ICO (Initial Coin Offering): Unveiling the Fundraising Revolution

Introduction

Initial Coin Offering, or ICO, has emerged as a transformative fundraising mechanism in the world of cryptocurrencies. This article aims to explore the concept of ICOs, how they work, and their impact on the financial landscape.

Understanding ICO

ICO (Initial Coin Offering) is a fundraising method used by cryptocurrency startups to raise capital for new projects. In an ICO, companies issue their own digital tokens to investors, typically in exchange for established cryptocurrencies like Bitcoin or Ethereum. These tokens often represent a stake in the project or future access to the platform's services.

Key Components of an ICO

- Whitepaper:

- ICOs typically begin with the release of a comprehensive whitepaper. This document outlines the project's goals, technical details, use cases, and the team behind the project.

- Token Creation:

- The startup creates a specific number of tokens on a blockchain, usually using standards like ERC-20 for Ethereum-based tokens.

- Smart Contracts:

- Smart contracts are employed to automate the distribution of tokens to investors based on their contributions. These contracts define the rules and conditions of the ICO.

- Token Sale:

- The token sale phase allows investors to purchase the newly created tokens using established cryptocurrencies. This sale can be conducted over a specified period.

- Use of Funds:

- The whitepaper often details how the funds raised through the ICO will be utilized. Common use cases include project development, marketing, and operational expenses.

How ICOs Work

- Project Initiation:

- A cryptocurrency startup identifies a need for capital to fund a new project or platform development.

- Whitepaper Publication:

- The startup releases a whitepaper, detailing the project's purpose, goals, technical aspects, team members, and the tokenomics behind the ICO.

- Token Creation:

- The startup creates a fixed supply of tokens on a blockchain, ensuring scarcity and value.

- Token Sale Period:

- The ICO is launched, and interested investors can contribute by sending established cryptocurrencies to the project's wallet address. In return, they receive the newly created tokens.

- Token Distribution:

- Smart contracts automatically distribute the purchased tokens to investors at the end of the ICO based on the terms outlined in the whitepaper.

- Listing on Exchanges:

- Post-ICO, the newly created tokens may be listed on cryptocurrency exchanges, providing liquidity and allowing investors to trade them.

Advantages of ICOs

- Access to Capital:

- ICOs provide startups with an alternative means of raising capital without traditional financing methods.

- Global Investor Participation:

- ICOs allow projects to attract investors from around the world, fostering global participation.

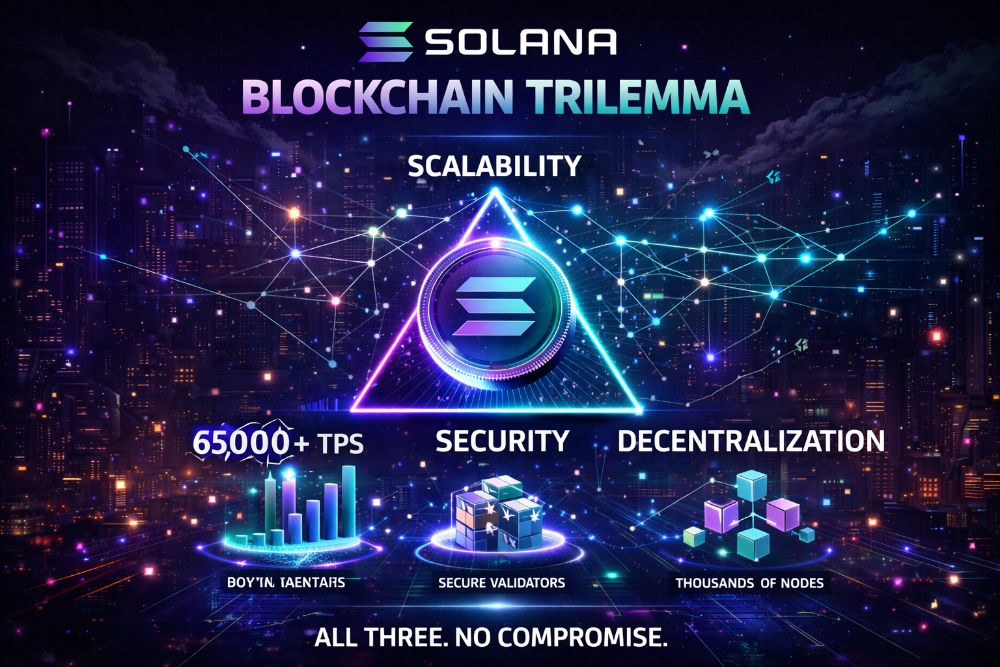

- Decentralization:

- The decentralized nature of ICOs aligns with the principles of blockchain technology, offering a peer-to-peer fundraising model.

Challenges and Risks

- Regulatory Uncertainty:

- ICOs often operate in a regulatory gray area, leading to uncertainty and potential legal challenges.

- Scams and Fraud:

- The lack of regulation can attract fraudulent projects, leading to scams and investor losses.

- Market Volatility:

- The value of tokens issued through ICOs can be highly volatile, posing risks for both investors and project sustainability.

The Evolution of Fundraising: STOs and IEOs

As the ICO landscape matures, alternative fundraising methods like Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs) have emerged. These methods seek to address some of the regulatory and security concerns associated with traditional ICOs.

Conclusion

While ICOs have played a crucial role in the development of the cryptocurrency space, they are not without challenges. As the regulatory landscape evolves, the fundraising models in the crypto space will likely continue to adapt. ICOs have left an indelible mark on the way startups raise capital, opening up new possibilities for innovation and financial inclusion.