Real-world assets on Solana

Introduction

Reborn from the ashes of FTX collapse in late 2022, Solana network has seen a parabolic growth in 2023. Not only its native token SOL did more than 10X, its ecosystem surged as well. Memecoins of the network, BONK and WIF among others surged exponentially (well, almost literally). One of the best airdrops of 2023 was Jito, a protocol which earns holders of its token MEV rewards of the Solana network. This and other airdrops, also anticipated JUP airdrop increased trading activity on Solana. At the end of the year, trade volumes in Solana DEXs surpassed that of DEXs built on Ethereum.

When markets go up and prices skyrocket, yield-generating get overshadowed. This is what happens to RWA protocols on Solana. But as I will try to show in this article, there are protocols building truly cool things and transporting real world assets onto Solana. Reasons why Solana is a very suitable blockchain for RWA are low fees, high speed, and a wide range of DEXs among other factors.

Real estate

Parcl

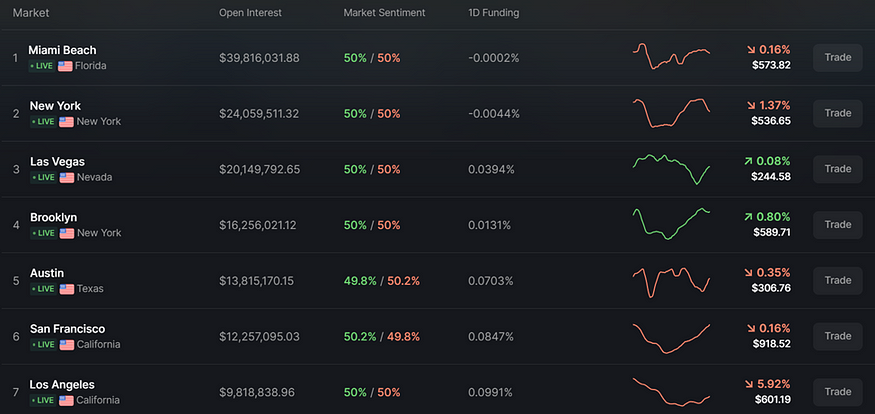

Parcl is a real estate trading platform. It allows you to trade price movements in real estate. What is unique about Parcl is that you can not only go long (i.e., buy) but also short a particular market on the platform. Prior to Parcl it was hard, if not impossible, to express a bearish view on the real estate in a particular region through financial markets.

You can trade real estate in more than 10 US cities, e.g., Los Angeles, Denver, and New York City. You can also earn passive income by providing liquidity in USDC. Both of these actions earn you points which will be considered in the upcoming $PARCL airdrop in late March or early April.

MetaWealth

MetaWealth is a fractional real estate investing platform powered by Solana. Once all legal, commercial and technical work is complete and a property is assessed by third-party experts, the property is listed on the platform. Then it is fractionalized and tokenized. With an amount as low as $100 you can invest in real estate assets and receive 10–12% annual yield which is generated by rents.

Private credit

Credix

Credix is a private credit lending protocol. It links institutional investors seeking higher yield, such as alternative asset managers, family offices and hedge funds to non-bank lenders in Latin America. Credix’s borrowers are credit fintech startups and non-bank loan originators. Looking at current active deals gives information about the profile of a typical borrower from Credix.

Credix issued more than $44 million to its borrowers on which the protocol earned $7.1 M interest. Six deals were repaid fully while 24 are still active.

Credible

Another RWA lending protocol which is in beta is Credible. Credible is a CeDeFi (Centralized and Decentralized Finance) platform which combines robust legal framework of traditional finance with transparency of blockchain technology. Protocol’s borrowers include real estate companies and renewable energy businesses. By pledging their real-world assets, such as land, properties, solar plants, windmills or electrical vehicle infrastructure as collateral, these enterprises can borrow from Credible’s liquidity pools.

The protocol has two tokens, one for LP and another for governance purposes. Users depositing USDC into a pool receive cUSDC which can be converted back to USDC at the loan maturity. Until redemption cUSDC can be deployed across Credible ecosystem for staking or farming. Governance token of the protocol is CRED which can only be minted if a user does dual staking — staking cUSDC with SOL, Solana network’s native token.

Credible is going to launch a points program with a potential forthcoming airdrop. Currently, you can complete several simple tasks, such as linking your social media profiles and earn points.

Physical goods

Collector Crypt

Collector enables trading of real-world collectibles. You can tokenize your collectibles, such as Pokemons by sending them to Collector’s vault. Once it is authenticated and scanned, a digital token called pNFT which represents your card is minted. This allows users to trade collectibles on the marketplace. Collectibles graded by major card grading services, such as BGC, PSA, and CGC can be digitized on Collector Crypt. Other than trading, one can use collectibles as collateral to borrow funds.

Baxus

Baxus is an online platform for trading wine and spirits. Once a bottle or cask enters Baxus warehouse in New Jersey, it is authenticated by the platform’s specialists to verify its contents. After a successful authentication, an NFT is minted for each bottle. NFT is publicly visible to anyone and displays the details about pricing and history of the bottle. It represents ownership of the beverage; once it’s sold on the marketplace, the ownership of the underlying physical bottle transfers to the buyer.

Ondo Finance

Ondo Finance is one largest RWA platforms tokenizing US Treasury and Bills. At the time of writing this article, Ondo provides two products:

- USDY. It is a tokenized security backed by short-term US Treasuries and bank deposits. This is a convenient way for non-US individuals and institutions to get exposure to high-quality US bonds.

- OUSG, which is available only to accredited investors, is mostly invested in iShares Short Treasury Bond ETF (the ticker — SHV) with a small portion in USDC and USD for liquidity purposes.

Currently, APY for USDY and OUSG are 5.10% and 4.89%.

Initially launched on Ethereum, Ondo Finance started deploying both products on Solana in December 2023. Nathan Alman, the CEO of Ondo Finance noted that, “Integrating Ondo’s offerings with Solana not only aligns with our strategic growth but also paves the way for novel decentralized finance applications leveraging tokenized US”. However, they themselves have a dose of skepticism about whether these products will be accepted well on Solana which has been known for its memecoin-driven plays: “The native issuance of OUSG and USDY will bring US Treasuries access to the Solana ecosystem. It is no secret that, as of late, Solana has become the house of speculation, and Ondo seeks to introduce a counter-balance facilitating a broader push to maturity.”

ISC

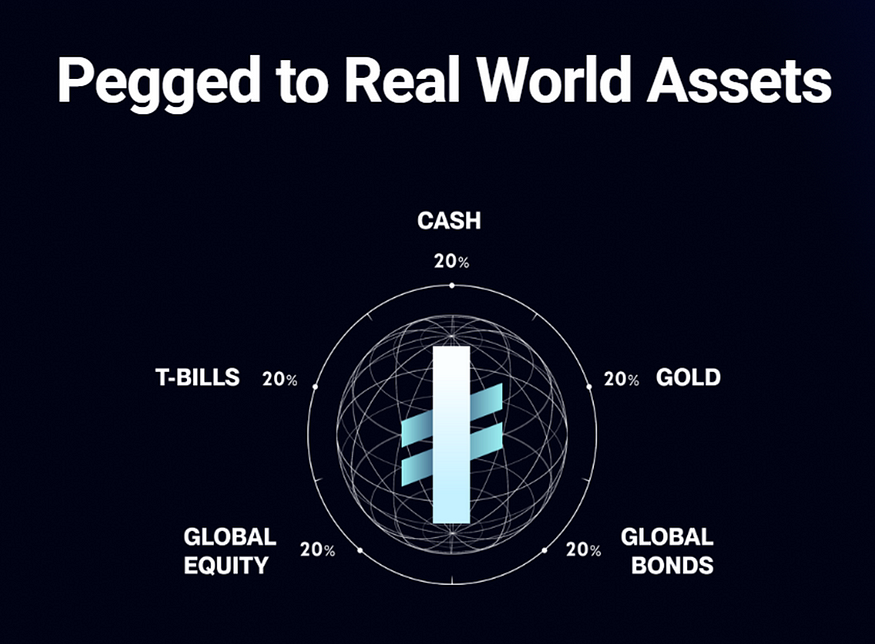

International Stable Currency (ISC) is a flatcoin, i.e, a stablecoin which doesn’t lose value over time due to inflation. It’s by design an inflation-resistant digital asset which is designed to appreciate in value over time. Unlike typical stablecoins mostly pegged to US dollar, ISC is not linked to USD only. Instead, it’s pegged to the basket of financial assets and commodities. At the time of writing, ISC reserves are equally allocated to cash, gold, short-term US Treasury bills, global bonds, and global equity markets.

Blockride

Blockride allows users to invest in fractionalized bus fleets with as little as $50. Once a vehicle of bus fleet is tokenized and fractionalized through Security Token Offering, you can see records of the vehicle, such as mileage, maintenance history, and its income reports. Investors receive a daily payout in USDC.

Conclusion

Though not as shiny and tempting as memecoins, RWA protocols do something useful — they bring real-world assets onto blockchain. Solana is well positioned to be a blockchain network for RWA. Its scalability and efficiency in terms of low fees and high throughput are among the most important reasons why some protocols, e.g., MetaWealth bridged to Solana. Furthermore, several DEXes with billions of dollars of monthly trading activity have been built on Solana which facilitate buying and selling of these tokens.

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)