Why does SOL price drop when network activity is strong?

Solana's native token SOL fell 9.8% from January 30 to February 1, failing to overcome the $104 resistance level for the fifth time in four weeks. When looking at a longer time frame, SOL is down 10.7% over 30 days, while ETH and BNB are trading down 1.2% and 2.6%, respectively, over the same period. This leaves investors questioning why SOL is underperforming, especially when the network's fundamentals are solid.

SOL 4-hour price chart | Source: TradingView

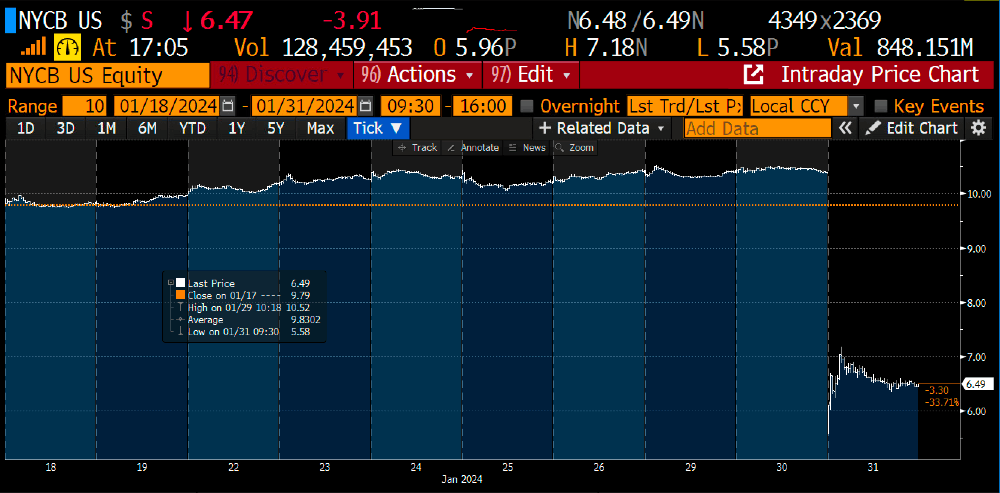

US regional banks pose risks to markets, including cryptocurrencies

From a broader perspective, the crypto market has been under pressure since the US Federal Reserve's (Fed) January 31 decision to keep interest rates unchanged at 5.25%. The central bank also noted that the target range will not change until there is “greater confidence that inflation is moving sustainably towards 2%”. Investors fear the crisis in U.S. regional banks could accelerate as these institutions come under severe pressure from their fixed-income portfolios offering lower yields current interest rate.

Shares of New York Community Bancorp (NYCB), which acquired collapsed crypto-friendly Signature Bank in 2023, have dropped 42% since Jan. 30 after reporting a $260 million loss in the fourth quarter of 2023. In March 2023, Signature Bank officially closed and was later taken over by the New York Department of Financial Services (NYDFS). The risk of contagion has attracted the attention of traders and investors, such as BitMEX co-founder Arthur Hayes.

“BTC is expected to fall a bit, but if NYCB and some others pull back over the weekend, then expect a new bailout quickly. After that, BTC will join the race similar to the price action on March 23.”

Source: Arthur Hayes

While Hayes predicts an initial negative impact on Bitcoin if the Fed does not opt for a quick relief package, the downstream effect could be positive, as investors will increase inflation expectations. Whether the stimulus comes in the form of an extension of the Bank Term Financing Program (BTFP) or a cash injection through the NYDFS, the overall impact is more money flowing into the monetary system than.

So why did SOL prices drop?

The first question to ask is the reason for holding the $104 resistance, and the answer may lie outside of Solana's ecosystem. At $104, SOL has a market cap of $45 billion, in line with the valuation of direct competitor BNB. However, BNB Chain holds a total value locked (TVL) of $3.54 billion, more than double Solana's $1.6 billion, according to DeFiLlama.

Top blockchains by 30-day DApp volume | Source: DappRadar

Solana's decentralized application (DApp) operation is significantly smaller than that of BNB Chain. Notably, the total number of active addresses interacting with BNB Chain's DApp (UAW) reached 3.3 million in 30 days, significantly exceeding Solana's 2.65 million. Similarly, BNB Chain's 30-day DApp volume amounted to $20.8 billion, a significant difference compared to Solana's $2.75 million.

The recent focus on the Solana network was the Jupiter (JUP) airdrop on January 31, which currently has a market cap of $800 million. The successful launch of decentralized exchange (DEX) aggregator Jupiter was praised by members of the Solana Foundation as millions of transactions were processed without a glitch. To date, over 438,000 addresses have claimed their JUP airdrop, with 9,391 of them receiving over 5,000 JUP – equivalent to $3,000 at current prices.

In addition to the success of the Jupiter airdrop, the Solana ecosystem also saw a spike in demand over the past week. Including, other decentralized exchanges, several NFT markets, yield protocols, gaming, and liquidity staking solutions.

Solana network's most active Dapps in the past 7 days | Source: DappRadar

Even excluding Jupiter's airdrop-hyped numbers, a handful of Solana DApps are seeing significant user growth, including MeanFi, MarginFi, Wormhole, Drift Protocol, Kamino Finance, and Jito. In essence, there is no sign of Solana's network activity weakening – quite the contrary.

As for the possibility of SOL breaking above $104 and eventually surpassing BNB's valuation, that remains an open question, as Solana should still break into the top 3 networks in terms of TVL and volume.