Is Ethereum Gas Fees at Record Lows a Bad Sign?

Gas fees continue to hit record lows, with some analysts suggesting that this could be a sign of the next big price rally for ETH.

As reported on August 12, 2024, gas fees on the Ethereum network have dropped to 2 gwei - the lowest level recorded in the past 5 years - leading to a resurgence in Ethereum inflation, raising concerns about the long-term impact on ETH supply and value.

But 2 gwei is not the bottom yet, as today, August 16, gas prices on Ethereum continue to "bottom out" with average transaction fees fluctuating around 1.1 - 1.9 gwei, at times dropping below 1 gwei.

Some analysts believe that the decline in Ethereum gas fees is the result of a combination of factors.

Lack of demand for Ethereum block space, even with a stable number of users, they mainly participate in interacting with bridge activities, restaking/staking, approve (which does not cost much gas fee)... with the condition of locking tokens for a period of time to enjoy yield and the potential to receive airdrops on Ethereum layer-2.

Users are preferring to use other blockchains because they want to "catch the trend", for example, the memecoin trend on Solana is being attracted by pump.fun or makenow.meme platforms.

Costs and performance on new blockchains or layer-2 have been cheaper since the completion of the Dencun upgrade in April, in line with founder Vitalik Buterin's vision of expanding to layer-2.

Therefore, users have more choices in usage besides Layer-1 Ethereum. Analysts affirm that low transaction gas fees on the network do not mean "dead blockchain" as users often "rumor".

The clearest evidence is that activity on Ethereum is still going strong, with key indicators such as the number of daily transactions, the number of active wallet addresses, and the number of active ERC-20 addresses showing no signs of slowing down.

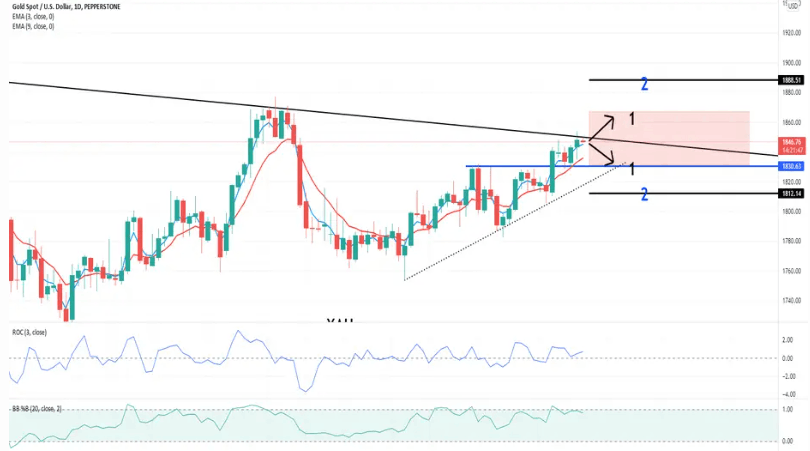

Another positive sign is that analysts who compared historical data unexpectedly found a correlation between low gas fees and strong price increases of ETH shortly after.

Ryan Lee, chief analyst at Bitget Research, commented:

"Whenever Ethereum network gas fees drop to a new low, it is usually a sign that ETH has bottomed out in the mid-term.

ETH prices tend to grow strongly after this cycle, and at the moment, it coincides with the interest rate cut cycle, potentially opening up a historic price increase for the market in the coming time."

However, as transaction fees on the network have declined, the amount of ETH burned via the EIP-1559 mechanism has also plummeted, meaning that the supply of this token has begun to increase, facing inflation again.

Data shows that more than 16,000 ETH, equivalent to nearly $42 million at current prices, has been added to the total Ether supply in the past week, pushing the supply up to 0.7%/year, instead of the deflationary state that occurs during periods when transaction fees on Ethereum skyrocket.

However, some users in the community have expressed concerns that stimulating demand to expand to layer-2 could also be a "double-edged sword", causing Ethereum to never return to a deflationary state.

"Layer-2s will continue to innovate to avoid creating a high-fee environment for themselves, which is a wake-up call for Ethereum developers. The result? Ethereum fees will remain low unless the network significantly increases transaction demand.

You have to balance scaling through layer-2s with keeping your core users on mainnet...not indiscriminately pushing them to dozens of other networks in the ecosystem," said 0xbreadguy, an anonymous DeFi developer on X (formerly Twitter).

"L2s will make Ethereum deflationary again"

No they won't - and we already have examples of why that's true.

A report on L2s, blobs and why the Ultrasound Money meme is dead without mainnet users

TLDR

🔹L2s will only make ETH deflationary if they saturate both the blob and… pic.twitter.com/yXh4aLa0jX— BREAD (@0xBreadguy) August 13, 2024

Among those who think low transaction fees are a sign of “blockchain trouble,” there is a solution being proposed to address this situation: Attract more users to transact on the Ethereum mainnet.

Martin Köppelmann, founder of the Ethereum sidechain Gnosis, proposed a way to attract more users to the mainnet by raising the network’s gas limit — which was originally proposed by “father” Vitalik Buterin in a discussion on Reddit in January 2024.

Because raising the gas limit would increase the Ethereum mainnet’s transaction capacity and reduce fees. But it also comes with the risk of increased operating costs for validators - the people who run the software that processes transactions on the network.

At the time of writing, ETH price has decreased by more than 2.5%, trading around $2,570 after the report recorded negative Ethereum ETF inflows of $39.2 million in the trading session on August 15.