Ethereum leads liquidations as $259 million wiped out in 24 hours amid Bitcoin price swing

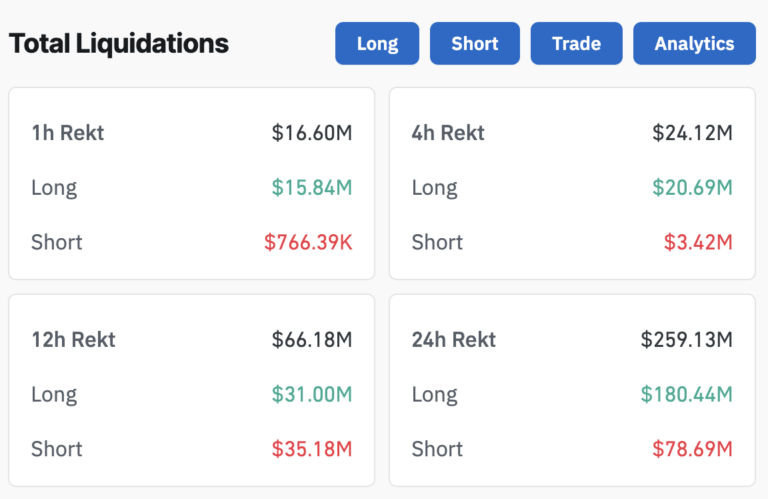

In the past 24 hours, the cryptocurrency market experienced significant turbulence, resulting in over $259 million in liquidations, with Ethereum liquidations leading the losses. The crypto market, already known for its volatility, saw a surge in liquidations across multiple platforms, particularly in long positions, as Bitcoin’s price swings contributed to heightened uncertainty. With Ethereum accounting for over $73 million of these losses, the market is showing clear signs of over-leveraging by traders.

Data from Coinglass reveals that 86,408 traders were liquidated during this period, highlighting the increasing risk associated with high leverage trading. The largest liquidation order, valued at $9.63 million, occurred on OKX's BTC-USDT swap, further demonstrating the massive impact of market fluctuations.

Bitcoin Price Swings Add to Market Volatility

Bitcoin's recent price fluctuation between $67,000 and $65,400 played a crucial role in amplifying the volatility of the broader cryptocurrency market. With Bitcoin being a bellwether for the market, even small movements in its price tend to send ripples across various crypto assets. This period of price instability triggered a wave of liquidations, with Ethereum liquidations surpassing $73 million, solidifying its position as the hardest hit among cryptocurrencies.

The significant liquidations of long positions accounted for $186.31 million, showing that traders expecting a continuous upward trend were severely impacted. Short positions saw a lesser, but still substantial, liquidation of $78.61 million. The predominance of long positions in the liquidation total indicates that many traders over-leveraged their positions in anticipation of Bitcoin and Ethereum price surges, only to be caught off-guard by the sudden price corrections.

Breakdown of Exchange Liquidations

Exchange data paints a clear picture of where the liquidations hit hardest. Binance led the liquidations with $9.40 million, a figure largely made up of long positions, which accounted for over 73% of the platform’s losses. OKX and Bybit followed closely behind, with liquidations of $4.70 million and $3.93 million, respectively. Both platforms also reported that over 86% of the losses came from long positions.

These statistics underline the risks of high-leverage trading and suggest that many traders are entering the market with overly optimistic expectations, particularly regarding assets like Ethereum. The $73.16 million in Ethereum liquidations represents one of the largest losses of the day, further exacerbating concerns about the current state of the crypto market.

Market-Wide Impact of Liquidations

The crypto market has been on a rollercoaster ride lately, with rapid price movements causing traders to panic and further drive up volatility. With Ethereum playing a leading role in the liquidation figures, it’s clear that its price movements are crucial to the stability of the broader market. The ongoing sell-offs and liquidations point to a market that is struggling to maintain its footing in the face of external pressures and internal speculation.

Moreover, these liquidation events highlight the precarious nature of trading in cryptocurrencies, especially when traders take on high-risk positions. While large institutional investors may have mechanisms to hedge against such losses, smaller retail traders often bear the brunt of these liquidations. The rise in Ethereum liquidations is a case in point, where over-leveraging can lead to substantial losses within a very short period.

Open Interest and Over-Leveraging

The surge in liquidations is closely tied to the recent spike in Bitcoin Open Interest, which recently hit an all-time high. Open Interest refers to the total number of open or outstanding futures contracts, and a high level of Open Interest can indicate increased activity and speculation in the market. However, it can also point to over-leveraging, which raises the risk of significant liquidations when the market turns against traders.

With Ethereum also experiencing a rise in Open Interest, the market has become increasingly susceptible to these liquidation cascades. The $73.16 million in Ethereum liquidations serves as a reminder that excessive optimism, combined with high leverage, can quickly lead to devastating losses in an unpredictable market. Traders must remain vigilant and consider adopting more cautious strategies, particularly in times of heightened volatility.

The Role of Leveraged Positions

Leveraged trading has become a popular strategy in the cryptocurrency market, allowing traders to amplify their potential returns. However, this approach comes with its own set of risks, as seen in the massive Ethereum liquidations over the past 24 hours. Leveraged positions are highly sensitive to market swings, and when prices move against traders, the losses can be much more severe than in traditional trading.

The liquidation of long positions, particularly those involving Ethereum, underscores the dangers of assuming that bullish trends will continue indefinitely. As the crypto market remains volatile, traders need to account for potential reversals and protect their positions with adequate risk management tools. Stop-loss orders, diversification, and limiting leverage can all help mitigate the risks of sudden market downturns.

Ethereum and the Crypto Market

Looking forward, Ethereum and the broader cryptocurrency market will likely continue to experience volatility, especially as external factors such as regulatory developments, macroeconomic shifts, and market sentiment play a significant role in shaping price movements. The sharp increase in Ethereum liquidations signals a need for traders to reassess their strategies and focus on reducing exposure to high-risk positions.

While the promise of significant gains will always attract traders to leveraged positions, the events of the past 24 hours serve as a stark reminder of the risks involved. The crypto market’s unpredictability means that maintaining a balanced and well-thought-out trading approach is essential to navigating the highs and lows of this emerging financial landscape.

Reference

https://cryptoslate.com/insights/ethereum-leads-liquidations-as-259-million-wiped-out-in-24-hours-amid-bitcoin-price-swing/

https://www.coinglass.com/LiquidationData

https://cryptoslate.com/insights/bitcoin-open-interest-hit-another-all-time-high-adding-32440-btc-in-7-days/