The Necessity of Using Indicators for Traders

Technical indicators are a set of tools that traders use to analyze market data and make trading decisions. They are based on historical price and volume data, and they are used to identify trends, momentum, and other patterns in the market.

There are many different types of technical indicators, and each one has its own strengths and weaknesses. Some of the most popular indicators include moving averages, relative strength index (RSI), stochastic oscillator, and Bollinger bands.

Indicators can be used to help traders identify trading opportunities, set stop losses and profit targets, and manage their risk. However, it is important to remember that indicators are not infallible. They can provide signals that are false or misleading, and they should not be used as the sole basis for trading decisions.

Here are some of the reasons why using indicators can be beneficial for traders:

- They can help identify trends. Trends are one of the most important concepts in technical analysis, and they can be used to identify potential trading opportunities. Indicators can help traders identify the direction of the trend, as well as its strength and momentum.

- They can help identify overbought and oversold conditions. Overbought and oversold conditions are often seen as signs of a reversal in the market trend. Indicators can help traders identify these conditions and avoid getting caught in a losing trade.

- They can help identify support and resistance levels. Support and resistance levels are important technical levels that can help traders set stop losses and profit targets. Indicators can help traders identify these levels and make more informed trading decisions.

- They can help manage risk. By identifying trends, overbought and oversold conditions, and support and resistance levels, indicators can help traders manage their risk and avoid large losses.

Overall, using indicators can be a helpful tool for traders. However, it is important to remember that indicators are not perfect and should not be used as the sole basis for trading decisions. Traders should always use their own judgment and experience when making trading decisions.

Here are some tips for using indicators effectively:

- Choose the right indicators for your trading style. There are many different types of indicators, and each one has its own strengths and weaknesses. It is important to choose the indicators that are right for your trading style and risk tolerance.

- Backtest your trading strategies. Once you have chosen your indicators, you should backtest your trading strategies to see how they would have performed in the past. This will help you to determine if the indicators are providing accurate signals and if they are compatible with your trading style.

- Use multiple indicators. No single indicator is perfect, so it is important to use multiple indicators to confirm your trading signals. This will help you to reduce the risk of false signals.

- Be patient. Indicators are not always right, and it is important to be patient when trading. Don't expect to make a fortune overnight.

By following these tips, you can use indicators effectively to improve your trading results.

Few indicators that traders use

Moving averages: Moving averages are a simple but effective way to identify trends. They are calculated by averaging the price of a security over a certain period of time, such as 50 days or 200 days. When the moving average is rising, it indicates that the trend is bullish. When the moving average is falling, it indicates that the trend is bearish.

[Image of Moving averages technical indicator chart]

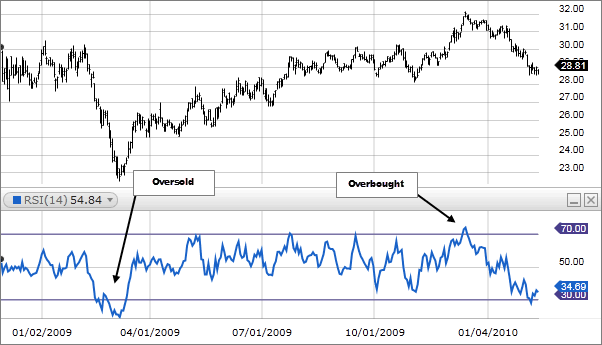

Relative strength index (RSI): The RSI is a momentum indicator that measures the speed and magnitude of price changes. It is calculated by dividing the number of up closes by the number of down closes over a certain period of time, such as 14 days. A reading above 70 indicates that the security is overbought and may be due for a reversal. A reading below 30 indicates that the security is oversold and may be due for a rebound.

[Image of Relative strength index (RSI) technical indicator chart]

Stochastic oscillator: The stochastic oscillator is another momentum indicator that measures the speed and magnitude of price changes. It is calculated by comparing the closing price of a security to its price range over a certain period of time, such as 14 days. A reading above 80 indicates that the security is overbought and may be due for a reversal. A reading below 20 indicates that the security is oversold and may be due for a rebound.

[Image of Stochastic oscillator technical indicator chart]

Bollinger bands: Bollinger bands are a volatility indicator that measure the price range of a security. They are calculated by adding and subtracting a certain number of standard deviations from the moving average. A narrowing of the bands indicates that volatility is decreasing, while a widening of the bands indicates that volatility is increasing.

[Image of Bollinger bands technical indicator chart]

On-balance volume (OBV): The OBV is a volume indicator that measures the positive and negative flow of volume in a security over time. It is calculated by adding the volume on up days and subtracting the volume on down days. A rising OBV indicates that buyers are increasing their activity, while a falling OBV indicates that sellers are increasing their activity.

[Image of On-balance volume (OBV) technical indicator chart]