Unveiling Base: Franklin Templeton's Insight into Ethereum Layer 2 Dominance in SociaFi Transactions

Introduction:

Franklin Templeton, a renowned investment firm with a keen eye on emerging trends in the financial landscape, has recently published a groundbreaking report that delves deep into the realm of decentralized finance (DeFi) and unveils a significant revelation. The report sheds light on the dominance of Ethereum Layer 2 (L2) base solutions, particularly Base, in commanding a substantial portion of SociaFi (Social Finance) transactions. This revelation not only underscores the pivotal role of Layer 2 scaling solutions but also highlights the profound impact they wield in addressing Ethereum's persistent scalability challenges.

In this era of rapid technological advancement and burgeoning interest in blockchain-based finance, Franklin Templeton's latest findings serve as a beacon, illuminating the path towards a more scalable and inclusive financial ecosystem. With Ethereum's scalability constraints being a longstanding concern within the blockchain community, the rise of Layer 2 solutions such as Base represents a transformative breakthrough. These solutions operate as a layer atop the Ethereum network, offering enhanced transaction throughput, reduced latency, and lower fees, thereby laying the groundwork for the expansion of decentralized finance and SociaFi applications.

By spotlighting Base's dominance in SociaFi transactions, Franklin Templeton's report underscores the growing maturity and adoption of Layer 2 solutions within the Ethereum ecosystem. Base, developed by Coinbase Global Inc (NASDAQ: COIN), has emerged as a frontrunner, capturing a significant market share and reshaping the dynamics of social and decentralized financial interactions. This milestone not only validates the efficacy of Layer 2 scaling solutions but also signals a paradigm shift in how financial transactions are conducted in the digital age.

Moreover, Franklin Templeton's comprehensive analysis provides valuable insights into the broader implications of Ethereum Layer 2 solutions for the future of decentralized finance and social finance ecosystems. As Base continues to gain traction and cement its position as a leading Layer 2 blockchain, it catalyzes innovation, fosters collaboration, and unlocks new possibilities for financial inclusion and empowerment. With SociaFi transactions serving as a tangible manifestation of Base's impact, the stage is set for continued growth and evolution in the decentralized financial landscape.

In essence, Franklin Templeton's report serves as a testament to the transformative potential of Layer 2 scaling solutions and their pivotal role in shaping the future of finance. As Ethereum's scalability challenges are addressed through innovative technologies like Base, the vision of a decentralized, inclusive, and resilient financial ecosystem edges closer to reality, paving the way for a more equitable and sustainable financial future for all.

Background

To understand the significance of Franklin Templeton's report on Ethereum Layer 2 (L2) Base commanding 46% of SociaFi transactions, it's crucial to delve into the context surrounding this development:

1. Ethereum's Scalability Challenges:

Ethereum, the second-largest cryptocurrency by market capitalization, has long grappled with scalability issues due to its limited transaction throughput. As the popularity of decentralized finance (DeFi) and social finance (SociaFi) applications grows, the strain on Ethereum's network becomes more pronounced, leading to congestion and high transaction fees.

2. Introduction of Layer 2 Solutions:

In response to Ethereum's scalability challenges, developers have explored Layer 2 scaling solutions. These solutions operate alongside the Ethereum mainnet, offloading transaction processing to secondary layers or sidechains. Layer 2 solutions aim to enhance scalability, reduce transaction costs, and improve overall network efficiency while maintaining Ethereum's security guarantees.

3. Rise of SociaFi Applications:

SociaFi, a burgeoning sector within the broader decentralized finance landscape, encompasses platforms that merge social networking with financial activities such as trading, investing, and lending. SociaFi applications leverage blockchain technology to enable users to interact, share information, and participate in financial activities within a social context. The rise of SociaFi platforms underscores the growing convergence of social media and finance in the digital age.

4. Coinbase's Role in Layer 2 Development:

Coinbase Global Inc (NASDAQ: COIN), a leading cryptocurrency exchange, has been actively involved in the development of Ethereum Layer 2 solutions. The launch of Base, an Ethereum Layer 2 blockchain developed by Coinbase, signifies the exchange's commitment to addressing Ethereum's scalability challenges and fostering innovation in the blockchain space.

The Rise of Ethereum Layer 2 Solutions:

Ethereum's scalability limitations have long been a point of contention within the blockchain community, hindering its ability to handle large transaction volumes efficiently. Layer 2 scaling solutions aim to alleviate these issues by processing transactions off-chain or through sidechains, thereby reducing congestion on the main Ethereum network. The increasing adoption of Layer 2 solutions reflects the community's proactive efforts to enhance Ethereum's scalability and usability.

Franklin Templeton's Report:

Franklin Templeton's report provides valuable insights into the dominance of Ethereum Layer 2 base solutions in SociaFi transactions. The data presented in the report highlights the significant role played by Layer 2 solutions in facilitating a wide range of decentralized financial activities, including lending, borrowing, trading, and more, within the SociaFi space. This data serves as a testament to the effectiveness and utility of Layer 2 solutions in addressing Ethereum's scalability challenges.

Implications for SociaFi and DeFi Ecosystems:

The dominance of Ethereum Layer 2 solutions in SociaFi transactions carries profound implications for the SociaFi and DeFi ecosystems. By offering enhanced scalability, lower transaction fees, and faster transaction processing times, Layer 2 solutions empower users to engage more seamlessly in decentralized finance activities. This increased efficiency and accessibility pave the way for broader adoption of SociaFi and DeFi platforms, driving innovation and growth within these ecosystems.

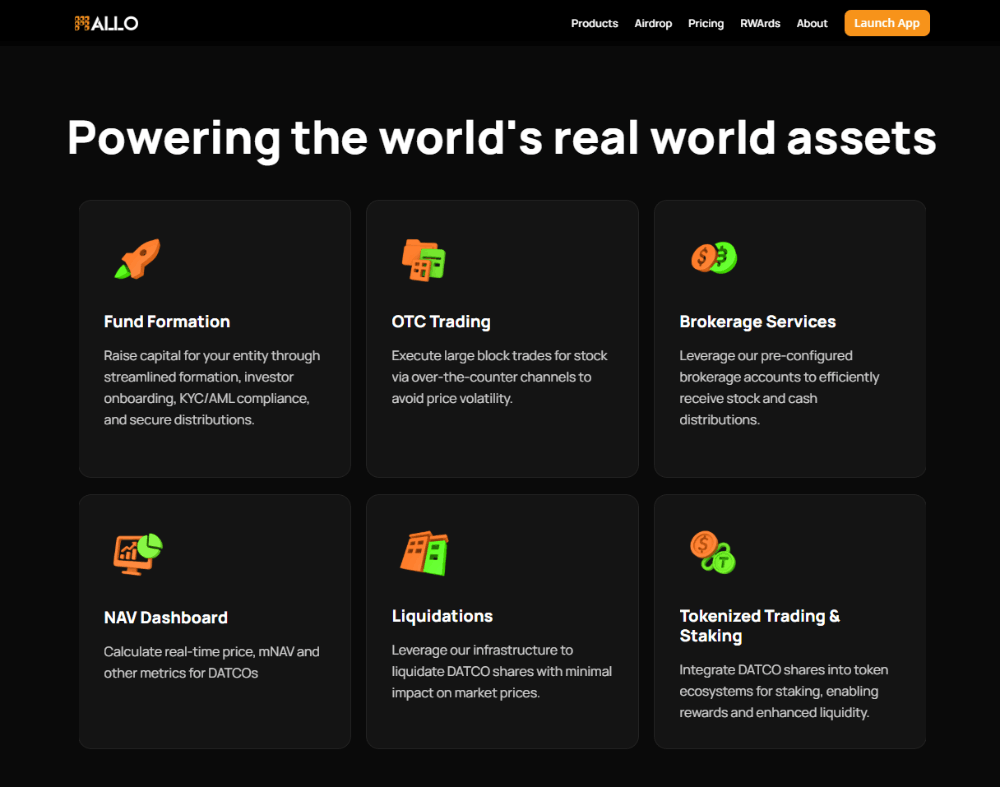

Base's Ascendancy in SociaFi Transactions:

As highlighted by Franklin Templeton's report, Base has emerged as a frontrunner in SociaFi transactions, outpacing other blockchains such as Polygon and BNB Chain. The report attributes Base's success to its robust ecosystem, which includes top crypto-based social applications and direct integrations with Coinbase's extensive user base. This positioning solidifies Base's leadership in the Ethereum Layer 2 landscape, offering a compelling platform for SociaFi innovation and growth.

Rising SociaFi Applications on Base:

Franklin Templeton's analysis underscores Base's pivotal role in facilitating the proliferation of SociaFi applications. With several leading crypto-based social platforms building on Base, the blockchain has become a preferred choice for SociaFi endeavors. Notably, the recent launch of Friend.Tech's native token, FRIEND, and the deployment of version 2 have further fueled Base's adoption and activity within the SociaFi space.

Friend.Tech's Unique Approach to SociaFi:

Friend.Tech's innovative mobile application, renowned for financializing users' social worth, has contributed significantly to Base's rising activity. The platform's unique features, including invite-only networking services and incentivized trading mechanisms, have attracted a burgeoning user base and propelled transaction volumes. Friend.Tech's remarkable growth trajectory, generating substantial protocol fees and attracting significant user engagement, underscores the transformative potential of SociaFi applications on Base.

Base's Dominance and Market Dynamics:

Beyond SociaFi transactions, Base has emerged as a dominant force in the Ethereum Layer 2 sector, surpassing competitors in revenue generation and transaction volumes. Recent data from the Block reveals Base's unparalleled performance, boasting the highest transaction counts and revenue metrics compared to other Layer 2 solutions. Leveraging Optimum's stack and optimistic rollups, Base offers streamlined off-chain transaction processing, positioning itself as a preferred choice for developers and users alike.

Challenges and Opportunities Ahead:

While Ethereum Layer 2 solutions have demonstrated remarkable progress in addressing scalability issues, challenges remain on the path to mass adoption. User education, interoperability, and continued development of Layer 2 protocols are essential factors that will shape the future trajectory of Ethereum's scaling solutions. However, these challenges also present opportunities for collaboration, innovation, and further optimization of Layer 2 technologies to unlock the full potential of Ethereum and decentralized finance.

Conclusion:

Franklin Templeton's report not only sheds light on the significant role played by Ethereum Layer 2 base solutions in facilitating SociaFi transactions but also underscores the transformative potential of these solutions in shaping the future of decentralized finance (DeFi) and social finance ecosystems. As the report reveals, Ethereum Layer 2 blockchain, Base, spearheaded by Coinbase Global Inc (NASDAQ: COIN), has emerged as a dominant force, commanding a substantial share of SociaFi transactions. This dominance not only underscores the efficacy of Layer 2 solutions in addressing Ethereum's scalability challenges but also highlights their instrumental role in fostering innovation and growth within the decentralized financial landscape.

With Base leading the charge, supported by its robust ecosystem, strategic partnerships, and innovative applications like Friend.Tech, the stage is set for a new era of scalability, accessibility, and opportunity in decentralized finance. Base's success serves as a compelling testament to the transformative potential of Layer 2 solutions, offering enhanced transaction throughput, reduced latency, and lower fees, thereby democratizing access to financial services and empowering individuals worldwide.

Furthermore, as Base continues to dominate the Ethereum Layer 2 sector and drive the evolution of SociaFi ecosystems, it catalyzes collaboration, spurs innovation, and unlocks new possibilities for financial inclusion and empowerment. The rise of Base exemplifies the convergence of technology and finance, paving the way for a more resilient, inclusive, and equitable financial ecosystem. With ongoing advancements and collaborative efforts, Ethereum Layer 2 solutions are poised to play a transformative role in shaping the future of blockchain technology and driving the global adoption of decentralized finance.

In conclusion, Franklin Templeton's report serves as a clarion call for the broader blockchain community, highlighting the transformative potential of Ethereum Layer 2 solutions in revolutionizing finance. As Base continues to lead the charge, supported by its vibrant ecosystem and innovative applications, it heralds a new chapter in the evolution of decentralized finance, marked by scalability, accessibility, and opportunity for all. With the momentum building and collaborative efforts underway, the future of finance looks brighter than ever, fueled by the promise of Ethereum Layer 2 solutions and the transformative power of decentralized innovation.