How to Build and Deploy a Crypto Arbitrage Bot in 2024?

Understanding Arbitrage in Cryptocurrency Markets

Arbitrage, a term rooted in financial markets, refers to the practice of exploiting price differentials for the same asset across different markets. In the realm of cryptocurrency, arbitrage has emerged as a popular strategy, allowing traders to capitalize on the decentralized and often fragmented nature of digital asset exchanges.

The Basics of Cryptocurrency Arbitrage:

Cryptocurrency arbitrage involves taking advantage of price variations for a specific cryptocurrency across multiple exchanges. These price differences can be the result of factors such as market inefficiencies, varying levels of liquidity, or delays in information dissemination between exchanges.

There are primarily three types of cryptocurrency arbitrage:

1. Spatial Arbitrage:

- Involves exploiting price differences for the same cryptocurrency on different exchanges at the same time.

- Traders buy the asset on the exchange where the price is lower and sell it on the exchange where the price is higher, making a profit from the spread.

2. Temporal Arbitrage:

- Takes advantage of price differences for the same cryptocurrency on the same exchange but at different times.

- Traders buy the asset when the price is lower and sell it when the price increases, profiting from the temporal price gap.

3. Cross-Exchange Arbitrage:

- Involves exploiting price differences for the same cryptocurrency by executing trades across different exchanges.

- Traders buy the asset on one exchange and simultaneously sell it on another exchange where the price is higher, making a profit from the price differential.

Challenges and Considerations:

While cryptocurrency arbitrage can be a lucrative strategy, it comes with its own set of challenges and considerations:

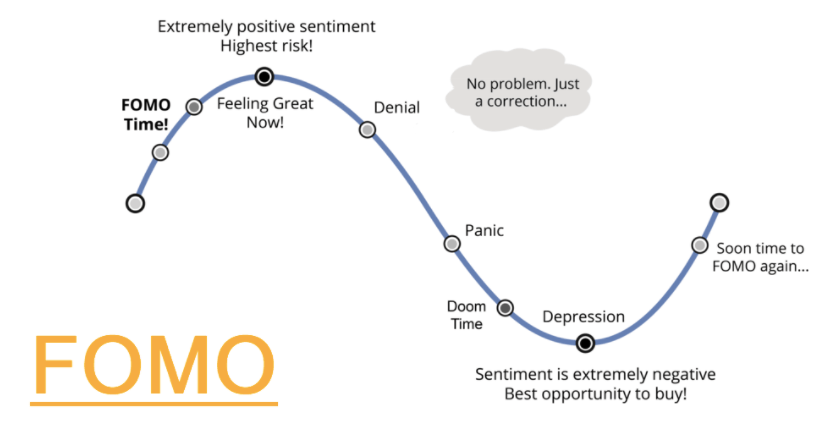

- Market Volatility:

Cryptocurrency markets are known for their high volatility, and prices can change rapidly. Traders must act quickly to capitalize on arbitrage opportunities.

- Transaction Costs:

Trading fees and transaction costs can significantly impact the profitability of arbitrage. Traders need to consider these expenses when executing trades.

- Liquidity Issues:

Low liquidity on certain exchanges may result in slippage, where the actual executed price differs from the expected price.

- Regulatory Considerations:

Different exchanges may operate under varying regulatory frameworks, adding complexity to cross-exchange arbitrage.

Understanding arbitrage in cryptocurrency markets requires a keen awareness of market dynamics, risk management, and the ability to leverage technology effectively. As we delve deeper into the world of cryptocurrency arbitrage, we will explore strategies, tools, and the development of automated solutions to navigate the complexities of this intriguing trading approach. Stay tuned for further insights into building and deploying crypto arbitrage bots for a competitive edge in the digital asset landscape.

How To Build A Crypto Arbitrage Bot?

Cryptocurrency arbitrage bots can be powerful tools for automating trading strategies that take advantage of price differentials across various exchanges. Here’s a step-by-step guide to help you build your crypto arbitrage bot:

1. Define Your Strategy:

- Determine the type of arbitrage you want your bot to execute (spatial, temporal, cross-exchange) based on your risk tolerance and market analysis.

- Set criteria for identifying arbitrage opportunities, such as minimum price differences, trading volume thresholds, and liquidity requirements.

2. Choose Exchanges and APIs:

- Select the cryptocurrency exchanges you want to trade on and obtain API keys. Ensure the exchanges support the trading pairs you’re interested in.

- Most exchanges provide API documentation, detailing how to integrate your bot with their platform.

3. Develop Market Data Collection:

- Implement a data collection module to fetch real-time price data from the selected exchanges.

- Consider using WebSocket connections for faster and more efficient data updates.

4. Implement Trading Logic:

- Develop the core logic of your arbitrage strategy. This involves identifying price differentials that meet your predefined criteria and generating trade signals.

- Integrate risk management mechanisms to handle issues like slippage, transaction fees, and unexpected market movements.

5. Build Execution Algorithms:

- Develop algorithms for placing buy and sell orders on the selected exchanges. Ensure your bot can execute trades swiftly to capitalize on arbitrage opportunities.

- Implement order verification mechanisms to avoid unintentional errors in trade execution.

6. Incorporate Security Measures:

- Prioritize the security of your bot and user credentials. Use secure methods for storing API keys and other sensitive information.

- Consider implementing two-factor authentication for added security.

7. Backtesting:

- Test your bot’s performance using historical market data to validate its effectiveness.

- Backtesting helps identify potential issues and fine-tune your strategy before deploying the bot in live markets.

8. Implement Monitoring and Logging:

- Integrate monitoring tools to keep track of your bot’s performance, including trade execution, order status, and potential errors.

- Implement logging features to record important events and debug any issues that may arise.

9. Deploy and Monitor:

- Deploy your bot in a controlled environment initially to monitor its behavior in live markets.

- Regularly review and update your bot to adapt to changes in market conditions and exchange APIs.

10. Stay Informed and Adapt:

- Keep yourself updated on market trends, news, and regulatory changes that may impact your bot’s performance.

- Continuously monitor and adapt your strategy to maintain competitiveness in the dynamic cryptocurrency market.