the Bitcoin price rises to make mining profitable again

- Newer miners with access to the latest technology can continue earning rewards with improved efficiency

- The halving reduces the rate of new Bitcoin supply, usually kickstarting a strong price rally following each halving event

How Halving Impacts Mining Economics

There’s no denying that the halving deals an immediate blow to the amount of revenue miners can generate by validating transactions and mining new blocks. With 50% less reward per block, margins are squeezed across the industry. Some key outcomes stemming from this dynamic include:

Some key outcomes stemming from this dynamic include:

- Older mining rigs becoming obsolete — For miners operating older, less efficient hardware like the Antminer S9 that rely more heavily on the block subsidy to turn a profit, running costs may exceed revenues following a halving. These miners will likely need to upgrade equipment or shut down until mining economics improve again.

- Network hash rate and difficulty falling temporarily — With unprofitable rigs going offline after the halving, the overall Bitcoin network hash rate drops, meaning less computing power is dedicated to processing transactions and mining blocks. As a result, the network difficulty adjusts downwards, making mining easier for those still participating.

- Stronger miners gain a larger share of mining rewards — Newer miners leveraging cutting-edge ASIC chips and access to cheap electricity can withstand thinner margins post-halving. As unprofitable competitors drop off, efficient players enjoy a greater proportion of mining revenues and accrue more Bitcoin relative to the past.

So in the short-term, the halving places immense pressure on profit margins and forces higher-cost miners to shut down operations. But over a longer time horizon, the halving offers scaling advantages to sophisticated miners running state-of-the-art infrastructure. The strong get stronger in the wake of each halving event.

The Halving’s Impact on Bitcoin Price

While the halving cuts directly into miner profits, supporters argue it’s a crucial step to catalyzing Bitcoin’s next bubble cycle and run-up in prices. The logic is rooted in basic supply and demand dynamics.

By slashing the supply of new Bitcoin entering circulation by 50% virtually overnight, it produces a supply shock against steady (or rising) demand for obtaining Bitcoin. Reduced issuance combined with constant demand puts upwards pressure on Bitcoin’s price until the next equilibrium is reached at a higher value per coin.

The data shows this theory has held up historically: While price appreciation is never guaranteed, the halving has set the stage for massive bull runs twice now in Bitcoin’s history.

While price appreciation is never guaranteed, the halving has set the stage for massive bull runs twice now in Bitcoin’s history.

Here is why this tends to occur:

- Scarcity increases — With only 900 BTC issued per day post-2020 halving compared to 1,800 previously, new supply dwindles which supports higher prices longer-term.

- Production costs hold steady — While mining yields fewer coins, costs related to hardware, electricity, personnel do not decrease proportionally. Miners are faced with the same outlays for less reward, incentivizing holders to bid up prices rather than sell at thinner margins.

- Speculation builds — As data accumulates that previous halvings powered huge rallies, speculation of another moonshot price run ensues. Traders front-run expected gains by accumulating ahead of the next halving.

So based on past data, the halving could offer a major boon to miners who weather the initial storm of lower revenues. Substantially higher Bitcoin prices in the 12–24 months after a halving can dwarf the impact of reduced block subsidies. Miners strongly believe another exponential move is in store within the current post-halving timeframe spanning 2020–2024.

Is Bitcoin Halving Good for Miners? Weighing the Pros and Cons

Given the analysis above, is the halving ultimately positive or negative for Bitcoin miners? There are solid cases to be made on both sides:

Arguments That Halving is Bad for Miners

- Revenue drops 50% overnight, decimating profit margins

- Forced shutdowns of older mining rigs unable to remain profitable

- Temporary drops in network hash rate and mining difficulty

- Short-term disruption until price appreciates sufficiently

Arguments That Halving is Good for Miners

- Reduces number of competitors as inefficient miners drop out

- Captures bigger share of rewards for miners remaining

- Historically, exponential price rallies offsetting smaller subsidies

- Stronger network and ecosystem via lower inflation schedule

There are clearly trade-offs to consider for miners evaluating the impact of the halving mechanism. Cost structures, efficiency profiles, price expectations, and time horizons all play a role in determining whether the juice is worth the squeeze.

But looking back on Bitcoin’s track record through two previous halving events, the data shows the temporary revenue pinch gives way to epic price runs that ultimately provide a rising tide lifting all boats. The halving is the first domino that must fall to ignite Bitcoin’s built-in bull market engine fueled by growing scarcity.

So after weighing the give and take, the halving remains a necessary step to incentivize miners to keep the network secure as emissions taper off over time per Bitcoin’s programmed scarcity.

While both sides have merits in this debate, halving is most likely “good” for the longevity of the mining industry and its future profit potential despite the short-term growing pains endured every four years.

Now that we have explored the economics of how the Bitcoin halving impacts miners’ profitability, incentives, and ecosystem. While the halving cuts miners’ block rewards in half, reducing short-term revenue, it has also preceded exponential price gains that greatly boost longer-term profitability.

What happens to miners in a halving? Case Studies

Now, we’ll analyze examples of what actually unfolded for Bitcoin miners during the last three halving events in 2012 and 2016. Examining this real-world data will shed light on how miners fared as well as the implications for the current post-2024 halving timeframe.

Case Study: The 2012 Halving

The first Bitcoin halving occurred on November 28, 2012. The block reward dropped from 50 to 25 BTC overnight, while the BTC price traded around $12 leading into the event. How did miners respond?

Hash Rate and Difficulty Fell Substantially

- Bitcoin’s network hash rate plummeted from 25,000 TH/s ahead of the halving down to approximately 15,000 TH/s in the months following. This represented a 40% decline.

- With fewer active miners, difficulty adjusted lower to compensate. Difficulty dropped nearly 15% over a 2-month stretch before stabilizing.

This data shows a significant portion of miners did indeed shut down operations in the face of thinner margins, just as expected. The portion of miners that stayed online reaped the benefits of easier mining and a faster path to gobbling up blocks.

Yet Bitcoin’s Price Started Soaring Heavily

As discussed previously, the halving also kicked off Bitcoin’s next monster bull run.

- Pre-halving: BTC traded right around $12

- One year later: BTC reached $1,038, a nearly 8,550% return

- The hash rate rebounded to even higher levels as mining became exponentially more profitable

The huge upside in Bitcoin’s price as supply growth slowed overwhelmed any impact from lower subsidies per block. Just as the Bitcoin protocol was designed to incentivize, miners held strong through short-term pain for huge long-term gain.

By April 2013, Bitcoin had re-achieved an all-time high above the previous peak of $32 in 2011. Halving-fueled hype attracted swarms of new network participants. Mining became more decentralized and popular than ever.

Case Study: The 2016 Halving

The second Bitcoin halving arrived on July 9, 2016, dropping the block reward from 25 to 12.5 BTC. This halving took place within a much more developed mining industry and volatile price history for Bitcoin:

- The pre-halving price was $652 after rallying from lows around $200 earlier in 2015

- Thousands more sophisticated miners worldwide are competitive over block subsidies

- Billions invested in custom ASIC hardware, data centers, and access to cheap electricity

With far higher expenses and investments committed to mining by 2016, would miners be able to stay profitable following a 50% haircut to their Bitcoin revenue?

Another Major Hash Rate Decline Ensued

As expected, the reduced block rewards squeezed mining margins and forced additional high-cost producers to flip off mining rigs yet again.

- The hash rate tumbled from a local high of 5.5 exahashes pre-halving down to approximately 2.5 exahashes in the first month post-event.

- Nearly 60% decline in network hash rate before recovering

The hash rate crash exceeded the drop seen in 2012. With industrial-scale mining infrastructure now the norm, the halving’s impact rippled through a far more advanced global mining ecosystem.

Meanwhile, Bitcoin Embarked on Another Monster Rally

Despite more extensive mining infrastructure getting disrupted this time around, the halving once again preceded a new bull market, carrying Bitcoin to exponential new highs:

- One year post-halving: Bitcoin hit $2,526 in July 2017, nearly a 4x return from the pre-halving price

- Profitability reached new highs as mining difficulty stayed suppressed via 2016’s hash rate crash

- A new all-time high eclipsed 2013’s previous peak around $1,150

So even with far greater global investment in place from professional mining firms, the halving delivered another surge in value that rewarded those who continued mining Bitcoin through the temporary downturn.

The resilience of Bitcoin again shone through following the decimation of less efficient miners unable to adapt to the new paradigm. The cost of production may have doubled for remaining miners in real dollar terms, but dollar-denominated earnings skyrocketed along with Bitcoin’s next bubble cycle.

Case Study: The 2020 Halving

Bitcoin’s third programmed halving took place on May 11, 2020. The block reward declined from 12.5 to 6.25 BTC as the world endured pandemic lockdowns and unprecedented money printing. Leading into the event:

- Bitcoin traded around $8,800, recovering from a crash below $4,000 during March 2020

- Mining hash rate and difficulty neared all-time highs around 120 exahashes and 17 trillion

- Mining professionalized at industrial scale, with groups like Hut 8 Mining, Riot Blockchain, and Marathon Digital focusing exclusively on Bitcoin

History Repeated With Another Hash Rate Retracement

Following the halving, around 30–40% of Bitcoin’s hash rate switched off by July 2020, similar to past events. Difficulty dropped by over 15%, making life easier for those left standing.

Older-gen hardware like Bitmain’s Antminer S9s fell below profitable levels given higher electricity costs. Even the latest-generation gear faced tighter margins and some degree of capitulation.

But as Always, a Monster Rally Ensued

Nine months later, in February 2021, Bitcoin surged to new all-time highs above $58,000. A 565% rally in less than a year powered miner profitability far beyond pre-halving levels.

With miners taking in less BTC but earning far greater sums of dollars, ROI metrics reached staggering new records. Marathon Digital and Riot Blockchain raked in $150–200 million in Q1 2021 alone as old highs were left in the dust.

Key Takeaways From Past Halvings

Analyzing the impact of these first two halving events makes a few themes evidently clear:

1) The halving repeatedly forced higher-cost miners to shut down operations as profitability decreased by 50% overnight. However, the miners structurally positioned to withstand short-term pain experienced less competition, easier mining, faster block times, and huge rewards on the other side.

2) Both previous halvings sparked the beginning of Bitcoin’s next price bubbles and bull runs that boosted profits vastly higher than pre-halving levels. Healthy, sustained price multiples well above the doublings in mining expenses followed each halving, more than offsetting reduced block subsidies.

3) While hash rate and mining difficulty dropped sharply after the 2012 and 2016 halvings, they rebounded to fresh all-time highs when Bitcoin’s price regenerated momentum. The temporary struggles gave way to an influx of new investment and participants re-entering the mining ecosystem.

So history shows Bitcoin’s three previous halvings severely tested inefficiency and boded poorly in the short term for marginal miners unable to adapt. However, they also preceded huge growth, decentralization, and prosperity across the network’s top layers for those positioned to capitalize.

What Comes Next Post-2024 Halving?

Many analysts forecast six-figure Bitcoin prices exceeding $100,000 as the halving’s material impact on scarcity kicks into higher gear. This would again send mining revenues, denominated in dollars, to unprecedented levels.

Miners with diamond hands have historically reaped unimaginable rewards post-halving, while short-term focused miners struggle with thinner margins. Once again this cycle, Bitcoin’s incentive scheme heavily favors those building for the long term.

Final Wrap: Is Bitcoin Halving Good for Miners?

While short-term pain persists in the months following each halving event, those who endure often experience spectacular returns, amplifying mining revenues to new highs within 12–24 months as Bitcoin bubbles.

However, the halving undoubtedly makes life difficult for inefficient miners unable to adapt to rapidly changing conditions. Thinner margins accelerate the “survival of the fittest” endgame, where professional-grade operations distance themselves further and further from amateurs.

Yet this is precisely the type of adversity designed to build network strength and security over the long run. The cost of production naturally increases as block rewards taper, providing pressure to attract higher-caliber participants and capital providers to the space over time.

After re-evaluating the on-chain activity, price data, and real-world consequences surrounding all three halvings now in the books, the verdict seems clear:

The halving remains an unequivocal net positive for Bitcoin miners in aggregate and network security overall, based on the exponential network growth fueled by each supply squeeze. While short-term pain manifests repeatedly for marginal miners unable to survive volatility and changing economics, the long-term benefits far outweigh temporary declines.

By flushing out inefficient operators not structurally fit for Bitcoin’s dynamic environment, the halving steels the network’s backbone and clears the path for steadfast miners to enjoy exponential spoils.

How do you think the upcoming halving will affect the mining ecosystem and the crypto space as a whole? Let me know in the comments.

Cryptocurrency

Bitcoin Halving

Bitcoin Mining

Bitcoin

Bitcoin Halving 2024

Follow

Follow

Written by Investing Ink

6 Followers

·

Writer for

Coinmonks

Your Passport to Cryptocurrency Insights and Knowledge investingink.com

More from Investing Ink and Coinmonks

Investing Ink

Investing Ink

What Really Happens to Your Bitcoin Fees When a Transaction Fails? Let’s Find Out!

Worried about loosing the fees you paid for that failed transaction? Fear not; your fees aren’t lost. Let’s take a look at what happens to…

7 min read

·

Nov 9, 2023

7

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

607

2

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

31K

827

Investing Ink

Investing Ink

How the Upcoming Bitcoin Halving Will Affect You as a Holder

The Bitcoin halving is one of the most anticipated events in the crypto calendar. Occurring once every 4 years, the halving reduces the…

6 min read

·

Dec 26, 2023

1

Recommended from Medium

Airdrop X Meta

Airdrop X Meta

TOP BEST AIRDROP 2024

- POLYHEDRA

6 min read

·

6 days ago

156 0xAnn

0xAnn

in

Crypto 24/7

Making Money Scalping Crypto

“Why do you work 9–5 when crypto trading is basically free money?”

·

7 min read

·

5 days ago

416

8

Lists

Modern Marketing52 stories

Modern Marketing52 stories

·

366

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

617

saves

Mike Coldman

Mike Coldman

Top 4 Crypto Gems Set to Explode in 2024 !

Unlock the Secret Strategies of Elite Investors and Transform Your Portfolio Overnight !

·

5 min read

·

Jan 8

109

3

Financeable

Financeable

12 Side Hustles You Can Do From Your Phone ($600+ Per Day)

Let’s be honest, if you’re reading this article, you probably have a phone or a laptop. And with this thing, you can make as much as $600…

13 min read

·

Dec 25, 2023

5.1K

83

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

7.9K

107

Intelligent Growth

Intelligent Growth

ALTCOIN TOKEN UNLOCKS: POTENTIAL PRICE CHANGES

Introduction

4 min read

·

Jan 5