The Rise of RWA and Stobox ($STBU) ?

Stobox: Asset Tokenization Through Web2 and Web3 Integration

The financial sector is witnessing a paradigm shift with the advent of blockchain technology, and Stobox is at the forefront of this revolution. By seamlessly integrating Web2 and Web3 technologies, Stobox has crafted an ecosystem that not only simplifies the issuance, management, and trading of security tokens but also bridges the gap between traditional finance and the digital asset landscape.

Awards and Recognition

- Asset Tokenization of the Year 2019 at Malta AI & Blockchain Summit

- Startup of the Year 2021 in Los Altos (USA, CA) by Hackernoon

- The Most Promising Startup of the Year at AIBC Summit in Dubai 2023

A variety of successful use cases and stories from businesses that have embraced Stobox's tokenization solutions.

Landshare: Bridging US Real Estate with Global Investors

Landshare's approach to tokenizing residential apartments in the US exemplifies the classic asset tokenization use case. By offering these properties to a global audience, including non-accredited investors, Landshare has managed to increase property value through liquidity premiums and expanded demand.

Candela: Capitalizing on Local Brand Strength

Candela's success story highlights the potential of targeting domestic markets through tokenization. By selling tokenized villas in Mexico, Candela tapped into the local crypto community and high net worth individuals, raising significant funds while leveraging its strong local brand presence.

GL Capital: Enhancing Liquidity for Investors

GL Capital's tokenization strategy underscores the growing demand for liquidity among investors. By raising funds from accredited US investors even before the official launch of their offering, GL Capital showcased the allure of tokenization in providing more exit opportunities for investors.

Pylon: Empowering Global Expansion for Startups

As a graduate from YCombinator, Pylon's journey into tokenization reflects the changing tides in startup financing. By incorporating global institutional investors into their funding mix, Pylon has harnessed the power of tokenization to gain leverage and fuel their international expansion.

Virtual Reality and Beyond: Disruptive Crowdfunding

A European VR startup's decision to forgo traditional institutional investors in favor of token-based crowdfunding is a bold move that illustrates the disruptive potential of Stobox's platform. This approach allows the company to target an international audience and raise funds in a tax-efficient manner.

Glory Entertainment: Fostering Creative Communities

Glory Entertainment's mission to support global artists through Web3 technologies is a prime example of how Stobox's solutions can enhance community engagement. By building a creator community to fund and promote their offerings, Glory Entertainment is embodying the community-first philosophy of Web3.

Ratio Group: Funding the Green Revolution

The Ratio Group's initiative to fund a waste management facility in Canada through tokenization is a significant step toward sustainable development. This use case demonstrates how Stobox's technology can attract investors to fund environmentally conscious projects.

Sterling Woodrow: Accessing European Markets

By tokenizing London real estate and reaching out to European professional investors, Sterling Woodrow is exploring new frontiers in investment. The use of a Liechtenstein-based company for issuing tokens shows the strategic approach to jurisdiction and investor reach.

Quarry Dynamics: Innovating Crypto Mining Investments

Quarry Dynamics' security token offering gives investors a share of profits from crypto mining operations, highlighting the innovative approaches to investment that Stobox enables. This case shows how tokenization can provide exposure to niche markets without the complexity of establishing infrastructure.

Nature’s Vault: A Sustainable Gold Standard

Nature's Vault presents an innovative solution to carbon emissions by tokenizing unmined gold. This approach ensures that the gold remains in the ground, offering investors a sustainable alternative to traditional gold ownership.

Powershift Capital: DAOs and Private Equity

The concept of a private equity fund operating as a DAO is groundbreaking, and Powershift Capital is at the forefront of this innovation. Stobox's technology enables high engagement and reduced overheads, paving the way for superior returns.

The Stobox Ecosystem: A Symbiosis of Innovation and Regulation

Stobox's ecosystem is designed to cater to the diverse needs of modern businesses and investors. It is built on a robust architecture that includes several key modules and four innovative products: DS Dashboard, DS Swap, Soulbound ID, and Progress. This infrastructure has enabled businesses to harness the power of blockchain for increased liquidity, global investment opportunities, and enhanced community engagement.

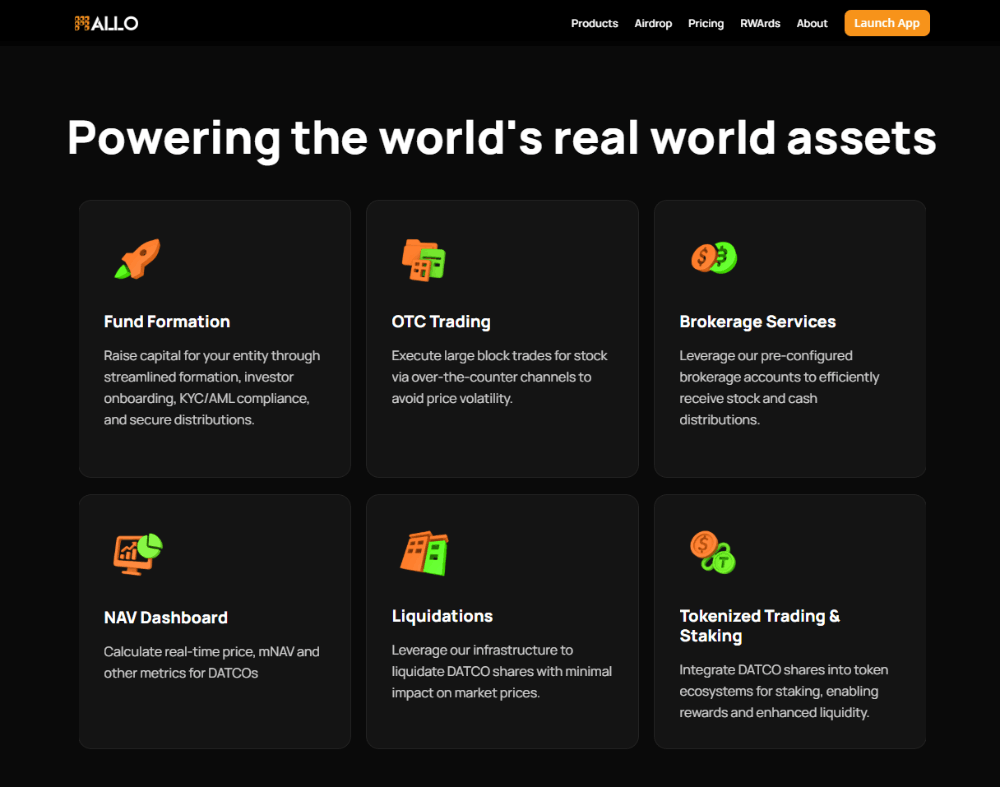

DS Dashboard: Simplifying Security Token Management

The DS Dashboard is a comprehensive tool for companies looking to manage their security token offerings (STOs) with ease. It provides a user-friendly interface for both issuers and investors, streamlining the complex processes associated with STOs.

DS Swap: A Secondary Market Solution

DS Swap addresses the need for a secondary market where security tokens can be traded. It offers a decentralized platform that ensures compliance with regulatory frameworks while facilitating peer-to-peer transactions.

Soulbound ID: A Web3 Identity Layer

Soulbound ID introduces a novel concept in the digital identity space. It allows users to have a unique and non-transferable identity within the Stobox ecosystem, which is crucial for maintaining trust and accountability in digital transactions.

Progress: Tracking Development and Engagement

Progress is a tool within the Stobox ecosystem that tracks the development and engagement of various projects. It ensures transparency and provides stakeholders with up-to-date information on the projects they are invested in.

Stobox Digital Assets: A Suite of Purpose-Driven Tokens

Stobox's dedication to innovation and regulatory compliance is reflected in its array of digital assets, each with unique features and use cases within the ecosystem.

Stobox Security Token (STBX)

The STBX token represents an investment in Stobox Technologies Inc., allowing token holders to share in the company's success and potentially receive dividends.

Stobox Utility Token (STBU)

The STBU token serves as the fuel for transactions within the Stobox ecosystem. It is used for service fees, access to premium features, and incentivizes participation and engagement.

Soulbound ID Community Token (SOULB)

The SOULB token is a community-focused asset that represents membership and identity within the Stobox ecosystem. It is non-transferable and ties the user's reputation to their activities.

Soulbound ID SBIDs (NTT)

SBIDs are non-transferable tokens that act as digital badges or certificates within the Soulbound ID framework. They verify the user's achievements, credentials, or affiliations.

Conclusion: Stobox's Role in Shaping the Digital Asset Landscape

Stobox has emerged as a pivotal player in the digital asset space by offering a harmonious blend of technological innovation and regulatory compliance. Its ecosystem empowers businesses to leverage blockchain technology for tangible benefits, while its diverse range of digital assets caters to the varied needs of its users. As the world continues to embrace digital transformation, Stobox's approach to tokenization and community engagement positions it in the ongoing evolution of asset management and investment.

Whether you're a business looking to tokenize your assets or an investor seeking new opportunities in the digital domain, Stobox offers a gateway to the future of finance, where traditional barriers are dismantled, and global accessibility is the norm.

Resources:

https://www.stobox.io/

https://docs.stobox.io/

https://whitepaper.stobox.io/

https://twitter.com/StoboxCompany

NOTE: The articles written here are for informational purposes only and are not investment advice.

Please, DYOR (Do Your Own Research)!