Bitcoin isn't Rat Poison after all! Official proof in this slightly comic article.

The Anti Bitcoin Gang. Who are they?

Charlie Munger: The former vice-chairman of Berkshire Hathaway and a billionaire investor, he was a close associate of Warren Buffett. He has called Bitcoin “disgusting and contrary to the interests of civilization” and compared crypto trading to "trading freshly harvested baby brains"

Warren Buffett: The chairman and CEO of Berkshire Hathaway and one of the world’s richest and most influential investors, he has repeatedly dismissed Bitcoin as a worthless and risky asset. He has called it “RAT POISON squared”, “a mirage”, and "a delusion"

Nouriel Roubini: An economist and a professor at New York University, he is known for predicting the 2008 financial crisis. He has been a vocal critic of Bitcoin and cryptocurrencies, calling them “the mother of all bubbles” and "the most overhyped and overvalued phenomenon in human history" Now this is one of the most depressed people on Earth. If you come across a video of him: don't watch!

Jamie Dimon: The chairman and CEO of JPMorgan Chase, one of the largest banks in the world, he has been a harsh opponent of Bitcoin and cryptocurrencies. He has called Bitcoin “a fraud”, “worse than tulip bulbs”, and "a scam"

Peter Schiff: The CEO of Euro Pacific Capital and a gold enthusiast, he has been a relentless critic of Bitcoin and cryptocurrencies. He has argued that Bitcoin has no intrinsic value, no use case, and no future. He has called Bitcoin “a Ponzi scheme”, “a bubble”, and "a fool’s gold"

Bitcoin has faced criticism from various quarters, and Warren Buffett stands among its skeptics. He has made particularly skeptical comments on the asset, reflecting a certain level of disbelief. Despite Bitcoin's notable success over the past 15 years, there are still individuals who remain steadfast in their skepticism, clinging to a bygone era where they amassed their fortunes.

They just don't get it: nothing lasts forever!

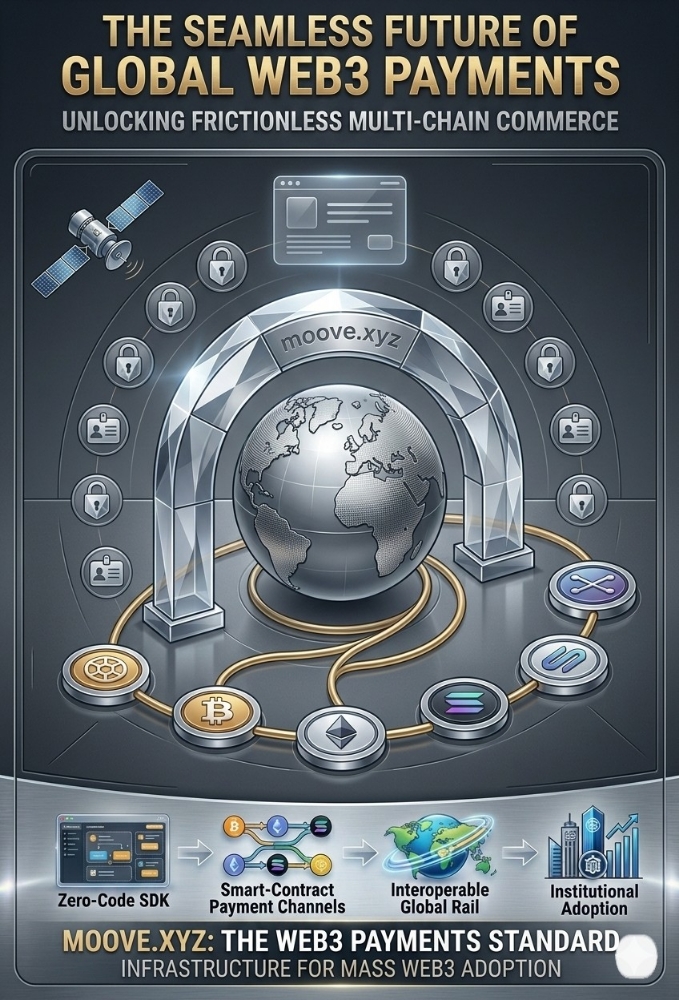

Warren Buffett draws a stark comparison between his farmland investments and the global monetary disruptor, Bitcoin. Buffett argues that, unlike farmland, Bitcoin doesn't yield tangible products. While he's correct in that regard, Bitcoin's value lies in its groundbreaking role as the first-ever global monetary system that integrates all 8 billion people simultaneously. It operates on the foundation of a scarce asset, offering a decentralized, permissionless, and trust-based peer-to-peer transaction model, eliminating the need for intermediaries.

However, Buffett's perspective is rooted in the framework of a United States-centric worldview, relying on its dominance and the ability to sell debt globally. The challenge emerges as China signals a shift away from investing in US Treasuries, a development that might seem minor to Buffett but holds significant implications.

Even the late Henry Kissinger, the architect of the Petro-Dollar System, recognized a new era unfolding. Having established a framework where nations had to

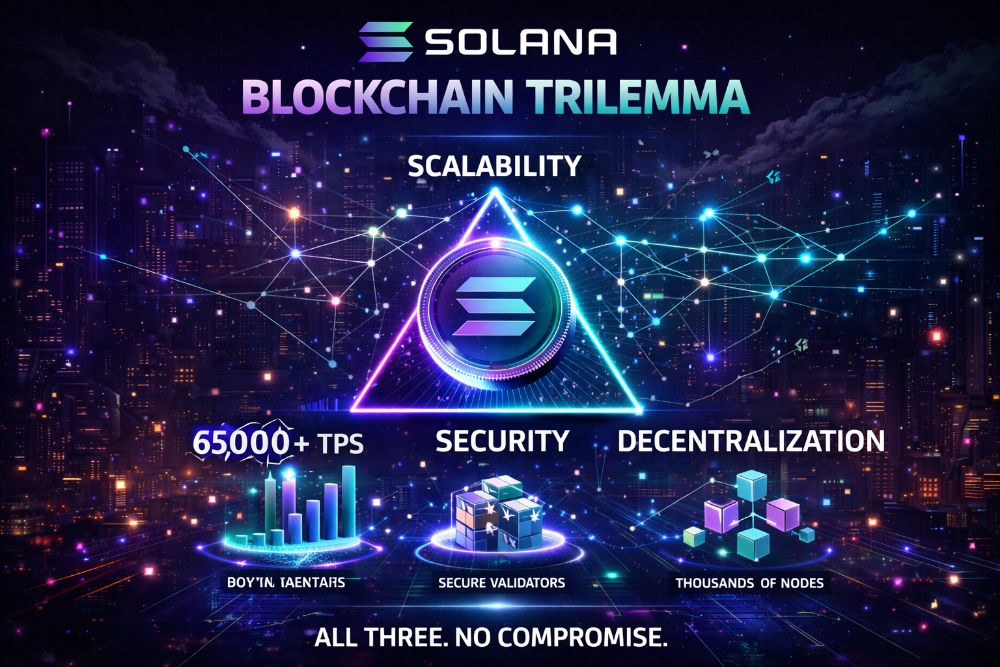

In alignment with Kissinger's assessment, the assertion is made that we are indeed in a new era: the era of Bitcoin.

What's your Poison, my dear?