Decentralized Infrastructure of Web3

What is DePIN?

We know that to build and maintain physical infrastructure requires a lot of time and money. Whether it is oil rigs (also called oil platforms or offshore platforms) for energy companies or large networks for telecommunication companies, erecting infrastructure and making it work at scale has always been costly. Other than requiring a lot of investment, legacy infrastructures suffer from the so-called “single point of failure” due to their very centralization. In these systems if any critical point fails, the chances are the whole system ceases to work.

What Web3 companies / protocols / projects are doing is to create physical infrastructure with the assistance of users who supply data, computing power, hardware or anything else required for the building and maintaining infrastructure. The reason why these volunteers are contributing to Web3 projects is because they are incentivized by tokens. So, we can define DePIN protocols as infrastructure projects employing token incentives to convince individuals to use and contribute to the infrastructure. Typically, the infrastructure project in question has already real-world demand. Areas where DePIN protocols have seen at least some success include computing, and wireless networking.

As the name suggests, DePINs are decentralized which implies that they are not governed by any single, centralized body but by smart contracts. These contracts run on nodes deployed by individuals. Any device, such as personal computer or smartphone, with connectivity and computing power can be a node contributing to a DePIN protocol.

DePIN is a new field within Web3, and with the growth of decentralized economy, physical infrastructure itself and how it contributes to other industries will change. At risk of becoming obsolete even after several months, we can categorize DePIN projects into four types:

- Wireless networks

- Sensor networks

- Cloud / storage networks

- Energy networks

Sensor networks

We are all surrounded by devices which produce data ceaselessly. Sensor networks receive these data — which can be anything from traffic conditions to weather to images of local streets — from nodes which can be any piece of machinery capable of collecting and processing data.

Hivemapper

Hivemapper’s goal is to build “the world’s freshest map”. It’s a decentralized mapping network, the decentralized version of Google Maps. The way it works as follows. First, you have to buy a dashcam which then is used to map local streets while you’re driving. Once users upload their images to the app, the protocol converts it into map data. Hivemapper, which is built on Solana, rewards drivers with $HONEY token. Given the strong performance of the Solana blockchain network and its native $SOL token recently, and the real-world utility of the project I think $HONEY will appreciate significantly in value in the upcoming bull market. One factor which can hinder the global adoption of Hivemapper is the price of its dashcams — $299 can be prohibitively expensive for many drivers especially in developing economies.

Below is the chart displaying the price of action of $HONEY during the last 30 days.

DIMO Network

Another project gathering data from a hardware device connected to a vehicle is DIMO. Any node supplied with the required hardware and software can participate as a node in the network. The nodes collect telemetry data, such as fuel consumption, car speed and road data, which then can be purchased by automobile manufacturers or insurers or any other industry which find it useful. For example, for auto companies the mobility data can give insights about the vehicle diagnostics, battery health, or car maintenance among other techniques. Getting real time information on driving behaviour and patterns can be helpful for vehicle insurers. Drivers connecting hardware and software and streaming data are rewarded with the native token of the network, $DIMO.

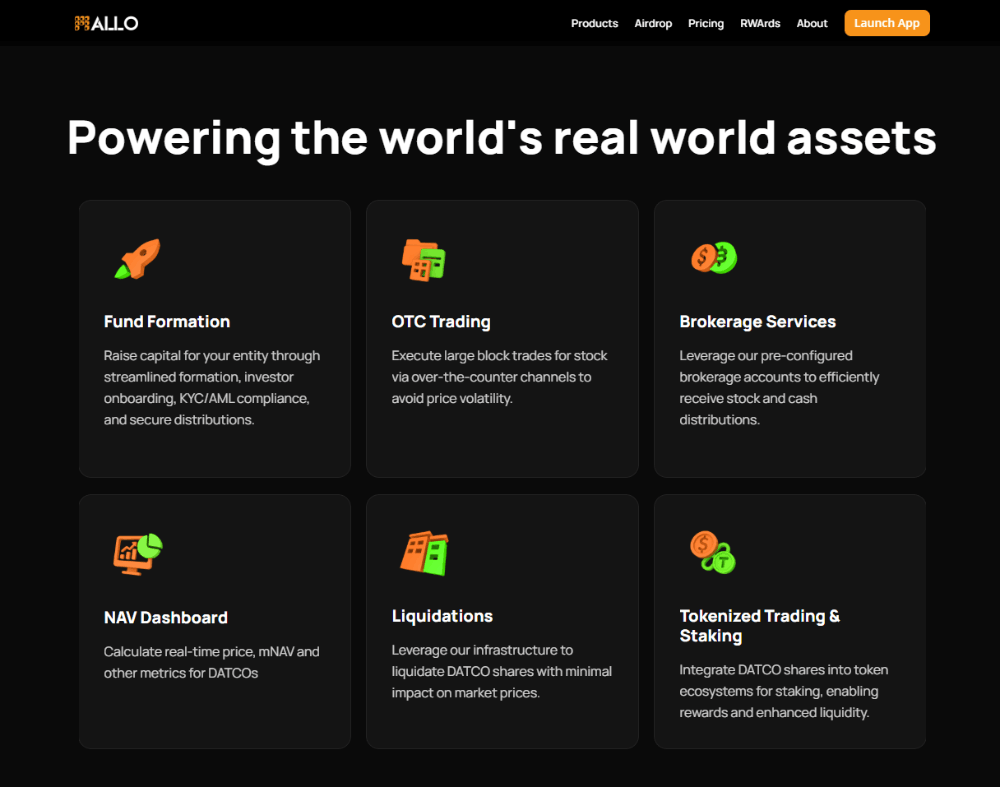

Server networks

Server decentralized physical infrastructure networks are networks of nodes where node operators provide computing resources, such as storage capacity or processing power, and get paid for their services.

Filecoin

Filecoin is one of the most famous DePIN protocols; being one of the first protocols which had an ICO (Initial Coin Offering) in 2017, it was created when even the term DePIN didn’t exist. Filecoin is a decentralized peer-to-peer file storage network. If you have unused storage space in your computer, you can “lend” it to others to store their files and earn $FIL. Users pay $FIL to storage providers (which can also be called storage node owners) to store their files in their space. Decentralization of the network means that the price of the storage service is not set by any company but by the “invisible hand” of open markets.

Filecoin already has several many use cases. Internet Archive, established in 1996 to maintain the contents of the World Wide Web from its first days, uses Filecoin to backup its records. That Filecoin supports not only text data, but also data in audio and video formats among others, enabled Audius and Huddle01, which are also Web3 protocols by the way, to store their music streaming and video conferencing data. Recently, SushiSwap, a large decentralized exchange, integrated with Filecoin which can pave the way to how the DEXes manage their data.

Akash Network

Cloud market is heavily dominated by the three tech giants: Amazon, Microsoft, and Google account for 65% of the cloud computing industry. If you think “we are here crypto or DeFi enthusiasts. So why bother?”, you’d be wrong. Let’s look at the largest blockchain network, Ethereum. More than one third of Ethereum nodes run on Amazon Web Services, which is a subsidiary of Amazon providing on-demand cloud computing platforms. About 1400 Ethereum nodes are located in a single data centre in Virginia. Doesn’t seem decentralized to me to be honest. If tomorrow Amazon decides to cease Ethereum nodes on its servers, it’s hard to imagine what will happen to DeFi.Enter Akash. Akash Network is a decentralized cloud computing marketplace connecting providers with buyers (customers). Cloud computing is one of those buzzwords these days that everyone has heard of and thinks that he gets the idea but most people actually don’t. To understand what it refers to we first have to understand why there is a need for it. There are some large Web2 companies, such as Google and Amazon, which need a lot of servers to store all the data they collect, manage and analyse. So, they buy a huge number of servers to handle all these data which can be anything from searches on Google to order requests on Amazon.

Having a lot of computing resources is good because it enables to manage peak periods, like Christmas or Black Friday. But eventually you realize that you don’t need all these resources — you are only deploying a part of them. If you don’t need something that you own, what do you do? Right, you sell it. That is what these tech giants started doing. So, it is unsurprising that the cloud market is dominated by the subsidiaries of big tech companies. This is the supply side of the equation. What about the demand side? Cloud computing services are typically purchased by developers because they allow builders to create applications more efficiently; as a developer you just do your work without all the hassle of purchasing and setting up the server. And when developers tend to buy fixed amount of hosting space which means that a large part of it remains unused.

So, we know that a lot of compute resources are being left unused which results in millions of data centres around the world working below capacity. This is where Akash enters the game and leverages underutilized data centres to provide cloud computing services to customers. Since Akash deploys already existing infrastructure, it doesn’t have to build any data centre which allows the protocol to sell cloud services much cheaper than other cloud providers.Low costs are especially attractive to blockchain validators. This is why several blockchains, such as Osmosis and Avalanche, already use Akash Network for this purpose.

With Akash you can choose many cloud providers and not depend on tech giants thus mitigating the risk of a single point of failure. This is why I think Akash, and decentralized cloud computing providers in general, are essential for the blockchain ecosystem. That Akash offers an option to control a wallet by multi-sig implies that it can be perfect for DAOs needing cloud services.

Wireless networks

Projects falling under this category provide wireless networking services which can be through 5G, Wi-Fi, Bluetooth, or LoRa protocols.

Helium

Being one of the largest protocols in DePIN space, Helium is a network for connecting IoT (Internet of Things) devices. Though their initial mission was to decentralize IoT connectivity, in 2019 the protocol established a cellular network called Helium Hotspots. By installing a device in your home of office space you can provide to wireless connectivity in your city and earn $HNT, the native token of the protocol. This is how a Helium Hotspot looks like.Helium always seeks to expand into multiple fields. What started as a network for IoT devices then entered a cellular network space, and now is building a 5G network. This created yet another opportunity for individuals to mine a token called $MOBILE. To earn the token, you have to contribute to Helium network to operate a 5G node and provide coverage to 5G Helium mobile network.

Energy networks

One of the pivotal effects of DePINs is going to be the transformation of several traditional industries where a handful of large players dominate the markets. Telecom and energy are examples of this kind of oligopolistic markets. Our energy generation comes mostly from centralized power plants. Not only our energy economy is highly decentralized but it is also produced from fossil fuels. The economy is expected to ditch them for clean, renewable energy sources and to become “net-zero” (whatever that means) by 2050.

Energy DePINs decentralize the process of energy production by incentivizing individuals to contribute resources to the network. The governance of the network by smart contracts cuts off the middlemen and links producers directly with consumers.

Conclusion

Physical infrastructure seems to be the last thing that is going be transformed by DeFi. But the problems with the traditional mode of building and maintaining infrastructure are so obvious that the power of decentralization cannot be ignored any more. DePINs seek to change the legacy markets and bring innovation to industries by reducing costs and effectively mitigating the risk of single point of failure. In DePINs, the whole networks depend not on a central entity but many coordinating operators or nodes which are rewarded with network tokens for their contribution.