Should You Invest in SEI Crypto? SEI Network Overview

If you were around the crypto block in the previous cycles, you know that blockchain networks (Layer-1 solutions) and their native tokens tend to gain a lot of traction during the bull markets. For instance, just look at Solana’s performance in 2020 and 2021. However, not every Layer 1 (L1) is such a great success. Thus, only time will tell how SEI crypto will perform in 2024 and 2025. But as a new project, it definitely has the potential for some large gains. So, should you invest in $SEI?

Diving into today’s article, you’ll have a chance to learn what the Sei crypto project is all about. First, we’ll cover the core aspects of the Sei network. This is where you’ll learn what this L1 chain is all about and how it supports DeFi developers.

Diving into today’s article, you’ll have a chance to learn what the Sei crypto project is all about. First, we’ll cover the core aspects of the Sei network. This is where you’ll learn what this L1 chain is all about and how it supports DeFi developers.

Next, we’ll shift our attention to the SEI crypto token. After all, as altcoin investors, this is where our main interest lies. As such, we’ll make sure to figure out what the token’s purpose and use cases are. Moreover, we’ll also take a glance at SEI’s tokenomics, which tend to impact the asset’s price.

With the basics about the Sei network and the SEI token under our belts, we’ll be ready to dive into the coin’s price action. Hence, we’ll go over the ranges the asset has covered so far and use the basics of technical analysis (TA) to outline the core levels of support and resistance. Furthermore, we’ll even deploy the power of the Money Line indicator for additional insight into the token’s performance.

Nonetheless, you’ll get to find out how to use Moralis Money to spot when $SEI is on the move. After all, it can even help you decide when to buy the SEI coin.

What is SEI Crypto?

“SEI crypto” primarily refers to the SEI cryptocurrency, the Sei chain’s native coin. However, the “SEI crypto” phrase also often tends to point to the entire Sei ecosystem, including the Sei network. As such, to properly answer the above question, we need to explore multiple aspects of this new L1 solution.

Herein, we’ll cover the basics and ensure you get a proper overview of the Sei blockchain. However, if you wish to start building on top of this chain, you ought to visit the above-outlined website. There, you can find useful resources, including the project’s documentation to help you get going on the right foot.

Sei Network Overview

Sei represents itself as a revolutionary Layer-1 blockchain that aims to position itself as a pinnacle in the crypto ecosystem. Primarily, the project and its chain are dedicated to facilitating the seamless exchange of digital assets.

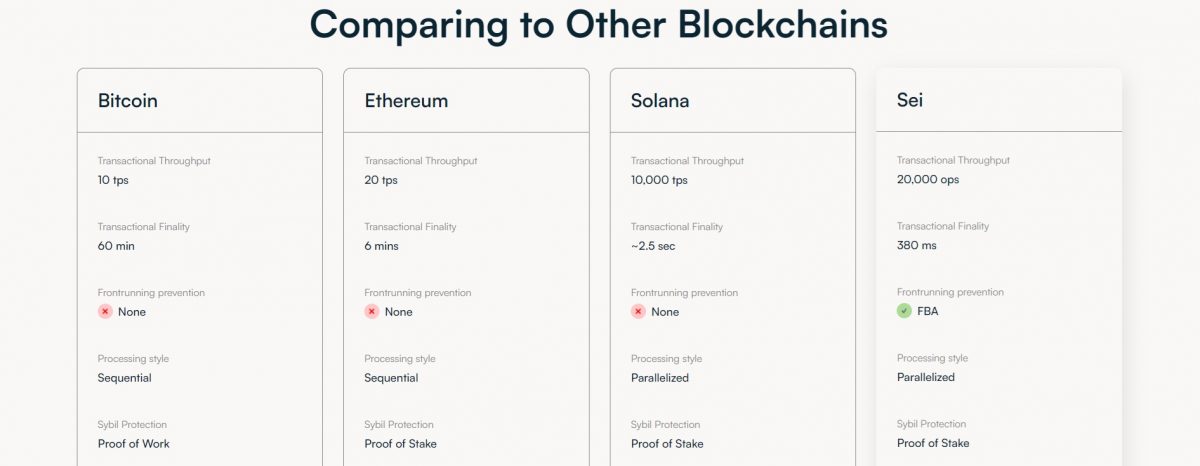

Launched with this grand vision, the Sei network prioritizes speed, performance, and technological innovation. Moreover, the project even offers a comparison of its network’s performance compared to other blockchains on its official website: So, as you can see in the above image, Sei distinguishes itself with a 380-millisecond time to finality and an impressive throughput of 20,000 transactions per second (TPS). This places Sei ahead in the race for efficiency, outpacing prominent competitors like Aptos, Solana, and Sui.

So, as you can see in the above image, Sei distinguishes itself with a 380-millisecond time to finality and an impressive throughput of 20,000 transactions per second (TPS). This places Sei ahead in the race for efficiency, outpacing prominent competitors like Aptos, Solana, and Sui.

At its core, Sei serves as a decentralized “Proof of Stake” (PoS) blockchain powered by the SEI token. However, the project specialized in DeFi trading solutions. After all, it has a keen focus on orderbook decentralized exchanges (DEXs). Thus, Sei promises to introduce specialized infrastructure, offering blazingly fast execution, deep liquidity, and a fully decentralized matching service.

Sei shows its commitment and belief in the significance of on-chain order books by promising to provide a trustless, decentralized, and high-performance environment.

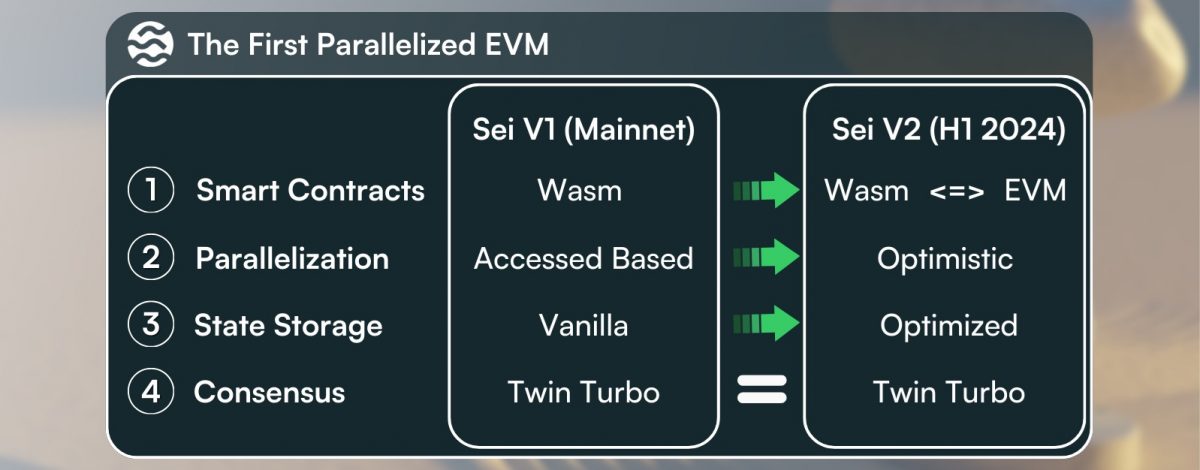

Parallelism and Smart Contracts on the Sei Network

One of Sei’s standout features is its commitment to optimizing smart contracts for parallel execution. By defining resources and dependencies, developers can ensure that transactions with mutually exclusive resource requirements execute concurrently. As such, this feature enhances the overall throughput of the network.

Furthermore, Sei incentivizes developers to parallelize their smart contracts by offering a 50% gas discount for contracts with properly defined resource requirements.

It’s also worth pointing out that Sei is built using the Cosmos SDK and Tendermint Core. Moreover, to parallelize the execution of Wasm contracts, developers need to identify and register resources appropriately with the chain. This involves creating a JSON-formatted proposal specifying all the resources a contract may need access to.

All-in-all, Sei’s emphasis on parallelism enhances the scalability of applications, making it a potentially good choice for decentralized finance (DeFi) projects, NFT marketplaces, gaming economies, and more.

Sei v2

It’s also worth mentioning that Sei v2 is in the pipework for 2024. This upgrade will introduce groundbreaking enhancements, making Sei the first fully parallelized EVM blockchain. Sei v2 is poised to achieve 390ms block finality, supports backward compatibility for Ethereum smart contracts, optimistically parallelizes transactions, enhances SeiDB for superior performance, and ensures seamless interoperability between EVM and other execution environments.

With this major upgrade, Sei aims to position itself as a global leader. After all, if successfully implemented, the network will allow developers a simplified EVM experience, superior throughput, and cost-efficient transactions. Testnet Sei v2 launch is slated for early 2024, marking a pivotal moment in Sei’s evolution. For more details about Sei and Sei v2, visit the project’s blog.

SEI Crypto Token

By this point, you already know that the SEI crypto token is the native digital asset of the Sei blockchain. As such, it serves as the cornerstone of its decentralized ecosystem. Moreover, as a Layer 1 blockchain, Sei leverages the SEI token to facilitate various functions within its network, fostering a secure, efficient, and decentralized environment.

SEI’s Purpose and Use Cases

The SEI token holds several roles within the Sei ecosystem. Here are the most important ones:

- Network Fees: SEI tokens are utilized to pay transaction fees on the Sei blockchain, ensuring a seamless and secure transfer of value.

- DPoS Validator Staking: SEI holders can participate in the decentralized proof-of-stake (DPoS) mechanism by delegating their holdings to validators or running their own validator nodes. By doing so, they contribute to the network’s security and governance.

- Governance: SEI serves as a gateway for engaging in the governance of the Sei protocol, influencing decisions, and shaping the network’s evolution.

- Native Collateral: $SEI serves as native asset liquidity or collateral for applications built on the Sei blockchain.

- Fee Markets: Users can pay a tip to validators to prioritize their transactions, fostering a dynamic fee market that incentivizes efficient network operation.

- Trading Fees: SEI tokens are utilized as fees for exchanges built on the Sei blockchain, which further integrates the token into the network’s economic infrastructure.

Tokenomics of the SEI Coin

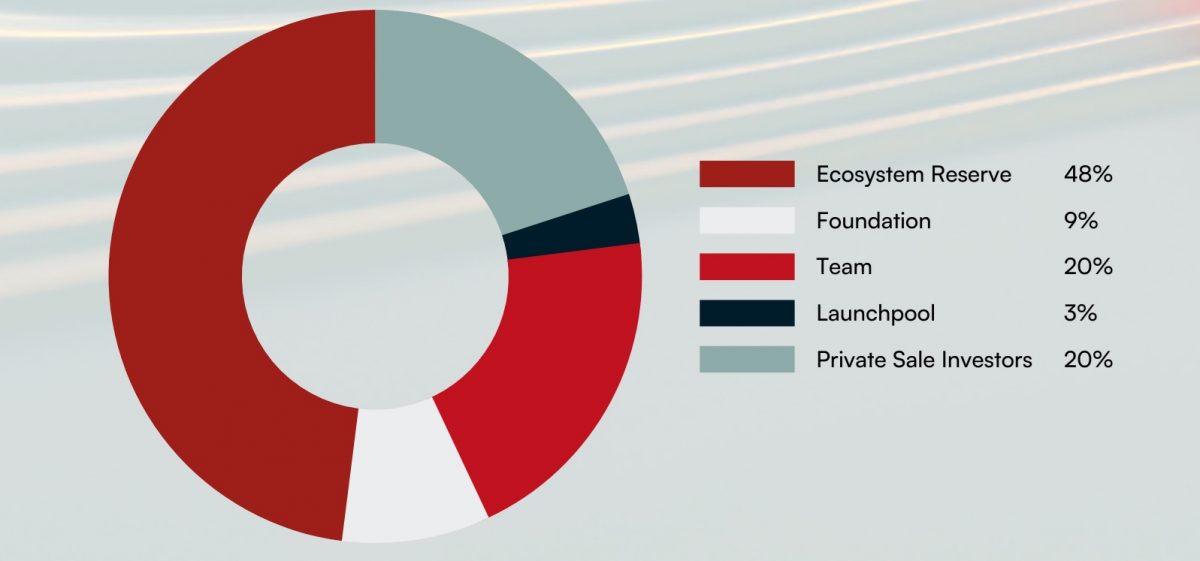

The SEI token operates with a capped total supply of 10 billion tokens, emphasizing community involvement and sustainable growth. Over half of the SEI token supply (51%) was allocated to the community, including an Ecosystem Reserve (48%) supporting staking rewards and ecosystem initiatives. The other three percent was allocated to the Launchpool, fostering community participation and engagement.

A portion of the SEI supply was dedicated to airdrops, incentivized testnet rewards, and ongoing programs, ensuring widespread distribution and community engagement. Moreover, nine percent of SEI tokens contribute to the Foundation Treasury, supporting the ongoing operations of the Sei Foundation.

$SEI Price Analysis

The above daily $SEI chart on a regular scale includes the entire price action of this DeFi cryptocurrency. Since the token started trading on August 15, 2023, there’s not all that much data to work with.

The asset was listed at $0.064 and its price spiked all the way up to $0.48 on its first day of trading. However, the first daily candle closed just below $0.18. On the second day, the coin increased, reaching as high as $0.28; however, it was becoming clear that the initial momentum was lost. So, on the following day, the SEI price started to decrease.

After a rather sharp 58% pullback during the second half of August, the asset found some support at around $0.12 by the end of that month. After that local low, the token was mostly trading sideways; however, it did set new local lows. The lowest one came in on October 19, 2023, at $0.0947.

As the rest of the crypto market started to climb up, so did $SEI. It started to gain some momentum in the final third of October but really picked up its pace in November. By December 5, 2023, the SEI price reached $0.32. This level served as resistance, pushing $SEI back down to retest the $0.22 region.

The letter served as support and served as a base for SEI’s recent rally, which so far offered $0.3887 as the highest price. However, given the RSI indicator, this rally could continue further.

At the time of writing, $SEI is sitting around $0.36.

TA and Money Line

By looking at the above chart, you can see all the key levels of support (S) and resistance (R) levels for $SEI. The above chart also includes the asset’s trading volume and the RSI indicator. Together, these TA features tell us that $SEI is quite strong at the moment.

However, let’s confirm the current condition of the SEI token’s price with the Money Line indicator. After all, the latter also utilized the power of on-chain insights. Hence, it offers traders/investors an extremely valuable evaluation of the market conditions.

We typically prefer to start on a weekly timeframe with this ultimate crypto charting tool. However, since SEI hasn’t been trading for long enough yet, we’ll instead focus directly on the daily scale:  Note: If you wish to get your hand on the Money Line indicator, make sure to opt in for the Moralis Money Pro or Starter plan.

Note: If you wish to get your hand on the Money Line indicator, make sure to opt in for the Moralis Money Pro or Starter plan.

As you can see in the above chart, the Money Line indicator offered the “Bullish” signal on October 25, 2023. And it continues to indicate an uptrend momentum. Moreover, the indicator’s cloud feature shows that SEI may even revisit $0.278 and remain bullish.

So, while the Sei network is just establishing its position as one of the leading DeFi networks, we can see that SEI has already increased in value. Still, the asset’s value could go higher as the bull market continues.

Thus, make sure to use the power of TA to determine proper entries/exits for $SEI. And do not forget to make things easier on yourself by using Moralis Money’s crypto bubblemaps.

Moralis Money and Crypto Bubbles

As one of the leading crypto analysis tools and the best crypto scanner, Moralis Money offers several features to help you make the most of altcoin opportunities. To access some of its more advanced functionalities, such as its crypto whale tracker and its crypto pump detector, you’ll have to select the proper menu option.

However, the Moralis Money crypto bubbles await you right on the platform’s homepage. These bubblemaps offer a great and intuitive insight into crypto market conditions. They allow you to spot the daily winners and losers with a single glance.

Do you spot the SEI token in the image below? As such, the Moralis Money homepage can help you keep an eye on SEI. For instance, let’s say that $SEI is on your radar as a token you wish to buy; however, you are waiting for its noticeable pullback before entering your position. In that case, you wait until you see SEI in a large red crypto bubble on the Moralis Money’s bubblemap.

As such, the Moralis Money homepage can help you keep an eye on SEI. For instance, let’s say that $SEI is on your radar as a token you wish to buy; however, you are waiting for its noticeable pullback before entering your position. In that case, you wait until you see SEI in a large red crypto bubble on the Moralis Money’s bubblemap.

Of course, you should also start using the above-presented Money Line to ensure that the token’s trend is supporting your decision. With this powerful crypto trading tool, you’ll become a much more successful crypto investor/trader.

Should I Invest in SEI Crypto?

We are not financial advisors, so we cannot answer the above question on your behalf. Plus, only you know your current financial situation and your risk aversions.

As such, make sure to use the information offered in this article to first determine if you find the Sei network and its native token interesting enough to even consider investing in this project. If yes, then you need to further DYOR the Sei ecosystem and consider the coin’s live price and on-chain metrics.

If you have an already established TA method that works for you, by all means, follow that path. However, if you haven’t been successful with altcoin trading/investing yet, then we highly recommend using Money Line.

Unlike most crypto trading tools that focus exclusively on price data, Money Line utilizes a powerful combination of price and on-chain insights. Plus, it converts these insights into a user-friendly visual indication that you can intuitively understand.

After properly DYORing SEI and using Money Line, you’ll be able to answer the above question with confidence!

Where to Buy $SEI?

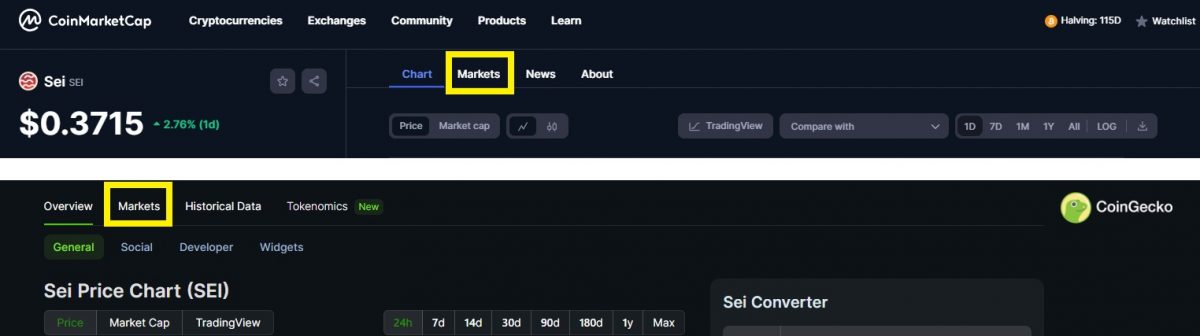

If you decide to buy $SEI, you can do so on several centralized (CEXs) and decentralized (DEXs) exchanges. To find out which markets exactly offer SEI trading pairs, use the “Markets” section of CoinGecko or CoinMarketCap:

Should You Invest in SEI Crypto? SEI Network Overview – Key Takeaways

- The Sei network is a new Layer-1 blockchain with a built-in orderbook. This makes it a solid choice for various DeFi dapps.

- The SEI crypto token is the native coin of the Sei network. It powers transactions, secures the network, and also serves as a governance token.

- So far, the best time to buy $SEI was in October 2023, when the token was at its lowest price since the launch. And the Moralis Money Starter and Pro users, who have access to the Money Line indicator, were able to spot this opportunity.

- Folks who bought SEI at its October low were able to more than triple their investment.

- To determine if $SEI is a good investment for you, make sure to DYOR the Sei network and its native coin properly.

- If you decide to buy $SEI, make sure to use the Money Line indicator to determine if now’s a good time to buy.

We’ve mentioned that Moralis Money offers several powerful features to help you make the most of altcoin opportunities. However, the pinnacle of this platform is Token Explorer. That core feature allows you to run preset or unique strategies and thus generate dynamic lists of altcoins with potential in seconds.

As such, make sure to watch the video below and learn how to get going with Token Explorer today!

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕖𝕒𝕟𝕚𝕖 𝔹𝕒𝕓𝕚𝕖𝕤 - Have Fun Staying Poor](https://cdn.bulbapp.io/frontend/images/17e87f53-0225-4de1-995f-9f66198cb037/1)