$HALL — The Symbol of Omnichain Interconnectivity

The Web3 Utopia — Where we want to be

It’s Year 2030, where creators, brands, developers (collectively referred to as “builders”) launch thousands of micro-economies with millions of digital assets, driving shared ownership amongst their communities. Communities of different shapes and sizes develop in verticals such as gaming, IP, finance, AI, with some pursuing dedicated blockspace through sovereign chains and rollups, while others hosting on monolithic infrastructure. Communities frictionlessly transact assets between states, strike economic arrangements with one another, and access new products. Localised communities are thriving and building towards a larger global economy together.

Present Reality — Where we are today

Present Web3 strays far from the interconnected Utopia. Drawing on the analogy of network states likened to physical nations, the current state of Web3 resembles an ecosystem of developing nations (networks), with limited attractive destinations (tokens), limited transportation infrastructure (liquidity), and poor access to the Internet (data and resources).

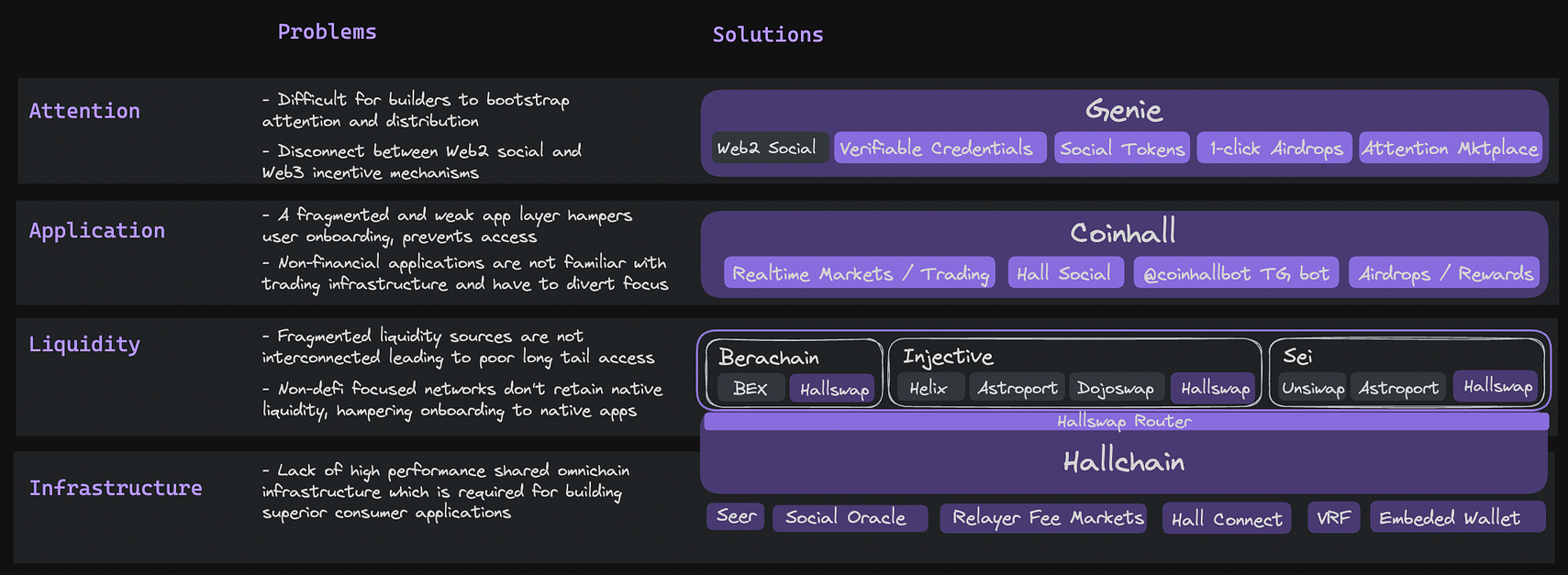

In working towards global interconnectivity, we have identified a number of key problems:

Problem 1: Limited Access to Shared Data and Infrastructure

Many Web3 applications heavily rely on data. It forms the foundation and determines the application’s performance, user-friendliness, and even safety. For on-chain data, the application needs to set up infrastructure such as nodes and indexers, and establish an entire data hub in order to obtain processed data. Typical application tasks include wallet connections, fetching asset balances, resolving USD prices, and RPC load balancing. Repeat this for every single network supported. These tasks often need to be built from scratch, consuming valuable engineering resources.

Wouldn’t the space grow faster if there was access to shared and performant infrastructure?

Problem 2: Liquidity Fragmentation

On top of the data layer, asset interoperability becomes the next obvious blocker for global interconnectivity. As of today, tokens are deployed in DEXes which typically exist as smart contracts on a network. Picture the concept of token liquidity like real world transportation systems: Stations (tokens) are linked together via train tracks (liquidity), on a train line (DEX), that operates in a city (network).

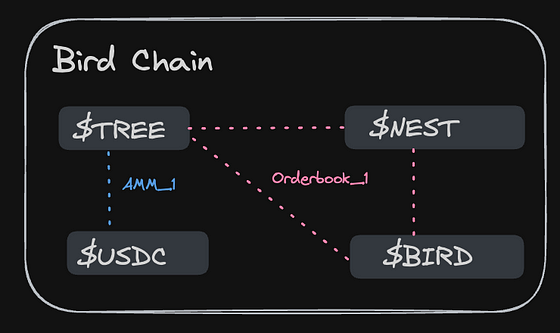

Let’s start easy from intrachain swaps. A user can get from $USDC to $TREE or $NEST to $BIRD because there is direct liquidity in AMM_1 and Orderbook_1 respectively. Without intervention, a user cannot get from $USDC to $BIRD as liquidity exists on 2 different DEXes (stations are on 2 separate train lines).

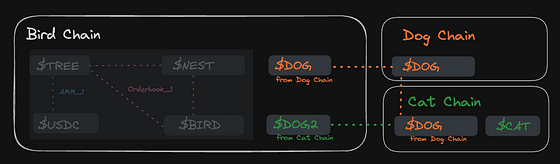

Now let’s take it up a notch by introducing bridged assets. Bridged assets are path-dependent which means that any 2 tokens which are not bridged from the same source are different tokens. Let’s reference the diagram below to illustrate this.

$DOG is an asset natively issued on Dog Chain. When native $DOG is bridged to Cat Chain and Bird Chain, both are considered the canonical version of bridged $DOG. In other words, when a user bridges the canonically bridged $DOG back to Dog Chain, it will be the native asset. However, when bridged $DOG from Cat Chain is bridged to Bird Chain, labelled as $DOG_2, this is an entirely different asset from canonically bridged $DOG.

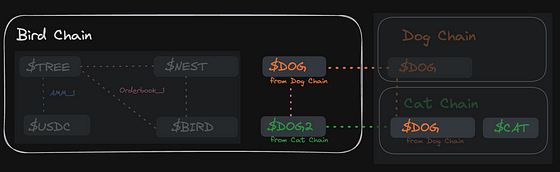

“Why can’t someone just create a stable pool of $DOG-DOG2 to make them interoperable?” Sure, you can! Poof. $DOG-DOG2 is now been pooled on Orderbook_1. But wait, now there isn’t any liquidity connecting $DOG to any other token on Bird Chain.

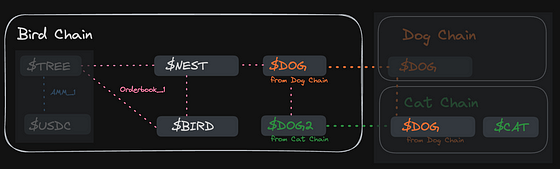

“Okay… then create another pool between $DOG and $NEST?” Sure! Poof. The $DOG-$NEST liquidity pool has now been created on Orderbook_1, and bridged $DOG can be traded with $NEST and $DOG2.

Awesome, now $DOG has some level of connectivity on all 3 chains. But hold on a minute… Did we jump through this many hoops, just for 1 token, on 3 chains? Imagine this blown up at the scale of 100 chains, with thousands of native assets and bridged assets.

In the present design, it’s pretty obvious that trying to plaster pockets of liquidity for a given token leads to infinite liquidity fragmentation, with poor capital efficiency. Every $1 budget of capital has to be fragmented across n chains, resulting in mere cents worth of liquidity on each chain — a subpar trading experience throughout.

Problem 3: Distributing via a social layer that is disconnected from Web3

Builders currently face a distribution problem, finding it tough to get attention and awareness of new user audiences beyond the power users of the underlying Layer 1 ecosystem. Social media has been the dominant strategy for distribution and discovery of new projects / tokens / communities, for obvious reasons: Twitter as a platform has multiple times the user base compared to the whole of Web3 combined… except the social layer is not natively integrated into Web3, yet.

Recall seeing a tweet that resembles this?

In this illustration, Coinhall (the marketer) is trying to align itself with the Bad Kids community (the marketing partner), to rent attention, likely for the purpose of onboarding a new user base. At the end of 24 hours, Coinhall uses a platform like twitterpicker.com to randomly pick a winner, before announcing the winner. Coinhall then DMs the winner for an address, before sending the NFT (reward). Wait a minute, we call this Web3? What happened to ‘Verify, not trust’?

Immediate questions that comes to the Web3 purist’s mind:

- How can we verify that the Coinhall team didn’t pick their own intern?

- How can we verify twitterpicker was not built by the Coinhall team?

- How can we verify this twitter user is a Bad Kid holder, and not a bot?

- How communities better align outcomes in a Web3 native way?

Surely, the future of Web3 distribution has to do better.

Shared Infrastructure. Shared liquidity. Superior distribution. Core problems, that once tackled, can scale economies, globally.

Introducing $HALL, the symbol of Shared Omnichain Connectivity

hall /hɔːl/ noun. the passageway that leads to other rooms

Coinhall started in August 2021 as a webapp offering realtime price charts on a single blockchain. After multiple DEXes launched, we soon realised the need for an aggregated liquidity layer to offer a smoother trading experience for user — Hallswap, our proprietary DEX aggregator, was born. Fast forward 13 chains and 25 DEX integrations later, Coinhall has 220k users and has facilitated $2.4B in transaction volume. We have connected local liquidity for these chains reasonably well, but there still exists a gap for cross-chain connectivity between long-tail assets. To scale across the next 1000 networks, we have to vertically integrate lower in the stack, to build a shared infrastructure layer that can be sufficiently decentralised.

Powering Shared Omnichain Infrastructure

From our lens, a scalable shared infrastructure design would have several properties:

- Positive Sum: ANY network, whether monolithic or modular, would have shared economic alignment and synergy from entering the ecosystem. Going global has to complement rather than compete.

- Network Effects: Every new network joining the fray would produce marginal benefits for the entire ecosystem.

- Low Friction: Going global has to be a modular plug and play solution.

Presenting Hallchain, the Shared Omnichain Connectivity Layer, where local economies become global economies. Hallchain is an EVM & Cosmwasm compatible, dPOS Layer 1 blockchain, built on the Cosmos SDK supporting up to 10,000 TPS.

Hall’s shared global infrastructure components will include:

- IBC Relayer Fee Market: On top of aligning economic incentives to cross-chain relayers, fee bonuses and rebates can be leveraged to incentivise flow across specific source-destination chains, similar to how bilateral trade agreements exist in the real world.

- Seer: Best-in-class indexer with subsecond query latency that has been powering coinhall.org, and will be progressively available to other applications.

- Hall Connect: A Decentralised Wallet Connection module to power seamless mobile experiences. 50% of coinhall.org’s existing users are on mobile, so it matters deeply to us that we improve the state of mobile wallet connections, which will be imperative in onboarding the next billion users.

- Social Oracle: Unifying a user’s Web2 social media account to a Web3 wallet, to power Web3 native social experiences.

- Verifiable Randomness Function (VRF): Hallchain will include a VRF module to allow builders to run social based campaigns which include chance based outcomes, such as lootboxes.

- Embedded Wallet: To facilitate superior consumer experiences without having to sign an EOA wallet with every transaction. Use cases include session-key based trading, playing games, governance.

- Global Asset Registry: Assets are crawled from supported networks and DEXes, and populated into an open sourced registry, accessible by fellow builders.

- Wallet Library: We maintain an open sourced wallet library which compounds with every new integrated network, accessible by fellow builders.

As we continue scaling shared infrastructure capabilities, some of aforementioned components will be progressively decentralised into the network level, run by Hallchain validators. Hallchain will be governed by $HALL, which will be the fee token for Hallchain services as well as the linchpin of the the Hall Liquidity Stack that will be described in the following section.

Powering Infinitely Long Tail Omnichain Liquidity

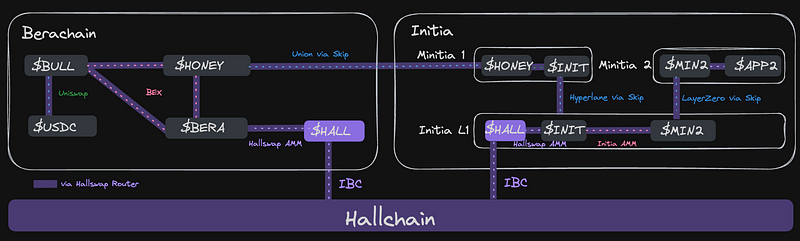

Hallswap is the Modular Omnichain Liquidity Layer that powers both local and global liquidity. There are 4 components making up the liquidity stack, listed from Infrastructure → Protocol → Application.

- [Infra] Hallchain, the infrastructure layer, will be the home chain of $HALL, where all $HALL bridging transactions will route through to retain canonicity.

- [Protocol] Hallswap DEX, which will be deployed on every integrated chain, pooling $HALL-L1 liquidity. Hallswap DEX will initially launch with PCL and XYK pools as viable options based on market conditions.

- The primary objectives of classical DEXes are to incentivise liquidity provision and to optimise capital efficiency for traders. Hallswap DEX is instead intended to accelerate omnichain connectivity and not to compete for existing liquidity. Forming an economic alliance, Hallchain and the integrated network will jointly pool $HALL-L1 liquidity, which self-sustains as swap fees accumulate and grow the liquidity depth. The DEX will not have emissions to incentive liquidity. The intention is for Hallchain to progressively decentralise and scale, such that $HALL liquidity can be permissionlessly requested by networks through governance.

- [Protocol] Hallswap Router will also be deployed on every integrated chain with multiple DEXes, aggregating local liquidity to offer users best price swap routes across long-tail assets, regardless of DEX. Hallswap will integrate bridges and interop aggregators like Skip to bolster the robustness of routes offered. Because Hallswap Router takes care of aggregation, any subsequent assets can be pooled with the $L1 token itself on any supported liquidity venue, without the need for additional pools outside of $HALL-L1.

- [Application] Coinhall, the application layer where users can discover new tokens, access aggregated liquidity, through a familiar interface. A Pro Trading Terminal, hyperlocalised for every integrated network.

On the swap execution level, ANY to ANY asset swaps will take place as follows:

- Intrachain swaps ($DOJO on Injective → stINJ on Injective): via Hallswap Router

- Cross-chain swaps, for example $INIT (Initia) -swap→ $HALL (Initia) -ibc→ $HALL on Berachain -swap→ $BERA on Berachain). Hallswap will prioritise $HALL as the bridged asset for cross-chain swap routes across any 2 integrated networks

- IBC transfers ($USDC on Sei → $USDC on Bera): via Skip Protocol

Through Hallswap, any token and network can now go omnichain on Day 1. Local -> Global.

Bootstrapping Omnichain Distribution and Attention

Upon tackling the data and liquidity layer, the $HALL ecosystem will look to tackle the attention layer next, which will be key in onboarding the next billion users.

In 2023, we launched Genie, a Web3 campaigns platform that enabled builders to set up campaigns in a no-code fashion quickly by parameterising the Target Audience (Wallets who stake/swap/provide LP above a certain threshold within a snapshot date range), Mission (Swap/Deposit/any onchain action), and Reward (Earn tokens, linearly variable based on the Mission/Lootboxes). Within a year, Genie facilitated millions of dollars in campaigns/airdrops to over 80,000 users, partnering with validators, DeFi protocols, NFT projects and more. We realised that while the protocol achieved successful outcomes in terms stimulating DeFi activity with reasonable CAC, there were limitations in distributing to new users as the product lacked social elements.

Once elements like Seer, social oracle, and VRF are embedded into Hallchain, Genie will be supercharged to become a social and distribution primitive. Imagine every new token project, launching via Genie for superior bootstrapping of distribution and attention. Projects can set aside a fraction of their supply to be airdropped to communities that they wish to socially align with, and execute with just a few button clicks. Imagine every creator having their own social token, with certain elements of FriendTech baked in. But alas, Genie has a whole exciting arc of its own, so we’ll go light on the details and leave you with the wider Hall vision.

Piecing everything in place, we present to you, the $HALL ecosystem.

How does the $HALL ecosystem contribute to its stakeholders

- Networks: Focus on building locally while accessing the global economy. Network-Owned Liquidity means that gas fees, user activity, MEV can all be captured by the network. Native liquidity improves native user experience for native applications. The $HALL ecosystem assimilates into your local ecosystem, building alongside with you.

- DEXes: Focus on driving capital efficiency and yield for your liquidity providers and traders. Every integrated DEX gets access to the Coinhall Trading Terminal, leveraging its features and omnichain user base.

- Token projects: Deploy on any support DEX and Coinhall will provide you with a dedicated shopfront and pro-trading experience. Projects can improve capital efficiency when deploying liquidity by concentrating liquidity where the user demand is. Leverage Genie as a go-to-market primitive to bootstrap distribution across other global communities.

- Applications: Leverage high-performance shared omnichain infrastructure and minimise redundancy.

- Users: A liquidity abstracted user experience. Trading becomes as simple as online shopping with global payment methods. Discover new gems, and onboard into new ecosystems in 1-click.

Globally coordinated economies with superior liquidity and distribution? That’s the Web3 world we want to live in. All global, all social, $HALL together.

What’s Next?

Register interest to work with us!

- Preliminary signups to be a Hallchain Validator are now open: Form

- If you are a Network/DEX/dApp that is keen to be $HALL aligned: Form

- Follow our socials for the latest updates:

Hallchain

- Discord: https://discord.gg/Ebz8yaveAk (You’re early!)

- Twitter: https://twitter.com/hallfdn

Coinhall

- Discord: https://discord.gg/v5NRFvzmY4

- Twitter: https://twitter.com/coinhall_org