Bitcoin's sharp downturn linked to futures liquidations, Michael Saylor sees opportunity for Bitcoin

Michael Saylor sees opportunity for Bitcoin in chaos

Despite a weekend dip in Bitcoin's price, MicroStrategy's holdings are still profitable.

Bitcoin tumbled over the weekend following a drone attack by Iran on Israel. Under the influence of Middle East tensions and the approaching halving, the price plunged from $68,000 to around $60,000 on Saturday, with $1.2 billion in long positions liquidated. Despite this sharp correction, Michael Saylor, co-founder of MicroStrategy, expressed a positive outlook, stating, “Chaos is good for Bitcoin.”

His statement was shared on X after Bitcoin’s weekend downturn eroded over $1.5 billion from MicroStrategy’s holdings. Still, the company maintains a substantial profit exceeding $6 billion.

Saylor’s comments sparked diverse reactions within the crypto community. Some criticized his timing due to the ongoing international conflict, while others agreed with his view of Bitcoin as a “hedge against chaos.”

Historical data shows that Bitcoin often faces initial price declines during geopolitical instability but tends to recover as it is seen as a long-term haven.

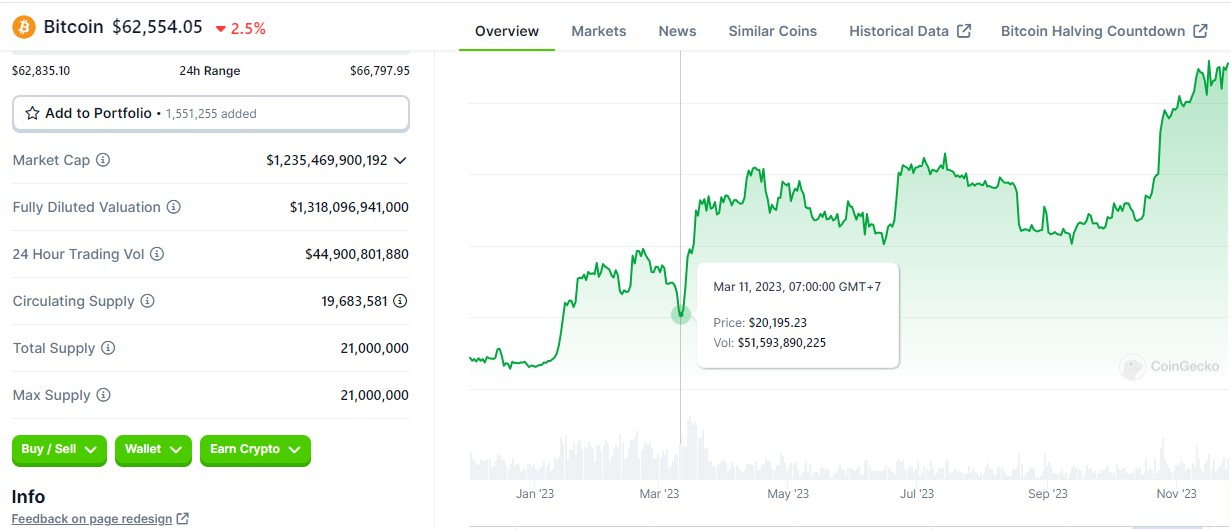

For instance, after the Russia-Ukraine conflict began in February 2022, Bitcoin’s price dropped to around $39,000 but rebounded to $44,000 within a week, according to data from CoinGecko. Similarly, following the Israel-Hamas conflict in October 2023, Bitcoin initially fell by 6% but rose to $35,000 within a month.

Banking distress last March also mirrors this pattern, though Saylor’s comment wasn’t necessarily related to economic chaos.

When Silicon Valley Bank faced bank runs on March 10, 2023, Bitcoin’s price briefly dipped below $20,500 but soon recovered, climbing to a nine-month high by the end of March. This recovery was further bolstered by BlackRock’s filing for a spot Bitcoin ETF.

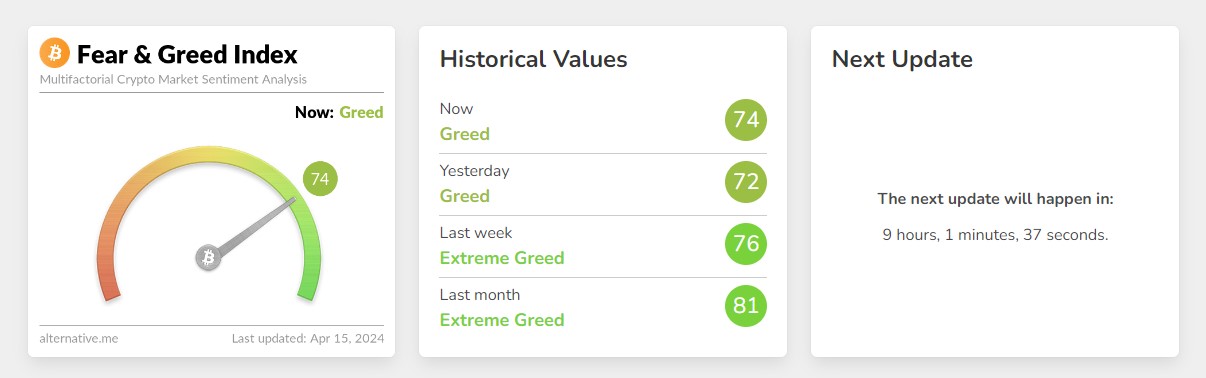

Despite recent war fears, Bitcoin market sentiment remains bullish. According to Alternative’s data, the Fear and Greed Index currently sits at 74, indicating “greed” – down from “extreme greed” but still reflecting strong investor confidence. This optimism is likely fueled by the approaching halving event, which historically has been followed by a price peak for Bitcoin several months later.

Bitcoin reclaimed the $66,000 earlier today after Hong Kong officially approved spot Bitcoin and Ethereum ETFs. At the time of writing, Bitcoin is trading at around $62,500, down 2.5% in the last 24 hours, per CoinGecko’s data.

Bitcoin’s recent price crash has been notably influenced by futures contract liquidations, according to the “Bitfinex Alpha” report. Over the past month, Bitcoin (BTC) has oscillated between $71,300 and $63,500, with a significant crash on April 12 leading to over $1.8 billion in liquidations amid geopolitical tensions.

According to Bitfinex’s analysts, these market movements are not isolated incidents, as similar patterns have been observed previously, where dips below the range low were met with a swift recovery. Yet, this time, the market’s response may be more subdued, as indicated by current spot flows into Bitcoin.

The concept of “time capitulation” is at play here, where leveraged traders face capital erosion through stop-losses and liquidations, while large holders potentially engage in distribution or accumulation.

The introduction of new supply to the market is a critical factor. If absorbed, it could propel Bitcoin out of its current range. However, the high volume of market participants exiting leveraged positions is contributing to a healthier market ecosystem with minimal funding rates.

The past few days have seen daily liquidations comparable to those on March 5th, which brought significant volatility and a 14.5% intra-day price swing for Bitcoin. Despite a smaller 8.5% intra-day movement on the recent Friday, liquidations reached similar levels across major exchanges. Saturday’s liquidations were among the largest in the asset class’s history, with a 12% intra-day fluctuation. Daily liquidations across major centralized exchanges. Image: Bitfinex/Coinglass

Daily liquidations across major centralized exchanges. Image: Bitfinex/Coinglass

An interesting development during this correction is the neutralization of funding rates. These rates are crucial in aligning the price of perpetual futures contracts with the actual spot market price. The recent trend towards neutral or even negative funding rates across various altcoins suggests a healthier market correction and potentially reduced volatility ahead.

In line with the reduction of leveraged positions, the overall market saw a significant decrease in open interest, with approximately $12.5 billion vanishing over three days. This shift brought the total cryptocurrency market’s open interest down to $35.4 billion by Saturday, a stark contrast to the $48 billion peak just days prior.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Sam Rae for Hawke boost](https://cdn.bulbapp.io/frontend/images/6b43c624-bd70-48c8-b0bc-7bc27c86e0ee/1)