Cryptocurrency Investing Strategies

Tips for Maximizing Returns

and Minimizing Risks

Investing in cryptocurrencies can be both exciting and daunting, with the potential for high returns accompanied by significant risks. In this article, we'll provide practical advice and strategies for cryptocurrency investors, covering key topics such as portfolio diversification, risk management, and the choice between long-term hodling and short-term trading.

Investing in cryptocurrencies can be both exciting and daunting, with the potential for high returns accompanied by significant risks. In this article, we'll provide practical advice and strategies for cryptocurrency investors, covering key topics such as portfolio diversification, risk management, and the choice between long-term hodling and short-term trading.

Portfolio Diversification

- Spread Your Investments: Diversification is essential for mitigating risk in cryptocurrency investing. Allocate your investment across different cryptocurrencies, industries, and use cases to spread risk and capture opportunities in various sectors of the market.

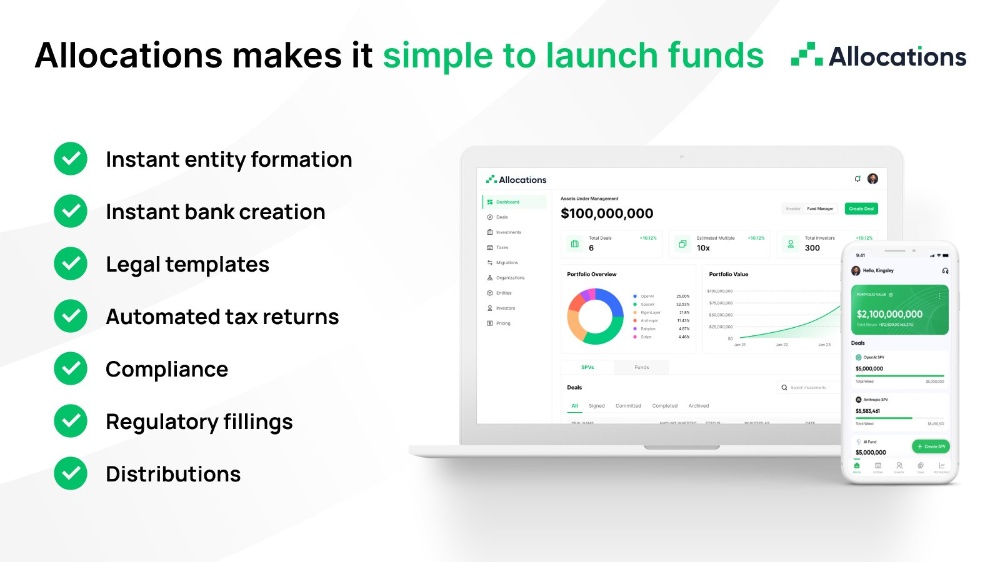

- Consider Asset Classes: Apart from cryptocurrencies, consider diversifying your portfolio with other asset classes such as stocks, bonds, and commodities. This can help reduce overall portfolio volatility and provide additional sources of return.

Risk Management

- Set Realistic Goals: Define your investment goals and risk tolerance before diving into the cryptocurrency market. Determine how much you're willing to invest, your target returns, and the level of risk you're comfortable with.

- Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses and protect your capital. Set stop-loss levels based on your risk tolerance and market analysis to automatically sell your assets if prices drop below a certain threshold.

Long-Term Hodling vs. Short-Term Trading

- Long-Term Hodling: Long-term hodling involves buying and holding onto cryptocurrencies for an extended period, typically years, with the expectation of significant price appreciation over time. This strategy requires patience and discipline but can be rewarding for investors who believe in the long-term potential of their chosen assets.

- Short-Term Trading: Short-term trading involves buying and selling cryptocurrencies within shorter timeframes, such as days, weeks, or months, to capitalize on price fluctuations and market trends. This strategy requires active monitoring of the market and technical analysis skills but can be lucrative for skilled traders.

Additional Tips

- Stay Informed: Keep yourself updated with the latest news, developments, and market trends in the cryptocurrency industry. Follow reputable sources, join online communities, and engage with fellow investors to stay informed and make informed investment decisions.

- Manage Emotions: Emotions can cloud judgment and lead to impulsive decisions in cryptocurrency investing. Stay disciplined and avoid making emotional decisions based on fear, greed, or FOMO (fear of missing out). Stick to your investment plan and strategy, regardless of short-term market fluctuations.

Cryptocurrency investing offers exciting opportunities for investors to generate significant returns, but it also comes with inherent risks. By following these practical tips and strategies for portfolio diversification, risk management, and long-term hodling versus short-term trading, investors can maximize their chances of success while minimizing potential losses in the volatile cryptocurrency market. Remember to conduct thorough research, seek professional advice if needed, and invest only what you can afford to lose.

Cryptocurrency investing offers exciting opportunities for investors to generate significant returns, but it also comes with inherent risks. By following these practical tips and strategies for portfolio diversification, risk management, and long-term hodling versus short-term trading, investors can maximize their chances of success while minimizing potential losses in the volatile cryptocurrency market. Remember to conduct thorough research, seek professional advice if needed, and invest only what you can afford to lose.

Always remember

D.Y.O.R.

Not your keys, Not your crypto!

Thank you for reading!

Find useful articles to read: HERE