How to Create a Successful Exit Strategy for Your Business

An exit strategy is a crucial component of any business plan, guiding entrepreneurs through the process of transitioning ownership or closing a business in a structured and beneficial manner.

Crafting a successful exit strategy not only ensures financial stability but also secures the legacy of the business.

This article delves into the essential elements of creating a robust exit strategy, offering professional insights and actionable steps for business owners.

Understanding the Importance of an Exit Strategy

Long-term Vision and Planning

A well-defined exit strategy aligns with the long-term vision of the business, providing a roadmap for future transitions.

It encourages business owners to consider their ultimate goals and the legacy they wish to leave behind.

Whether aiming to sell the business at its peak value, pass it on to family members, or simply close operations gracefully, an exit strategy is a testament to thoughtful planning and foresight.

Financial Security and Maximizing Value

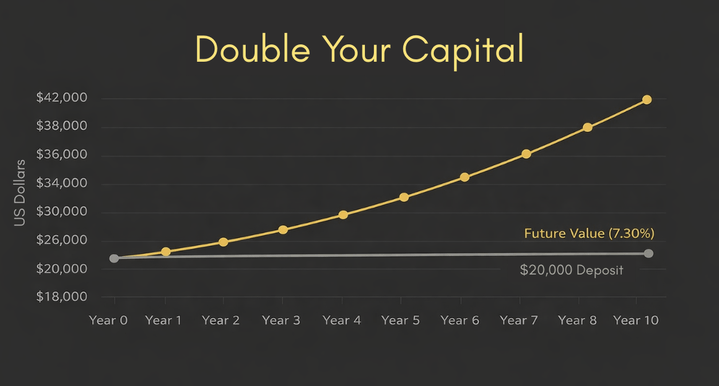

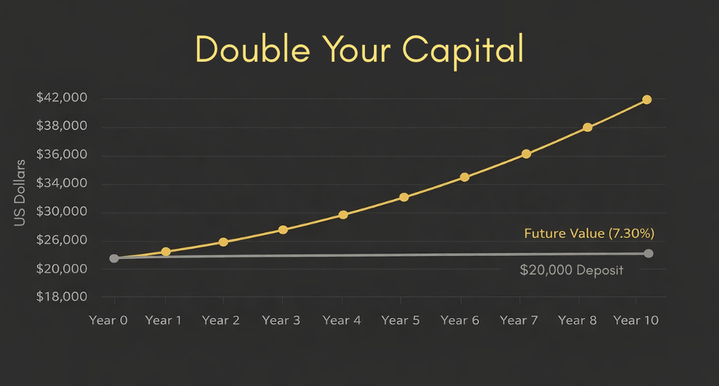

One of the primary objectives of an exit strategy is to maximize the financial return from the business.

This involves not only understanding the market value of the business but also strategically positioning it to attract potential buyers or successors.

Proper planning can significantly enhance the value of the business, ensuring that owners reap the rewards of their hard work and investment.

Risk Management and Continuity

An exit strategy also serves as a risk management tool. It prepares the business for unforeseen circumstances, such as economic downturns, health issues, or market shifts.

By having a plan in place, business owners can ensure continuity and stability, mitigating potential disruptions that could arise during the transition period.

Steps to Crafting a Successful Exit Strategy

Evaluate Your Business and Personal Goals

The first step in creating a successful exit strategy is to clearly define your business and personal goals.

This involves a thorough evaluation of your current business operations, financial performance, and future aspirations.

Consider the following questions:

- What are your long-term personal and professional goals?

- How do you envision your life post-exit?

- What are your financial needs and retirement plans?

By answering these questions, you can identify the most suitable exit strategy that aligns with your objectives. Whether it's selling the business, merging with another company, or passing it on to a successor, your goals will shape the direction of your exit plan.

Assess Business Value and Market Conditions

Understanding the value of your business is crucial for a successful exit. Conduct a comprehensive business valuation to determine its worth. This process involves analyzing financial statements, assessing market conditions, and benchmarking against industry standards.

Engaging a professional appraiser or business broker can provide an accurate and unbiased valuation.

In addition to internal assessments, keep an eye on market conditions. Economic trends, industry growth, and competitive landscape can significantly impact the timing and success of your exit. A favorable market environment can enhance the value of your business and attract more potential buyers.

Develop a Succession Plan

A key component of any exit strategy is a well-thought-out succession plan. This plan ensures a smooth transition of leadership and operations, minimizing disruptions and maintaining business continuity.

Identify potential successors, whether they are family members, key employees, or external candidates, and provide them with the necessary training and support to take over the business.

A robust succession plan includes:

- Identifying key roles and responsibilities within the business.

- Developing a timeline for the transition process.

- Providing training and development programs for successors.

- Establishing clear communication channels to manage the transition effectively.

By grooming successors early and involving them in the strategic planning process, you can ensure they are well-prepared to lead the business in the future.

Financial Planning and Tax Considerations

Financial planning is a critical aspect of any exit strategy. Work with financial advisors to develop a comprehensive plan that addresses your financial needs and goals post-exit. This includes retirement planning, investment strategies, and estate planning.

Tax considerations also play a significant role in the exit process. Understand the tax implications of selling or transferring your business and explore strategies to minimize tax liabilities.

This may involve structuring the sale in a tax-efficient manner, utilizing tax deferral techniques, or exploring options for gifting the business to family members.

Legal and Compliance Aspects

Navigating the legal and compliance aspects of an exit strategy is essential to ensure a smooth and successful transition.

Engage legal professionals to review and draft necessary documents, such as sales agreements, non-compete clauses, and confidentiality agreements. Ensure that all legal and regulatory requirements are met, including any industry-specific regulations.

Additionally, consider intellectual property protection and ensure that all patents, trademarks, and copyrights are appropriately transferred or retained during the exit process. Addressing legal and compliance issues proactively can prevent potential disputes and safeguard the interests of all parties involved.

Executing the Exit Strategy

Marketing and Positioning the Business

Effectively marketing and positioning your business is crucial to attract potential buyers or investors. Highlight the strengths, unique selling points, and growth potential of your business.

Develop a compelling narrative that showcases the value proposition and future opportunities. Utilize professional marketing materials, such as pitch decks, financial projections, and business plans, to present your business in the best possible light.

Negotiating the Deal

Negotiating the terms of the exit is a critical step that requires careful consideration and strategic thinking. Engage experienced negotiators or business brokers to assist in the process.

Key elements to address during negotiations include:

- Purchase price and payment terms.

- Transition period and handover responsibilities.

- Non-compete and confidentiality agreements.

- Employee retention and compensation.

Aim for a win-win outcome that satisfies both parties' interests and ensures a smooth transition.

Transition and Handover

The transition and handover phase is crucial to maintaining business continuity and ensuring a successful exit. Develop a detailed transition plan that outlines the steps and timeline for the handover process.

This may include:

- Knowledge transfer and training sessions for successors.

- Communication plans to inform employees, customers, and stakeholders.

- Operational handover, including access to systems, processes, and documentation.

Provide ongoing support and guidance to successors during the transition period to facilitate a seamless handover.

Post-Exit Considerations

Financial and Lifestyle Adjustments

After the exit, it's essential to reassess your financial and lifestyle goals. Work with financial advisors to manage the proceeds from the sale and ensure long-term financial security.

Consider reinvesting in new ventures, pursuing philanthropic interests, or focusing on personal pursuits and hobbies.

Maintaining Relationships and Legacy

Maintaining relationships with former employees, customers, and industry peers can be beneficial post-exit.

Your reputation and network can continue to provide opportunities for mentorship, consulting, or new business ventures.

Reflect on the legacy you wish to leave and consider ways to give back to the community or industry that supported your business journey.

Legal and Financial Wrap-Up

Finally, address any remaining legal and financial matters to complete the exit process. This may involve finalizing tax filings, settling outstanding liabilities, and updating legal documents, such as wills and trusts. Ensure that all loose ends are tied up to avoid future complications and maintain peace of mind.

Conclusion

Creating a successful exit strategy is a multifaceted process that requires careful planning, strategic thinking, and professional guidance. By understanding the importance of an exit strategy, evaluating your goals, and meticulously executing the plan, you can ensure a smooth and profitable transition.

A well-crafted exit strategy not only secures your financial future but also preserves the legacy of your business, paving the way for continued success and new opportunities.