Case Study: Pyth Network

The Pyth network is a first-party financial oracle network designed to publish continuous real-world financial data on-chain in a tamper-resistant, decentralized, and self-sustainable environment.

Pyth Network, a high-frequency oracle built using Solana ecosystem technology, presents a compelling use case in data sharing for decentralized finance (DeFi), offering products like real-time price feeds and benchmarks to be used by a host of financial service providers. Its ecosystem is a thriving community hub where users can leverage information contributed by vetted data providers, become providers themselves, or simply access desired statistics from the network. And not only is Pyth Network enabling near-instant, open-source data at your fingertips, but it is growing the concept of a self-sustaining, crowdsourced DeFi resource powered by onchain governance and user participation.

If all this activity sounds, well, fast — it is. As Yaser Jazouane, head of product at Douro Labs, puts it, a blockchain oracle is less about a wizard’s clairvoyance and more about the precision of deep, real-time computer analytics, which is only possible on a high-throughput, low-latency blockchain like Solana.

In DeFi, the Pyth Network’s role is crucial: It aggregates diverse data points in order to sync on the most accurate price for any given asset. Without oracles, decentralized exchanges and other DeFi protocols would have no consensus, says Jazouane.

“There's no global, universal truth in the world for what any asset is worth,” he explained, adding that “data-driven solutions must come to a consensus about what is the most prevalent price out there — that's what makes an oracle."

That’s where Pythnet comes in. Oracles like the Pyth Network aggregate “many, many views around the price,” in order to provide decentralized applications (dApps) with the most universally agreed-upon information possible.

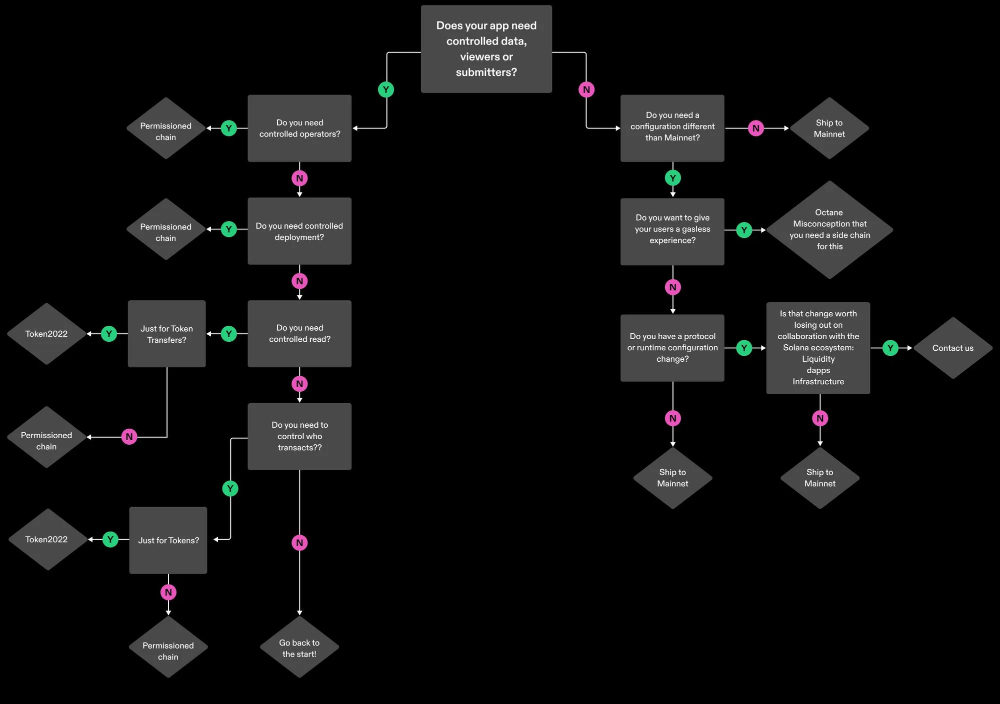

How a Solana Permissioned Environment (SPE) empowers Pythnet

Pythnet is a Solana Permissioned Environment (SPE), a specialized Solana appchain environment designed for custom uses. This flexibility allows for the creation of a permissioned — or as Jazouane prefers to call it, a "governed" network — where access is permissionless yet managed through the use of tokens.

Pythnet's main job is to gather different prices and combine them into one reliable price for each item it tracks. To do this, it actively delivers real-time market data that anyone can track, encompassing 292 feeds in cryptocurrencies, 68 in equities, 16 in foreign exchange, two in commodities, and eight in fixed income/rates at the time of publication. It distributes this data across more than 45 blockchains, enhancing a wide range of DeFi ecosystems.

Over 90 major market players contribute to Pythnet, ensuring that over 269 applications, like perpetuals and lending protocols, receive secure, accurate and reliable data.

According to Jazouane, the choice of a Solana permissioned environment for Pythnet was influenced by several factors:

- Solana’s fast block time — the chain creates blocks every 400 milliseconds — allows Pythnet to produce high-frequency price updates.

- A culture of collective, collaborative expertise found within Solana’s developer community.

- Flexibility and control provided by the Solana protocol, especially in terms of gas configuration and the cost of deploying applications to ensure focus and security for its intended use.

Known for its high scalability, rapid transaction speeds, and low fees, the Solana protocol provides an ideal foundation for Pythnet. Like the Solana blockchain, Pythnet is designed to update very quickly with almost no delay. Pyth’s oracle services enhance Solana's ecosystem by providing the rapid-fire data that allows for seamless communication between different blockchains — a critical feature for a decentralized, multi-chain future.

From its inception, Pythnet has always been developed in close alignment with the Solana ecosystem, says Jazouane. The initial version of Pyth, which is still operational, was built directly on Solana. Pyth Network’s primary target for sharing this data is high-throughput trading applications, which require the capacity for demand require capabilities for high-frequency data exchange trading and lightning-fast transaction rates. Thankfully, says Jazouane, Solana was designed to deliver low latency, high throughput, and optimal block rates, making it well-suited for these kinds of demanding applications.

Solana has a block time that basically produces blocks every 400 milliseconds. Pyth also produces prices every 400 milliseconds. This feature of Solana is perfect for a high-throughput data use case like Pyth. This is one of the reasons why the marriage made sense.

A customized, trusted validator set

As an SPE, Pythnet can be customized to its own specific parameters — including a validator set optimized for oracles. Pythnet is a proof-of-authority (PoA) network, in which a select group of validators known for their reliability and strong reputation are responsible for verifying and approving transactions. This approach streamlines the transaction process for Pythnet’s needs.

The Pythnet oracle is managed by the Pyth DAO, a decentralized organization governed through tokens, which makes sure only certain vetted groups can update prices. Once publishers are admitted, they are provided with Pythnet’s native token (PGAS) to perform their functions. PGAS is used as the token for transaction fees within the Pythnet environment. It acts as a gating factor, ensuring that only authorized publishers and validators can participate in the network. The token is considered valueless outside its specific use within Pythnet, emphasizing its role as a control mechanism rather than a tradable asset.

PoA environments are useful for protocols who want to use blockchain without everyone seeing their information. In the Pyth Network, only permissioned publishers can publish data, but anyone can read and utilize.

The benefits of Solana Permissioned Environments (SPEs)

The key advantage of SPEs lies in their ability to provide customizable, governable blockchain environments using Solana Virtual Machine (SVM) architecture. They are ideally suited for specific applications that demand customizable environments.

While Pyth operates on both Solana mainnet and Pythnet, it also retains the ability to transfer prices constructed on Pythnet to over 45 other blockchains — a function that is only possible from a high-performance mainnet such as Solana. This cross-chain capability is crucial for wider accessibility and usability of the data Pyth provides.

Utilizing an SPE model, Pyth can enable new uses for financial data sharing:

- Distributed: Pythnet presents a new, fully crowdsourced and transparent oracle system.

- High-frequency updates: Traditional oracles didn’t update fast enough for many financial applications, leading to inaccuracies and vulnerabilities. Pyth offers low-latency, high-frequency price feeds, a feature that requires a high-throughput blockchain like Solana to operate effectively and deliver real-time data.

- Coverage and availability: Developers have often lacked access to necessary price feeds for their specific blockchain, limiting the development of financial services. Solana's versatile environment supports a wide range of applications with the ability to integrate with Pyth data, such as exchanges, lending platforms, and analytics tools.

- Sourcing and quality: Previous data sources were opaque, often aggregated from third-party sources, undermining trust and accountability. Pythnet sources from multiple data publishers for each product, thereby enhancing the accuracy and robustness of its system. Meanwhile, Solana's decentralized infrastructure invites various publishers to submit pricing information securely and reliably. This combined decentralized approach helps in reducing the risk of manipulation or single points of failure.

- Transparency: Solana's permissionless environment aligns with Pyth's ethos of open access, allowing developers to integrate with Pyth data seamlessly and without barriers. Pyth data from Price Feeds can be viewed online.

- Gas efficiency: Pyth’s Pull Oracle architecture is highly gas efficient, as users only pay for the prices they request. Solana's low-cost transaction environment complements this design, making it cost-effective for users to access data.

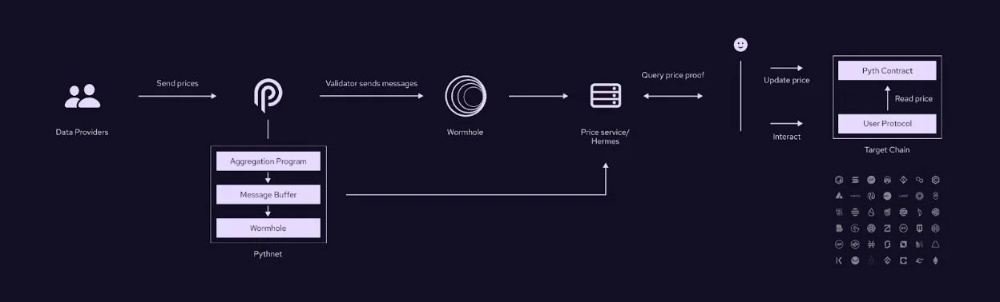

It's important to note that SPEs operate separately from the Solana mainnet, which means they do not inherently benefit from interoperability with the broader Solana ecosystem. Bridging SPEs to the mainnet is possible through the use of a bridge called Worhole.

"We don't bridge currently back and forth between the two [Pythnet and mainnet] because there is no need," Jazoune said, explaining that two versions run in parallel. "We are bridging out from the appchain to other blockchains through the Wormhole bridge.”

According to Jazouane, the Wormhole bridge helps Pyth access as many as 45 other blockchains.

“This is the power of [a permissioned environment] is connected to other blockchain worlds through bridging,” said Jazouane.

The strategy, he says, allows Pythnet to operate directly within the Solana protocol’s high-throughput ecosystem while still participating in a broader multichain industry.

Enabling multichain DeFi application

The integration of Solana and Pyth has enabled various applications in DeFi. Platforms like Synthetix utilize Pyth's high-fidelity data for efficient and accurate trading operations, along with a number of traditional financial institutions. These applications highlight the practical benefits of combining Solana's high-speed blockchain with Pyth's reliable data feeds, which are updated by members every day.

What is Pyth Network Used For?

The core application of Pyth Network lies in providing real-time, accurate financial data to blockchain-based DeFi applications, thereby enhancing their functionality and reliability.

Its utility spans a broad range of financial applications:

- Lending Protocols: Pyth’s data, including real-time price feeds of assets like Tesla stock, is vital for lending platforms. It enables effective management of loans collateralized by specific asset tokens.

- Decentralized Exchanges: The network’s price feeds, such as the ETH/USD exchange rate, are essential for decentralized exchanges. They rely on this data for accurate trade valuation and market stability.

- Risk Management and Derivatives: Pyth’s data feeds are key in calculating risk metrics and valuing complex financial products. This includes futures and options in the decentralized finance space.

- Portfolio Management Tools: Investment tools and portfolio trackers leverage Pyth’s data for real-time asset valuation and performance analysis.

By integrating high-quality financial data on-chain, Pyth Network ensures that financial applications are built on a foundation of reliable and transparent data. This is crucial for informed decision-making and the robust functioning of the financial system.

How Does Pyth Network Work?

Pyth Network operates through a synergistic collaboration of various participants who regularly publish price updates on-chain.

The network’s operation is underpinned by several key components and processes:

- Publishers

Entities like crypto exchanges and trading firms that supply frequent price updates for various financial assets. For example, an exchange might publish BTC/USD prices, while a trading firm could provide Tesla’s stock price. The effectiveness of Pyth Network depends on the precision and promptness of data from these publishers.

- Aggregation Algorithm

Pyth Network uses a sophisticated weighted median algorithm for data aggregation. This method calculates a median of the prices, giving more weight to publishers known for accuracy and higher staking amounts. This approach guards against manipulation, ensuring data integrity and reliability.

- Economic Incentives

Publishers are motivated to deliver high-quality data through rewards linked to the quality of their price feeds. They also gain a share of the data fees paid by users, aligning their interests with the network’s objective of accurate data provision.

- Real-Time Data Updates

A key feature is its rapid data refresh rate, vital for applications needing current information. This feature establishes Pyth Network as a leading solution for real-time financial data in the blockchain environment.

What are $PYTH Tokens?

The PYTH token is the native cryptocurrency of Pyth Network. It plays a crucial role in coordinating the activities of various participants through crypto-economic incentives.

PYTH tokens are key to aligning the interests of different stakeholders in the network, such as publishers, consumers, and delegators.

In the Pyth Network ecosystem, these tokens are utilized in several important functions, including data staking, distribution of rewards, and governance. This makes them central to both the operational and strategic decision-making processes within the network.

Pyth Network Pros and Cons

Pros

- Democratizes financial data

- Supports DeFi applications

- Decentralized and transparent

- Advanced technical framework

Cons

- Complexity and technical challenges

- Dependence on participant integrity

- Emerging technology risks

Pros Explained

Democratizes Financial Data: Pyth Network’s greatest strength is in making high-quality financial data accessible to a wider audience. This democratization breaks down traditional barriers, allowing individuals and small entities to access information previously available only to large financial institutions.

Supports DeFi Applications: By providing reliable data feeds, it becomes a crucial component for various DeFi applications. It enhances their efficiency and reliability, enabling more complex and varied financial products and services on the blockchain.

Decentralized and Transparent: The network’s decentralized nature ensures transparency and fairness in the financial sector. This transparency is crucial for trust and accountability in financial transactions and applications.

Advanced Technical Framework: Pyth Network’s sophisticated aggregation algorithms and rapid data refresh rates position it as a technically superior platform compared to its peers. This technical excellence is vital for real-time decision-making in financial markets.

Cons Explained

Complexity and Technical Challenges: Despite its advantages, the technical complexity of Pyth Network might pose a barrier to entry for some users. Understanding and effectively utilizing the network requires a certain level of technical expertise.

Dependence on Participant Integrity: The network relies heavily on the honesty and effectiveness of its participants. The accuracy and reliability of the data depend on the quality of information provided by publishers, which could be a point of vulnerability.

Emerging Technology Risks: Being a relatively new and evolving technology, Pyth Network faces risks associated with adoption and integration into existing systems. The network must continuously adapt to changing market dynamics and technological advancements.

Latest Pyth Network News

Pyth Network has recently garnered significant attention in the DeFi sector, particularly with a major token airdrop valued at $77 million, distributing 250 million PYTH tokens to early users.

This event significantly increased the protocol’s market capitalization, highlighting its growing importance and potential in the DeFi space.

Moreover, boasting over 300 real-time price data points across various asset classes, it is set apart from competitors like Chainlink with its exceptional refresh rate speed.

Recent project developments:

- Multi-Chain Expansion: A recent focus is expanding its reach across multiple blockchain platforms, enhancing its versatility and utility in the DeFi ecosystem. This expansion is a strategic move to integrate Pyth’s services with a broader range of blockchain networks and applications.

- Innovative Airdrop Campaigns: The recent airdrop campaign conducted by Backpack, which distributed PYTH tokens to 74,000 wallets, showcases the network’s innovative approach to community engagement and token distribution.

- Market Capitalization Growth: Following its launch, the PYTH token experienced significant market fluctuations, demonstrating the high interest and speculative nature surrounding new tokens in the DeFi space. Despite these fluctuations, its market valuation remains commendable, reflecting investor confidence in the project’s long-term potential.

- Governance and Token Supply Plans: Pyth Network plans to gradually increase its token supply, with inflation incentives released every six months to decentralize governance further. This approach aims to balance token distribution and ensure a decentralized governance structure for the network.

The Bottom Line

Pyth Network represents a significant innovation in the blockchain and DeFi spaces, addressing the long-standing issue of restricted access to high-quality financial data. By harnessing blockchain technology and a diverse participant network, Pyth is steering the financial world toward a more open and equitable system.

With its ongoing developments and growing prominence in the DeFi space, Pyth Network is well on its way to becoming an integral component in the evolution of decentralized finance.

Thank you for reading!

If you found this content valuable, please show some love by commenting, reading, reacting and Tips to this article. A little donation can do so much for me :)

Here are my Addresses:

BITCOIN: bc1pynx6729f0tdet9fqd83972aw2xnr9a5zzak9egx79a23h0ewxj6slnwl9r SOLANA: DLty8P2BUR8ZeUr35tGnBH7LLn3S5fTKk3JzNePgtCHv ETH/MATIC/OP/ARB/FTM/AVAX/BNB: 0xa78D51b47334FD78643d56c4B3c009a4337eaBC2 INJ: inj1sqd65n2d690x6ezzx3pca956y0j9dnlvcgu9g0 SUI: 0x27b136b62a22d89679e0df6afba6bb506cc777cfb1dffdb2fee14ecb6d0268d3 APTOS: 0xce95104b351eb05517674b6813953a5d955659a7279551d34f8c17b179605548