Bitcoin Halving: Understanding its Significance to the Crypto Market.

Understanding Bitcoin Halving

At its core, Bitcoin halving is a testament to the ingenuity of Satoshi Nakamoto’s creation, a predefined event that encapsulates the principles of scarcity and deflationary currency. Like a digital heartbeat, the Bitcoin network pulses with the rhythm of halving events, each one meticulously occurring after 210,000 blocks are mined, approximately every four years. This mechanism is Bitcoin’s answer to the age-old dilemma of currency devaluation: it intentionally reduces the speed at which new bitcoins are minted.

The halving process is an intrinsic part of Bitcoin’s protocol, serving not just as a technical event, but as a pivotal moment that reaffirms Bitcoin’s ethos of limited supply — a stark contrast to traditional fiat currencies with their limitless printing capabilities. By design, this system will preside over the creation of bitcoins until the capstone of its supply, the 21 millionth bitcoin, is minted around the year 2140. Beyond that point, the network will sustain itself not on the allure of new bitcoins, but on transaction fees borne by its users, rewarding miners for their crucial role in maintaining the ledger’s integrity.

Tracing the Halving Legacy: A Historical Context

Bitcoin’s narrative is rich with chapters of halving events, each contributing to its legend. The genesis block came into existence in 2009, carrying with it a reward of 50 bitcoins. This bounty has since been halved thrice, with the latest chapter unfolding in 2020 when the reward dwindled to 6.25 bitcoins. Each halving has been a harbinger of significant chatter, speculation, and ultimately, historical market movements within the cryptocurrency community.

As we stand today, the ledger indicates a circulation of approximately 19.5 million bitcoins, drawing us ever closer to the final curtain of the mining reward saga. This journey towards the last bitcoin is not just a countdown; it’s a reflection of Bitcoin’s growing maturity, an evolutionary path lined with anticipation, analysis, and a sense of camaraderie among crypto aficionados.

These previous halvings have not only been statistical milestones but also cultural moments that rally the community together, sparking discussions, debates, and dreams of what the future holds for this pioneering cryptocurrency.

Understanding the Gearwork Behind Bitcoin Halving

Demystifying the Halving Process

Think of Bitcoin halving as a heartbeat in the cryptocurrency’s ecosystem. It’s programmed to beat slower every four years, reducing the ‘pulse’ — which is the reward miners get. Miners use powerful computers to solve complex puzzles that validate transactions and secure the Bitcoin network. When they succeed, they’re rewarded with new bitcoins. Halving cuts this reward in half, meaning miners have to work harder for the same prize.

Mining Motivation and the Halving Effect

This reduction in reward influences the whole mining community. Some smaller players might find it doesn’t pay to mine anymore because their earnings drop while the costs of running those big computers don’t. But this isn’t just about miners’ pockets. It’s a deliberate move to control how many new bitcoins come into existence. This makes sure Bitcoin doesn’t suffer from inflation, where too much currency reduces its value.

Why Halving Holds Bitcoin Together

Bitcoin halving is central to the cryptocurrency’s deflationary strategy — think of it as Bitcoin’s promise to not flood the market. By limiting the total number of bitcoins to 21 million, halving helps keep Bitcoin scarce and valuable. It’s similar to why diamonds or vintage wines are pricey — they’re not easy to find or make more of. This scarcity is part of what drives people’s interest in Bitcoin and can lead to price increases as each halving makes new bitcoins more rare.

By understanding these gears that turn within Bitcoin’s engine, we can appreciate the thoughtful design behind it. The halving isn’t just an event; it’s a fundamental part of what gives Bitcoin its value. For the crypto community, each halving is a milestone, a time of potential change and opportunity. It’s a reminder of the delicate balance between scarcity and value that defines Bitcoin and the fascinating world of cryptocurrency.

The Ripple Effects of Past Bitcoin Halvings

Market Movements Following Halvings

History has shown us that Bitcoin halvings can send waves through the market. After each of the previous halvings, there was significant attention on how the price reacted, often with considerable upswings in the following year. These events have become almost legendary within the community, seen as catalysts for some of the bullish cycles that followed. However, it’s crucial to remember that markets are unpredictable and influenced by many factors beyond just halving.

How Miners Have Adapted Over Time

Every halving has been a test for Bitcoin miners. The immediate effect of a halving is a potential drop in profitability, prompting a shift in the mining ecosystem. Some miners find their operations no longer sustainable, while others invest in more efficient technology to stay competitive. These transitions have led to more centralization in mining with bigger players dominating, although each halving brings fresh discussions and potential for change.

Community Sentiment and Strategic Shifts

With each halving, the Bitcoin community has gone through a rollercoaster of emotions — anticipation, excitement, uncertainty, and adaptation. Long-time holders often view halvings as vindication of their belief in Bitcoin’s scarcity-driven value. Newer members of the community ride the learning curve, aligning their strategies with the seasoned insights shared by veterans. Educational content flourishes around these events, with more community engagement and interest in understanding the deeper mechanics of Bitcoin.

The past halvings have each been unique, with their own narratives and market reactions, but the common thread is their role in maturing the community. They’ve been opportunities for learning, recalibration, and growth, reinforcing the collective understanding that Bitcoin is more than a digital asset — it’s an evolving ecosystem with a heartbeat of its own that brings people together from all corners of the globe.

The 2024 Halving: A Crypto Community Milestone

The Buzz Around the Next Bitcoin Halving

The Bitcoin halving due in 2024 is stirring up the crypto communities. It’s seen as a pivotal event — one that historically has signified turning points for the asset’s value. With less than a year to go, investors, traders, and enthusiasts are on high alert, knowing that, while the halving isn’t the sole driver of Bitcoin’s value, it’s a key event that has historically been followed by market uplifts. The sense of scarcity that the halving emphasizes reinforces Bitcoin’s appeal as a store of value — much like gold, but digital.

Reflections on Past Performance

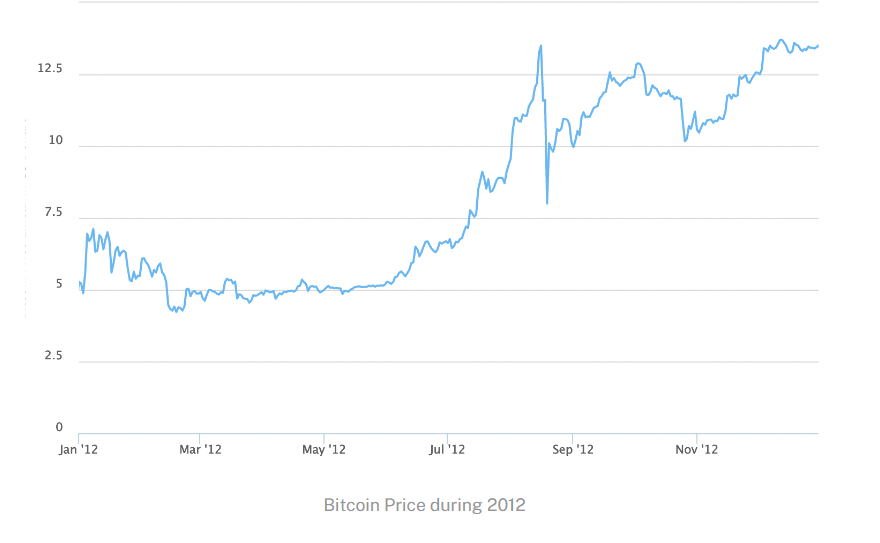

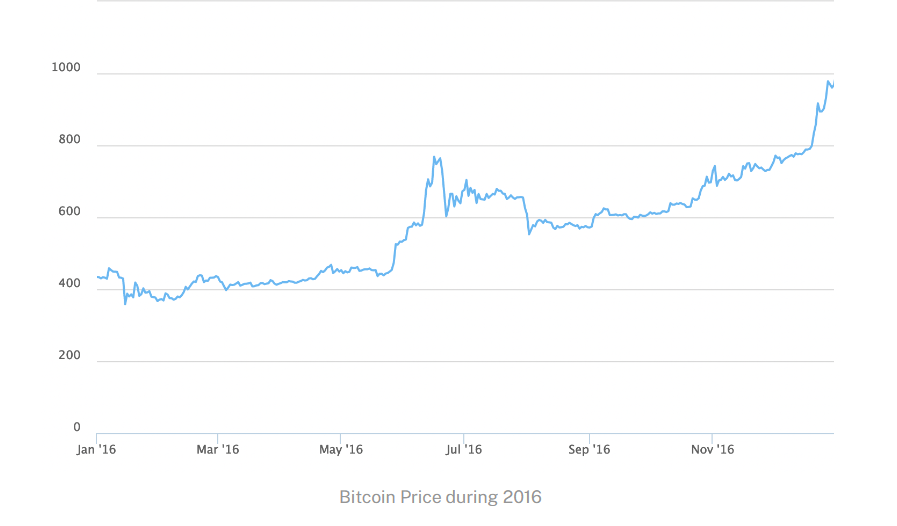

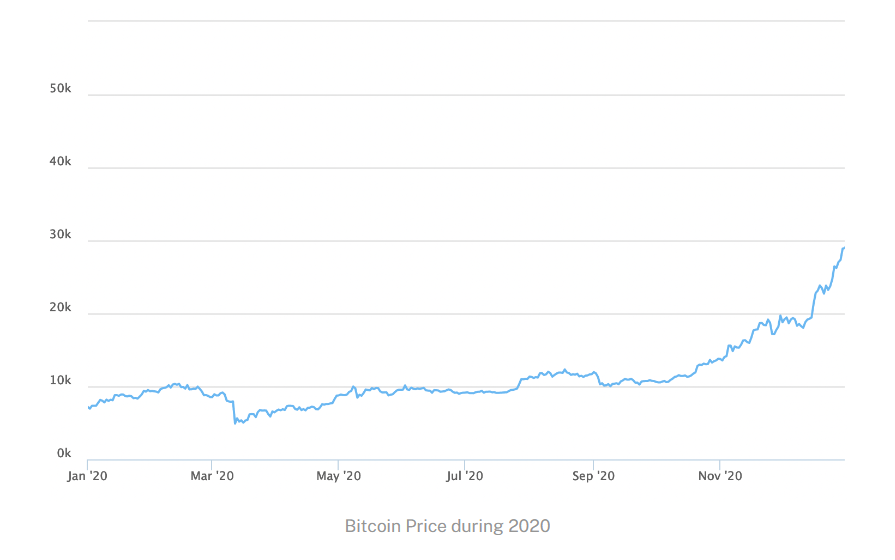

Looking back, the impact of Bitcoin halving events on the market has been undeniably significant. After the 2012 and 2016 halvings, the price of Bitcoin soared, yielding staggering returns over the years that followed. The 2020 halving continued the trend with impressive gains. These patterns are etched in the collective memory of the crypto community, feeding into the narratives of long-term bullishness post-halving.

BITCOIN PRICE MOVEMENTS AFTER THE PREVIOUS HALVING EVENTS

BITCOIN PRICE MOVEMENTS AFTER THE PREVIOUS HALVING EVENTS

Navigating the Future with Historical Insights

While it’s vital to acknowledge that past performance is not a reliable indicator of future results, these historical moments provide valuable insights. They spark discussions and strategies within the community, as everyone tries to anticipate the possible outcomes of the 2024 event. Crypto veterans and newcomers alike are tuning in, eager to see if the upcoming halving will follow the footsteps of its predecessors.

Educated Speculation and Preparedness

As the crypto world looks towards April 2024, there’s a blend of educated speculation and strategic preparedness taking hold. Community forums, social media, and discussion groups are abuzz with analysis and predictions. The general consensus is clear: the halving is a fundamental aspect of Bitcoin’s economic model, and as such, it holds the potential to significantly influence the market’s dynamics.

Navigating the Horizon: Bitcoin’s Journey Post-2024

Bitcoin’s Role in the Evolving Digital Asset Landscape

As the original cryptocurrency, Bitcoin has continuously shaped the digital asset landscape. Its influence is expected to endure, acting as both a gateway for new crypto adopters and a bedrock for the broader market. Bitcoin’s established track record and its deflationary nature could solidify its status as ‘digital gold,’ even as the ecosystem evolves with new tokens and technologies emerging.

Driving Blockchain Adoption and Inspiring Innovation

The halving event goes beyond influencing market dynamics — it also has the potential to drive broader blockchain adoption. As attention on Bitcoin grows around halving periods, it can lead to increased interest in blockchain technology as a whole, spurring innovation and adoption across various sectors. We could witness blockchain solutions gaining traction in industries like finance, supply chain, and beyond, as the technology underpinning Bitcoin proves its value in real-world applications.

Preparing for a Multi-Faceted Future

In preparing for what lies beyond the 2024 halving, the community is aware that the path ahead is multi-faceted. It’s not just about market movements; it’s also about how Bitcoin’s evolution will influence global finance, technology, and even geopolitical dynamics. The upcoming halving could act as a catalyst, prompting greater institutional adoption and perhaps even prompting governments to consider their stance on digital assets more seriously.

Call to Action

For the seasoned crypto enthusiasts and newcomers alike, the upcoming halving serves as a beacon, prompting both reflection on past trends and preparation for future possibilities. It’s a time to stay informed, engaged, and proactive:

Stay Informed: Keep abreast of market trends, news, and analysis as the halving approaches. Understanding the broader market context is key to making informed decisions.

Engage with the Community: Join discussions, attend webinars, and connect with others in the crypto space. The collective wisdom and diverse perspectives can enrich your own understanding and strategies.

Plan Your Strategy: Whether you’re considering investing or already hold cryptocurrencies, think about how the halving could affect your portfolio. Consider talking to financial advisors who understand the nuances of crypto.

Educate and Share: If you’re knowledgeable, help others in the community understand what the halving means. Share resources, write articles, or create content that helps demystify the event for others.

Be Prepared for Volatility: Markets may be turbulent around halving events. Ensure that your investment approach accounts for this and that you’re prepared for any scenario.

In conclusion, the 2024 Bitcoin halving is not just an event; it’s a chapter in the ongoing story of digital currency. How we as a community approach, interpret, and react to it will shape not only the immediate market but also the role of Bitcoin and cryptocurrencies in our collective financial future. So let’s continue to learn, share, and grow together.

See you anothee blog.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)