Crypto Technical Analysis: A Step-By-Step Guide

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Technical analysts believe that the historical performance of a security, as depicted on a price chart, can be used to predict its future performance. In the world of crypto, technical analysis is used to predict the future price movements of cryptocurrencies by analyzing charts and indicators.

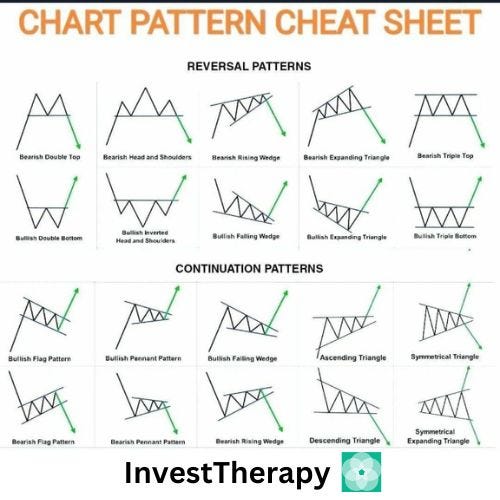

Chart Patterns By InvestTherapy

When it comes to crypto, technical analysis is particularly popular among traders because of the high volatility of the market. By using technical analysis, traders can identify patterns and trends that can help them make informed decisions about when to buy and sell a particular coin or token.

To perform technical analysis on a crypto asset, you will need a charting platform that provides historical data on the asset’s price and volume. Some popular charting platforms for crypto include TradingView and Coinigy.

There are several key components to technical analysis in crypto, including chart patterns, indicators, and support and resistance levels.

- Chart Patterns:

One of the most fundamental aspects of technical analysis is the study of chart patterns. These patterns are formed by the movement of the price of a coin or token over a certain period of time. The most common chart patterns include head and shoulders, double tops and bottoms, and triangles.

Head and shoulders patterns are considered bearish reversal patterns and are formed when the price of a coin or token reaches a new high, followed by a pullback, and then another high that is not as high as the first. The pullback is then followed by a final low that is lower than the previous low.

Double tops and bottoms are considered reversal patterns and are formed when a coin or token reaches a new high or low, followed by a pullback, and then another high or low that is not as high or low as the first.

Triangles are considered continuation patterns and are formed when the price of a coin or token is moving within a narrowing range.

- Indicators:

Another key component of technical analysis in crypto is indicators. Indicators are mathematical calculations that are based on the price and/or volume of a coin or token. The most common indicators used in crypto include the moving average, relative strength index (RSI), and the Bollinger Bands.

The moving average is a widely used indicator that helps traders identify trends in the market. A moving average is calculated by taking the average of the closing price of a coin or token over a certain period of time.

The RSI is a momentum indicator that helps traders identify overbought and oversold conditions in the market. The RSI is calculated by comparing the average gains and losses of a coin or token over a certain period of time.

The Bollinger Bands is a volatility indicator that helps traders identify when a coin or token is experiencing unusually high or low volatility. The Bollinger Bands are calculated by taking the moving average of a coin or token and adding and subtracting a standard deviation from it.

- Support and Resistance Levels:

Support and resistance levels are other key components of technical analysis in crypto. These levels are determined by analyzing the price of a coin or token and identifying areas where the price has found support or resistance in the past.

Support levels are areas where the price of a coin or token has found support in the past, and are considered to be areas where the price is likely to find support in the future. Resistance levels are areas where the price of a coin or token has found resistance in the past, and are considered to be areas where the price is likely to find resistance in the future.

By using chart patterns, indicators, and support and resistance levels, traders can make informed decisions about when to buy and sell a particular coin or token. However, it’s important to note that technical analysis is not a perfect science and should be used in combination with other forms of analysis such as fundamental analysis and market sentiment.

Conclusion:

technical analysis can be a useful tool for evaluating crypto assets and identifying potential buying and selling opportunities. By analyzing historical price and volume data, looking for patterns and trends, and paying attention to volume and other indicators, traders can make more informed decisions in the crypto market. However, it’s important to remember that technical analysis is just one aspect of evaluating a crypto asset and should be used in conjunction with other methods such as fundamental analysis and market sentiment analysis

Disclaimer: The information provided in this article is solely the author’s opinion and not a investment advice — it is for educational purposes only. By reading this, you agree that the information does not constitute any investment or financial instructions. Do your own research before making any investment decisions.

If you like this post, here are 3 things you can do to support my work:

- Give this story a React 👏.

- Follow me for my upcoming stories.

- Give a Comment to my Story.