Avoid Liquidation! How to Analyze a Coin Before Investing

Investing in cryptocurrencies can be highly lucrative but also incredibly risky. The volatile nature of the crypto market means that investors must exercise due diligence to avoid costly mistakes, such as liquidation.

Thoroughly analyzing a coin before investing is crucial to mitigating risks and making informed decisions.

This article explores the key factors and strategies you need to consider when evaluating a cryptocurrency for investment.

Understanding the Basics of the Coin

Before diving into the complexities of a coin, it’s essential to grasp its fundamental aspects. This foundational knowledge provides context and helps you understand the coin's potential.

Before diving into the complexities of a coin, it’s essential to grasp its fundamental aspects. This foundational knowledge provides context and helps you understand the coin's potential.

Whitepaper Analysis

- Purpose and Vision: The whitepaper outlines the coin's purpose, vision, and the problems it aims to solve. Evaluate whether the project addresses a real-world issue and how effectively it proposes to solve it.

- Technical Details: Assess the technological framework, including the consensus mechanism, scalability solutions, and any unique features. Ensure the technology is sound and innovative.

Team and Advisors

- Team Credentials: Research the backgrounds of the team members, focusing on their experience in blockchain, technology, and relevant industries. A strong, experienced team is often a good indicator of a project's potential success.

- Advisors and Partnerships: Check the advisors and partnerships associated with the project. Well-known advisors and reputable partnerships can lend credibility and provide valuable support to the project.

Use Case and Market Potential

- Utility: Determine the coin’s utility and how it is intended to be used. Coins with clear, practical use cases are more likely to succeed.

- Market Size and Demand: Analyze the target market and demand for the coin’s application. A large, growing market with increasing demand is a positive sign.

Evaluating Market Metrics

Understanding market metrics helps you gauge the coin’s performance, stability, and potential for growth. These metrics provide insights into market sentiment and investor confidence.

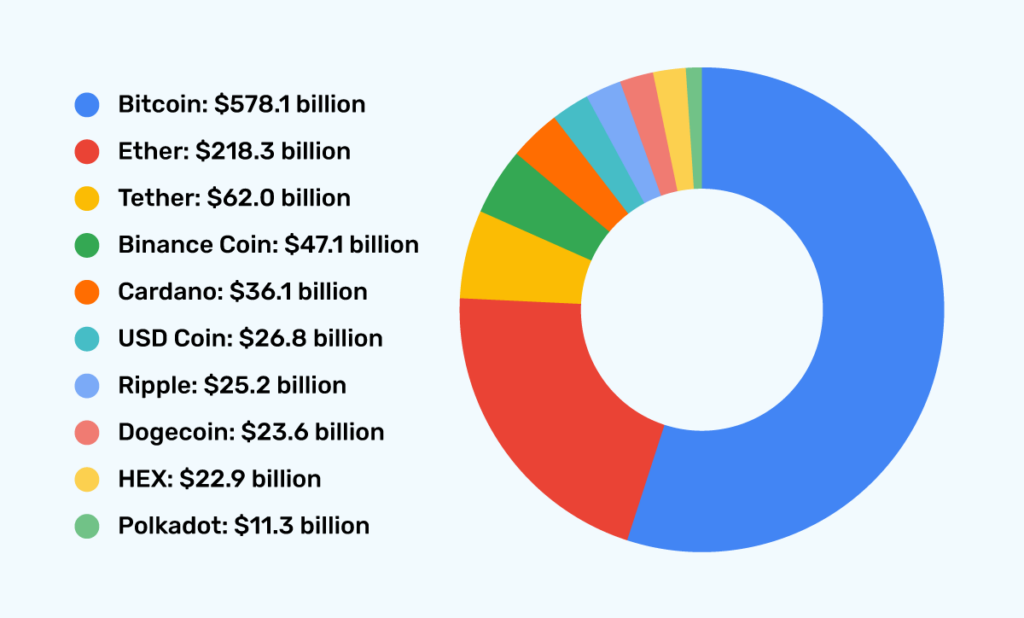

Market Capitalization

- Definition: Market capitalization is the total value of all the coins in circulation. It is calculated by multiplying the current price by the total supply.

- Significance: High market capitalization usually indicates a stable and widely accepted coin, while low market capitalization might suggest higher volatility and risk.

Trading Volume

- Definition: Trading volume refers to the total amount of the coin traded within a specific time frame.

- Significance: High trading volume indicates strong interest and liquidity, making it easier to buy and sell the coin without significantly affecting its price.

Price History and Volatility

- Historical Performance: Examine the coin’s price history to identify trends, cycles, and historical highs and lows. Understanding past performance can help predict future movements.

- Volatility: Assess the coin’s volatility. Highly volatile coins can offer high returns but also come with greater risk.

Circulating Supply and Total Supply

- Circulating Supply: The number of coins currently available in the market. A lower circulating supply can lead to scarcity, potentially increasing value.

- Total Supply: The maximum number of coins that will ever be created. Understand the coin’s issuance model and how it might affect future supply and demand dynamics.

Technical Analysis

Technical analysis involves using historical price and volume data to predict future price movements. This approach helps identify trading opportunities and potential entry and exit points.

Chart Patterns

- Trend Lines: Identify upward or downward trends by drawing trend lines. These lines help visualize the overall direction of the coin’s price movement.

- Support and Resistance Levels: Determine key support and resistance levels where the coin’s price tends to find buying or selling pressure. These levels can signal potential reversal points.

Technical Indicators

- Moving Averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA) are commonly used to smooth out price data and identify trends.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements. Values above 70 indicate overbought conditions, while values below 30 indicate oversold conditions.

- MACD (Moving Average Convergence Divergence): MACD helps identify changes in the strength, direction, momentum, and duration of a trend.

Volume Analysis

- Volume Trends: Examine volume trends to confirm price movements. Increasing volume during an uptrend or downtrend suggests strength in the current price movement.

- Volume Spikes: Significant volume spikes can indicate major buying or selling activity, often preceding significant price movements.

Risk Assessment and Management

Effective risk management is essential to protect your investment and minimize potential losses. Assessing and managing risks ensures you make informed decisions and are prepared for market fluctuations.

Risk-Reward Ratio

- Calculation: The risk-reward ratio compares the potential loss to the potential gain of an investment. A favorable risk-reward ratio typically means the potential reward outweighs the risk.

- Application: Use the risk-reward ratio to evaluate whether an investment is worth pursuing based on your risk tolerance.

Diversification

- Portfolio Diversification: Spread your investments across multiple coins and asset classes to reduce risk. Diversification helps mitigate losses if one investment performs poorly.

- Sector Diversification: Invest in different sectors within the cryptocurrency market, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and utility tokens.

Setting Stop-Loss and Take-Profit Levels

- Stop-Loss Orders: Set stop-loss orders to automatically sell a coin if its price falls to a predetermined level. This helps limit losses and protect your capital.

- Take-Profit Orders: Set take-profit orders to automatically sell a coin when its price reaches a predetermined target. This helps lock in profits and manage risk.

Staying Informed

- News and Updates: Stay updated with the latest news, developments, and regulatory changes in the cryptocurrency market. News can significantly impact coin prices and market sentiment.

- Community and Social Media: Engage with the coin’s community on platforms like Reddit, Twitter, and Telegram. Community sentiment can provide valuable insights into the coin’s potential and emerging issues.

Conclusion

Analyzing a coin before investing is crucial to avoiding liquidation and ensuring a sound investment strategy. By understanding the basics of the coin, evaluating market metrics, conducting technical analysis, and implementing effective risk management, you can make informed decisions and navigate the volatile cryptocurrency market with confidence. Thorough research and a disciplined approach are key to achieving long-term success in crypto investing.

Sources

- CoinMarketCap: Cryptocurrency Market Capitalizations

- Binance Academy: Understanding Market Cap, Volume, and Circulating Supply

- Investopedia: Technical Analysis Strategies for Beginners

- CryptoCompare: Cryptocurrency Technical Analysis

![[LIVE] Engage2Earn: Veterans Affairs Labor repairs](https://cdn.bulbapp.io/frontend/images/1cbacfad-83d7-45aa-8b66-bde121dd44af/1)