$JUP Initial Circulation Supply Reduced to 1.35B: How Will This Affect Price Discovery?

The decrease in $JUP's initial circulating supply to 1.35 billion has ignited optimistic speculation regarding its price discovery, especially as Jupiter, Solana's largest DEX aggregator, prepares for its upcoming launch.

With Jupiter, the leading DEX aggregator on Solana, primed for the launch of its governance token $JUP in less than 24 hours on January 31st, the cryptocurrency community is buzzing with anticipation over the latest updates. The revised tokenomics, unveiling a decrease in the initial circulating supply from 1.7 billion to 1.35 billion, has ignited fervent discussions among investors and analysts. They are closely examining how this substantial alteration will influence $JUP's price discovery in the volatile crypto market.

The reduced initial supply, approximately 26% lower than initially anticipated, has already had a significant impact on pre-market trading for $JUP. Currently, $JUP is trading at around $0.74 on the Whales Market OTC platform, with $26 million worth traded, and at $0.66 on the Aevo exchange. This averages to approximately $0.70, giving Jupiter a market valuation of around $945 million for the circulating supply. With a total supply of 10 billion tokens, the fully diluted valuation (FDV) is set at $7 billion. This revised market cap, considerably lower than the previous estimate of $1.4 billion at a circulation of 1.8 billion, suggests considerable potential for growth and price movement for $JUP.

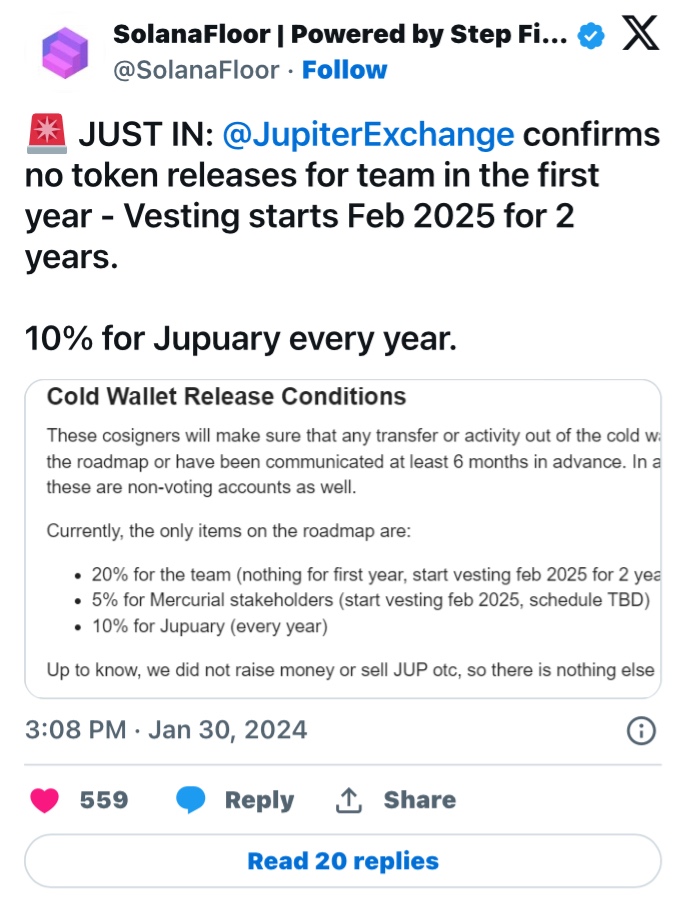

The team's announcement of no token unlocks until next January, combined with the absence of investor unlocks, instills a robust sense of confidence among investors. This strategic decision will contribute to a more stable and natural price discovery for $JUP. Nonetheless, the market eagerly anticipates the comprehensive whitepaper on $JUP, slated for release post-launch, which is expected to offer deeper insights into its long-term potential.

Major cryptocurrency exchanges have already revealed listings for $JUP, with the market closely monitoring potential listings on prominent platforms such as Binance, Coinbase, and Kraken. These significant exchanges typically announce listings either concurrently with or shortly after a token's launch, further fueling anticipation among investors and traders.

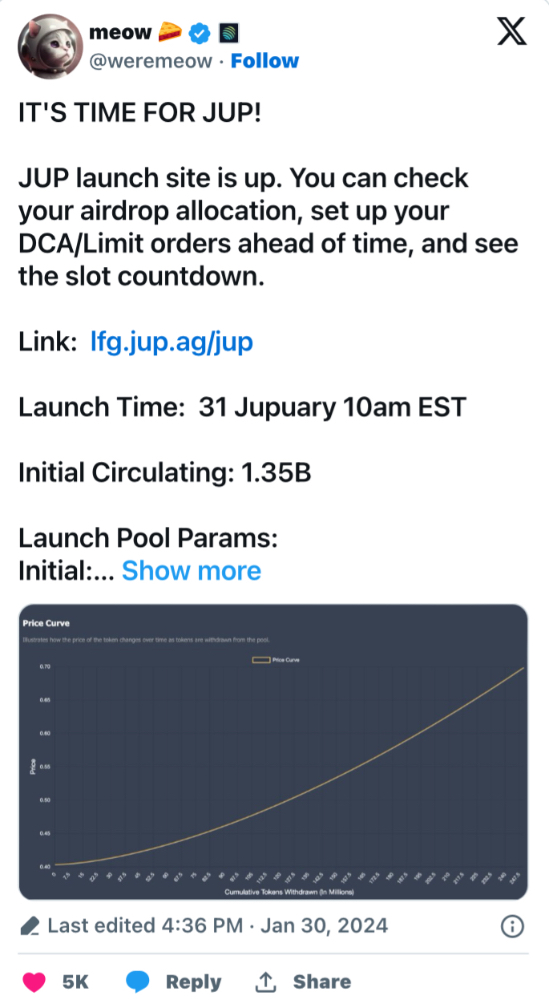

The trend of a significant portion of airdrop claimers selling on the first day is anticipated to persist, allowing genuine price discovery to unfold shortly thereafter. Jupiter has established enticing launch pool parameters, featuring an initial price range of $0.4 to potentially $0.7, encompassing over 250 million tokens. With a curve of 1.6, approximately half of these tokens will be accessible within the $0.4 to $0.5 range, ensuring sufficient supply for early adopters in alignment with demand and order flow.

In contrast to typical launches characterized by tokens being offered at significant discounts, prompting swift buying and selling, the initial price of $0.4 for $JUP, translating to a $540 million market cap, does not present an exaggerated discount from the OTC market price. This is expected to encourage more organic buying activity rather than speculative quick flips, signaling a healthier market entry for $JUP.

With Jupiter's revised tokenomics now established, $JUP is poised to navigate the intricate landscape of cryptocurrency markets. The decrease in initial circulating supply, along with well-planned launch parameters and increased investor enthusiasm, presents a favorable outlook for $JUP's market journey. As the cryptocurrency community observes, the true test for $JUP will be its performance in the real-world market following the launch, which will ultimately shape its future trajectory.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)