How Spot Bitcoin ETFs Work: A Comprehensive Guide

Bitcoin ETF news is everywhere, yet most of us crypto enthusiasts have very little understanding of their inner workings. Admittedly, it’s not that straightforward, but that's okay because we're here to demystify it all. Our goal? A concise, straightforward breakdown of what Bitcoin ETFs are and what actually goes on behind the scenes when buying or selling them.

This means we’ll have to explore the two predominant models used for processing the transactions: in-kind and in-cash. These methods dictate the flow of cash and Bitcoin throughout the entire transaction. By understanding these two models, you’ll grasp how Spot Bitcoin ETFs function and appreciate the nuances of the process.

What is A Bitcoin ETF?

A Bitcoin ETF is an Exchange-Traded Fund listed on traditional stock exchanges like the New York Stock Exchange or Nasdaq. So, instead of directly buying Bitcoin on cryptocurrency exchanges, you’re buying shares in a fund that holds Bitcoin assets. These ETFs give you exposure to Bitcoin without having to hold the cryptocurrency in self-custody directly.

The ETFs come in two types. First, we have Spot Bitcoin ETFs, which directly hold Bitcoin and closely track its value based on current market prices. They offer the advantage of providing direct exposure to Bitcoin. Some examples of spot Bitcoin ETFs available in the United States include the Grayscale Bitcoin Trust and the BlackRock iShares Bitcoin Trust ETF.

Another type is Futures-Based Bitcoin ETFs. These funds do not directly invest in Bitcoin but instead buy Bitcoin futures contracts traded on platforms such as the Chicago Mercantile Exchange (CME). They operate by tracking the performance of these futures contracts and have been around since October 2021.

Bitcoin ETFs: Important Terms to Know

Before we go into more detail, familiarising yourself with the following terms will make it easier to understand the process:

ETF Issuer: An issuer oversees the ETF’s operations, managing the underlying assets, and ensuring that the ETF adheres to its investment objectives and regulatory requirements. In the example above, the Issuer would be BlackRock.

Broker-Dealer: A market-making broker-dealer ensures there’s enough liquidity in the market. They facilitate trading by quoting both buy and sell prices for BTC, thereby creating a market for those securities. Broker-Dealers are needed to ensure that there are buyers and sellers available for price discovery and market stability.

Transfer Agent: This is a third-party entity responsible for transferring assets between the authorised participant and the ETF issuer. The transfer agent ensures that the exchange of securities between the authorised participant and the ETF issuer is executed accurately and efficiently. They could also handle administrative tasks related to the redemption process, such as processing redemption orders, maintaining records, and communicating with authorised participants and the ETF issuer.

Authorised Participant (AP): An authorised participant is an entity that can secure and sell Bitcoin as needed, ensuring there’s always enough liquidity. In the in-cash redemption model, authorised participants for the ETFs are responsible for handling the creation and redemption of baskets of shares in the fund and transfers of cash to and from its administrator. In the in-kind model, they facilitate the exchange of ETF shares for the underlying assets held by the ETF. They initiate the redemption process by submitting orders to the ETF issuer and delivering a basket of securities, mirroring the assets held by the ETF, in exchange for newly created ETF shares.

Prime Broker: The prime broker serves as part of the bridge between the market maker and the ETF issuer, providing access to substantial liquidity pools and ensuring the availability of necessary Bitcoin liquidity. They facilitate transaction execution, including buying ETF shares and selling Bitcoin. Additionally, they manage risks associated with large transactions, including market, counterparty, and operational risks. Prime brokers also supply detailed reports to all involved parties and manage the settlement process. While the Bitcoin custodian directly handles Bitcoin holdings, the Prime Broker oversees the entire process, collaborating with the custodian to ensure the secure movement of Bitcoin.

Now that we have broken the key definitions of some of the market participants we can get into the two methods we noted at the beginning of this article.

In-Kind versus In-Cash: An Overview

If you recall, before the Spot Bitcoin ETF was approved there was a fair bit of back and forth between applicants and the Securities and Exchange Commission (SEC). One point of contention was related to the practical aspects of buying and selling Bitcoin ETFs. Specifically, the debate was over the mechanisms for ‘creation’ (when new ETF shares are issued) and ‘redemption’ (when existing ETF shares are redeemed). The two different mechanisms are called ‘in-kind’ or ‘in-cash’ redemption models and determine how authorised participants (APs) can exchange ETF shares for the underlying Bitcoin or cash.

When comparing the ‘In Kind’ and ‘In Cash’ redemption models for ETFs, various differences come to light. In the "In-Kind Redemption" model, APs can redeem ETF shares by directly receiving the underlying assets, typically Bitcoin, instead of cash. This process involves transferring a matching portfolio of securities to the ETF issuer, who then creates new ETF shares based on this portfolio, thereby avoiding immediate selling for cash. The benefits of this model include tax efficiency, liquidity maintenance, avoidance of market impact, creation/redemption flexibility, and transparency. However, considerations such as logistics, custodial challenges, and feasibility during extreme market conditions must be acknowledged.

On the other hand, in the "In Cash Redemption" model, APs receive cash equivalent to the ETF's net asset value when redeeming shares. The ETF issuer sells the underlying assets in the open market to generate the necessary cash. Situations where cash redemption might be preferred include liquidity constraints, tax considerations, operational simplicity, extreme market volatility, and AP preferences for convenience.

Understanding the significance of these models is important as they impact the ETF's overall cost structure. While most ETFs utilise in-kind redemptions due to tax efficiency and liquidity benefits, the SEC prefers cash redemptions for the Bitcoin ETFs, which may stem from oversight and transparency concerns. There is also the question of how hard it would be for arbitrageurs to make a profit from the in-cash variant - something I talked about in a Q&A a few weeks ago.

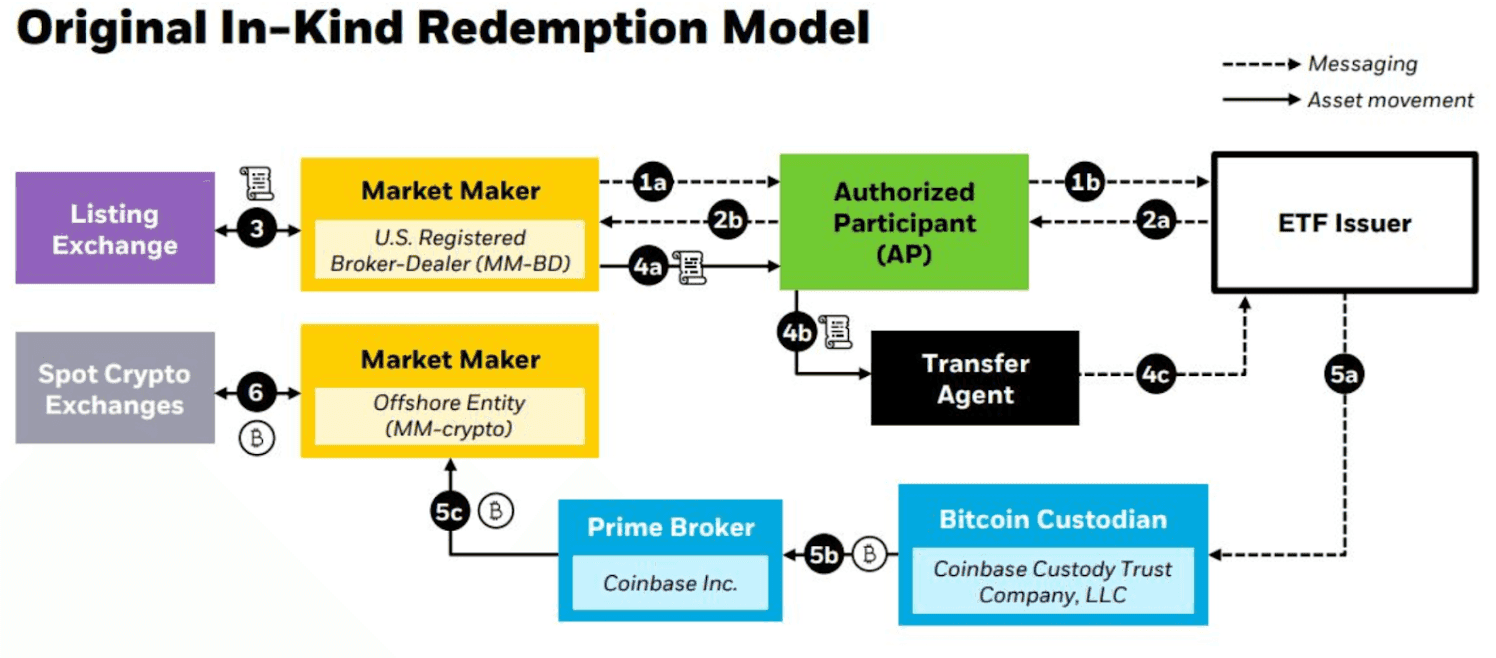

Obviously, this simplified overview isn’t very ‘simple’. So let’s go over the process step-by-step using BlackRock’s flow chart in the following section to get a better handle on it.

Step 1: MM-BD places a redemption order via AP in response to ETF dislocation from NAV

In this scenario, a broker-dealer initiates the process by placing a redemption order. This order allows investors to exchange their ETF shares back to the issuer in return for the underlying asset, which in this case is Bitcoin. When an investor submits a redemption order, they are effectively instructing the fund manager to sell their shares or units in the fund and to return the proceeds to them.

APs execute this order when the ETF's market price significantly deviates from its NAV to restore balance. So, by creating or redeeming shares they ensure that the ETF’s market price aligns with its true underlying value (NAV). This process helps maintain arbitrage opportunities

Step 2: ETF Issuer approves redemption order

In this step, the issuer then approves this redemption request and takes the necessary steps to fulfil it.

The issuer's approval is essential because it ensures that the redemption process is conducted in accordance with the rules and regulations governing the ETF. It also confirms that the ETF issuer has the necessary assets or resources to fulfill the redemption request, whether by providing the underlying securities or cash equivalent.

Step 3: MM-BD buys ETF shares via Listing Exchange

At this point, the MM-BD is acquiring ETF shares directly from the exchange where the ETF is listed for trading. They purchase them directly from other market participants who are selling them on the exchange. This action adds liquidity to the market and helps facilitate trading activity in the ETF.

Step 4: MM-BD delivers ETF shares to Transfer Agent

The market maker delivers the shares to the ETF’s transfer agent so they can maintain the shareholder records and handle share issuance and redemption. They will verify the contents of the ETF and ensure it aligns with the ETF’s investment strategy. Essentially, they’re ensuring the smooth execution of the redemption process between market participants.

Step 5: ETF issuer instructs Bitcoin Custodian to release Bitcoin to MM-Crypto via transfer through Prime Broker.

This part of the process begins with the ETF issuer providing instructions to the Bitcoin custodian, who holds the actual bitcoins on behalf of the ETF, regarding the release of the bitcoins. Upon receiving the instruction, the Bitcoin custodian verifies the legitimacy of the request and ensures compliance with regulatory requirements.

If all is in order, they proceed to release the specified amount of bitcoins. These released bitcoins are then transferred to MM-Crypto. This transfer occurs through a prime broker, acting as an intermediary between the custodian and MM-Crypto, facilitating the seamless movement of assets and ensuring timely delivery.

Once MM-Crypto receives the bitcoins from the custodian, they could create new ETF shares if there is demand, or engage in arbitrage by buying or selling ETF shares based on market conditions. They could also help maintain liquidity in the ETF by offering to buy or sell shares as a market maker.

Step 6: MM-Crypto May unwind Bitcoin position

Unwinding in this context means that MM-Crypto may sell some of their Bitcoin holdings for one of many reasons. Firstly, it could be driven by profit-taking, where MM-Crypto sells Bitcoins that were purchased at a lower price to lock in profits, especially if the market has appreciated. Additionally, unwinding could be a risk management strategy, as MM-Crypto may seek to reduce exposure to Bitcoin due to market volatility or other factors. Regulatory compliance might also play a role, with requirements or internal policies prompting the need to decrease exposure to certain assets.

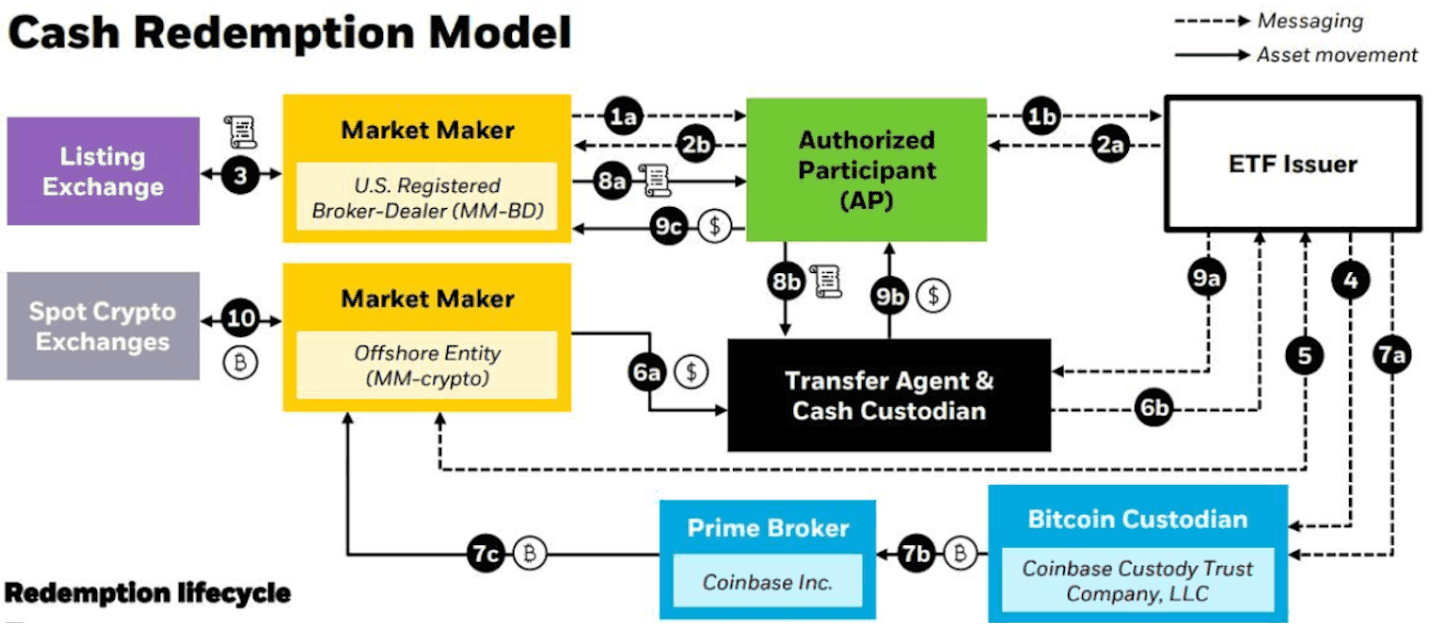

Steps 1 to 3: Similar to the In-Kind Model

The first three steps of the in-cash redemption model are the same as the in-kind redemption model. To sum up, after the MM-BD places the redemption order via the authorised participant and the ETF issuer approves the redemption order, the MM-BD buys the ETF shares via the listing exchange, bringing us to step 4.

Step 4: ETF Issuer instructs Bitcoin custodian to move Bitcoin out of Cold Storage so it can be sold.

The ETF issuer typically follows a structured procedure to direct the Bitcoin custodian to transfer Bitcoin out of cold storage for selling purposes. Firstly, communication is initiated between the ETF issuer and the Bitcoin custodian, ensuring mutual verification and authorisation. Upon a redemption request, if Bitcoin needs to be sold for in-cash redemption, the issuer proceeds to provide detailed instructions to the custodian. These instructions specify the quantity of Bitcoin to be moved, the destination for the transfer (such as a cryptocurrency exchange), and the timing of the transfer.

Given the sensitive nature of Bitcoin custody, stringent security measures are implemented, including multi-signature approval and secure authentication methods. The custodian then executes the transfer by retrieving the Bitcoin from cold storage, initiating a transaction on the blockchain, and waiting for blockchain confirmations. Detailed records of the transaction are maintained, including timestamps, transaction hashes, and audit trails for transparency and compliance. Post-transfer verification ensures the successful movement of Bitcoin to the specified destination, with updates made to the ETF's records accordingly.

Step 5: ETF Issuer enters trade with MM-crypto to sell Bitcoin for USD.

In this step, the issuer sells their Bitcoin holdings to the market maker in exchange for US dollars.

The market maker may facilitate liquidity in the market by providing bids for Bitcoin, allowing the ETF issuer to execute their sell order efficiently.

This trade enables the ETF issuer to convert their Bitcoin assets into fiat currency (USD), which can then be used for various purposes such as covering expenses, meeting redemption requests, or rebalancing the ETF's portfolio. The market maker, on the other hand, may profit from buying Bitcoin at a favorable price and potentially selling it later at a higher price, or by fulfilling their role in facilitating trades and earning trading fees.

Step 6: MM-Crypto delivers cash to the Transfer Agent.

When the MM-Crypto delivers cash to the transfer agent they are fulfilling their obligation to settle a transaction involving the creation or redemption of ETF shares. This cash could be used to cover the cost of newly created shares or to receive proceeds from redeemed shares, depending on the nature of the transaction.

Step 7: Bitcoin Custodian delivers Bitcoin to MM-Crypto Via transfer through Prime broker.

In this step, the custodian verifies the investor's eligibility and authorises the transfer of the corresponding amount of Bitcoin to MM-Crypto. To fulfil the redemption, the custodian withdraws the specified Bitcoin amount from secure cold storage wallets and collaborates with a Prime broker to facilitate the transfer.

Communication between the custodian and MM-Crypto ensures coordination, including agreement on the receiving Bitcoin address. Subsequently, the custodian transfers the authorised Bitcoin amount directly to MM-Crypto's designated wallet address via the Bitcoin blockchain. MM-Crypto confirms the successful transfer upon monitoring the blockchain for incoming transactions, while the Prime broker ensures proper settlement, accounting for any associated fees or costs.

Step 8: MM-BD delivers shares to the Transfer Agent via AP.

Following an investor's decision to redeem ETF shares, the MM-BD initiates the redemption order via the AP, who facilitates communication between the ETF issuer and the investor. Upon approval of the redemption order, MM-BD coordinates with the AP.

The MM-BD will then deliver the ETF shares to the Transfer Agent, who maintains the official record of share ownership. Concurrently, the ETF issuer instructs the Bitcoin Custodian to transfer the equivalent amount of Bitcoin to MM-crypto. Upon receiving the Bitcoin, MM-crypto closes its short position, completing the redemption process. This model offers transparency by directly transferring underlying assets, cost efficiency, and shifts execution risks to the market maker. Moreover, it eliminates the need for issuer financing and reduces operational risks associated with trading events.

Step 9: The ETF issuer instructs the Cash Custodian to release cash to MM-BD via the AP.

In this step, the ETF issuer directs the cash custodian, responsible for managing the ETF's cash holdings, to release the required cash amount to the MM-BD. Subsequently, the MM-BD, acting through the AP, receives the cash from the Custodian. In exchange, the MM-Crypto delivers the necessary Bitcoin to the ETF via the AP. This final step completes the redemption process, ensuring the transfer of assets between the parties involved.

Step 10: MM-Crypto can unwind the Bitcoin position.

Similar to Step 6 in the in-kind redemption model, unwinding the Bitcoin position refers to MM-Crypto potentially selling some of their Bitcoin holdings for one of many reasons previously noted.

Closing Thoughts & Insights

After reviewing these processes, it’s obvious that ETF transactions are more complicated than simply tapping a button on your phone app to exchange $USDT for Bitcoin. But, at least now you'll have a solid understanding of Spot Bitcoin ETFs and how they function. You’ll also understand why there was so much ‘back-and-forth’ between regulators and applicants before the approvals were finalised.

The in-kind model is notably simpler, resulting in reduced fees, less time, and fewer challenges for the Applicant. However, it's important to recognise that the SEC's requirement for cash redemption models stems from regulatory considerations, transparency, and oversight. The transition from in-kind to cash redemption models underscores the intricate regulatory landscape surrounding Bitcoin ETFs and emphasises the SEC's cautious stance toward cryptocurrency investments.

With all that said, let's not forget that Spot Bitcoin ETFs were designed for individuals who are entirely unfamiliar with the crypto space and have no interest in delving into the inner workings of traditional finance. Sometimes, we overlook the fact that both avenues for investing in Bitcoin can be confusing to those entirely outside the space. And, admittedly, simply walking into a large institution and expressing a desire to invest in some Bitcoin and then walking away while they handle it sounds pretty nice.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Did This Poor Baby Make A Profit On The BTC He Sold?](https://cdn.bulbapp.io/frontend/images/255151e6-9e83-4151-9644-80af06e53b74/1)