Commodity trading strategies

In this essay I will share some popular and not so popular commodity trading strategies. Investors’ portfolios may benefit greatly from commodities because they can perform well in economic circumstances that are deleterious to conventional investments such as stocks and bonds. Furthermore, commodities can provide a natural hedge against inflation and inflation expectations.

There are several sources of structural returns in commodities markets due to their nature. One of them is hedge pressure. It is a well-known fact that in some commodity futures markets, there is a hedge pressure on one side of the market. Till and Eagleye (2006) note that since there are more commercial sellers (hedgers) in these markets, there tends to be a downward price bias. Non-commercial investors, i.e, speculators can harvest “insurance premium” by taking the opposite side of trade which means to long these futures contracts. Live cattle and gasoline are examples of hedge pressure effect.

Short hedging in live cattle futures is a much higher percent of open interest in comparison to long hedging. To reduce the risk of fall in cattle prices, livestock producers hedge their positions “without significant regard to price level”. However, no such big group of commercial buyers exists in this market. Therefore, there is a positive systematic return of holding live cattle futures for investors who are ready to provide the supply side of hedging.

Another example of the market with systematic downward bias which results from there not existing large commercial buyers, is gasoline futures. Several features of the gasoline business make it difficult for buyers to hedge against. These characteristics are 1) consumers’ buying their gasoline from many retailers, not only from one supplier 2) prices varying widely. It is not surprising that both live cattle and gasoline futures had double-digit returns over a 20-year time period (1980s to 2004).

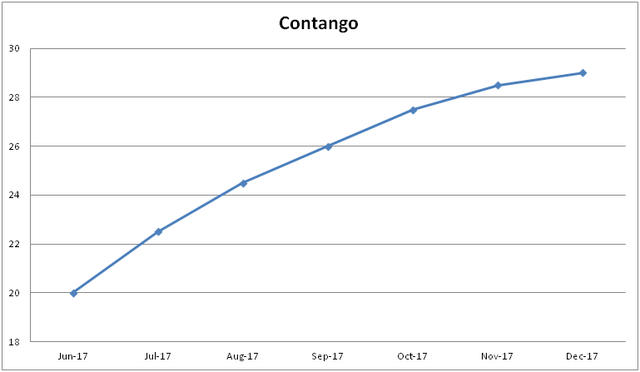

We can also specify scarcity as a separate return driver of commodities futures. To find out which commodities are scarce at the moment, we have to understand the term structure of futures contracts. Term structure just means prices across different months. If a front-month contract’s price is lower than the prices of further months’ contracts, then it is said that the market is contango.

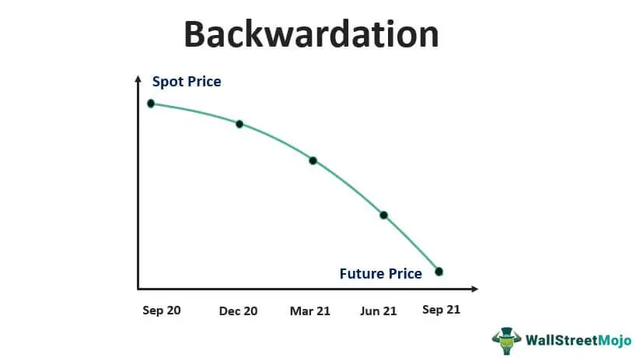

Conversely, if a front-month’s contract is trading at a premium to the far-dated contracts, then the curve is in backwardation.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)