A Comprehensive Crypto Glossary: Unraveling the Jargon

The crypto market contains various terms and keywords, therefore, it is important to get a thorough understanding of the most popular terms to get a better grip on information. This crypto glossary contains the most commonly used terms and definitions, assisting investors on their crypto journey.

The crypto market contains various terms and keywords, therefore, it is important to get a thorough understanding of the most popular terms to get a better grip on information. This crypto glossary contains the most commonly used terms and definitions, assisting investors on their crypto journey.

The Ctrl + F shortcut should be helpful in finding specific terms in this glossary more easily. If there are other terms that need to be included, please leave a comment below.

Altcoin

Altcoin is the general term used for cryptocurrencies other than Bitcoin. Previously, most Altcoins were made as upgraded versions of Bitcoin. As the market goes, Altcoins are now known as Utility Tokens, representing their projects and having various use cases in the project’s ecosystem.

For instance: LINK is used to pay Node Operators, BNB is used to pay transaction fees on Binance exchange, etc.

AMA

AMA stands for Ask Me Anything, which is an online event to resolve questions from the community. AMAs can be conducted as live streams or group calls on platforms such as YouTube, Facebook, Telegram, etc.

Many projects use AMA as a way to reach out and communicate with their supporters, raising brand awareness and giving updates on their products.

Airdrop

Airdrop is an event where users are rewarded with free tokens from the project. Some of the common forms of airdrop are retroactive rewards, holding and staking rewards, event rewards, etc.

Airdrop is usually used for marketing campaigns or introducing projects’ ICO to draw more users into the community.

Learn more: What is retroactive airdrop?

ASIC

ASIC stands for Application-Specific Integrated Circuit, a specialized integrated circuit manufactured to serve a specific purpose. For example, the Bitcoin ASIC miner has the highest efficiency, since all its resources are gathered for only one purpose: mining Bitcoin.

The Bitcoin ASIC Miner

ATH

ATH stands for All Time High, the highest point regarding price or market capitalization of a coin/token, a share, etc. throughout its history.

For instance, the ATH price of Bitcoin in 2021 was $64,000.

Aggregator

Aggregator is a platform that gathers multiple features, for example, trading, lending, etc.

Algorithmic Stablecoin

Algorithmic Stablecoin is a new stablecoin model, keeping the $1 price based on algorithms instead of backed assets.

An example of algorithmic stablecoin was UST, whose price was kept at $1 by adjusting the supply and demand of LUNA.

BAGHOLDER

BAGHOLDERS are investors who keep a large amount of coins, waiting to sell when the price surges in the future.

Bottom Fishing

Bottom fishing is defined as investors buying at a price that they believe is the lowest, in hopes of making great profits when the price increases.

Blockchain

Blockchain is a hierarchical database that stores information in blocks that are linked together with encryption and expand over time.

Specifically, blockchain is an electronic ledger distributed on many different computers, storing all transaction information, and ensuring the information cannot be changed in any way. All information stored on that ledger will be verified by a series of computers connected in a mutual network. Nothing will be able to change, overwrite or delete the data in that ledger.

Bull Market - Bullish

Bull market or Bullish refers to an uptrend market, with prices increasing more rapidly than the average historical rate. The prices increase over a long period of time with large trading volumes.

In a bull market, the buy demand is higher than the sell demand.

Bear market - Bearish

In contrast with Bull market, Bear market or Bearish refers to a downtrend market, in which the prices of coins/tokens decrease sharply and consistently over a long period of time.

In a bear market, the sell demand is higher than the buy demand.

Learn more: Differences between Bear and Bull market

Binary Options

Binary Options is a type of Options in which users predict the candle price in a short period of time and profit if they win, or lose money otherwise.

Breakout

Breakout is a term used in technical analysis, describing the price breaking its support or resistance level.

The technical indicators used to determine the breakout point may be moving averages, trend lines, price patterns such as head and shoulders, candlestick patterns, etc.

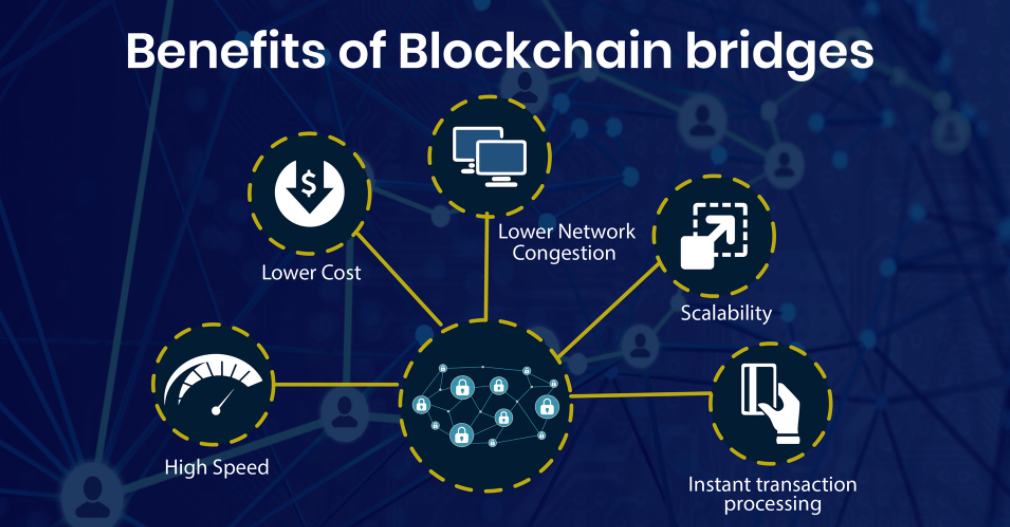

Bridge

As the name implies, Bridges connect blockchains with each other. As assets have different standards on each blockchain, they can not be exchanged directly without bridges.

Read more at: What is Cross-chain Bridge?

Circulating Supply

Circulating supply is the total amount in circulation of a coin in the market.

CEX

CEX stands for Centralized Exchange, an exchange managed by a third party, either an organization or an individual. All assets deposited to centralized exchange accounts are managed by that organization or individual. Some popular CEXs are Binance, Okex, Huobi, etc.

Child node

Child node is a type of node that’s extended from another type called Parent node.

Collateral asset

Collateral asset is the asset that users deposit into projects in order to borrow money. To retrieve the collateral assets, they must pay the borrowed amount in full along with a fee (depending on the project). Collateral assets are commonly seen on Lending projects such as MakerDAO, Venus, Unit Protocol, etc.

Cross-chain

Cross-chain is a solution that helps transferring assets from one chain to another, optimizing the connection between chains and is commonly used by multi-chain projects.

For instance, SushiSwap’s services can be used on Ethereum, Polygon, etc.

Crypto Asset Management

Crypto asset management includes buying, selling and managing digital assets to invest and gain profit regarding the overall value. This is not a new method, but managing the cryptocurrency portfolio or cryptocurrency as part of the investment portfolio has become necessary, since crypto has a higher volatility than other financial assets in general.

Cliff

Cliff is a term usually seen in projects’ token release schedule section. It refers to the token lock up period, in which investors, users or any individual will not receive any token. Cliff is commonly applied for the team, advisors or investors’ shares.

For example: Team Allocation: 12-month cliff, then vesting over 12 months.

This means there will not be any token for the team in the first 12 months, then the allocation will be released gradually from month 13 to 24.

CeDeFi

CeDeFi is the combination of Decentralized and Centralized Finance, with applications bridging DeFi and CeFi. With CeDeFi, individuals and organizations will be able to approach crypto and DeFi more easily, while complying with the provisions of the law.

Dapp

Dapp stands for Decentralized Application, which are applications built on existing platforms and protocols. Dapps focus on resolving issues in different areas, and tokens are used among them.

Since Dapps are built directly on platforms, their factors such as transaction speed, TPS, scalability, stability, etc. are reliant on these platforms.

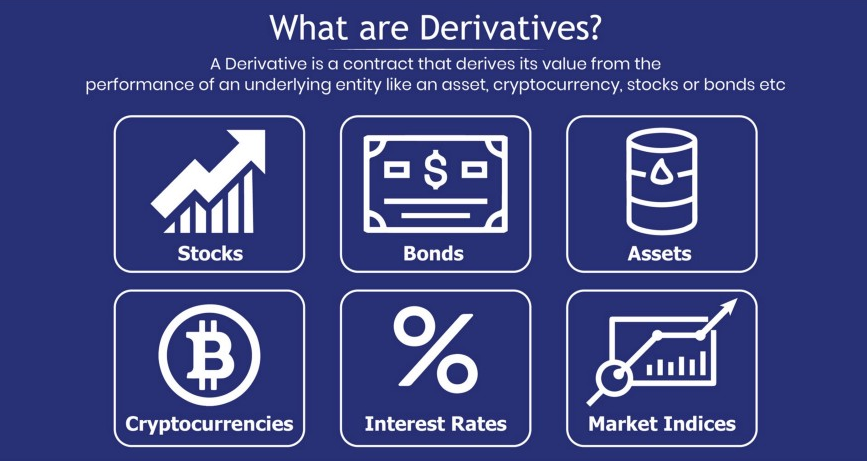

Derivatives

Derivatives are a financial tool in which investors are able to trade multiple products based on price without owning them. Derivatives allow investors to buy a larger asset amount than what they own by using leverage.

DeFi

DeFi or Decentralized Finance include financial applications built on blockchains. Users can access any application, anywhere without the need for a third party such as banks, since users are in full control of their assets.

DYOR

DYOR stands for Do Your Own Research, which means gaining information and knowledge about a certain project to consider whether an investment should be made.

DEX

DEX stands for Decentralized Exchange, an exchange without any controlling party. Transactions made on DEXs do not involve any intermediary and only happen between the selling and buying parties. Some popular DEXs are UniSwap, SushiSwap, PancakeSwap, etc.

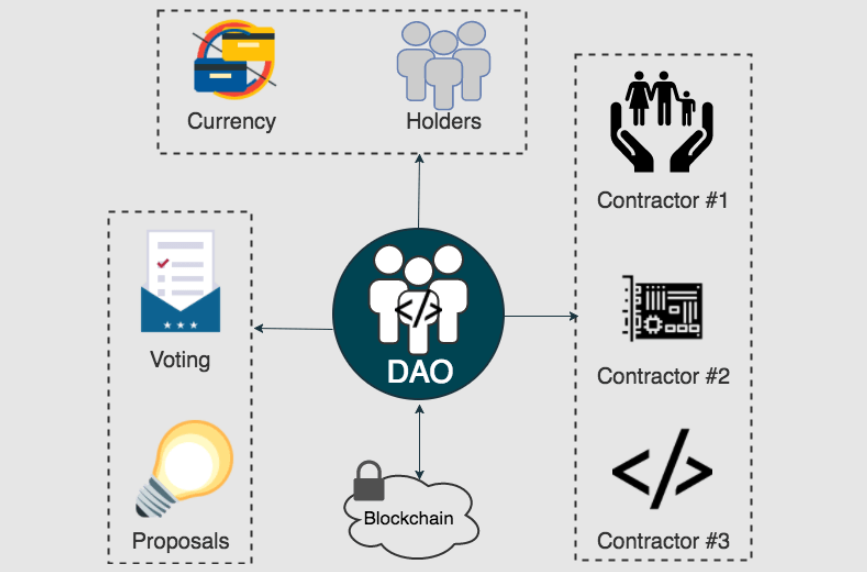

DAO

DAO stands for Decentralized Autonomous Organization, an organization run by members based on an encrypted set of rules. The set of rules may be consensus or smart contracts.

All members have the right to vote on important decisions of DAOs. In return, they’ll get rewarded for running these DAOs.

Simply put, DAO is a group of members that cooperate based on a set of rules with a mutual purpose, and participants will be rewarded in the process.

How DAO works

On-chain Data

On-chain data is the data of an asset on a blockchain, which can be the number of holding wallets, the trading volume within a certain period of time, the deposit/withdrawal status on exchanges, etc. On-chain data is used to assess the current situation of the asset and come up with predictions such as whether the price will rise or fall, demand versus supply, etc.

Discord

Discord is a communication platform similar to Telegram, where users can participate in conversation with different communities, projects, etc. Discord’s specialty is that each server can be divided into smaller groups based on topics, e.g. general channel, entertainment, developers’ channel, etc.

Ecosystem

In crypto, a blockchain ecosystem consists of multiple products, connecting and supporting each other. Each blockchain is considered an infrastructure company aiming at building their own ecosystem.

There is no framework on how many projects should be built to form an ecosystem, but it is easy to recognize blockchain ecosystems in crypto. Some of the most popular ecosystems are Ethereum, BNB Smart Chain, Solana, Near, etc.

The Ethereum Ecosystem