Bitcoin accumulation reaches a new peak ahead of the halving.

As of the information provided, it seems to be a discussion about the impact of Bitcoin ETFs on the cryptocurrency market and order book liquidity. Here is the translation into English:

"As predicted in December last year, Bitcoin ETFs domiciled in the United States, approved in January, are not only affecting the prices of cryptocurrencies but also influencing the liquidity of the order book or the ability to trade at a stable price.

These impacts are becoming increasingly evident a month after the trading commencement of 10 ETFs (excluding Grayscale's GBTC).

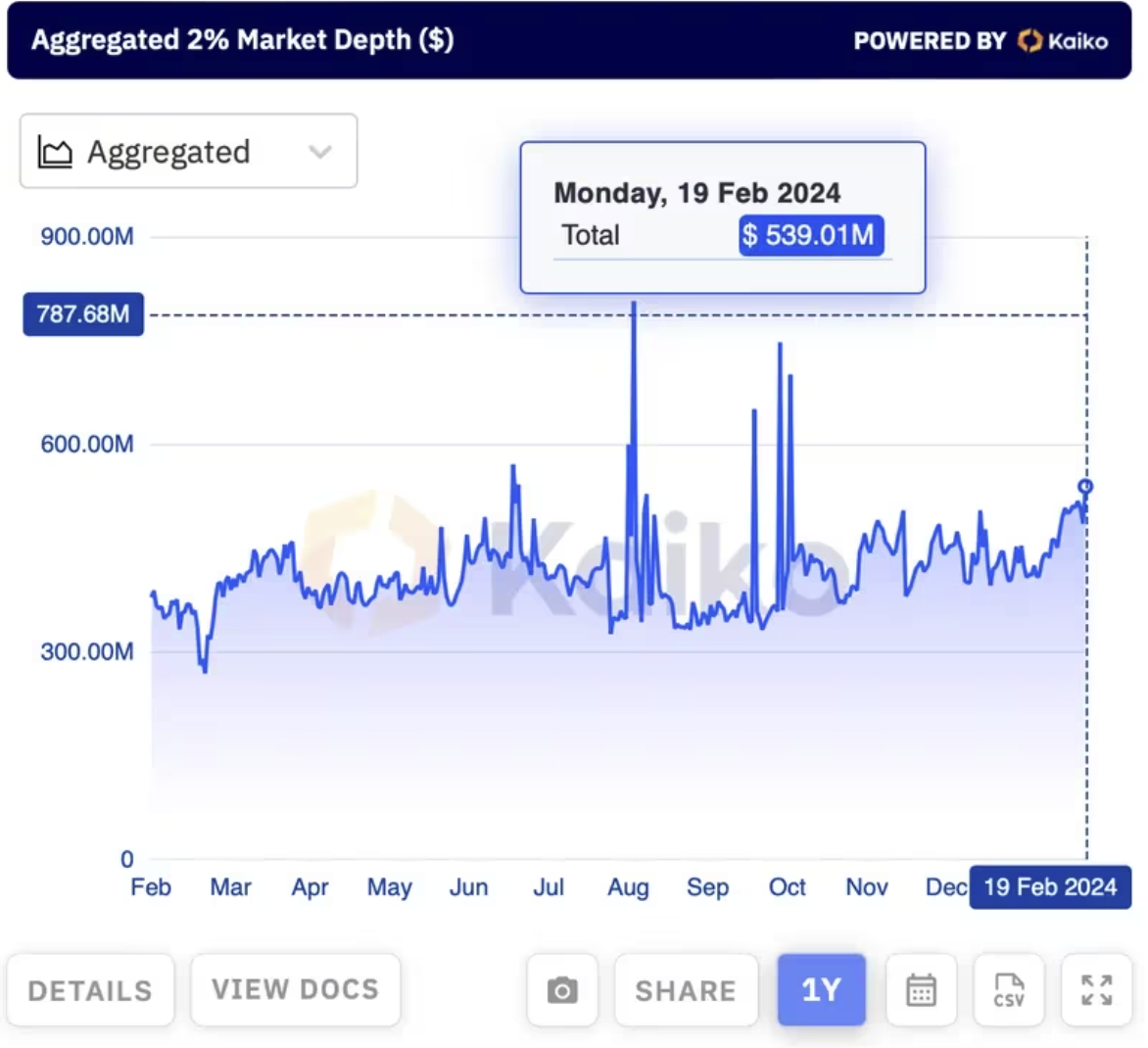

On the third day, Bitcoin's 2% market depth across 33 concentrated exchanges, or the combined value of buy and sell orders within a 2% range of the market price, has increased to USD 539 million. This is the highest level since October and has risen about 30% since the launch of ETFs on January 11, according to data tracked by Kaiko."

The increased market depth or liquidity makes it easier to buy and sell large quantities without significantly affecting prices, and reduces slippage, the difference between the quoted price and the executed price.

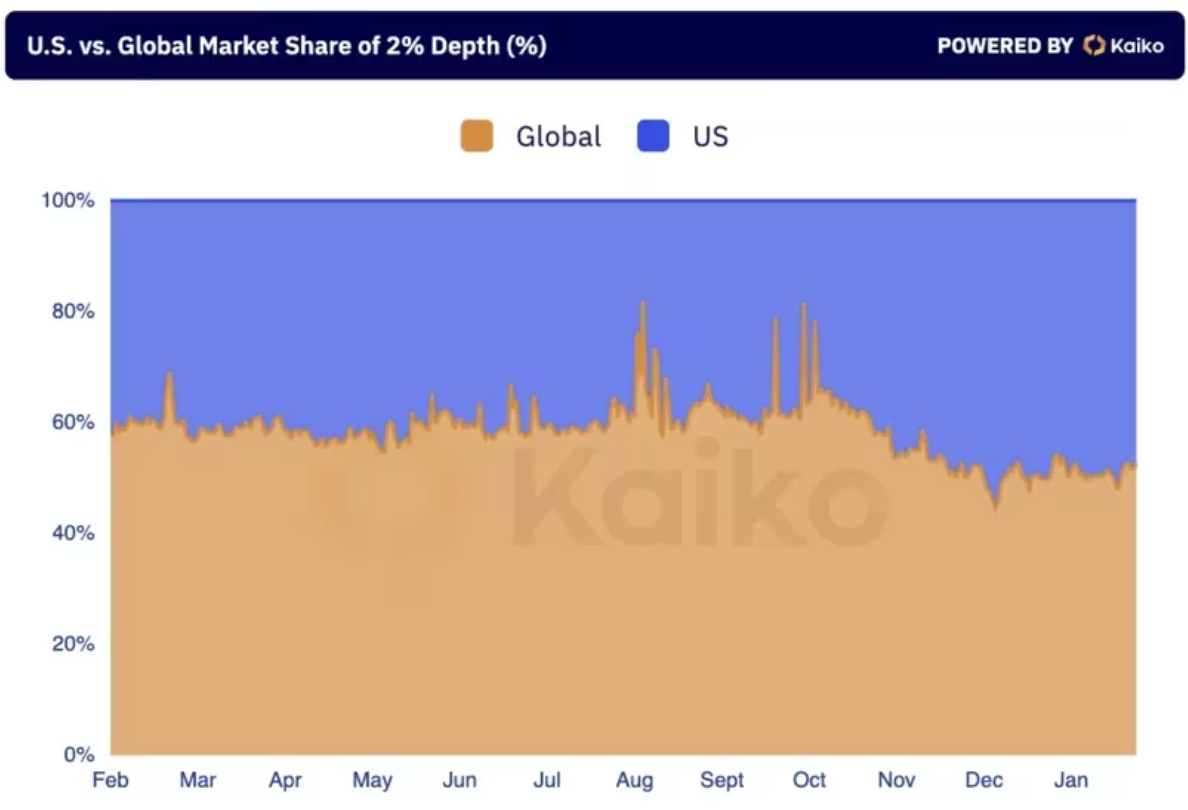

According to Kaiko, U.S.-based exchanges have contributed to the global increase in market depth for Bitcoin.

The share of U.S.-based exchanges in the global 2% market depth has risen to 48%, up from 14.3% since expectations of ETFs attracted the market in October.

Although market depth has improved, it still remains significantly lower than the observed levels exceeding $800 million before the collapse of Sam Bankman-Fried's FTX exchange and its sister company Alameda Research in November 2022. Accumulation of Bitcoin

Accumulation of Bitcoin

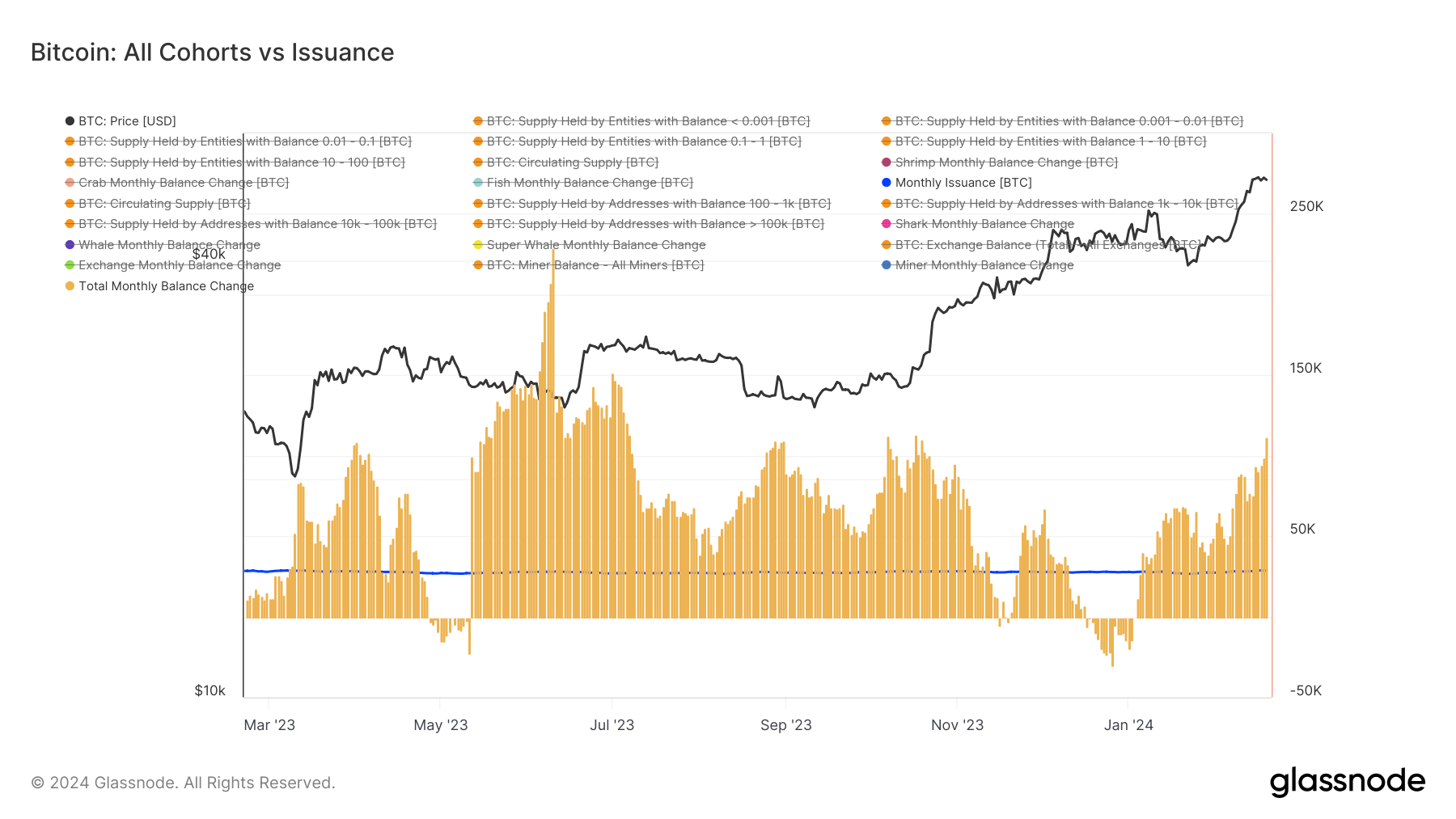

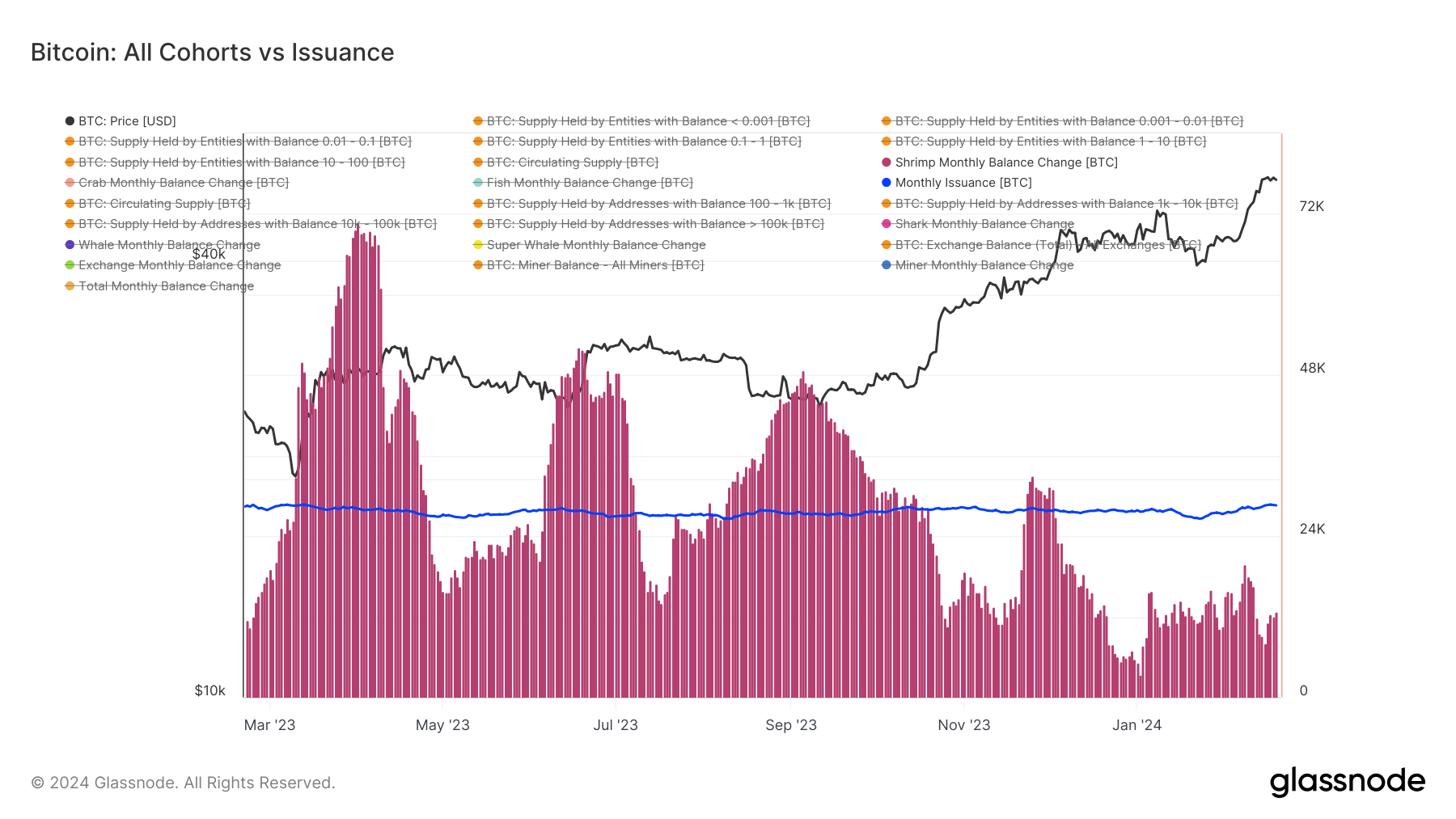

Over the past 30 days, Bitcoin holding groups have demonstrated significant accumulation, reaching the highest level observed in October 2023, with a monthly total balance change of 111,000 BTC.

This is the highest level of Bitcoin accumulation witnessed since the notable price surge when the value of Bitcoin increased from $25,000 to $40,000.

Currently, the monthly issuance of Bitcoin stands at 27,000. However, the anticipated halving event in April is expected to reduce this issuance to 13,500 BTC per month. Interestingly, across all groups, the accumulation of Bitcoin is exceeding the issuance level by more than four times.

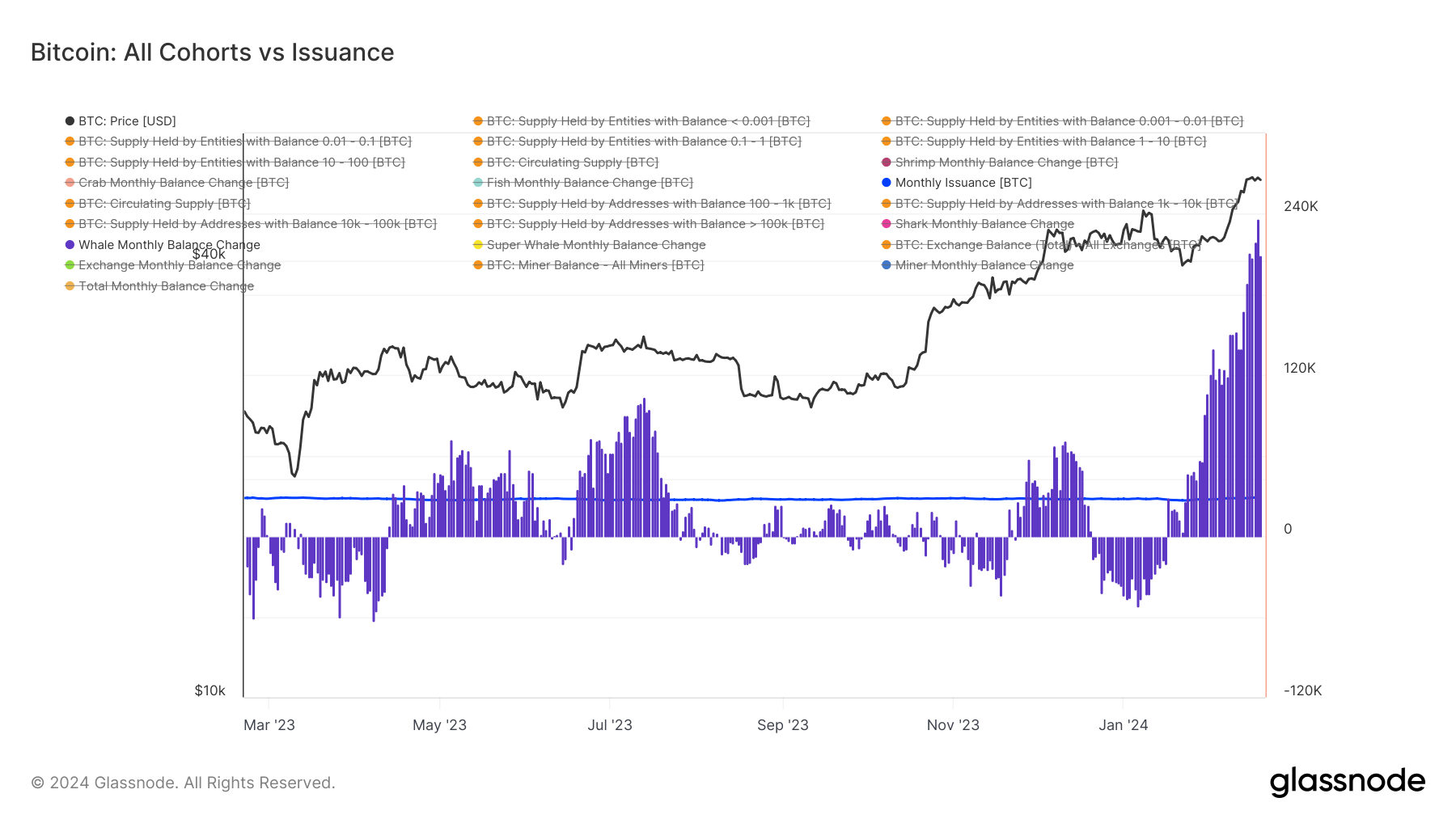

Digging deeper into the behavior of specific groups, the 'Whales,' entities holding from 1k-10k Bitcoin, are accumulating approximately 236,000 BTC over the 30-day period, leading the accumulation race. Meanwhile, the 'Super Whales,' those holding 10,000 Bitcoin or more, have been observed distributing around 50,000 Bitcoin in the past month.

At the same time, exchanges have witnessed a net outflow of around 50,000 Bitcoin in the past 30 days. Among smaller groups, 'Shrimps,' individuals holding less than 1 Bitcoin, have accumulated 13,000 Bitcoin, while 'Crabs' and 'Fish' have been noted to have low distribution in the past 30 days.

Bitcoin ETFs, such as Grayscale, often distribute their holdings across multiple wallets. Furthermore, based on data from Glassnode, entities with assets under management exceeding 51 million USD are currently classified in the 'Whale' category.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)