CRYPTO DAILY NEWS

Solana Strikes Back

Weekly Recap: Chapter Two pre-orders, BTC eclipses Silver

1️⃣ Solana Mobile Strikes Back

Solana Mobile has announced pre-orders for their second device, Chapter Two, set for delivery in 2025 and priced at $450 instead of $599 (a reduction from its initial $1000 launch).

Buying the original Saga actually turned into a profitable venture for its holders, thanks to airdrops like BONK, WIF, and Sagamonkees. If you take the BONK airdrop alone ($1025 at its all-time high), the $599 would have yielded you a 58% return — a strong draw to add your name to the list for Chapter Two.

Playing further into this dynamic, Solana has introduced a referral system for this second phone that rewards participants with ecosystem rewards from partners like Tensor, Phantom, Solflare, DRiP, and Backpack Wallet. Even with all of these perks, there's skepticism over the long lead time, with some anticipating it will never reach production – Solana says it will reimburse all users in that case.

2️⃣ Blast's Big Bang

Ponzinomics meets Shark Tank. Blur’s L2, Blast, launched their testnet this week by announcing the Big Bang Competition.

Blast is leveraging the $1.3 billion already deposited by over 100k users as incentives, hoping to attract dapps building in 8 categories to their testnet. Winners, decided by 12 judges, will be announced via livestream on Feb 20 and actively promoted to Blast users come mainnet launch in late Feb. Additionally, winners will have access to office hours with people like founder Pacman himself, score introductions to investors, and receive part of the 50% of Blast’s airdrop specifically reserved for developers.

Interested in participating?

- Register here for the Blast Builders Slack before Feb 16

- Submit your project by Feb 16 in the form of a 3-minute video.

Simple as that! Also, Blast has made a point of stressing that projects of all stages are welcome and that early-stage and late-stage projects will be judged by separate criteria.

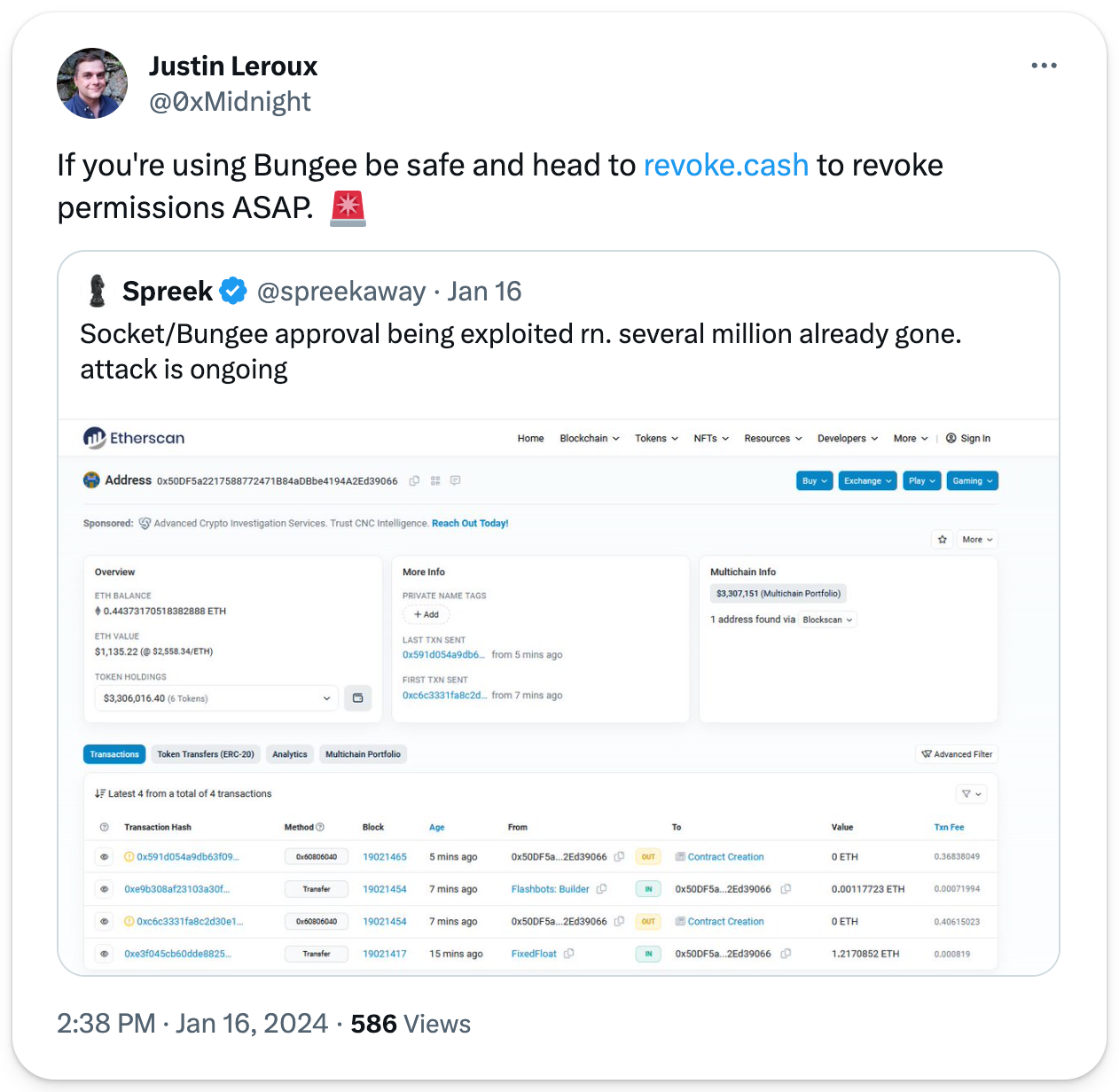

3️⃣ Revoke, Revoke, Revoke

On Tuesday, cross-chain bridge Bungee powered by Socket was hit with an exploit, resulting in a total loss of $3.3M. The hack came by way of active token allowances — think of it as a backdoor left open — that let the crook siphon out all approved tokens from people’s wallets when they accessed the smart contract.

Socket responded quickly, pausing the compromised contracts to prevent further draining of wallets. Sadly, this event continues to underscore the importance of security and wallet hygiene in Web3. The attack could have been prevented by simply revoking token approvals, a precaution we walk through in our explainer on Revoke Cash.

We strongly recommend you take the two minutes needed to read it because what good are gains if they aren’t locked in?

4️⃣ Bitcoin Blows Past Silver

Right out of the gate, Bitcoin ETFs eclipsed silver in the ETF market, replacing it in second place to trail only behind gold among commodities.

Thanks to Grayscale Bitcoin Trust's transformation into an ETF, nearly $30 billion has flowed into Bitcoin ETFs, dwarfing silver ETFs' $11 billion. That being said, gold, the traditional safe-haven asset, remains the top dog with about $95 billion. Further, since Jan 12, Grayscale has unloaded over $2.3 billion — selling pressure to which many attribute the carnage in the market this week.

Nevertheless, the launch of the Bitcoin ETFs remains a remarkable success. As of Jan 16, the new funds had traded $10b in volume. This compares to the $450m, the collective amount traded by all ETFs that launched in 2023 on that day. This proves important to remember as we enter into a potential lull in the market. These numbers, coupled with BTC ETFs surpassing silver ETFs, affirm the launches were a resounding success. At this rate, who knows, it might not be long before gold’s digital twin boots it from the throne.

5️⃣ SEC Slows ETH ETF

In classic Gary behavior, the SEC announced yesterday they want to slow things down a bit on Fidelity's proposal for an Ethereum ETF and delayed a decision on its approval until March 5. This chill pill approach was expected, said ETF expert James Seyffart, who thinks, while the decision has only been delayed til March, the real action will begin in late May.

The Ethereum ETF story officially kicked off last November when Fidelity announced they intended to launch the Fidelity Ethereum Fund. They're making a strong case, too, citing last year's court ruling determining the SEC had failed to provide any logical reason why it should reject spot ETFs when it had already allowed futures-based ones – Ethereum Future ETFs went live last October.

Remember, though Fidelity isn't alone in this race; BlackRock has tossed its hat in the ring with Larry Fink stating on CNBC that he sees the value in having an Ethereum ETF. Just another step in his plan to tokenize the world.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)