Ripple’s co-founder confirms $113m theft, XRP down 5%

Collect the article

share

On-chain sleuth ZachXBT noted 213 million XRP tokens moved through almost a dozen addresses to centralized exchanges in an apparent Ripple hack. The XRP tokens worth roughly $112.5 million started moving on Jan. 30 before being laundered on platforms like Binance, Gate, HTX, HitBTC, Kraken, and OKX, according to ZachXBT’s investigation.

The XRP tokens worth roughly $112.5 million started moving on Jan. 30 before being laundered on platforms like Binance, Gate, HTX, HitBTC, Kraken, and OKX, according to ZachXBT’s investigation.

Shortly after ZachXBT reported the incident, Ripple co-founder and executive chairman Chris Larsen said there was unauthorized access to some of his personal XRP accounts.

Larsen stressed that the tokens were not controlled by Ripple as a company, adding that exchanges and law enforcement had been informed about what may be a hack.

You might also like:

Ripple’s technology chief shows support for proposed XRPL governance changes

XRP hack or insider dumping?

However, some social media observers espoused skepticism about the supposed theft and speculated why Ripple or Larsen did not flag the transactions until ZachXBT shared his findings with the public.

Kirill Tiufanov, founder of web3 security startup Polyzoa, highlighted delays in transaction execution during the XRP outflows. Speaking with crypto.news, Tiufanov cited the on-chain timestamps, which showed the funds were moved over a 10-hour period.

The web3 security expert said delayed transactions also suggested manual input rather than an automated script or smart contract typically employed by crypto hackers and wallet drainers. Coinbase director Conor Grogan echoed similar comments, noting that the activity was odd.

The dumbest hacker would never send to CEXes and wait 10+ hours to withdraw funds.

Kirill Tiufanov, Polyzoa founder

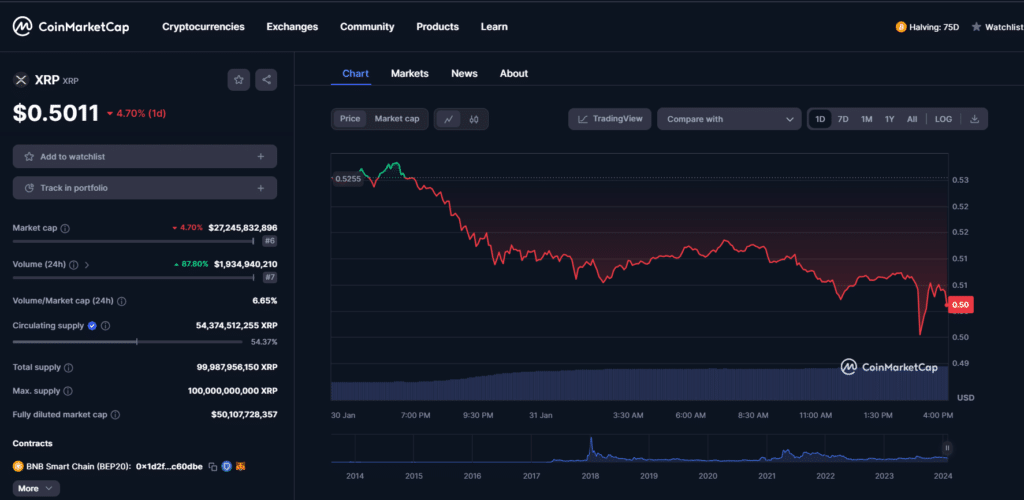

XRP’s market price reacted to the news with a 5% drop per CoinMarketCap. The token fell as low as 49 cents. XRP’s trading volume also skyrocketed more than 85% while its market cap dropped over 4%. Ripple XRP’s price and trading volume | Source: CoinMarketCap

Ripple XRP’s price and trading volume | Source: CoinMarketCap

The event joins many suspicious activities tied to crypto-native personalities and entities. Criminals have stolen tens of millions of dollars in digital assets from web3 operators and compromised several social media pages belonging to platforms like CoinGecko.

This comes after North Korea’s Lazarus group siphoned $600 million last year, a third of all hacks and thefts in 2023. Despite this staggering amount, Chainalysis reported a 39% drop in crypto received by bad actors and cybercriminals.

Read more:

How high can Ripple (XRP) price rebound in February 2024

READ MORE ABOUT

cryptocurrency

hack

xrp

Electricity demand to double in 3 years. How AI and mining play a part

By Anna Kharton

By Anna Kharton

January 31, 2024 at 2:09 pm Edited by Lena Bozhkova

Edited by Lena Bozhkova

FEATURES

Collect the article

share

Electricity demand worldwide could double over the next three years, mainly due to cryptocurrency mining and artificial intelligence. How will crypto keep up?

AI and cryptocurrencies accounted for almost 2% of global electricity demand in 2022, which illustrates the scale of their energy impact. This increase is mainly due to the growing complexity and volume of computing operations for artificial intelligence and the ever-increasing number of cryptographic transactions.

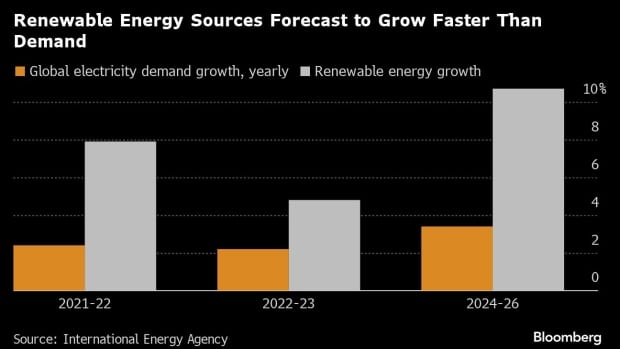

According to a recent report from Bloomberg, which cites the International Energy Agency, global demand for electricity from data centers, cryptocurrencies, and artificial intelligence could more than double over the next three years, amounting to the equivalent of Germany’s entire electricity demand. Source: International Energy Agency

Source: International Energy Agency

AI’s appetite to grow

Artificial intelligence (AI) has become an integral part of modern life, streamlining various aspects. However, its extensive integration raises concerns about a substantial surge in energy consumption. According to Alex de Vries, a graduate student at the University of Amsterdam Free University, the global AI infrastructure might demand an energy equivalent to that of an entire country.

It’s been nearly a year since the AI industry entered a phase of rapid expansion triggered by the introduction of the OpenAI ChatGPTAI chatbot. The training and operation of neural networks, such as the one powering this service, involve a notably energy-intensive process. Hugging Face, an AI-developing company and a key contributor to large language models, disclosed that training its platform demanded 433 megawatt-hours (MWh) of electricity – roughly equivalent to the energy needs of 40 average American households for a year. In comparison, ChatGPT, being a more extensive project, consumes approximately 564 MWh daily.

And there seems to be no way out of this situation. Companies worldwide are working to improve AI systems’ efficiency in hardware and software, making them less energy-intensive. However, increasing the efficiency of these machines will inevitably increase the demand for AI services, causing resource use to increase even further—a phenomenon in economics known as Jevons’ Paradox.

You might also like: 2050: CBDCs, AI, and the uncharted path ahead | Opinion

How AI will change electricity demand

Amid these developments, the most substantial projects raise concerns. According to the paper by Alex de Vries, Google currently handles a staggering 9 billion search queries daily. Using this information, the researcher calculated that if AI were employed for every Google search, it would demand approximately 29.2 terawatt-hours (TWh) of energy annually – a figure on par with Ireland’s total consumption. While de Vries acknowledges that this extreme scenario may not materialize in the near future, he does concede that the expansion of AI servers will contribute to an overall rise in energy consumption. By 2027, the cumulative volume could range between 85 and 134 TWh annually.

This volume is comparable to the needs of larger countries, such as Argentina, the Netherlands, and Sweden. Increasing the efficiency of AI accelerators will allow developers to repurpose processors to solve problems associated with AI algorithms, which will additionally lead to an increase in the related energy consumption.

The future of artificial intelligence, where everyone has a personal assistant, relies heavily on having access to affordable energy. Without it, the pace of AI progress could slow down considerably. There’s hope for cost-effective energy sources through innovations like new energy solutions or advancements in thermonuclear fusion. Currently, creating robust neural networks, exemplified by projects like ChatGPT, is a privilege limited to a handful of major players with hefty investments, such as OpenAI.

You might also like: Why Artificial Intelligence (AI) Could be a Game Changer in Building Decentralized Applications (DApps)

Is it profitable to mine cryptocurrencies?

There are over 8,000 data centers scattered worldwide, with approximately 33% located in the U.S., 16% in Europe, and 10% in China. The numbers are rising, with more centers in the planning stages. In Ireland, where the data center landscape is expanding, the International Energy Agency (IEA) anticipates the sector to devour 32% of the country’s electricity by 2026, a significant jump from 17% in 2022. Currently, there are 82 centers in Ireland, with 14 under construction and another 40 awaiting approval.

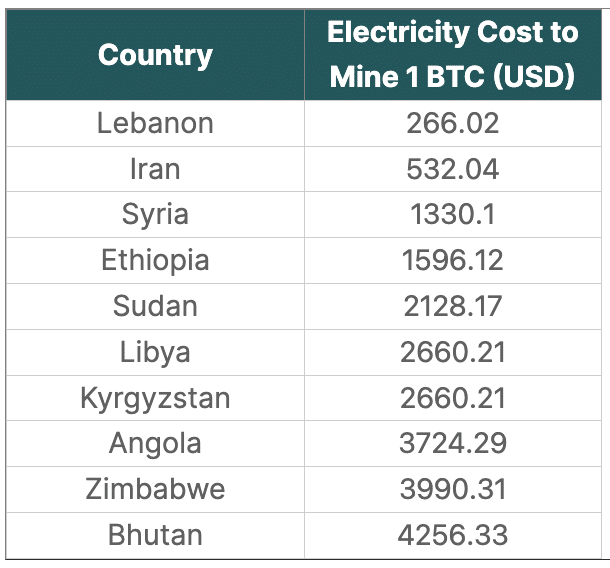

However, as of July 2023, analysts at CoinGecko pointed out that Europe remains the least profitable region for mining. By mid-2023, only 65 countries were deemed profitable for individual Bitcoin mining, according to electricity cost data. Europe contributed five countries to this list, while the Americas, particularly South America and the Caribbean, offered opportunities in eight countries. In Africa, 18 regions were profitable for mining, and in Asia, 34 countries presented favorable conditions for mining endeavors. At the same time, mining Bitcoin is unprofitable in 82 countries. The top 10 most expensive countries with the highest electricity costs for households when mining one BTC were Italy ($208,560.33), Austria ($184,352.44), Belgium ($172,381.50), Denmark ($166,795.06 ), Germany ($163,336.79), Ireland ($159,612.50), Lithuania ($152,163.92), Netherlands ($137,798.79), United Kingdom ($130,616.23) and Cayman Islands ($128,222.04).

At the same time, mining Bitcoin is unprofitable in 82 countries. The top 10 most expensive countries with the highest electricity costs for households when mining one BTC were Italy ($208,560.33), Austria ($184,352.44), Belgium ($172,381.50), Denmark ($166,795.06 ), Germany ($163,336.79), Ireland ($159,612.50), Lithuania ($152,163.92), Netherlands ($137,798.79), United Kingdom ($130,616.23) and Cayman Islands ($128,222.04).

You might also like: US authorities to impose 30% electricity tax on crypto mining

Electricity demand after halving

The upcoming Bitcoin (BTC) halving in the spring of 2024 is poised to bring about a noteworthy shift in mining dynamics.

Halving directly impacts the profitability of mining operations, as miners receive fewer Bitcoins for their efforts when the reward is halved. This can particularly affect miners facing high energy and equipment costs, potentially leading some to suspend their operations if they can’t recover their expenses.

A substantial increase in the price of Bitcoin could offset the decrease in block rewards by enhancing the value of the mined Bitcoins. To put it formally, if the price of Bitcoin doubles, individuals may be more willing to invest in electricity costs to enhance the returns from their mining efforts. Consequently, there’s a possibility that the demand for electricity in mining could see an increase.

You might also like: How much you could make or lose mining Bitcoin in 2024

Will the predictions come true?

As new technologies emerge, they naturally demand more resources, and electricity is no different. Consequently, predictions about heightened consumption by both AI and miners appear quite plausible.

However, there is a catch. Meeting the increased demand for electricity will require exploring new energy sources, particularly renewables.

If successful in finding and implementing these new sources, there’s a strong likelihood that AI and cryptocurrency miners could emerge as significant players in the energy consumption sector.

You might also like: Analysts predict a major Bitcoin supply shock before the halving

READ MORE ABOUT

ai

electricity

mining

XRP and Cardano struggling, Borroe Finance rallying in presale

January 31, 2024 at 1:45 pm

SPONSORED  PARTNER CONTENT

PARTNER CONTENT

Collect the article

share

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

While Ripple’s legal battle with the U.S. SEC continues, Cardano (ADA) has made significant strides in the smart contract arena in early 2024. However, a new defi project, Borroe Finance (ROE), has caught the attention of investors.

Ripple vs U.S. SEC legal battle

The SEC has requested a thorough examination of contracts to determine whether Ripple’s planned sales of XRP were in line with the court’s summary order.

In response, Ripple filed a Motion to File a Sur-Reply related to the SEC’s Motion to Compel on Jan. 24, 2024.

You might also like: Ripple’s top lawyer scrutinizes SEC’s courtroom defeats during Gensler tenure

Meanwhile, XRP is under pressure, failing to break above $0.55.

As of Jan. 26, XRP was trading at $0.512, down 6.85% in the past week.

XRP needs to close above $0.55 for the uptrend to be valid. Losses below $0.45 might trigger a sell-off.

Cardano smart contracts skyrocket in 2024

The number of smart contracts deployed on Cardano spiked in early 2024.

Recent insights reveal that the number of V1 and V2 Plutus smart contracts was 14,379 on Jan. 1. As of Jan. 24, it was at 24,050, a 67% increase.

You might also like: Cardano releases development updates, ADA is recovering

ADA peaked at $0.66. On Jan. 26, it hit $0.47, a 20.33% decrease.

The red bars on the histogram of ADA’s MACD indicator indicate volatility, and the RSI signals a sell-off.

Experts predict it may drop to $0.43 if Cardano continues to struggle.

Borroe Finance

Borroe Finance is a web3 financing system on Polygon focusing on liquidity pools and dapps, using innovative technologies like AI, NFTs, and blockchain.

You might also like: Analysts predict Borroe Finance, XRP, and Injective to trend higher

Through its NFT marketplace, web3 businesses and content creators can generate instant cash flow.

It has raised over $2.7 million in ongoing presale. Presently, ROE is available for $0.0190.

Experts predict that ROE will rally once released on DEXs. The token will list for $0.040.

Read more: Market activity lifts Polkadot, Borroe Finance, and Solana

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

READ MORE ABOUT

sponsored

Solana threatens Ethereum’s stablecoin dominance, new meme coin surging in presale

January 31, 2024 at 12:50 pm

SPONSORED  PARTNER CONTENT

PARTNER CONTENT

Collect the article

share

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Solana has emerged as a competitor to Ethereum’s stablecoin dominance. Amid this, investors are exploring Rebel Satoshi, a leading meme coin whose presale is ongoing.

Solana’s ascendance in stablecoin volume

Solana’s total stablecoin volume reached $322 billion in January. In October, it was only $12 billion.

This growth is due, in part, to the introduction of USD Coin (USDC) and Paxos’ stablecoin USDP, which attracted a large number of users and transactions.

You might also like: Solana Pay partners with Shopify to enable USDC payments

Ethereum is still the leader in stablecoin transfers, with a total volume of $335 billion in January, slightly more than Solana.

However, Solana is catching up and could soon surpass Tron to secure the second position.

Can Solana surpass Ethereum?

Solana offers fast transaction speeds and low fees. However, it faces tough competition from Ethereum, which has an established user base and a thriving ecosystem of decentralized applications.

You might also like: Coinbase to charge fees on USDC to USD conversions

Ethereum is also upgrading its platform to make it more efficient and scalable.

While Solana is growing, it must overcome challenges such as building trust with users and ensuring network security and scalability to compete with Ethereum.

Rebel Satoshi presale is growing

Rebel Satoshi promotes decentralization and defying centralized authority, drawing inspiration from the philosophies of Guy Fawkes and Satoshi Nakamoto.

Through its native token, RBLZ, the project encourages long-term commitment by offering rewards for staking. RBLZ holders support the ecosystem’s stability and enjoy rewards aligning with their commitment to decentralization.

You might also like: MEV bot on Solana rakes $1.7m in profit, Rebel Satoshi’s potential engages investors

Rebel Satoshi is also entering the NFT space with two collections featuring 9,999 characters.

The project sold over 107 million RBLZ in the ongoing presale, raising over $1.5 million.

Read more: Spot Bitcoin ETF set for launch; Solana and Rebel Satoshi attract investors

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

READ MORE ABOUT

sponsored

Solana transaction volume hit multi-year high in January

By Anna Kharton

By Anna Kharton

January 31, 2024 at 12:49 pm Edited by Dorian Batycka

Edited by Dorian Batycka

NEWS

Collect the article

share

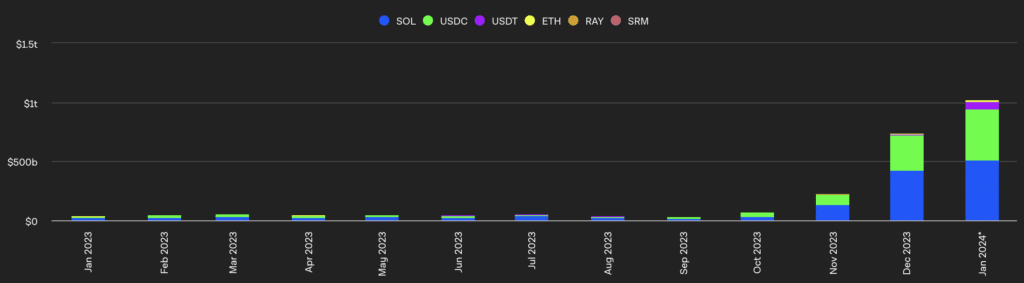

Transaction volume on the Solana network crossed $1 trillion in January, a multi-year high.

According to The Block’s dashboard, transaction volume is up 30% from December 2023, at $738.8 billion. Online transaction volume has hit a record high since September 2022, at $1.55 trillion. Source: The Block

Source: The Block

Experts note that the growth in blockchain activity is significantly higher than in 2023 and through much of 2022. For example, in September 2023, transaction volume on the Solana network reached a low of $40 billion.

In January, the number of registered addresses on the Solana blockchain reached a multi-month high. This month, the number of new Solana addresses exceeded 10 million, the highest figure since May 2022, when the number of addresses was 11.72 million.

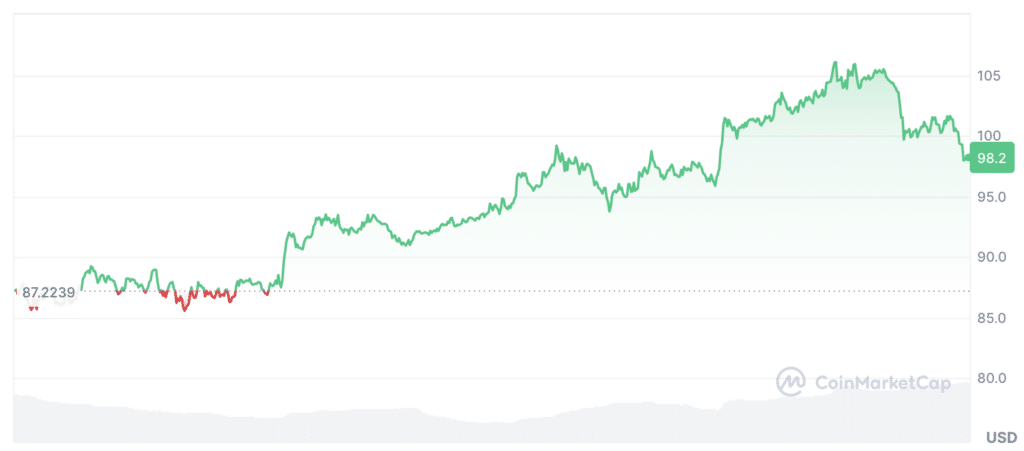

In addition, the naive token Solana (SOL) has shown steady growth. Over the past week, the asset price has increased by about 12%. At the time of writing, the cryptocurrency is trading at around $98. Source: CoinMarketCap

Source: CoinMarketCap

Solana has performed exceptionally well over the past year, performing much better than Ethereum (ETH) despite unfavorable market conditions. Moreover, following the approval of the Bitcoin (BTC) ETF, the price of Solana did not change significantly, indicating another distinctive market reaction compared to the rest of the market.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: $AUSPOL on the memecoin shill-dar](https://cdn.bulbapp.io/frontend/images/d8e380ef-23df-4ddc-8e19-28c3be2bece6/1)